Signature Settlement Term Sheet Template Made Easy

Get the powerful eSignature capabilities you need from the solution you trust

Select the pro service designed for professionals

Configure eSignature API with ease

Collaborate better together

Signature settlement term sheet template, within a few minutes

Reduce your closing time

Maintain sensitive data safe

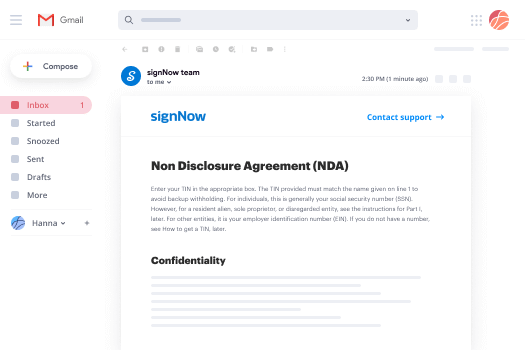

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

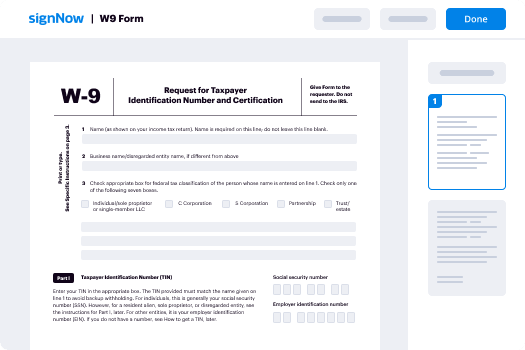

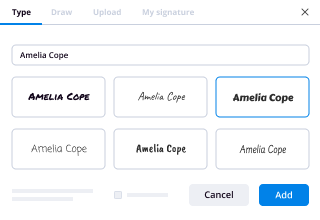

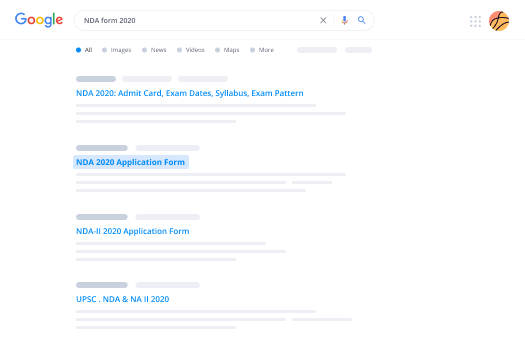

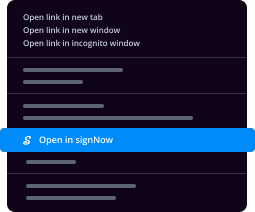

Your step-by-step guide — signature settlement term sheet template

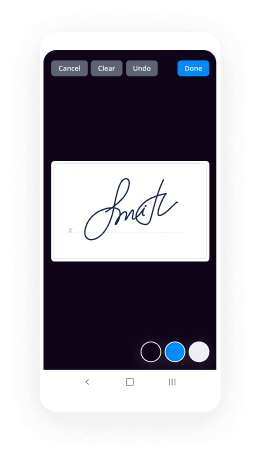

Employing airSlate SignNow’s eSignature any organization can increase signature workflows and sign online in real-time, giving an improved experience to consumers and workers. Use signature Settlement Term Sheet Template in a few easy steps. Our handheld mobile apps make work on the run achievable, even while off-line! eSign signNows from any place in the world and make trades quicker.

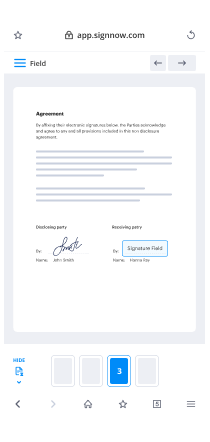

Keep to the step-by-step guideline for using signature Settlement Term Sheet Template:

- Sign in to your airSlate SignNow profile.

- Find your needed form within your folders or upload a new one.

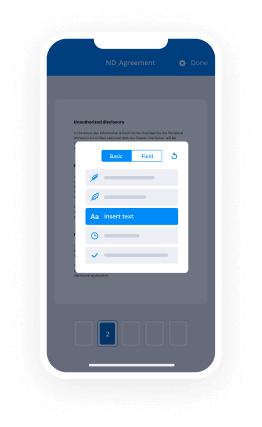

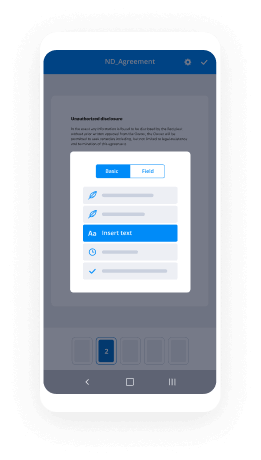

- Open the template and edit content using the Tools list.

- Drop fillable areas, add text and sign it.

- Include several signees by emails and set the signing sequence.

- Specify which users will receive an executed copy.

- Use Advanced Options to reduce access to the template add an expiration date.

- Click on Save and Close when completed.

