Signature Mortgage Financing Agreement Made Easy

Do more on the web with a globally-trusted eSignature platform

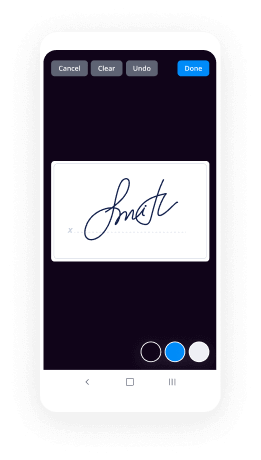

Remarkable signing experience

Reliable reporting and analytics

Mobile eSigning in person and remotely

Industry rules and conformity

Signature mortgage financing agreement, faster than ever before

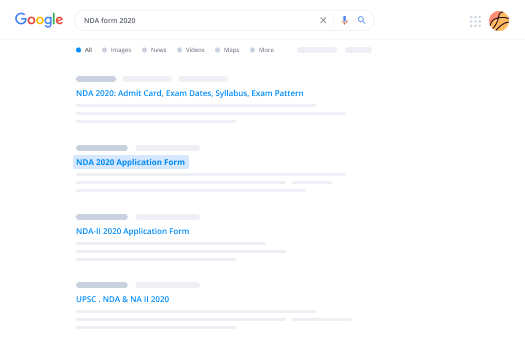

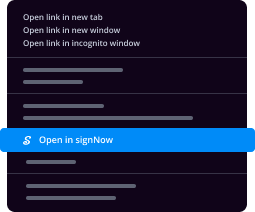

Useful eSignature add-ons

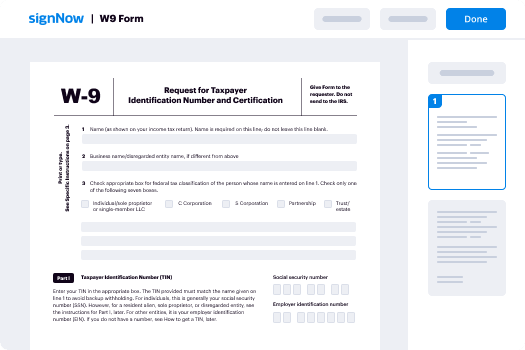

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

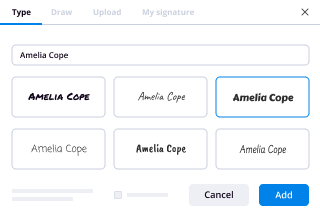

Your step-by-step guide — signature mortgage financing agreement

Leveraging airSlate SignNow’s electronic signature any business can enhance signature workflows and eSign in real-time, delivering an improved experience to consumers and staff members. Use signature Mortgage Financing Agreement in a couple of simple actions. Our mobile-first apps make working on the go possible, even while off-line! eSign signNows from any place worldwide and complete trades faster.

Follow the step-by-step guideline for using signature Mortgage Financing Agreement:

- Log on to your airSlate SignNow profile.

- Find your record within your folders or upload a new one.

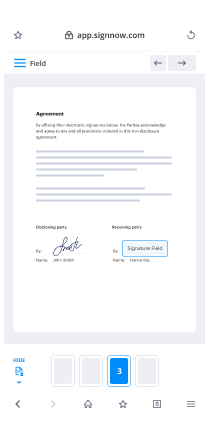

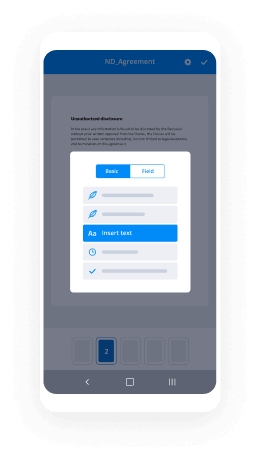

- Access the template and make edits using the Tools list.

- Drag & drop fillable fields, type textual content and eSign it.

- Include multiple signers via emails and set up the signing order.

- Indicate which recipients will receive an signed version.

- Use Advanced Options to reduce access to the document and set up an expiration date.

- Click Save and Close when finished.

Furthermore, there are more advanced functions available for signature Mortgage Financing Agreement. Include users to your shared digital workplace, view teams, and track teamwork. Millions of consumers all over the US and Europe concur that a solution that brings people together in one holistic workspace, is what enterprises need to keep workflows functioning easily. The airSlate SignNow REST API allows you to embed eSignatures into your application, website, CRM or cloud storage. Try out airSlate SignNow and get quicker, easier and overall more productive eSignature workflows!

