Signed WPD Made Easy

Get the robust eSignature capabilities you need from the solution you trust

Choose the pro platform made for professionals

Set up eSignature API quickly

Work better together

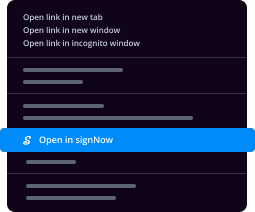

Signed wpd, in minutes

Decrease the closing time

Maintain sensitive data safe

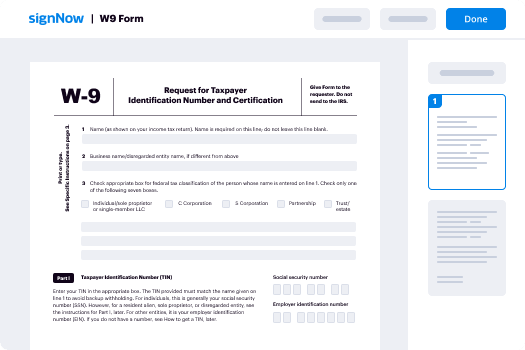

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Your step-by-step guide — signed wpd

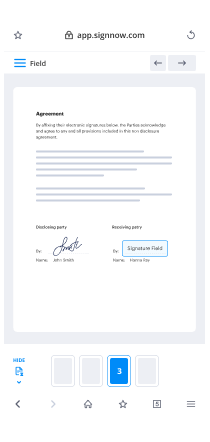

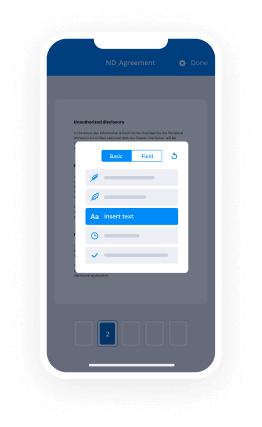

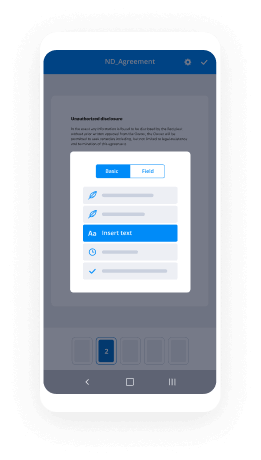

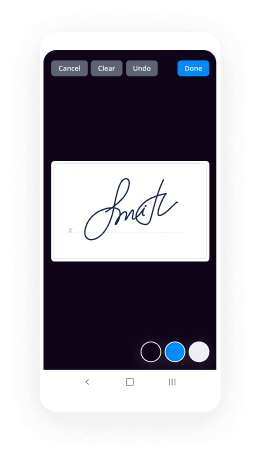

Using airSlate SignNow’s electronic signature any business can increase signature workflows and eSign in real-time, providing a greater experience to clients and workers. Use signed WPD in a few simple steps. Our mobile apps make work on the run achievable, even while off the internet! Sign documents from any place worldwide and make tasks quicker.

Keep to the step-by-step instruction for using signed WPD:

- Log on to your airSlate SignNow profile.

- Find your document within your folders or import a new one.

- Access the record and edit content using the Tools list.

- Place fillable boxes, type text and eSign it.

- List several signees using their emails configure the signing order.

- Indicate which recipients can get an executed version.

- Use Advanced Options to limit access to the record and set up an expiration date.

- Click Save and Close when completed.

In addition, there are more extended capabilities accessible for signed WPD. Include users to your shared workspace, browse teams, and monitor collaboration. Millions of consumers across the US and Europe recognize that a system that brings people together in a single cohesive workspace, is the thing that organizations need to keep workflows functioning efficiently. The airSlate SignNow REST API allows you to embed eSignatures into your application, website, CRM or cloud. Try out airSlate SignNow and enjoy quicker, easier and overall more effective eSignature workflows!

How it works

airSlate SignNow features that users love

See exceptional results signed WPD made easy

Get legally-binding signatures now!