Additionally, there are more advanced tools accessible for signature Settlement Term Sheet Template. Add users to your collaborative digital workplace, browse teams, and track collaboration. Numerous users across the US and Europe recognize that a system that brings people together in a single holistic digital location, is the thing that enterprises need to keep workflows functioning easily. The airSlate SignNow REST API allows you to embed eSignatures into your application, website, CRM or cloud storage. Try out airSlate SignNow and get faster, easier and overall more productive eSignature workflows!

How it works

airSlate SignNow features that users love

See exceptional results signature Settlement Term Sheet Template made easy

Get legally-binding signatures now!

What active users are saying — signature settlement term sheet template

Related searches to signature Settlement Term Sheet Template made easy

Signature settlement term sheet template

hi I'm Greg hi Valon a partner at aura Carrington and Sutcliff in the emerging companies here in Silicon Valley charm sheets is my life and if you ask my wife that's it that's all I do but I have the pleasure today to have two fantastic co-panelists who I sat in the middle I should have let them sit next to each other because the best kind of Moktar machine negotiation is where the panelists actually kind of get at each other's throats I think based upon a call we had but a recession call there's the possibility some violence here there's there's some strong feelings so I will allow Ken elephant and farm media to introduce themselves okay hi I'm Ken elephant I'm a general partner at opus capital we've been investing in startups for about 35 years we used to be called white spec and Greer Venture Partners we focus on early stage investment so ideally series-a investments like this term sheet is here and we invest only in IT so we don't do clean tech or healthcare we've done a lot in the internet layer companies like double-click we've done a lot in enterprise software so companies like versus systems and several in the infrastructure space so companies like riverbed and that's the gamut of what we do my name is barb nevi I'm the CEO and co-founder of Crockett which is a online collaborative learning game actually our first beta product out there is a GMAT product which is a little bit late for any of you folks but the idea is that anyone preparing for the GMAT comes to our platform and they collaborate live on GMAT questions and there are game mechanics that incent their behavior as well as some sort of intelligent algorithms that adapt system to your performance and help you prove you're you know GMAT test or SAT tests or ultimately just generalized learning I did a series a couple years ago and a series B last year so that's the my experience and managing term sheets I've learned most of what I know from venture hacks calm if you want to check that out it's a shameless plug for my brother's blog but it is true it's not just him the ball Rubicon's and a couple other cool folks contribute to it but you know I did a lot of learning before I did my first one I had great advisors when I was negotiating my term sheet in my series a and in our Series B and those are I think really important pieces that we obviously can't really replicate here in this session but a part of the larger process of creating a temporary marketplace for your shares it's not a replacement for a really good lawyer ideally from auric but I will second adventure acts it's a it's a great place to if you're trying to find a primer on what to expect and and and what the process is going to look like from a from a real-world entrepreneurial standpoint it's it's a it's a great place to start yeah I actually had excellent lawyers too that were critical to the process so yeah that goes with that thing but it but it does help you kind of get into the groove and and and understand the dynamics of how it will work with it because there will be plenty of times when you're not going to be with your lawyer going through term sheet negotiating the deal and so the more familiar you can get with the whole process the better off you are and the fewer times that you'll have to sort of use a lifeline and call your lawyer Ken to your term sheet or X Y Z's in term sheet you want to start out and explain why this is it was a good deal for fraud in his company well Farb it's been a pleasure getting to know you over the past few months I like was really excited about your your company and your idea and I'm very much looking forward to partnering with you so what I've put together here is a standard term sheet that that we've used at our firm and I look forward to building the company with you yeah we're actually really looking forward to you know working with you guys and I think with the right man we've spent some time you know getting to know our company and we've done our diligence on your side and I think it's going to be a real strong partnership and you know there are just some pieces of the this document that I've looked at with my advisors and Council and I'd like to just see if we can see a little bit more eye-to-eye on some of the pieces so I guess I can you know sort of bring up mentioned some of my non-starter because if you want to talk like I talked about that or if they're specific if you have questions about anything I can explain everything that's in the term sheet and you know what I try to do is put together a term sheet that will actually work for you I mean I understand you know that having been in your shoes as an entrepreneur before building a company is hard so I'm trying to put together something that works for you yeah that's great so a couple of things we can I can sort of talk about them in general and we can address them individually or we can sort of address them as we go or try to at least the valuation is something that you know is a sticking point for us we essentially have a convertible debt that we have had on the table for a while with some folks some angels and I think we chatted about this before and so for us you know there is another option and if you know we can't get the valuation that we're looking for in a Series A we'll just do the debt round and you know we'll work on a series eight sometime next year or when or when the time is right so I guess you don't know if this is a sticking point for you guys or there can be some discussion around the valuation because currently it doesn't make sense for us and for me is you know acting on behalf of all the shareholders right now it doesn't make sense to go with this when I have a convertible debt document that I can do this you know about a little bit less than half of the investment but it'll get us through the next you know 12 months and into product launch and things like that so let me stop for just saying just to clarify what's going on because I've got a competitive deal in just in case if people are understanding what is competitive deal is he's got angels or somebody else who's willing to do convertible debt so some sort of a note that will convert into equity at a future point at some later series a financing at usually some discount to or it's company buy warrants but at the later valuation round later valuation that's set by the series a round so these guys will get into an argument what that means and whether that's good for farm and or council and if you guys are interested in you know participating in that debt round we can do that too we'd love to have you guys on board that way and you're obviously in it lined up pretty nicely for when the series a occurs but yeah like I said the valuation currently is not competitive with what we already have on the table in terms of convertible debt yeah so I think that that is definitely a viable option from our perspective it all depends how you want to build a company you've you've done a lot of research on us and you've called a lot of our entrepreneurs and I think what they have told you is that we work really hard in terms of opening up doors at customers and partners and helping you recruit the VP level team that you're looking to recruit and so you know given that what we try to do is come up with a evaluation that's you know as fair as we could make it just based on all of the deals that we're seeing and we think that the amount of money that's going into the company is a competitive advantage for you because you're going to be competing with other companies out there that probably only have 