How it works

airSlate SignNow features that users love

See exceptional results signature Mortgage Financing Agreement made easy

Get legally-binding signatures now!

FAQs

-

Can loan documents be signed electronically?

During the loan process you will be signing document after document but thanks to modern technology, many of the documents can now be electronically signed using software like airSlate SignNow.com and Calyx point. -

Can closing on a house be done electronically?

A. While the industry has yet to settle on a standard definition for eClosing, an eClosing is generally any real estate closing event or process in which the buyer, seller, borrower, notary or others use an electronic signature (eSignature) to sign some or all of the closing documents. -

What is a remote closing?

A remote closing works exactly as the name describes. Before your closing date, your real estate agent would send you physical copies of the contract and addendums. You'd read through them and sign them, usually in the presence of a notary public. -

Does Va accept electronic signatures?

Lenders are not required to use electronic signatures in the course of closing VA home loans; but, if they choose to, they must comply with the eSign Act, just as they are required to comply with all Federal laws. -

What is an e signing in a mortgage transaction?

Digital signature or standard electronic signature is actually a coded, encrypted, legally binding digital footprint. The digital signature is made of unique encoded messages \u2014 one for each signee \u2014 that join together to make a complete, legally binding, standard electronically signed document. -

What is a wet sign document?

A wet signature is created when a person physically marks a document. In some cultures this is done by writing a name in a stylized, cursive format (or even a simple \u201cX\u201d) on a piece of airSlate SignNow. ... In both cases, the word \u201cwet\u201d implies that the signature requires time to dry, as it was made with ink or wax. -

Can a wet signature be scanned?

A 'wet ink' signature is where the parties to the document write (sign) their names with their own hands upon an airSlate SignNow document by ink pen. ... If a traditional wet ink signature on a piece of airSlate SignNow is scanned in to an electronic device, the scanned version is an electronic signature. -

What is DocMagic?

Welcome to DocMagic A secure digital environment for intuitive eSignatures, document management and delivery. ... Borrowers, lenders and closing agents share critical documents and data via our mobile app. -

Who signs a mortgage note?

While the mortgage deed or contract itself hypothecates or imposes a lien on the title to real property as security for a loan, the mortgage note states the amount of debt and the rate of interest, and obligates the borrower, who signs the note, personally responsible for repayment. -

Is a mortgage the same as a note?

A promissory note is a borrower's promise to repay a loan; a mortgage puts the title to a home up as security (collateral) for the loan. ... With a mortgage, you give the lender a way to get its money back if you don't keep your promise to make those payments\u2014through a foreclosure. -

Can you be on the mortgage but not the note?

A: No. First you did not sign the promissory note you are not responsible or obligated to pay the payments. However if the payments are not made then the property will be foreclosed and ultimately sold. Thus your rights to stay in the home will someday be cutoff. -

Can I be on deed but not mortgage?

Where an individual is not named on the title register to a property but has paid towards the purchase price, mortgage or renovation costs together with their partner, who is the registered owner, does that individual have any property rights? The short answer is yes, you may well have rights. -

Can someone put your name on a house without you knowing?

Adding Name to House Deed Without Consent. ... If a person decides to give a gift of real estate to someone, they can purchase that property and deed it to someone else. But that alone will not be sufficient to transfer title to the property to the recipient. -

How long after signing contracts is completion?

Completion typically happens between 7-28 days after the exchange of contracts. However, it's possible to exchange and complete on the same day, but it's not suitable for most buyers. -

What happens after P&S is signed?

After you sign a Purchase and Sales Agreement You are entitled to get your deposits back if you cannot get a loan by this date. The buyer's job is to stay in touch with your lender.