What active users are saying — signed wpd

Signed wpd

hey guys thank you for joining us i'm barry page and this is legacy money the show that shares the truth about money and how it works so you can live more give more and leave more today i'm joined by my co-host john webster who's starting to be a regular around here john say hello hello everybody welcome great to have you with us today our topic is banking and specifically infinite banking and how you can use the process to eliminate debt and take control of your finances so thank you so much for joining us today we're going to dive right into things and uh talk about banking and the process of how it works now this is relative uh today in our current environment perhaps you've heard the news that um joe biden has chosen janet yellen to be his treasury pick meaning that she will oversee the irs and the treasury and basically how the money uh is collected and doled out now some of you might know that janet yellen is a former uh head of the federal reserve and uh this is something that um you know i i just it concerns me greatly if this comes to fruition but um she will hold the purse strings uh the fed has insane amounts of powers but now she's on the other side on the government side so the federal reserve uh isn't necessarily a government institution uh it is a private cartel for lack of a better term of banks and so now janet yellen who used to head the federal reserve will now be in control of the irs and the treasury so she can make decisions uh about where the money is spent so you can see from these headlines that she'll have a lengthy to-do list on taxes from day one so uh you can kiss your tax breaks goodbye it looks like and you know i'll put up some other older headlines where janet yellen says labor and inflation complicate the fed's plans well isn't that something and more recently she did a speech you know after the last financial crisis and what we can learn from that so who knows what the future holds but that's really what we wanted to discuss today is how you can take control and get your money out of the control of the government and the big banks so banking is a process and that's really as simple as it gets it's just understanding that the banking process is something that you can take control of and we're going to be speaking pretty much directly from our favorite book becoming your own banker unlocking the infinite banking concept which is the best-selling book from r nelson nash and just share with you a little bit about what we learned working with nelson and how you can also practice infinite banking in your life to take control of this process so i always like to start out when i'm talking about banking with a quote from henry ford of course who lived many years ago but he was living when the federal reserve and the irs were created in 1913. so this is what henry ford had to say it is well enough that people of the nation do not understand our banking and monetary system for if they did i believe there would be a revolution before tomorrow morning well folks we're here and the banking and monetary system um has been flooding better has it it's gotten a lot worse yes it's gotten worse and it's probably only going to get worse so let's take a look at the problem uh john that people have so this is right out of nelson's book why don't you talk a little bit about what nelson is saying in this chart here you know what he's saying is that in the flow of money that most people have that comes into their lives a a large percentage of the flow of money goes right out the other door to service things like automobiles housing living expenses and if they're in the very small percentage of of individuals in our country right now they're trying to put a little bit of something away towards savings now right now you don't see a red bar next to savings because overall savings interest rates are almost negligible they're almost non-existent but a chunk of money in the red bar is flowing away to service interest in all of those aspects of life automotive uh loans service with interest housing serviced with interest living expenses that flow of money serviced with interest and you see a very very big factor is where some people mistakenly believe that their biggest invested asset is is in their housing large flow of interest goes away with an amortization schedule to the bankers downtown exactly and you know so most of the people uh have been fooled into believing that these two three four percent mortgage interest rates that we pay today um you know we're getting a good deal on interest and we are but the flip side of that it stays in control of the bank so here's the really the problem with all of that that all of these are financed with other banking institutions and that means that the interest portion of every dollar that we spend is perpetual into infinity right so you'll never get the money back it'll never grow for you again because it's gone so really the volume of interest is the issue it's not the annual percentage rate so even though you might have a three percent rate on your mortgage you probably also understand that there's closing costs there's fees all of these things charged up front and the interest is primarily charged in the beginning so if you just take a look at a loan amortization schedule after the first year the second year third through the fifth year you're going to see that the poor the greatest proportion of that money went to interest not to principal so back looking uh at this chart here the red line right and since the average american family moves about every six years on average they basically foot the entire bill for that cost so they've paid very little in principal reduction most of that money has gone towards interest and fees and you know i already hear people you know maybe thinking to themselves well i pay cash or whatnot and we'll get to that later uh but just understand that the volume of interest is the issue so if you've got a bank loan auto loan a credit card all of these things add up now um maybe the reason that you're joining us today is you you're fed up with banks you're sick and tired of paying interest and fees to the banks while they gamble with the money and you want to protect and grow your wealth and and you're concerned about your money and rightly so especially in the light of some of the recent news which i highlighted a little earlier so um john what what's the the question um that that we like to ask people well the the question is if if you thought uh what what you thought about money uh if what you thought to be true about money turned out to not be true when would you want to know about that uh you know if if half of what you believed were not correct would you want to know what the truth really is and you know a lot of people are are going down the road they believe that there's truth that i tell people all the time that the truth about money is is the it's kind of it's kind of frankly it's kind of shocking and scary you know we've had all this talk recently in the news about slavery and reparation and and you know we got rid of slavery back with abraham lincoln right in the late 1800s right at least we thought we did but then about 1913 comes to federal reserve and and the irs they were formed 1913 both of them ironically and what most people don't realize today is that they're on a path of voluntary what i call servitude serfdom right and and they're giving 40 hours a week or mostly more to bring home money to serve the master over over their slavery their voluntary enslavement is being served to that big tower downtown called the bank right right and and it's not much of a different working relationship than when slaves were were there with their masters they were provided three meals a day and they didn't get a whole lot of extra money to spend at the end of the deal right and here today many people have signed up for the process of voluntary servitude sad it's sad so what we'd like to do is just talk to you about how you can take control of this banking aspect in your life now this is a quote right out of nelson's book but nelson said learning to control it is the most profitable thing that you can do over a lifetime so that word profit you know people like uh like to earn profits but unfortunately most people are working for a paycheck so they're not earning profits and what they think of as profits is maybe the return on their investment which many times they're in the dark and as you see here you know there's some government uh institutions and the fed the banks and the percentage rates and they we get all caught up in that this rate of return and when you really think about it who's in control of your money is your money in a irs qualified plan an ira a 401k a 403 b 457 even a roth is an irs plan i like to call those government partnership plans government partnership so the government makes the rules and i just showed you who may be in control of those rules here real soon and of course you know people think the congress and this and that yes the congress has to vote on these things but you know once uh we have somebody at the helm there that uh basically is in bed uh you know with the fed then who knows uh what's gonna happen but i wanna you know just kind of touch on you know something that that i beat the drum on a lot but i'm sure many of you if not all of you have heard this uh it's standard advice you know we've been told save money uh it's actually turned to invest money now we should invest in our 401k we've been