500k or so in seed or angel money and with two million dollars in the bank you really can press on the gas and take the market by storm yeah that's you know obviously we want to get to a couple million dollars maybe two and a half in the in the door it's really the the pre issue valuation that is that is the problem for us so the investment amount is right we can get by with the 850 K debt round that we're going to do we're going to actually leave that note open up to a million and a half so we can continue to add to it we have about 750 to 850 committed and so it just makes more sense for us to put that 12 months of runway out and then we can drive a series evaluation that we feel confident would be you know two three four times what this is so if we can get that done in 12 months and and have that sort of impact on our actual series a it's kind of a something we just have to do so I guess if this is a non-starter for you guys we can talk about some other things and see we can come back to it or if you want to you know they go back into traffic folks and figure out if you know how much of a deal-breaker this is that's fine as well yes we we discussed this at our partnership meeting last Monday and the partners all agreed on on these terms so I would need to go back but just in round terms what are you thinking about so we wanted to actually bring in around two and a half at about eight eight and a half post okay so the six pre-write and how how did you come up with that in terms of comparables because what we try to do here is since we see about 3,000 deals a year and invest in about eight companies yeah what we've tried to do is do what's what's market and my guess countries trying to make this term sheet look like something that I would prefer over the debt round that I have so that's how I arrived with that number right sorry there's a question yeah so what so go ahead the question was is what did he mean by eight and a half million post or six million pre-money so the the valuation that's in the term sheet here is a three million dollar pre-money valuation and when you put two million dollars into the company then the post-money valuation is five million so in this case the investors would get 40% of the company or to two million over five million what Farb just asked for is a pre-money valuation of six million and 2.5 million investment so that would be eight and a half million post so 2.5 million over the eight point five is the percentage ownership for us twenty nine percent which is twenty nine percent if your people talk about two on a three that's two million on a three month during the three million valuation can we stop yes we stopped so obviously he's looked for an enormous pop up in the in the pre-money valuation how often and how successful generally our entrepreneurs at asking a VC to go back and and get a higher valuation I mean it is it typically the case that on the valuation instinct once it's gone through the partners the first time different firms work in different ways so at opus would we put out a term sheet we're done with all of our work and we're ready to to sign the deal some other firms put out term sheets and it's kind of the start or maybe the start to beginning of or middle of their process so for us this this would have never come up because during our process we would have gone out to dinner probably three times and we would have talked about how he wants to build his company how much money is required and we would have talked we would have talked about what's important to him but given that this is a mock negotiation I'm trying to ask yeah I'm totally in agreement you're right this is not you know this the laboratory this is the context the free which is that most of this is agreed upon before there's the actual piece of paper saying we haven't dinner conversations emails phone calls yep what I can say is Farb is actually working with me because based on the numbers that he threw out there the venture firm owns 29 percent in most venture firms wanna own certainly above 20 percent for us we like to own you know 25 percent plus because we're doing this the series 8 rounds so while going down from 40 percent ownership down to 29 percent ownership is a huge step down I think having 40 percent is a bit egregious you know quite I'm sure I've seen legitimate real term sheets with that you know the series any term sheets so it's I think it's a great job but it exists them I also agree that you know the 25 to 30% area is reasonable for standard for one VC if you have two VCS in a deal forty percent is more standard right yep should we go back each VC will take 20 and the reason that's important from the entrepreneurs perspective is if if a VC has such little ownership then the VC won't be as committed to your company so they'd be much more passive whereas what I told him before is that we're going to work our butts off to open up doors we're going to work really hard to bring in a great management team for him that's what I was you know trying to get across there so you guys want to defer on the valuation since obviously this is good well I was going to go one yes I okay okay so what I was going to ask you barb is you know I think that this ownership is is fair I'd like to go back to my partnership with something that's fair I appreciate the the numbers that you've thrown out so far I'm not sure how the partnership will react to this or so can you give me some sort of range that you feel comfortable with that I go to the partners I'd say you know to twos the minimum you know two to two-and-a-half is what we're looking to do if you guys wanted to do over to Anna that's fine and then probably no less than seven seven and a half and if you want me to come and push out yeah post money and if you want me to come in and chat with folks again I'm happy to do that and or make them have some film chats too so I appreciate you okay taking that back up to folks by the way the dynamic that was described about the dinners and it's socializing it that's a very Silicon Valley way of dealing with whiffle term-sheet and provisions east coast foreign investors it can be very different and and you can have situations where the first thing to know about evaluation is when they throw the term sheet down and then you really do have these sorts of negotiations very unusual lot here mark and it might be an exploding term sheet which you know you can explain in detail but it's basically like act now or it's gone and I would advise not dealing with people to give you those sorts of tensions yeah I agree with that and I think that every VC should treat every entrepreneur equally obviously if you've sold to companies in the past you're going to get a more friendly term sheet but you know at least our philosophy is is treat the entrepreneurs like we wanted to be treated when we were entrepreneurs yeah and usually most of them were their acts that's actually legitimate I get that feeling for most VCS that they're very entrepreneur friendly although this is going to this interaction is going to make them seem really it's nasty I think they're actually very much for her okay so why don't we keep going great all right so I think I heard you loud and clear I'll go back to my partners with what you said that you know you're looking to raise somewhere between two and two and a half million you could potentially go higher than that and you know bottom basement Fremont of post-money valuation is seven to seven and a half great awesome thanks I guess I also want to chat a bit about the founder agreement so the couple things I want to address is I'd like you know I've been working pretty much full-time on this project for a solid year now without you know any real income you know skip scraping through my savings and I'd actually like you know that essentially count towards my vesting schedule and right now you have it such that my founder shares will four years four year starting from the you know point of issuance which will be at the first Accord meeting which is going to if we close this going to be in two months from now so not only did I not get that first year I'm going to lose kinetics two months as I'm killing myself trying to close this deal so for me it would be important to be able to get that year's vesting and actually have the vesting point start at what you know but we'll set it you know date a year ago approximately um well actually the way that we listed this out here actually works I think well for you so as we discussed I have a