Signatory Tax Sharing Agreement Made Easy

Upgrade your document workflow with airSlate SignNow

Versatile eSignature workflows

Fast visibility into document status

Easy and fast integration set up

Signatory tax sharing agreement on any device

Detailed Audit Trail

Rigorous protection standards

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Your step-by-step guide — signatory tax sharing agreement

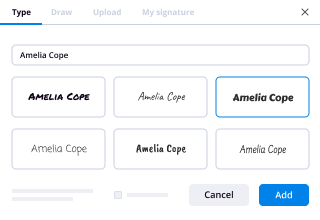

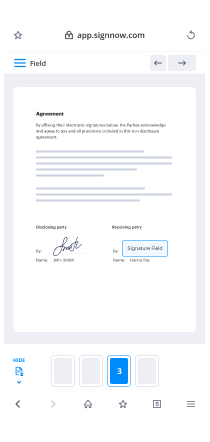

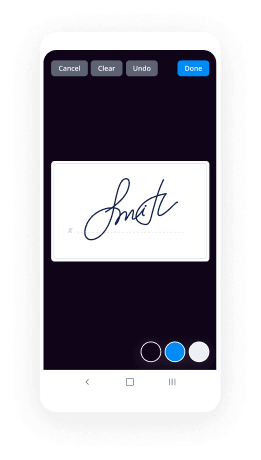

Adopting airSlate SignNow’s electronic signature any company can increase signature workflows and eSign in real-time, supplying a greater experience to clients and workers. Use signatory Tax Sharing Agreement in a couple of simple actions. Our mobile-first apps make working on the go possible, even while off the internet! eSign signNows from any place worldwide and make trades in no time.

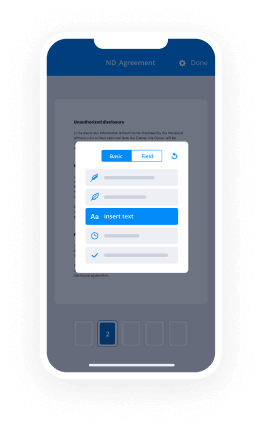

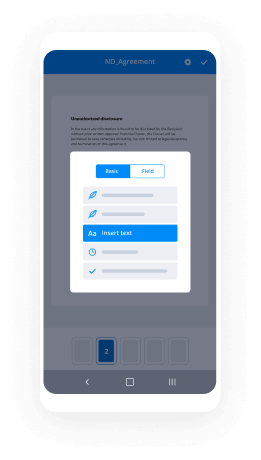

Follow the stepwise instruction for using signatory Tax Sharing Agreement:

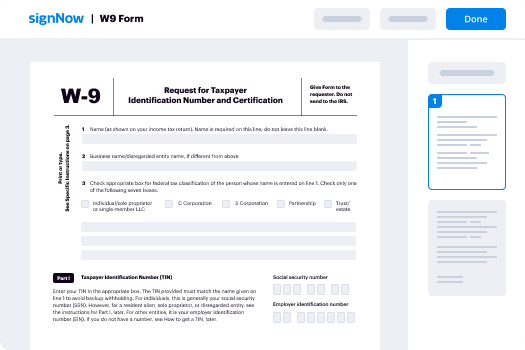

- Log on to your airSlate SignNow account.

- Find your document in your folders or upload a new one.

- Open up the record and edit content using the Tools menu.

- Drop fillable areas, add textual content and eSign it.

- Add several signers via emails and set the signing sequence.

- Specify which individuals will receive an completed copy.

- Use Advanced Options to limit access to the template and set up an expiration date.

- Click Save and Close when completed.