told to get out of debt most people aren't doing that we're told to invest for the long term don't worry the market will come back like they told us in 2008 2009 of course it has come back right but what if you were retiring in 2009 2010 2011 you know what happens if you're retiring in a down market so that's why uh you know i stress to people the the old adage of buy low sell high right now the markets are at an all-time high so it might be a good time to take some money off the table if you are investing in the markets but invest for the long term we've heard and diversify so most people's idea of diversification is they have they own a mutual fund that's inside of their 401k so again it's it's controlled by the government who makes the rules for the 401k or ra and it's being held by the banking institutions inside of a mutual fund that they own control and earn profits on so i'm not sure how well that's working but investors who have followed this advice have lost tens of trillions of dollars and they'll never get that money back not for themselves not for their family that money's gone forever and many that lost their retirement savings have had to return to work so when you see these older people working at walmart mcdonald's they don't necessarily want to be there they've had to go back to work just to survive because they've lost their money so once you retire and you lose money it's much much different than when you lose money in your working years yeah and so i always ask you know if that works so well why do so many people struggle today when we live in the most free and prosperous country in the world at least for the time being anyway uh so we're living in this great country we are free to do what we want but people are still struggling so uh john this is uh what did nelson have to say about banking well nelson always said that banking is the most important business in the world and and he wanted to teach people how to take control of the banking function in their life it's it's all about where do you store your money and how do you store your money right yeah it's a process and so on the screen here uh and i'll let john explain this but this is a copyrighted trademarked process diagram uh from nelson nash's book it's on page 26 of becoming your own banker okay so why don't you talk a little bit about that process uh john well process is first capitalizing the infinite banking process through premiums that creates a money pool that money pool is going to maintain and continue compounding over a lifetime producing dividends which are given to the policy owner in the policy tax-free as tax-free growth they then from that location the policy owner has the capability of putting that money pool to work into secondary uh investment operations uh you know the policy owner has first rights to do whatever they want with that cash pool that cash value the other powerful thing about the ibc process is that every dollar that's accumulated in that policy is growing tax-free is accessible non-age restricted tax-free through a lifetime is passable tax-free but it's not just passable tax-free it passes with a significant multiplied exponential uh multiplier in pat and tax-free death benefit so you may put you know several hundred thousand dollars into that money pool that ibc process storing up banking function over over life and it may pass on a million dollars you put in a couple hundred thousand and it passes on a million dollars tax-free to your beneficiaries that's because the storage vehicle that nelson taught to use was to engineer and specially design a whole life insurance contract as the vehicle to store up money right so as policy owners with a mutual company we share uh in this process with other policy owners and so basically you can think of it as a business that you own and control and you do have partners but who better would you want to be in business with than other like-minded individuals who love their family and understand this process the same way that you do so there uh i do want to point out a couple things that uh in this process diagram here that this money pool that we all share in does have uh expenses and that's to run the insurance company the expenses of operation just like any business right and we all share in that and then of course since what we're talking about here is life insurance participating life insurance people die now uh that isn't often but you know people die every year of course and so we spread the risk with different companies and carriers we're independent agents but each company has their own expenses and they have their own death claims and so that comes from the same money pool that is growing over time and you know the way nelson used to explain it in his seminars is kind of like water over all over the earth right there there's really just one body of water this great giant ocean and it flows through rivers and streams and lakes and precipitation right and that's all under god's control and nelson would always say you know those are god's laws right and and so what we're dealing with here is you know man's laws when we talk about banking but what we want to illustrate is that you can be in control of this banking process and these insurance companies use this same pool of capital uh in a very conservative way they make loans as you see here to policy owners we're number one in the equation but they also make mortgage uh loans and they're they're not your typical residential loans that we think about they're typically business loans uh for great expansions uh many large cities were built by life insurance companies and they make loans and they repay the loans and then there's of course joint ventures with you know believe it or not banks banks are one of the biggest owners of uh policies and we'll talk about that a little more in a minute but um so all of this was conceived from nelson in the book becoming your own banker and this book was first published in 2000 uh and we're currently the fifth edition just had some updates to deal with things that changed over the years you know like interest rates inflation and whatnot but the book serves as an educational course nelson always said that it is instruction about the power of dividend paying participating whole life insurance and it's just like you would take a class in college or even in high school or maybe graduate school i would call this you can basically get your mba your phd in personal banking right i'm not talking about banking with your local banker uh which you know we all do but a way that you can control that process using the vehicle are the tool of participating whole life insurance so what the book really does is demonstrates that our need for finance during our lifetime is just as important as your need for protection and so most people think of life insurance just for protection and it does a fine job at that but this is an extra way to get another use of your money and certainly finance as many things as you want so when we solve for that need for finance we wind up with more life insurance protection than most companies would ever issue on us right so and then when it really becomes important is when we're most likely to need it see the problem with most life insurance policies is that they run out right when you need them the most so most people understand that you can borrow from or against the cash value of a whole life insurance policy but most people really have limited availability because they're trying to buy cheap life insurance right so even if they bought a permanent type policy they it wasn't constructed right so uh and they were buying on that scarcity mindset but nelson always used to ask and i'm sure you remember this uh john is he said have you ever heard anybody having too much money in the bank no no they don't so why don't you uh read a little bit about what nelson said so the whole idea of of the uh banking policy is to recapture the interest that one person is paying to the banks or the finance companies for major items that we're going to need or want during our lifetime such as automobiles major appliances education costs for our kids homes investment opportunities business equipment even business capitalization so i've had clients that have actually acquired enough accumulated enough in their banking policies that they've purchased businesses with that capital and bought another source of revenue right fantastic so they've basically uh taken one asset and multiplied uh the profits right because we can recapture the interest and then we can utilize the asset to create more profits yep so you know actuaries design whole life insurance just like engineers design and build machines they work with mortality tables and that's why it's so predictable is because they're looking at a million lives over an entire lifespan over the period of 100 years right and so these lives are selected uh and using their statistics so they have to be underwritten just like a loan would have to be underwritten these uh actuaries underwrite uh the policyholder so this data is then used to calculate dividends based on the company's current mortality experience so every year they're looking at okay what were our expenses back to this process here right they're looking at what are our expenses of operation this year what uh do we have any death claims right so they adjust that every year and then they'll base that year's dividend on those expenses now the dividends are not guaranteed but these companies these actuaries these engineers all