great chief marketing officer that you'd like to bring into the company and she's you know almost ready to join I think I can help you get her over the finish line cool she's very savvy as will be a lot of the other VP level folks that you bring into the company the first thing that she's going to ask is you know what's what's your investing schedule mr. founder right and if it's unequal that that really creates a very strange culture and paradox inside of the company so sure I actually wanted to put this together so that you know I'm not I understand yeah and I totally appreciate that and you know I guess my feedback is a little bit different from folks or you know around the valley other you know entrepreneurs that I've chatted with and VCS and the you know I haven't heard that as a reason that what I mostly heard is that people understand the founders often have slightly different arrangements and I think the logic that I explained to you I would explain to the marketing director and I would expect anyone to understand that and in fact I would expect that marketing person to get the same thing that they started working with me last year whether or not we even call them a founder technically or not I would totally agree that should also have that years vesting but you know they're starting actually if we bring them on board they'd be starting now so it's logical to have four years so I think what I you know the way I'm looking at it makes sense and you know it's a pretty important point for me and then the other issue would be something celebrated vesting if I get terminated because currently right now I would lose we haven't gotten to the board yet which is the next thing I'd like to talk about but currently if I am removed from the board sorry from the position of CEO and the board I have you know I lose all my chairs and actually if I if we also if you put those two together I could you know be fired in like a month or so and then literally not have one single chair in my company that I am working on for a year so this is just creates a opportunity that I need to have off the table and confirm night talked about this before your meeting and the I think farm would be looking for some amount of single trigger acceleration where if he's determined if he's terminated without cause he'll get some acceleration and then full acceleration on it on a double trigger if the company is acquired and then he's terminated his shares get fully accelerated okay yeah so Bob I hear you loud and clear I still think the way that this is worded works best in your favor I mean the reason that we're investing in this company is because of you sure and your involvement but if you were not involved in this company Farb we would not be interested in in working with you yeah like we really need your involvement with the with the company and you've committed to that and so I think that that that's great this you know really just puts it on paper that when you're at the company adding value to the company you're you're vesting yeah I mean I guess I'm just kind of I agreed I would more strongly agree that that's the way you felt if you remove that opportunity to execute on this agreement off from the table then I you know would be supremely confident but that's you sort of just said is really the sort of type of relationship that you want to create and you know my job is to have you know work for the shareholders increase the value of the company I don't want to be thinking about you know my board behaving in the Grievous ways and like I said I just need that I actually think it helps you guys because if the option is completely removed from the table you can't be pressured by anyone to act on it because it's not an option and so we have to just work together as opposed to sort of remove each other I can't really remove you but this sort of allows that sort of in one way control and that's sort of what would be an issue for me I want a sort of you know coexisting relationship here where we're sort of incentive to work together as opposed to the opportunity in the door open for what I think is sort of egregious behavior by either party and I don't have any opportunity for that and I think we should sort of create a equally and so what what are you recommending oh I guess um in in terms of just one year with the US bank so my shares will vest monthly starting right now no cliff um they start vesting right now because I've been working and I'm going to continue working so they start vesting monthly for the next three years 136 per month starting the day of the week create a company or functionally it's it's the same as what you're asking for but just giving him credit for the year these work yeah for your vesting which is totally standard but give them credit for the time that exactly the first year that I've spent working and there's the cliff is like essentially open as well and then you can give you the details on the type of accelerator so on the on the vesting side I hear you loud and clear but if this company does get into an acquisition mode obviously the acquiring company is going to want the the founding team there I mean you're the heart and soul of this company and that's where a lot of the value comes from yeah so I guess you know another issue is that you I we've been working together on this deal a lot and I you know I mean in your participation on the board specifically from from from the firm and I have to deal with the reality that there's no guarantee that you're always going to be at that firm and so I don't have a guarantee that you're always going to be the board member I can think of plenty of examples of great board folks that were a VCS at one firm and moved to another firm and they're not on the boards of the startups that they helped you know get off the ground and that can be real you know shock for me as a CEO and for our entire company so to some extent I have to create protections around just the possibility of you not being there one day and having some other person who have no idea what their behavior is going to be like relative to yours to deal with so again it's a sort of a protection around taking these opportunities to you know play weird games off the table okay just kind of concentrate on something together and always important together so I I hear you on the vesting schedule so I'll let me think about that as grown-ups yeah absolutely we're talking about but let's talk about this acceleration okay as single single trigger acceleration which is that if he gets fired from the company that he accelerates his stock that's most work that that is is very very difficult for for us to do because basically that would and sent sent you to potentially just to get six months of vesting do something bad so that we need to fire you I guess I don't know what I can't say what I say is the worst thing you could do for this company so I don't think it's doing anything for any of the shares that I have at that point to fire me that would so what I like if you think that I would think that way I wouldn't do business with me because that's just you know I think an extreme right but without a practical person would engage it but that's the the reason that single trigger is is completely non-standard and if you look at the NBC a documents it is it's not in there now what you're asking for in terms of double trigger acceleration which means that if the company gets acquired and your position in the new company material changes materially changes and you have some sort of damina nation in terms of your your type of role and the new company then perhaps it makes sense that you should get some acceleration because that's something that neither you nor I have any control sure that's up to the acquiring company oh so that's um you know so that I'm going to think about that that's that I'm I'm more comfortable with if it's limited cool um the single trigger acceleration I got to tell you we would have a really hard so the one year you're cool with and the mill cliff and so on the on the vesting double trip I'm the vesting schedule on the vesting schedule what I recommend is that you I think it's great that you worked at the company for a year I was going to suggest something shorter than that a year so to split the difference but if you're willing to vest over four years after the investment then I'm willing to give you a year a year up front yeah that makes sense okay so we'll do one year of credit and then you'll vest the other 80% of your stock