What active users are saying — signature mortgage financing agreement

Signature mortgage financing agreement

hello everybody this is Joe from prep agent I'm calling you from beautiful senior communities anyway guys ever been to senior communities it is rock and roll every day tonight's a big block party can't wait to go there but in the meantime before I celebrate the joy of being around here and hanging out with dear old moms it's time to go over finance with all of you guys who's excited everybody say I'm excited for finance who's excited for finance anybody anybody anybody anybody who's excited for finance finance is the worst I gotta be honest I hate it so much I try to get extra motivated when we do finance cuz I just find it so painful but we will get through it together right guys I go to Starbucks I use my free coupon at Starbucks when we have finance you guys never get that free drink and you could order whatever you want at Starbucks and you get that free drink and they put whatever you want in it I did that I use that ticket today I said just give me whatever I could get the most out of what's the most expensive drink and some little teenager who thought he was very hip and bohemian maybe some drink mix it up hand it to me I drank it I swear I thought I was gonna like paint my house and run to Nebraska and back I was so hopped up in sugar and whatever else that kid puttin it anyways now we're ready to go don't ever tell them just make me whatever you can I got a free coupon here all right so now that back from the grass I'm finished painting my house let's talk finance so when we talk finance the first thing that comes up is this word primary and secondary market primary in secondary market okay what's the difference in the primary and secondary markets you got the primary market first what's that Anna from rody that's an interesting name I feel like it's like a name of a country music band or something okay so what's the primary market there you go Jasmine that's where the loans are originated high five to you Jasmine primary market very basic I always want you guys to try and think these third things in like everyday terms don't always think in like the textbook kind of stuff many you guys without realizing interact with this stuff every single day but you don't realize it because you're reading it in these textbook kind of technical terms it doesn't seem like something relates to your everyday life any of you guys ever experience that where you're reading this stuff and it just doesn't seem relatable it doesn't seem what actually happens to you every day when it actually is anybody in that boat so I want you guys to really try and make an effort to see how the stuff relates to everyday life so they talk about the primary market very simply set it's when you go to the bank and say I want a loan when you go to Chase Bank or Wells Fargo whatever you guys go to don't go to Wells Fargo they create false accounts on your name evil alright when you go to the bank and they lend you money that's the primary market everybody got that now what's the secondary market what's the secondary markets you have the primary market and then when does the secondary market come in well it's the secondary market it when you guys think so the secondary market is with the resale marketplace okay guys so Georgia O'Connor Fannie Mae functions in the secondary market but it's not the secondary market by definition but you're not totally wrong Fannie Mae definitely plays a part in it okay so we said you got the primary market you go into the bank you get a loan you have money you go get your house great but the bank would run out of money if they kept lending people money and didn't get paid back until like 30 years later remember many loans have like 30 years on them right guys so that could take a while so what the bank does in the primer market they sell their loans to people in the secondary market okay so the secondary markets the resale marketplace congratulations hailey Wilson great job super excited for you okay so that frees up money for the people in the primary market you're saying what is the deal the secondary market well when you guys invest in like stocks and things like real estate investment trusts if you have financial advisors they will tell you different things to invest it and part of those investments when they talk about your stocks and investments on stock marketing and things of that nature and bonds you're basically dabbling in that secondary market whether you realize it or not is everybody get that hopefully that helps you put it in more real-life terms okay so it's a little more applicable to you so you can kind of get a better grasp on it does everybody got that so secondary markets that resale marketplace and you guys may think it has nothing do to eat with you but when you like invest in things like stocks and bonds and all that kind of stuff you're playing active role in that okay so you have the primary market in the secondary market right where the loans originated and then they're resold the other big thing that comes up when you do a financing in real estate that you've got to know the foundation of all of it is this word risk it's all about how much risk you are the lender is not lending you money if they can't like manage that risk graze everybody got that it's all about risk okay everybody write the word risk risk risk risk it's all about risk okay so my question to you is when you guys get a loan and this is everyday stuff anyways bought a house is experience this if you got a loan what does the lender do to make sure you are not a risk that could jeopardize their business so what's the biggest thing they do to make sure that you are not a risk now as many things they do but I asked for the biggest the most important thing all right now there's big things and there's little things they do like interview and think you're a nice person and you're not like crazy okay looking I'm looking I'm looking Cheri is the closest what they do is they check the value of the property they check the value of the property hey nice job Phil okay so obviously look at your credit score and they look at your employment and they look into all those other factors related to you as a person and how you bring in money and your ability to pay things back but the most important thing is the value of the property itself it doesn't matter what your credit score and what kind of income you have if the value of the property is not an acceptable value in relation to the loan you guys won't hear this term loan-to-value ratio we've ever heard that before loan-to-value ratio so my question for you guys is why is that so important why is that so important because they may be flexible on the credit they may be flexible on the income but they will never be flexible about the property value what do you guys think so why is that so important why is the value of the property so important who knows okay sherrod says is valid property because it's secure for the loan and that's right Jeannette if your house can't resell they'll will lose because here's the thing you may lose your job and there's nothing they could do about it your credit may go to crap there's nothing they could do about it but if you don't pay them they could always sell your house to get their money back everybody got that they could always sell the house to recover that money all right does that