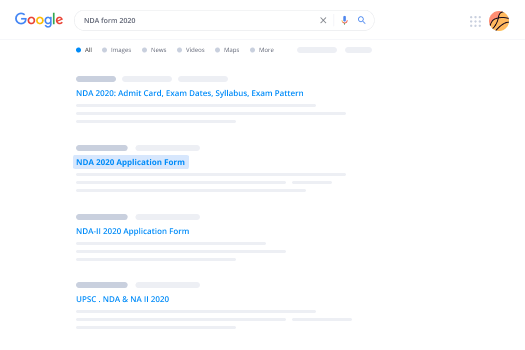

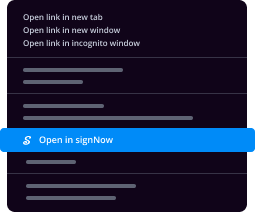

Additionally, there are more extended tools open for signatory Tax Sharing Agreement. Include users to your common digital workplace, browse teams, and monitor collaboration. Numerous customers all over the US and Europe recognize that a system that brings everything together in a single unified digital location, is the thing that organizations need to keep workflows functioning efficiently. The airSlate SignNow REST API allows you to embed eSignatures into your application, internet site, CRM or cloud. Check out airSlate SignNow and enjoy faster, easier and overall more efficient eSignature workflows!

How it works

airSlate SignNow features that users love

See exceptional results signatory Tax Sharing Agreement made easy

Get legally-binding signatures now!

What active users are saying — signatory tax sharing agreement

Related searches to signatory Tax Sharing Agreement made easy

Signatory tax sharing agreement

short taxation first of all there are perfectly legal and acceptable manners in which to utilize international companies and financial institutions Boeing for example utilizes offshore companies and bank accounts to operate its business enterprise as does Microsoft Apple Amazon IBM ExxonMobil Ace Hardware as well as hundreds of not if not thousands of other us-based companies now many businesses who want to form international companies and establish international bank accounts do full do so for business expansion asset protection or other perfectly acceptable purposes and there are satisfactory ways to utilize such tools provided one complies with tax securities and other laws now with that background we delve into the world of international taxation now there is a thought among some members of the public that if profits are distributed offshore one is not required to pay taxes until they're brought back into the country now this may have been the case in the past however as of 1964 u.s. tax laws changed requiring taxation of both us and international income like domestic companies there are US reporting requirements with respect to owning directing and controlling international companies there are also tax and Treasury Department forms to complete when one has signatory authority over an international financial account though these forms are relatively simple it is recommended that one secures a knowledgeable licensed accountant to ensure the forms are properly and timely filed now we believe in full compliance with US and international law including tax law after all somebody has to pay for the satellites my father was a government employee my son was a u.s. Marine and those important jobs they keep our country safe cost money so we believe and take advantage of all the legal tax deductions possible and paying as little as the law allows but once all is said and done pay what the law requires and you'll sleep a lot better at night so discuss the forms on this particular page on one of our websites with a tax advisor that's offshore corporation comm for it slash tax - forms there you will find a list of many of the tax forms that are utilized for people who have offshore entities and bank accounts now some foolishly believe that offshore service providers shouldn't exist in the u.s. that they should all be put out of business and others want to go around the backdoor by playing by placing such financial and psychological pressure on the leaders of the industry that they would want to change professions now this short short sighted the well-meaning thinking shows a great lack of understanding of the offshore services industry and would simply create a bigger problem and here's why it is a fact and we know this that some people in the US and other places are determined to establish international companies and bank accounts this may be for business business expansion international diversification or asset protection and like it or not those who desire these services with enough vigor will obtain them if the providers in the US are put out of business offshore service providers who reside outside the US are just a mouse-click away now we agree that any US service providers who are knowingly and willfully assisting their customers in illegal tax evasion money laundering or other illicit activities should be put out of business however this is a very low percentage of providers in our estimation in the u.s. because those who provide such services are generally cognizant of the fact that in order to remain in business they must act within the proper legal framework our company for example insists that every sales representative signs an agreement that our company policy is to obey the law first and make a profit second they are not to knowingly do business with would-be customers who intend to use our services to carry out tax evasion evade security laws or conduct in other illegal activities we repeatedly email reminders to employees post boltons rehash the importance of legal compliance with co-workers co-workers of meetings overhear conversations to make sure these policies have followed as much as we can a reverent fear of and respect for our laws a law enforcement and law makers make us dance like ticks on a hot griddle on a daily basis to make sure there is never a in our legal armor moreover we live here too so we filled as our patriotic duty to be sure we do our part to support our laws now foreign service providers on the other hand have no such motivation to support our laws they can put profit above adherence to US statutes because they are not necessarily bound by them in fact I did a simple google search a while back and here is a summary of what I found one misguided service provider in the Bahamas said quote under the statutory US tax code offshore banks and offshore companies can trade in the US stock market free from capital gains taxes they proceeded to illustrate an erroneous structure where US taxes could be evaded by the use of three international companies in to foreign trusts another website operated by attorneys in Central America shows how US people may have aid taxes in their jurisdiction they say that a certain Central American government will not share information for tax offenses even if it is construed to be a criminal tax matter what another website purported was quite shocking it discussed using offshore entities to raise a certain amount of money by promoting illegal drug activities these tax havens quote will not share information about you this is why it is best to set a goal reach it and stop all illegal illegal activity before the government nails you yes it actually said that in shock indeed another provider boasts of a certain African jurisdiction that quote there are no information sharing treaties and that they will quote not share information with any other country moreover I personally traveled to Zurich Switzerland down Bahnhofstrasse to meet with early international bankers in fact I've walked down the street with the highest concentrations of banks in Switzerland there and I visited the district in order to see firsthand the ongoings of the hub of the world's international financial center the scenario was nearly the same in every Swiss institution first of all I shuffled into a small private room it closed the door a bank employee would push a silver cart offering me sparkled on or non sparkling bottled water and a bank employee would soon come in wearing a suit a gentleman would enter the room and shut the door now one of the first questions I was asked in almost every instance was will these accounts be reported or none reported in other words the banker wanted to know whether or not the accounts were going to be reported to the government for tax purposes and that's really said reported the first time I heard this my job was hit the floor but I was asked that that in every situation when I entered a Swiss bank the same question shocking so this being said it is very obvious to any reasonable person that annihilating the us-based offshore services industry while good intentioned would be a very big mistake in fact responsible and law-abiding service providers such as our company we strive to be that put legal compliance above profits and to provide guidance that one should seek license and legal advice should be allowed to remain alive and well it would certainly be a big mistake to leave a hole in the International in d-formation industry that would only be filled by those who have no incentive to respect the laws of our country the quote let's see what we can charge them with or less let's hassle them till they're broke mentality is truly a suicide vest so these statements are not merely self-serving persuasive tactics because I'm associated with an organization that provides international services and incidentally I believe we have established far more domestic entities than foreign we talk to people day in and day out who truly believe they can put money over yonder and not pay taxes until they bring it back and if they do not have us-based companies such as ours to correct their thinking you can see by the above examples who would be left to fill the gap so now if you're watching this on youtube you like it please click like below enter your comments or questions you can share this video if you have any questions you can visit us at offshore company comm or give us a call at one eight hundred nine five nine eight eight one nine we appreciate your watching thank you