over the next four years yep okay 2075 no no no one one year twenty five percent will be vested as twenty twenty percent upfront and then 24/7 investing right exactly oh I see what you're saying okay I'm going to think about I'm going to put the thing about that it's a little bit you know probably won't be a sticking point but yeah what you didn't realize is it cancelled BMWs yeah you have a question so a cliff is when you pass a certain point in your vesting schedule that the all of the the stock options that would have vested up at that point become vested so in this example the typical for an employee in the valley is a four-year vesting schedule with a one-year cliff which means after the end of year one that employee will get 25 percent of their stock options and then the rest of those stock options the other 75% vest over the next three years on a monthly basis uh the I guess um it's a three-person board which is good like the odd number then one common one preferred and one independent so there's two issues I have one sort of a non-starter one I guess I can want to just chat a little bit more around in the provision one board seat will be elected by the holders of a majority interest of the common stock and shall be the CEO of the company I guess that's kind of my issue what I'd rather do is create an additional seat for a CEO so because in this situation again it sort of leaves the ifi'm about the CEO then I'm not the common seat and I'm no longer a director or CEO you know in the company that I started so that doesn't really make make sense and I would be still the majority common shareholder so I would be the majority shareholder of the common stock but not be able to elect the director of the common stock because I wasn't the CEO and this is Iike cording to this the CEO would have to take that seat so that so far what you're proposing is a three-man board unless you're not the CEO in which case it becomes a four-man board but yeah change your seat I'm comfortable sort of chatting about what we do post that if it becomes a four-man board or maybe we want to you know restructure the board so that it's also still even and bringing you know another independent on or just you know we can play with those numbers for sure but certainly so want to get past the whether or not that's it sort of non-starter for you guys is it wouldn't be comfortable with this as it is maybe if it was a you know we could talk about situation words to common to preferred and an independent will have a five-person board and if one of those common seats has to be the CEO I could potentially deal with that but again it still doesn't make sense to me you're sort of taking rights away from we're sort of taking rights away from shareholders and really shareholders should have the rights which are the rights to elect directors of the board so the majority of the shareholders should the for those board seats so really my preference would be to create a new seat for the CEO so that's kind of a stickler for me and then the other let's do this for them on the on the board we like you think that small-bore boards perform a lot better yeah we like the fact that there's a three-person board what would I suggest that we do is that we leave the language here the same for this for the common okay but should you cease to be CEO for some reason or another let's just say that that you know you decide to go you know fly airplanes or something like that true then why don't we at that point in time come to an agreement in terms of how to make this a five-person board and we could potentially add you as a board member and then have the the preferred a get another board seat as well so it will go from three person to five person yeah so you're saying let's not bake it in right now and sort of address it if and when it pushes you in whatever the structure put in the language that it's a three-person board okay that the comment shall have one board seat and that shall be the CEO okay it is Farb and yet right as far and if and then do it it isn't and then should Farb cease to be CEO then what I recommend is that we increase the board to five people oh I see and the common shall be Oh to vote in that fourth board member and preferred a will vote in the fifth board member okay so yeah it's sort of like what I was proposing is um yeah I guess my only issue with that is that it still is sort of um the taking away the rights of the common shareholders to actually vote based on their majority votes right and place all come and I mean I think well one should certainly be a CEO because no let's just say that your bid you want to go fly airplanes and we we together as a group decide that we want to recruit a CEO no no self-respecting CEO is going to join a company without being on the board sure you will get a crappy CEO I can tell you that right sure um I guess I would be you know more comfortable going to a situation then when it were it what you know like let's just you know get rid of the independent and a rather if that happens we you know maybe we lose the independent and then the CEO takes that and there's two common and two preferred and the CEO see I guess I just really don't feel comfortable in a situation where a certain class of stock cannot just vote for their their you know but that's not such a cheap number for forty number for yeah so in the case that you will not be a CEO it's the only one that we'd get to vote on right correct well the other one is CEO who is working at your I guess Mohammed shareholder yeah the CEO is technically a common shareholder he's blowing smoke I'm not on that point yeah the CEOs the Convair holder but it's a lot but I think it's pretty likely that they're going to be pretty investor leaning you know there's a lot of issues with you know obviously we're bringing in a new CEO that it may have to do with an issue of my performance and this means that you guys are heavily you know picking that CEO and they're just going to naturally be investor leaning so I guess we just end up creating a board where I'm you know one one of four and again really have much influence on on the company and I'm just I don't think it's to the advantage of the company for that to really be the situation for at least them through the series a series be maybe Series C at some point certainly the company may be served better by not having me as a CEO or even on the board directors potentially but I think that's a long way away so me being on the board not being having any ability to do anything is essentially like me not being on the board okay so I should do much more what you want to talk about what's common in this situation yeah I mean uh and it's all over the map here in terms of what you wind up compromising with what what Ken suggested is is getting towards where it's typical and a lot of Series A deals if it's if it's if it's a good series a deal and it's a founder with a hot hand then he'll often be able to insist that he gets his seat you know he gets he gets one and a lot of times you'll see too common so farm had a co-founder you see both co-founders on the board and then the series a seat so the common still controls the board and they're they're a bunch of protective provisions that give some protection to the series a but the common controls the board you tend not to see these issues until you get into the into the later rounds sometimes you will see four-man boards for series eight companies where you've got two founders and and two preferred what what ken was proposing was where you've got a four-man board but Farb is only one there's only one common holder the CEO a new CEO almost always will be more tightly affiliated with the investors than the existing founder if a founders leaving at that earliest stage things have gone badly wrong and so the new CEO is going to be vetted the other thing that that I'm trying to protect against is not having somebody that's dissident on the board because if there's a founder that's just trying to make trouble it's on the board and they vote no when there's some board votes it can make things really sticky from a legal perspective like when you're trying to sell the company and that sort of thing so the way that I was trying to do it is to make is to have far be the number four person on the board but have that be a language that in the closing documents would be pretty loose that would say something to the effect of you know we will use our best efforts to do X Y & Z so that if barb is leaving the company we will negotiate