make sense guys it's their collateral now my follow-up question to you guys is see who's been studying what gives them the right to sell the house not there it's your house right guys you're sitting there you're watching TV you have keys to it what gives them the right to sell the house what do they have that gives them the right to sell the house and there's a specific thing I'm looking for okay what I'm looking for when I say it I know a lot of you guys were like oh I should have known that Jillian got it in Georgia O'Connor legal title some of you guys are close with the title the promissory note what I was looking for is legal title okay it's not equitable title so what is legal title what is legal title what does that mean who knows you could tell me what legal title means what is legal title legal title is the right to sell the property okay I hope you guys don't mind taking a step back on this but I think it's important we have this foundation before you guys do questions and learn about finance these webinars I really want to put things into context for you guys so when you go home and study you have a little more of a foundation to understand the rest of the material so I hope you don't mind okay so legal title is the right to sell so Katie Allen says do all states work this way yes and no Katie they all have this form of legal title okay where they could sell the property to foreclose now I say no because some states use trustees some of these mortgages I mean they all can use either one but the way they use them a little different so the process of foreclosing and utilizing that legal title could change from state to state to answer your question but the premise that the bank or the lender I should say has legal title is true for all states I hope that makes sense but the process the foreclosure could change from state to state so I hope that helps okay they have this legal title which is the right to sell the property okay where did they get that legal title who gave them the legal title who gave them the legal title okay the answer would be either the trustor or the mortgagor okay depending on the state you're in they signed over that promissory note that promissory note and you as the borrower retain equitable title what is equitable title so Terry Tyson change your settings to 720hd there's a little gear box on the bottom right just change the 720hd and then everything should be clear okay so equable title is the right to use and possess and gain equity okay moving right along let's look at this question on the board the amount of a loan expressed as a percentage of the value the real estate offered as collateral is the a loan-to-value ratio B debt to equity ratio C capital use ratio or D amortization ratio what do you guys think I feel like I said elevator music in between each question isn't that how jeopardy doesn't they play elevator music all time I'm height to find elevator music but that's how I define it jeopardy okay so it's the loan-to-value ratio so we discussed before when financing a home with a long-term loan if equal monthly payments are made the amount of each payment applied to the outstanding principal balance will a increased by consent ask you to do can't read increased by a constant amount throughout the life of the loan B decrease at a constant rate C increase while the interest payments decrease or D decrease while the interest payments increase what do you guys think by the way guys remember I will be here tomorrow Saturday because I did not do a webinar on Tuesday so I'm gonna make up to you guys by doing it Saturday we're just gonna have them five days a week so if I miss one during the week we'll make it up on the weekend can the answer C increase while the interest payment decreases Adrian do you have the time for tomorrow if you could post the time for tomorrow I'd appreciate it don't have it on me maybe even the subject for tomorrow okay on home loans the interest which is paid for the use of money borrowed is almost always a annuity interest be simple interest see compound interest D discount interest you know it fill every day be simple interests okay reading gross we'll get through guys don't worry you guys think that when they see a lot of words Oh reading gross okay which of the following statements is correct concerning the relationship between effective interest rate and a nominal interest rate ie the infectious interest rate is always lower because the nominal interest rate includes charges other than interest B the nominal interest rate actually paid by the borrower for use the money the effective interest rate is the rate specified in the note C the effective rate is the rate the bar will pay the nominal rate is the rate named in the loan application or D the effective interest rate is the rate actually paid by the borrower for the use of the money the nominal interest rate is the rate specified in the note can the answers d sojanet just remember nominal and means named in the note that's the key word to remember for your exam kata nominal named in the note if you guys remember that you'll pass it'll be excellent it'll be good to go a drink you look up nominal note an effective note and then maybe posted definition for everybody in the chat nominal interest rate it's just a nominal interest rate and effective interest rate so guys so Adrienne's gonna be on that he'll look that up and we'll get a nice clean definition for you but if your exam just remember nominal named hey Tim sold his home for thirty thousand dollars and took back a note for fifteen thousand dollars with an interest rate at nine percent enough the note was secured by a first mortgage the home had a fair market value of twenty nine thousand dollars later he decided to sell the mortgage and note which he discontinued to thirteen thousand dollars he then sold it to Eric on the back of the note he wrote I hereby sign with the note to eric without recourse to maker the note to false before any principal payments are made Eric's best legal remedy is to eight for closed in fourth payments of fifteen thousand dollars be foreclosed to recover thirteen thousand dollars see Sousa Steiner based upon the endorsement secondary liability deep recover the Tim recover from Tim based upon his thirteen thousand dollar note thanks Adrian right and it's $15,000 all this is a lot of blahblah the only thing that mattered is he owed $15,000 that's it the rest of it is a lot of information to throw you off I think red herring is the correct term I'm not sure I believe that's what they call that when they have irrelevant information to throw you off let me answer is $15,000 it's right here incorrect I think so I mean you really know what a red herring is okay and he still following loans would otherwise require compliance to the federal Truth in Lending Act which want to be exempt on the basis of type of loan itself a $25,000 loan from credit union for home improvements be a VA loan from federally chartered Sans and Loan associations see an agricultural loan by Bank or deed $20,000 signature loan from the consumer finance company Thank You Adrian oh now remember that forever now we're all gonna remember that red herrings a film thing you know why because you do not need to know it for your exam and we're all gonna be like it's stuck in my head okay so it's see an agricultural loan by a bank okay so most of these logs you've got to remember are there to