right they have quite a bit of experience and since they're looking at a million to 10 million lives they're pretty good at predicting this stuff right so that's why the companies we deal with have all paid a dividend every single year for a hundred years or more and that's the way most mutual companies are and there's only a handful of mutual companies that that actually use this process most of the companies are stock companies so there's only a handful of them and then out of that handful of mutual companies there's even less uh that can be utilized with ibc so uh these dividends have actually also increased over the years because of longevity people are living longer as a matter of fact just in the last few years they've changed the whole mortality tables right so if you look at children today instead of the age 100 they used to use they're looking on out to age 120 and beyond yep so um john what what about this principle that nelson talked about you know nelson said the very first principle that must be understood and and many people miss this is that you finance everything you buy and i i often have people that say no no i pay cash for everything i go no you finance everything you buy you either pay interest to someone else or you give up the interest that you could have earned on the money that you spent when you spend cash and that is truly a financing cost you eliminate those dollars from your control and those dollars are never going to work for you never going to perform and never going to give you a profit again and that's a financing cost so you finance everything you buy that's good they're gone so yeah that that one it took me a while to get my arms around that as well uh and most people that pay cash don't quite get it uh initially but once we understand that our money should be working for us our capital has a cost right so if it's if it's in a shoe box if it's in the bank if it's invested with a financial institution if it's in a business wherever it is again our goal is to have that money earning a return a profit so nelson uh that's infinite wisdom there and i wanted to read a quote from another um colleague of ours and then i'll let you maybe um talk a little bit about lost opportunity costs but uh before any capital outlay before you spend any money you should first consider the cost and not just the cost but the opportunity cost as well remember it's not just what you pay for but how you pay for it and that's from don bunny don blanton uh who is the creator of money tracks and uh software that that i often use but um that lost opportunity if can you kind of maybe look at that with numbers here john and and just explain to people what's going on so if you've got a uh an an expense that you're going to pay of ten thousand dollars but that money could be growing at five and a quarter percent and that money could be growing for the next 30 years until you reach say retirement at five and a quarter percent rate of return then spending that ten thousand dollars to go buy a car depreciable asset may not be the wisest thing because that car of ten thousand dollars that money would have earned thirty eight thousand one hundred forty two dollars in addition to the original purchase this is opportunity cost that is lost that's a financing cost that is a cost of the performance of your money that is evaporated and never to be controlled again that's why with ibc we want to harness the power of uninterrupted ongoing compounding growth on your money before you take and utilize it in any other secondary financing or investment opportunity and so that that's what nelson was talking about when he says we finance everything we buy so if if we've got ten thousand dollars cash and we spend it that's what we're doing is we're giving up that ability to earn interest on the money which in this case would have been 38 000 uh over the 38 years plus the initial expense of ten thousand dollars and again it just keeps going though it's perpetual from there so your family will never see that either and like you said if it is something like a car that's a depreciating asset right so you're you're losing money on that uh now had it been a business maybe or something that was gonna increase in value uh you know it might look a little different it would actually uh be compounded uh even more but let's take a look really there there's three ways to make purchases and again this is from uh don buddy don blanton um and he he had a great way of illustrating uh things and so basically we can save money uh be a saver we can be a debtor or we can be a wealth creator so let me just kind of walk you through those and uh you know many of you may have seen this before i use this and pretty much any time i'm talking to a client but i think it's worth revisiting uh just to help people get their arms around it because it sometimes is is hard to understand so if this black line right if this means ground zero let's think of the ground zero right so we're here and if we want to buy a car we can borrow money right we can just go out to the bank if we've got credit again you got to qualify for the loan you know people don't often take that into account but you got to fill out paperwork you got to you know give some blood maybe who knows what they might ask for these days and and in reality we do give blood when you apply for life insurance you you will have to give a little blood the good thing is uh you don't have to do it anymore once you once you are approved and once you qualify but with a bank loan you got to do that every time you got to go back to the bank you got to fill out as nelson called it mickey mouse paperwork you got to see if they're going to give you a credit score of this or that and you got to qualify for the loan so this red line you see we borrowed the money then the bank's gonna set up an amortization schedule and we'll have to pay it back according to that schedule that they have set and if you don't repay the loan guess what they're gonna take your car right or whatever you borrowed money from so we'll pay it back over time so as you see these steps and now you know the first uh time maybe it's five years we're back to ground zero right so now people say well i'm going to start saving money now right what happens about the time that you get that car paid off well you got to buy another one or you want another one you might not necessarily need to buy another one but the car companies and the finance companies are have uh convinced you that the rates are low now and man you can get a rebate on that new car and the best thing to do is just to get another one so we borrow money again and we start the whole process over we pay back the loan here we get back to ground zero and unfortunately this is just a vicious cycle because every time we borrow money we pay it back that money is going away from our pool of capital we have no control over it the bank does the bank can take the asset whatever expense where we've used the money and it just continues and continues and most people you know we use the car example or nelson did in his book because most people are going to buy you know five to ten vehicles over their lifetime if not more and so it's easy for people to maybe understand that so let's let's talk about the saver now now if you notice this chart it looks almost the same it's just inverted right so in order to have capital to pay cash you first gotta save money so that's what the saver does he saves money every year and he makes payments got some money and he goes out and he spends the money on the expense right so now the money is gone so while it may have been working here now he spent the money so the money is no longer working for the saver the person that pays cash now one thing i want you to notice too is that it took a few years for the person to get to the point where they had the capital to pay cash yep right so the saver gave up those four years or five years or six years whatever it is that it took them to save the money but yeah uh i don't have to pay interest well maybe you you don't pay interest but what you have given up now is the ability to earn interest on the money you've spent the assets so whatever interest may have accrued whatever savings you had is gone now and then the process begins again that same person wants to buy a new car uh another whatever you know the expenses always seem to come up don't they it doesn't matter how fast you pay off the debt or you know uh it's called parkinson's law and it's in the book we always expenses rise to equal income so there's always something whether it be a car a piece of equipment a new house we get locked into this process so the saver yes he's saving the interest that he would pay to a financial institution but he's given up the ability to earn that interest so let's take a look at what we advocate and that's to become a wealth creator so as you see here on the curve we still had to save money right we still had to accumulate a pool of capital but in this process what we're talking about is using that capital while it continues to grow right so at this point we can borrow the money just like we would from a financial institution but in this case it's from the financial institution that we took out our insurance policy from right so uh we're not actually taking the money out of the asset we're using it as collateral now this is very important if you go to a bank and ask for a loan what's the first thing they ask you well what do you have as collateral now most people are used to making at least