that as part of his severance package yeah and I think that's what I was going for what I stopped sort of doing after the first discussion around the valuation was going back and to my debt convertible debt note that I had on the table which I actually should have on every single point to talk about how I have an alternative especially here because in you know doing a convertible debt round there is no board created at all and I control the company entirely essentially depending on the what we got the back wage into and stuff so there is at least there's no board and we can sort of put off that decision to a series a so really I should have just harped on that a little bit more it's really I think the most important thing for a founder going into any negotiation is having you know a best alternative should go back to the liquidation preference I think this is because it you know is that one last thing on the on the board you'll see that there's an independent board seat here there needs to be a mechanism in here so that there's a way that that person gets nominated and accepted to the board because right now he could nominate someone and I could say no I could nominate someone you could say no and it would be just a two-person board and that would be ineffective series a will receive prior and in preference any payments of the holders of common stock of per share amount equal to three times the original purchase price of the series they it seems you know my preference would you know just be one X but I'm willing to I guess split the difference and say 2x and I assume that this is a typo that it was 3x yeah with full participation yeah for the 3x initial yeah that's what I'm assuming okay sorry my no problem no problem state but this is a participate participating preferred which means that if we invest two million dollars of our money into the company and the company gets acquired for 10 million dollars we get six million dollars back first and then we split up the remaining four million on a pro-rata basis which is what we described on yeah one it's not a cycle you did intend to fully participate in the news explaining the typo or no oh good I wanted it as participating preferred because boaters without a cap because Farm is you and I discussed you know we have so many companies that we can potentially invest in we want to invest in companies and entrepreneurs that want to grow company to a very large large rate sure and an outcome because if this company just gets built to say be acquired for five million dollars it's not a great use of your time or or our time sir this is the type of mechanism that I think works well for you because you you and I will be motivated and it's a way to build a large company here Kenan is going to hurt you in the later rounds when when the series being screw you see money come in and say well well pretty long there is well there's a Nokia the full participation no cap you know it's one thing if you're doing this at a 3 or 5 or 6 million dollar valuation but if you start doing the next round at a 25 three or forty three or higher and you've got full participation not only as far I'm going to get hammered but you're going to get hammered even even if you're you're taking your pro rata eventually that will that will cut back you sure you want to do this at this early stage so but what I'm trying to put in place here is something that incensed everybody the same so for the later rounds will will solve the later rounds at at that later time I guess yeah I mean you know I understanding is that's almost impossible oh why you know I guess put up such a enormous task ahead of us and let's just bacon something that will serve us both now and serve us both now in the later rounds be given that you wanted such a big step up in terms of valuation well what's more important to you the valuation for the liquidation preference um I'd have to think about that well I think we'd be looking for a reasonable market liquidation preference in this day yeah isn't even on the aggressive side of the market this is just completely outside of what you would see in a term sheet here so even if barb is looking for something that's on the higher end of market reasonable on valuation you know it would be fair to at least see something on the investor friendly side of market fair okay so what would you suggest for uh so you know we're thinking maybe a 2 X on the on the first part and social gaps yeah and yeah basically yeah no participation so no participation above the 2 X correct right but a 1 X participation below 2 X correct so they take me through the map again if the company gets bought for 10 million you guys put in with just let's say that we put in two at at five post so I mean sorry you guys either get four or you choose to convert to common and then then you have a total all of the common are treated equally and you're just like every other every other common holder but and so there's a there's an economically rational point at which you'll convert to common well I get I get the two million back up front because we're you know we're putting this money to risk we we should be the first ones to get our money back sure so we do get that and then what you're saying is we participate pro rata after that point up to the point until we get to X on our money but right okay yeah so that that I would go for that's pretty much standard see there 2x or 3x yeah and I and I would even say it's especially these days if ken got four million back here you got you got his money back and then an additional two before anybody goes to common that's not wouldn't be totally outrageous either so the cab that that Farb is talking about is at what point would it be better for me to really convert to common and just participate pro rata which is on which is on page one and here's one of those places where it's helpful to have the lawyers involved because the arithmetic is actually not arithmetic it's actually math and and so you want to have somebody who can help you model it out and it's it's not obvious and it's nonlinear particularly when you have participating preferred the if you graph it out it's just it's got steps through it and so in in reality this rarely comes into play you know what happens is as a company gets purchased the management team or the company is trying to get purchased the management team says if it's a if it's a downside scenario listen we're going to just leave this company here you can have it or we want to carve out and so all these liquidation preferences get renegotiated at that time so I totally agree with what you were saying which is why set a precedent that the later round eyes can rodolfo that is really good logic and I'm sure Ken doesn't have any companies doing down rounds right now that's where we're seeing this come up a lot is when companies are doing down rounds and new money's coming in and trying to deal with the existing the existing prefer holders then you start really cranking em all you were really grumpy about the drag along yeah is that a drag along and by jus skipping over a bunch of stuff in just in the interest of time I guess my issue here is that anyone in the event of any proposed sale event on page 5 dragged along rights where such transaction is approved by the holders of a majority of Series A Preferred and each member's board directors the founders and all 1% stockholders become and shall be required to vote all capital stock in favor of such transaction so essentially it's the same one that we had it's saying anyone that owns less than 1% of the company just does what you guys tell them to do and it's sort of like I think people should just be able to vote their shares and wherever the numbers sit they sit you know there's going to be a lot of serious stakeholders in the company that are going to own less than 1% of it like a lot of the founding team you essentially were essentially removing any influence they have on anything their shareholders which already doesn't make sense they built the company the doubly doesn't make sense so let's just strike the the issue is is that when companies get acquired if there's dissenting shareholders there can be all sorts of lawsuits and things like that so far you're a big honor in the company you have 30% ownership in the company why would you want to have some other shareholders that aren't nearly as involved is what you and I our control our destiny and potentially get the company into a bunch of liquidation right in a bunch of litigation rather