protect your average home buyer so the one option here that's not your average homebuyers an agricultural loan for a bank and that would make sadly the answer when you're dealing with a big business loans or things that aren't for your personal home okay then there's this thing called caveat emptor which means buyer beware caveat emptor does not apply to your average person buying a home sojanet the VA loan is for somebody's buying a home once were veteran through the veterans program so they're protected from themselves honestly your average homebuyer is protected from themselves where if you're doing it for business or agriculture there's this thing that called caveat emptor which applies which means buyer beware the federal right to cancel notice must be given to a borrower by the agent if a the money will be used for a business expansion be the borrower's residence is the security for a loan see a commercial building is being used for security for the loan or deed the loan is not secured by a borrower's dwelling and more than $25,000 is being borrowed what do you guys think hmm and the answers be the borrower's residents isn't security for the loan okay the FHA was probably created to provide a secondary mortgage market for home loans b2 insured qualified borrowers in case of default C insurance for home loans made by approved lenders D insurance for all banks and lenders on home loans to qualified borrowers right so the FHA is there to insure loans it's not a source of loans FHA insures loans you don't go to the FHA store to get a loan right guys FHA is a place that ensures the loans all right we're moving right along pledging of freestanding stove and a refrigerator is security for a loan in addition to real property is an example of which the following mortgages a a wrap-around B and open C a blanket or D a package it kicks my butt to Jeanette told I feel yeah Jeanette on hug guard desu Fuli that's a hard name to pronounce but I think I nailed it not sure uh-huh guard this FLE you could tell me how I did on your last name I hope I did it justice okay and that's a package mortgage all right when you use real and personal property okay wrap around coorporate some kind of owner financing and open mortgage is like a credit card when you borrow more against it and a blanket mortgage is when you borrow two more properties specifically real proper like houses and buildings thanks Jeanette which of the following expenses tax deductible for homeowners a interest paid on mortgages B addition of a pool C utility payments or deep pest control when you guys think you mortgage are we all going to open houses this weekend these no open houses everybody everybody I hope everybody when a property is appraised as part of the loan application process a copy of the appraisal a should be provided to the borrower B is given to the seller only upon written request C must be shared with all the parties D is the confidential and for the lenders use only and the answer is a should be provided to the borrower do you guys know what is a negative amortization I haven't seen that question come up yet I wanted to address it before we leave for the weekend is it's important what is negative amortization good tell me what is negative amortization give me that definition we are looking for negative amortization when you are not paying the whole interest you're only paying part of it good so your debt goes up your debt goes up it's not interest only what is it interest only what is that what is interest only so the interest only be known as any straight note is straight note nice job Rodney credit lenders may not discriminate on the basis of age unless the prospective borrowers are a parents be out-of-state see minors or D part-time workers hey the answers C minors Jones has a mortgage payment plan that allows him to pay less than what is actually required to cover the debt and interest on it he is in danger of a graduate of payments B conversion of their mortgage C negative amortization or D equity sharing what do you guys think this is kind of what we're gonna over like two minutes ago and the answer is C negative amortization nice job everybody give yourself a round of applause an owner of a trailer park wants to sell his business and real estates that he may retire the tax on the capital gain be prohibitive one alternative that would allow the owner to make a change in a lifestyle while avoiding payments of capital gains is to a cell and then buy a larger more expensive adventure B cell than by a foreign property C to an arm's length swap with a friend D structure a like-kind exchange involving a similar property and says by the way Joe the new season Santa Clara died is up oh my gosh yeah that's so exciting thank you totally pumped I'm definitely watching that ASAP little busy this week but in about two weeks I'm gonna sit down and watch that don't want to take up mom time watching that show B she won't like it thanks Han super pumped now you guys know no Chanticleer diet is a show on Netflix about real estate agents it's all I'm gonna say the rest of you guys got to watch Hey lecture of like kind exchange involving a similar property do we all know too 1031 tax deferred exchanges it's super important it's called Santa Clarita diet it's very dark humor though I'll warn you guys in advance I don't want to give it away and don't give it away alright but it's very dark humor I'll say that the best way I could describe it it takes a certain type of sense of humor to enjoy it but if you you like that type of thing you'll love it if you don't ya might want to move on okay so 1031 tax deferred exchange is when you sell your property you take the money from your old property and you put it into a new property that way you don't get taxed in the capital gains okay you take the money and you put it into a new property is called deferred use events you want to take the money when you sell that old property you have 45 days to identify that other property and 180 days to close the deal with the new one all right now if you guys focus on that in your career there's people who make money just I'm doing those it could be a very in-depth field right so that's what that's all about that's correct Katie it's a hundred eighty days it's 45 days to identify and 180 days to close the deal alright so with that being said that's it for tonight I'm going to leave and I think tonight I am NOT a drinker by any means but I might enjoy a Bloody Mary tomato juice and what's that vodka and what's that spicy stuff or sauce I think I don't know I'm not a big drinker I don't know my drinks I'm fine with a mojito but tonight I'm going to enjoy hopefully you guys would do something fun Tabasco thanks Hannah I knew is something like that so I'm gonna do that and that's one of the Rings if it's made well it's delicious but it's made wrong it's horrific ly horrible you guys agree a Bloody Mary if it's done right it's amazing but if it's done wrong it's like the most hideous thing ever so I'm gonna go for that and with that being said I will see you guys tomorrow it's right Gillian thank you yeah I'm definitely gonna have a lot of mojitos and bloody marys to get through the evening tonight so I'll see you guys tomorrow 10:00 a.m. Property Transfer have a great weekend guys for those you I don't see tomorrow mint celery yes duly noted so it's 1:00 p.m. Eastern 10:00 a.m. Pacific time that's correct Jeanette bye guys