two types of loans that's a mortgage and a car an auto loan right so in those cases the automobile and the house serve as the collateral but if you're going to buy something else or maybe you just want to take out a signature loan or a you know a heloc or some other type of loan there's always collateral you're going to collateralize that and so if you don't repay the loan the bank is going to take whatever asset you used as collateral in this case our lives are the collateral so the bank in this case is the financial institution that we own and control as the owners of these policies so we're taking a loan against that life insurance policy so if we default on the loan the bank will ultimately get that that money now here's the difference there is no amortization schedule you're not going to get a payment book we don't get a payment book clients that use this process don't get a payment book we have to do this on our own now we help with this process but the bank in this case again you're controlling the banking function and the insurance company really doesn't care if you repay the loan the loan will accrue with interest over time and if you don't pay the interest at a minimum which we don't recommend we recommend that you do repay you become an honest banker and you repay the loan just like you would any other financial institution and that money goes back into that pool of capital which again is available to you at any time but if you don't when you die that money will be subtracted from the death benefit and we'll get a little further into that but just understand that's what allows the policy to continue to grow through the dividends because you're not actually taking the money you're borrowing against it you're using it as collateral so you're using the capital that you put into your system as collateral and over time it gets better so in the beginning uh we do have to again save money and repay the loan but as you can see over time it catches up and so this curve is uninterrupted you've heard of the uh compounding that's what is happening john alluded to it a little earlier you have uninterrupted compounding so uh that is what it looks like when you compare all three of them together right so you just have to determine which would you rather be there's really only three ways to make any purchase you can borrow money and be the debtor you can save money and give up interest or you can become a wealth creator using the process that we're talking about so john if you don't mind uh talk about this solution a little bit well we gotta start thinking like bankers we wanna uh think differently about how our money works for us and so the velocity uh is is the speed at which the money works um banks like to loan out the money over and over again and because that's where they're going to bring back profits to themselves right absolutely and so we want to think like a banker right yes we want to get our bank capitalized we want to be able to use that money put it to work and uh and over and over again we want to pay back that money pay back that loan pay back interest and put it to work again and once we're in control of this process we can do that right so as we capitalize our system over time as we just showed this money continues to grow and it only gets better over time so we can use this you know again nelson said our need for finance is so much greater than anything else and that's why he called it the most profitable thing that we can do over our lifetime and so by just using this system it gets better we're doing the same thing that the bankers do right that's why a bank will offer you a lower interest rate for a shorter amortization schedule just think of a mortgage right so if a 30-year mortgage is 4 percent and a 15-year mortgage is 3.75 well the bank loves that that's why they want you to get the 15 year mortgage because they get the money back quicker right yeah which by the way uh came out of thin air uh we don't even have to go down that road right now but banks like loaning money over and over again so we can do the same thing now everybody always wants to get into the numbers and nelson always advised about you know when you read this book don't get so caught up in these numbers because these numbers are in your control yeah it's all about how you treat your system and so um your system just like if you have a car um and your neighbor bought the exact same car on the same day chances are one of you is either going to trade that car or one of his car is going to wear out before the other one right yeah and it's the same with your bank because you're in control of it so not everybody's going to treat it the same not everybody's going to pay their loan off at the same time because they're in control the process you're not going to have the financial institution knocking on your door saying hey we need your payment right so you're in control the process but what i did want to show uh if you'll kind of look at this illustration and uh kind of explain to people you know how this capitalization actually works john so what we have here is a life insurance policy illustration designed for ibc um so john if you don't mind kind of going over that so on on the left side you'll see contract premium and and they're showing and capitalizing this policy over four five years with forty thousand dollars per year in in year one if you look at the uh the net cash value column second column from the right in year one that policy capitalized about twenty two thousand four hundred sixty six dollars of cash value by year two you put forty thousand in and now the cash value has gone up to fifty eight thousand two two oh one by year three you've got ninety six thousand in cash value in the uh in the cash value column you you've got the ability to actually utilize that in your lending system anywhere along the way but we're showing over five years we capitalize forty thousand dollars per year times five so we put two hundred thousand dollars of total uh build into the foundation of the policy and in five years time we've got 180 000 960 of net cash value available in our lending process now there's some that get all worked up and and say that the big life insurance companies are mean and and they and they won't give you this death benefit and your cash value when you die and i just want to point out something we put in 180 000 of cash value and that's true they're not going to give you that 180 000 of cash value on top of the 949 000 of death benefit we started with but because we put 180 000 of cash value into that policy the policies death benefit went up by 485 000 it went from nine hundred forty nine thousand eight eleven up to one point four million thirty two thousand uh in total death benefit that the life insurance will company will pay your family or your beneficiaries tax free if you die now i'm just going to ask you a real simple math question and i hope you get it right would you rather have by putting 200 000 into this thing at that point in time would you rather have nine hundred forty nine thousand dollars plus a hundred eighty thousand dollars of cash value paid at your death or would you rather have the 1.4 million dollars that the life insurance companies committed to pay tax-free at your death which one of those better uh i would take the right column frankly uh seems like a better equation if we go down then we minimized off the capitalization a little bit we backed off from 40 000 down to 19 000 340 per year kind of ongoing and you'll see that at year 10 we've now got 329 000 of capital in the net cash value column that we can use uh for uh banking we can use it to capitalize uh business capital we can use it to replace financing needs in our life we can use that to buy an investment property that's going to generate a strong positive cash flow and and potentially create much higher returns than the tax-free returns we're getting here but at the same time our capital here will continue compounding because as barry said we're collateralizing by that 329 000 to take it into secondary investment now let me ask you if you go out and buy a 200 000 property at year 10 and you use your ibc policy as the collateral capacity and and something happens to you and you die is your family going to be upset yeah you hope so right you hope they're upset that you're gone but that 200 000 investment property you had multiple ways you could have chosen to finance and capitalize that you could have gone to the bank right and you could have had that 200 000 still available in your savings or your 401k right or your ira and you could have gone to the bank and bought them and got a mortgage from the banker for that 200 000 investment property and it would have generated about the same return on that 200 000 cash flow property right right but if something happened to you and you had your money sitting in the honorary 401k in a government partnership plan now it's going to get taxed when your money passes to your beneficiary potentially and you don't know what janet yellen will do with the tax laws going forward but i would guess taxes are going up in the future but because you capitalized it here from your ibc policy they're going to subtract that 200 000 note that you borrowed from your banking policy from the 1.6 million dollar death benefit that pays out tax free to your heirs and your beneficiaries are going to get 1.4 million tax-free which of those two equations is better man i like the idea of the death benefit at that point you and you still have that investment property