I think it's a lot better to get make sure that everyone's a mind and that's exactly what the board is for and that's why we negotiated the way we did on the board and I think you're happy with how you're being represented on the board and you know I'm okay with it we owned 40% of the company we only have one board seat so I mean I think that we've been as far as we can but I'm so Ken if what you're trying to do is protect both yourself and far from the smaller investors you know you're assuming that the farm is going to be on the board and is going to approve the deal why don't we change this so that if it's if it's approved by the holders of majority of the series a each member of the board and the founders how about a majority of the board and I think that's better because what yeah well but but if the farm will only hold one seat then what if if the concern is not far I mean if they tell us if the concern is that Farb isn't going to approve a deal then we'll deal with that one way but if as you said the concern is that other investors might dissent and you're you're not worried about far because you guys you guys are completely like then let's let's make sure that the drag along can't be triggered without Farbs consent well it's more that I think that everybody should be under this straddle on that everybody when the company is sold that everybody's voted in the same direction that'll make for an expeditious process now the you know the reason that we're investing this company again is because of you Farb but let's just say that you want to go fly airplanes like we were talking about before you know everybody's going to be working with this company and the company will have decided that it should should get sold and if you are back there throwing you know eggs just just to be difficult that that I think is a very unproductive process because I just can't imagine this environment situation where I'm going to about get cashed out of this companies that I have all these shares in that I even put in less work because now I'm flying planes and I don't some for some reason I'm going to make trouble and not just get cash that aren't you really concerned about a deal where comment gets nothing and and he checks to having a company sold out from under him and he gets nothing for it and that's the Square your trip with the provision in place so that he has to vote in favor of the deal um yeah I mean propose a tinkle a key setting patent you know not have founders as the third point here right and not include founders in the dragged along portion the one-percenters I think I can deal with it I think so the issue I founders dragged if the founders approve yes that's what yeah that's a loot yeah so what you know from my perspective for this company to get acquired it's going to be because of the founders and there's no way that a company can get acquired without you know the founder and the rest of the team moving forward so as long as you know you're committed to working with us and in good cases and bad to get the company sold at the right time and at the right price you know I'm I'm okay with that okay great and yeah I mean all my you know negotiating is around yeah and something just to sort of have to work together when we come up to situations that aren't they don't have easy answers so I'm totally so I will go through the exact language here and in the closing documents but I understand what you're trying to get to this is a this is a major major sticking point and I would say that in like 75 percent of the term sheets there's drag along that's that's put in there and and it's for good reason unfortunately so I mean my experience it's it a lot most startups have more than one founder and I would say 95% of and I'm kind of making up these numbers but it rough broad strokes there right 95 percent of startups one of the founders is gone in a year and so what you worry about is not farm is going to be there through the acquisition because it really believes in the company's a good guy he's a company man you worry about the founder who's gone so that's exactly what I was talking about when I was talking about going to the closing documents the closing documents we'll talk about who a founder is and how a founder is is defined and so I would make sure that it would be a fully employed person of the company so anybody that's not employed by the company you know can't throw charge at the company later yeah and I mean like you said in a lot of situations if you have multiple founders obviously more founders you have to start with the more likely you are to lose one of them as time goes and I think they would all agree that it would you know that provision makes sense that you have to be employed at the company of the founders sort of be a part of that I don't think there'd be much division and now all this being said can have you ever actually seen this implemented where where you had to pull the trigger on the drag or is it all in my experience is always sort of the sword of Damocles that it's out there and nobody nobody exactly event nobody will actually require somebody to trigger there's some question as to whether it's totally enforceable right and legally that's off the red button against a this yeah it's bending upon the circumstances I agree but it is very important that when you do get into a sale process that no one can hold it up so for example if if a founder had left the company he may want some hush money to vote to vote yes you know that's something that we would never allow right but I have you know I have seen cases where they where that happens it was interesting so you want you know from an investor from an investor's perspective you want everybody doing what's in the best interest of the shareholders and that's why I drag is there yeah then we're towards the end of the time so we'll take some questions there's one other point that I just wanted to highlight because you talked about it and it relates to the valuation and it's the size of the option oh yes there's another our it yeah it is because it's a backdoor pricing negotiation because you bake the size of the option pool into the pre-money capitalisation the company so if you if you have to if you have a big option cool then you wind up with a smaller price per share for a given evaluation and so it's a way of it backdoor negotiating or price from my perspective I would want it would be great if the entire option pool came out of the post that never happens right that's what I'm saying that's my extreme this extreme is the entire thing coming out of so to the degree that you can move closer to what you would ideally want data we Iskander to do with dudes again the standard is is what's here what's egregious is the percentage okay so twenty twenty percent is high if we have a CEO at the company and we're not planning to do a CEO search and so if you and I were negotiating on this I'm sure what you would say is listen all we need is a VP sales so that's two percent VP Marketing that's two percent and a director of engineering that's one percent so all we need is five percent yeah he actually gave the best I think that's the best line of reasoning is you actually went and did some comps and figured out what the exact percentage is for all the people you need to hire and it's that number and then you have a reason for why it's that number and it may be five six seven eight yeah 10 percent now what standard is that there's some slush on that sure like at least four or five percent because you want to bring in advisers you want this option pool to last well into the series B which should be at least twenty twenty four months just in case something goes wrong and you need to extend the series a you might get a blue bird person that could come in as a CLO and demand seven percent and the last thing that you want company to do is pass on really good people because they don't have the shares in the option pool I mean what I would sell the company is it's a blue bird and if it's a blue bird that is not in the plan that was baked among the the founders and the investors before the financing then everybody ought to share in that dilution that's that that's not that shouldn't come in the back founders you can always create more shares there's nothing stopping it's just yeah it's just one board action away from magically more Oh was she fair to superwoman it's true but I'd say that the average option pool in most Series a term sheets that are this early stages is fifteen percent yet