Show moreFrequently asked questions

How can I scan my signature and use it to sign documents on my computer?

What is the difference between an electronic signature and a digital signature?

How can I sign a PDF created from an image?

Get more for signatory Tax Sharing Agreement made easy

- EIDAS byline

- Prove electronically signing Free California Room Rental Agreement Template

- Endorse digi-sign Simple Sales Proposal Template

- Authorize signature service Coffee Shop Business Plan Template

- Anneal signatory Employee Resignation

- Justify eSignature Free Movie Ticket

- Try initial Smoking Lease Addendum

- Add Facility Agreement eSign

- Send Property Management Proposal Template eSignature

- Fax Restaurant Gift Certificate autograph

- Seal Patient Satisfaction Survey electronic signature

- Password Relocation Policy signed electronically

- Pass Lawn Service Contract Template electronically sign

- Renew Influencer Contract electronically signing

- Test Travel Planning Registration mark

- Require Waiver Agreement Template signed

- Comment teller signature

- Boost man initial

- Compel signer signature service

- Void Settlement Term Sheet Template template esigning

- Adopt Conversion Agreement template digisign

- Vouch Catering Invoice template electronic signature

- Establish Fundraiser Ticket template countersign

- Clear Endorsement Agreement Template template sign

- Complete Sales Report template electronically signing

- Force Grant Proposal Template template initials

- Permit Maintenance Work Order template eSign

- Customize Photography Services Contract Template template eSignature