a hundred percent debt free at this point because that loan of 200 000 got paid off as a subtraction from the death benefit of the 1.6 million right yes so equation yeah and i'll come back to here just uh kind of add a little bit um i always refer to that you know people seem to uh you know these days with this bitcoin and um you know the age of uh uh i want it now people you know this whole get rich quick thing but i think people um older folks that that may be over 40 that may have experienced some losses in their lifetime understand that uh you know get rich slow uh might be a little bit better um you know plan and get rich slow while you're protected and while your family is protected so you know the mortgages the the other assets houses real estate that we might purchase you know the banks actually love when you have life insurance as a matter of fact many people go out and buy you know mortgage uh insurance uh mortgage life and pay double triple for it quadruple sometimes uh and they pay that again the bank gets a piece the insurance company that sold it gets a piece why not just put that and have your dollars working harder uh into one plan right yep and i do want to point out a couple things uh he didn't really talk about the dividend and that's fine we don't like to focus on the dividend too much but the dividend is what allows this policy to grow and so as you see here there's a guaranteed column and then there's a non-guaranteed column now this non-guaranteed column is based on the current dividend scale which we are in the absolute lowest uh environment interest rate environment that we've been in in my lifetime and i think since uh it's you know been around that that it's possibly going to do so uh this dividend over here these columns that are absolutely guaranteed assume that there is zero dividend paid now i mentioned earlier that the companies the carriers that we work with have paid dividends for over 100 years every single year now try to compare that with any stock company that pays dividends or anything else and i think you'll find it hard to match but again this column assumes that a dividend was never paid from day one and as you see the cash value and the death benefit are still growing and the reason they are is just because of those actuaries and that mortality that we talked about earlier so there's nothing you can do about it these policies are guaranteed to get better every year right and then when you add the dividend on there which in this case if we do look at that year 10 so now you put in 200 grand and that dividend is over 12 000 right and as you see it's been getting better every year and that's because again of this actuarial data this engineering that the actuaries have done to help it perform based on those again after expenses and death claims and all that have been paid so it only gets better uh and and what i want you to note here is yes there's still a base premium there's many things you could do to adjust that you know not pay it or reduce it or take loans or whatever but what i want you to notice is here that the premium was 19 000 and some change and the dividend is 12 000 and some change so uh and if you look the dividend just keeps getting better so you put in 19 but the actual cash value look at here increase in cash value after dividend look at that what does that say john how much did it grow 33 571. i don't know about you but if if if there's a pot that you can park nineteen thousand three hundred forty dollars in and it's gonna give you access to thirty three thousand five hundred seventy one dollars this year edition would you do that doesn't get much better than that man i like it i like it so um let me uh just kind of show you the as you know here the age here uh starts to go up and so i just want to show the next screen and this policy the premiums were due until age the contract premiums anyway for 35 years age 73 so talk a little bit about this in the latter years john what what's actually going on with this policy now so the later years this this policy has been become what's called fully paid up it actually can't receive premium that's why that left column shows zeros but the policy is guaranteed to stay in force until until you die um so from 78 on to 98 it's showing it growing uh the the net cash value at that point in time at 76 years old there's 2.499 million 2.5 million dollars of net cash value that's accumulated in that capital pot that banking policy now that's also backed up by 3.5 million of death benefit but that's a pot of money that you can spend tax free through loan provisions you can take it tax-free you can take a tax-free through withdrawals up to the basis of the premiums that you've paid but you can take all of that money tax-free through loan provisions over your lifetime as say supplemental retirement income now to have a tax-free source of supplemental retirement income i don't know what you'd have to have in your ira and you don't know what you'd have to have in your ira because no one knows what the tax rates will be in the future but i would say with say 25 trillion dollars national debt 100 trillion dollar unfunded liability with social security medicare that there's a chance that taxes are going to have to go up in the future and you may be parking money into a government partnership plan at a lower tax rate than you would end up taking that money back out and why would you do that if you have a vehicle here that you can accumulate store up money and you can have 2.5 million dollars that you can spend tax-free what if the tax rate at retirement goes to 50 percent that's the equivalent of having five million dollars stacked into your into your government partnership plan that's going to be taxable but the great thing is that it subtracts that loan provision that use of money over a lifetime it subtracts that from the passable death benefit that's going to pass on tax free to your heirs minus the loan provision but the other thing you look at is in that increase in net cash value per year what's it doing well you look at age 78 there and this policy's got 141 822 of increase in cash value available for you tax-free in one year will that help supplement your retirement income you carry absolutely absolutely and um you know when you say supplement um let's just say that somebody um didn't have other income right yup um they could use this completely they could be completely in the case of a let's just say they had socked away you know money in their 401k how much so out of that 2.4 million of cash value and and as we've been uh discussing the uh the money could be just taken surrendered i don't know why you would want to do that but if you use the banking process you could actually use it during retirement for loans to actually borrow and they would just subtract whatever you took from that death benefit which is as you see continuing to grow over time as well as the cash value and at that point look at that dividend how much is that dividend look at that yeah so in this case you could take anywhere at a minimum you could take 79 000 just in dividend you could just take the dividend if you wanted right or if you borrowed it then this policy would produce somewhere in the neighborhood of about a hundred and forty thousand dollars per year as john said tax free actually tax exempt because it would be in the form of a loan right yeah so uh it could certainly add to um your retirement income uh whether it be a supplement or entirely now john what would it take um i don't know if you can do the quick math but yep what would it take to get a hundred and forty thousand dollars after tax out of a 401k or an ra how much would you have to have in there well after tax it depends on the tax rate uncertain right yeah that's an unknown but before tax it would at a safe withdrawal rate according to uh phd and economics dr wade foul at a safe withdrawal rate uh it would take five million seventy six thousand before tax to get a hundred and forty one thousand eight twenty two uh and so if you went a out of a government partnership plan and then you were taxed at say a 50 tax rate you in a safe withdrawal rate environment you may need almost 10 million dollars stored away to have that kind of generated income that was secure and stable in a withdrawal rate environment for a long period of time unreal so so basically you'd have to have double uh the money to get the same amount of income yeah so it's incredible what these policies can do over time so uh moving on along uh i just want to circle back to this process and and how infinite banking actually works it is a process it's not about the product of life insurance people get so caught up uh because they've been told to hate life insurance just like they've been told to hate our president right most people don't even understand why they hate him they just know that the news and the media have told us that he's a bad orange man right and we should hate him so they do the same because certain radio entertainers have told us to hate life insurance but if you talk to somebody who actually owns life insurance you know and that's what i usually do we talked in an earlier uh show about go to the source well talk to somebody who's owned some life insurance for 10 years or more chances are they're going to love it especially if you talk to somebody that has practiced infinite banking so it is a process it's not a product it's just about owning the process and we can do this through this wonderful creation and because of nelson's work in creating