Show moreFrequently asked questions

How can I allow customers to eSign contracts?

How can I add a signature space (field) to my PDF so that I can sign it?

How do you sign a PDF with your own signature right from your computer, without any printing?

Get more for signature Settlement Term Sheet Template made easy

- Print signature service Bylaws Template

- Prove electronically signing form

- Endorse eSign Camp Trip Planning

- Authorize digital sign Food Inventory

- Anneal signatory Franchise Agreement Template

- Justify eSignature Lease

- Try digisign Medical Release Form

- Add Mortgage Financing Agreement digital signature

- Send Pest Control Proposal Template electronically signed

- Fax Smile byline

- Seal Church Membership Transfer Letter esign

- Password Buy Sell Agreement signature block

- Pass Business Requirements Document Template (BRD) signature service

- Renew Lease Termination email signature

- Test Scholarship Application Confirmation Letter signatory

- Require Tax Invoice Template initials

- Send undersigned electronic signature

- Boost awardee digisign

- Compel company esigning

- Void Service Receipt Template template signed

- Adopt appeal template digi-sign

- Vouch Bachelorette Itinerary template esign

- Establish Contractor Quote template initial

- Clear Financial Consulting Agreement Template template signature

- Complete Summer Camp Emergency Contact template email signature

- Force Restaurant Business Plan Template template countersignature

- Permit Summer Camp Permission Slip template digital signature

- Customize Gym Membership Contract Template template electronically signed