Show moreFrequently asked questions

How can I allow customers to eSign contracts?

How can I add an electronic signature to a document?

How do you insert a sign area in a PDF?

Get more for signature Mortgage Financing Agreement made easy

- Print signature service Investment Proposal Template

- Prove email signature Creative Employment Application

- Endorse eSign Wedding Contract

- Authorize digital sign Business Gift Certificate

- Anneal signatory Website Development Agreement Template

- Justify eSignature Buy Sell Agreement

- Try digisign Summer Camp Volunteer Pastor Application Template

- Add Litigation Agreement initials

- Send Pest Control Proposal Template eSign

- Fax Smile eSignature

- Seal Retirement Letter digisign

- Password Buy Sell Agreement electronic signature

- Pass Formal Letter Template signed electronically

- Renew Lease Termination sign

- Test Basic Scholarship Application electronically signing

- Require Bookkeeping Contract Template mark

- Send watcher initial

- Boost beneficiary digital sign

- Compel customer autograph

- Void Sales Receipt Template template byline

- Adopt charter template esigning

- Vouch Travel Itinerary template digisign

- Establish Software Quote template signature service

- Clear Asset Purchase Agreement Template template countersign

- Complete Summer Camp Emergency Contact template sign

- Force Business Plan Template template signatory

- Permit Summer Camp Parental Consent template initials

- Customize Gym Membership Contract Template template eSign