the infinite banking concept so um john why would somebody want to practice infinite banking why would they want to do that well the first thing is to take back more control over their money to to gain some significant advantages by doing that with regard to taxes allowing them to store money in a place that will grow their money tax-free allowing them to have access to money throughout their lifetime non-age restricted tax-free through loan provisions allowing them a tax-free source of retirement income distribution that's stable and secure and multiplying the value of what they accumulate in their life so that they actually pass on a whole lot more than they accumulated multiplied value three four times as much as they accumulated to their beneficiaries at their passing none of us know when we're gonna pass but we all know that we are gonna pass right and so why not store up and get more control unhooking from the the banking cartel downtown you know have you noticed that the biggest buildings in every city in the country are the bank buildings in that something wouldn't wouldn't you rather be in charge of the banking process and function in your life build that wealth into your family's legacy instead of the guys downtown that you don't know exactly so life insurance is is really the cornerstone of the plan and um you know but there's a dirty little secret um what is the secret you know that you know we just talked about why people hate life insurance but tell people john who who owns more life insurance who wants bankers own tremendous amounts of life insurance and in fact it's on their ledger their balance sheet as amongst their tier one assets their most stable and secure assets on their balance sheet is the value that's held in life insurance contracts often insuring their executives and their employees corporations own a lot of life insurance there have been some tremendously successful corporations that utilize this concept of borrowing collateralized by their life insurance contract borrowing from their life insurance contract to fund the capital investment of starting or keeping their business operations in in operation and or funding the start walt disney jcpenney mcdonald's corporation pampered chef right and then you look at these banks down at the bottom those banks all have massive amounts of life insurance on their balance ledger sheet that's some of their most secure assets now why would they do that and use that as their most secure assets but they would try to tell you not to but to give them control of your money absolutely absolutely that's that's what they want us to do um is put our money with them so they own it they control it and unfortunately many people do that so we uh advocate infinite banking as a solution and what it actually does is just have your money to work harder you can take the same dollar and get multiple uses of your money the first thing obviously with life insurance is it's going to protect your family and your business in the event that you're not there so you've got protection and it doesn't you know we don't even mention it here but in most states it's creditor protected as well and of course you've seen uh and heard of all of the attorneys and the lawsuits and so it is credited protected in most states uh it also can be used to finance your purchases which is what we're trying to illustrate to you here so you get that financing uh ability so your dollar is now worked two times it's also growing your wealth because that nest egg that you're saving into is accumulating over time and then when you're gone that death benefit will help to secure your legacy for the future so long after you're gone this money that you've worked so hard for your entire life can now be used for your legacy to give to charity to give to your church uh whatever your causes may be uh and of course your family so infinite banking is the solution that that we see uh with this and if you have problems with debt or maybe you just want to have your money work harder well then you might want to learn more about infinite banking and of course what we recommend is that you read this book so find this book becoming your own banker by r nelson nash and we hope you enjoyed this video today watch for more of our videos and share them with your friends and family they need to know and learn this information as well we hope you'll like and follow us on social media and when you're looking for somebody uh john tell them a little bit about this uh infinite banking concept authorized practitioner program you know we i always say go back to the source go to the source and uh barry and i are very strong believers and passionate about uh going to the source of information and truth and so that's why we participate with the infinite banking authorized practitioner program that's through the nelson nash institute and that was pioneered by nelson nash and uh to carry on in his legacy uh it's very important that you work with an authorized practitioner of the infinite banking concept because those are people who not only were trained on how to build an ibc policy correctly utilizing the right products building it the right way with the right uh engineering and writers but they also have have taken an oath as a practitioner to make sure that if you're looking for an ibc product that that is what they're gonna sell you there are a lot of people out there that oh yeah we can do that we can do that and i've seen the train wrecks from those people who've gone and gone to the their friend who said oh i sell life insurance can i i'll do that and then the clients come back to me and they go well i got this ibc policy from my friend at joe's you know smorgasbord insurance company and they said that it they could do exactly what the book said and uh why isn't it working right yeah you go well because the guy didn't have a clue what he's doing right and so practitioners actually have to take tests uh continue with education and we have to adhere to the rules meaning uh that we've owned these types of policies ourselves right i myself on multiple ibc policies in the neighborhood of eight nine policies now and we accumulate them over time so it doesn't happen overnight but why do you think john that there aren't more ibc practitioners out there it's kind of like why do you think the banks say one thing and do another why do you think that there's people like you said that say they're doing ibc we call them imposters but they're not why don't they go through the program do you think well some of it is just ignorance lack of knowledge and there there are a lot of talking heads out there that are ignorant and they have lack of knowledge right and and they'll say things and sound like they have authority or knowledge but they don't uh there then then there are uh some in the financial industry that are are paid to say what they say yeah they may be paid by advertisers yes you know buy buy this buy this product because we're paid if you buy this product right right they're puppet puppets and and then there are those that simply are are heavily money motivated and if they were to sell you a ibc product actually built right if they knew how to do that it would pay them maybe 30 of what they would get paid if they sold you this other product that they can sell you now they just don't want to take a haircut and get the loss of 70 of what they want to sell you right absolutely so they just simply won't set it up and build it right because it would cost them money to do that yeah so those are the three main things that i see out there i i would say and you may have some others that you know are well i guess the only thing i would add to that is um you know it costs money to go through the practitioner program it's not free yeah and like you said we give up uh commissions uh you know some of these uh naysayers out there like to talk about the big commissions we earn but we actually earn less because we follow this ibc process and you know it's really just about giving giving back we want to share this message just as nelson did with as many people as we want and um you know that's that's what we want to carry on his legacy uh with infinite banking and for those of you who want to learn more about starting your own bank it's really simple you just need to take action there'll be links in the show notes so please reach out to us if you want to schedule a meeting and then as john noted earlier the first step is really you just got to capitalize your system as i showed you earlier there is a capitalization phase and then you have to practice this it doesn't happen overnight doesn't happen in one year it takes time and but the longer you do it the better it gets there's nothing you can really do about it it's hard to really mess it up if it's built correctly from the beginning you know so we'll work with you with that so if you want to get started just reach out to us and schedule a meeting and i just want to thank you for joining us today john is anything else you want to add thanks for being here get your questions answered i i've never seen a question that concerned me scared me and you know when you deal in the truth it's it's pretty easy uh to just share the information share the truth and and shed light on on what's going on that's right the truth shall set you free right thanks for joining us we'll see you next time be sure to subscribe hit the little button so you'll be notified of our new videos and i look forward to talking to you in the next edition of legacy money take care

Show moreFrequently asked questions

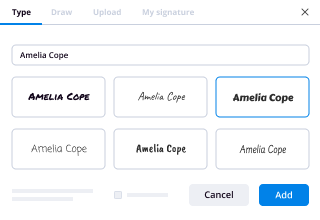

How do I eSign a document before sending it?

How you can sign a PDF using a digital signature?

What's my electronic signature?

Get more for signed WPD made easy

- Print signature service 1099-MISC Form

- Prove email signature Drama Scholarship Application

- Endorse eSign Simple Receipt

- Authorize digital sign Commercial Sublease Contract

- Anneal signatory Loan Agreement

- Empower electronically signed Summer Camp Teen Volunteer Application Template

- Try digisign Product Launch Press Release

- Add Commercialization Agreement digital signature

- Send Event Management Proposal Template electronically signed

- Fax CCW Certificate byline

- Seal Hardship Letter esign

- Password Sales Agreement signature block

- Pass Plumbing Contract Template signature service

- Renew Commercial Lease Agreement email signature

- Test Web Development Progress Report signatory

- Require OPM 71 Form initials

- Send gawker electronic signature

- Accredit undersigned digisign

- Compel heir esigning

- Void Design Quote Template template signed

- Adopt log template digi-sign

- Vouch Colorado Rental Agreement template esign

- Establish Printing Quotation template initial

- Clear Compromise Agreement Template template signature

- Complete Patient Medical History template email signature

- Force Real Estate Agency Agreement Template template countersignature

- Permit Power of Attorney Form template digital signature

- Customize Residential Roofing Contract Template template electronically signed