Size Byline Request with airSlate SignNow

Upgrade your document workflow with airSlate SignNow

Agile eSignature workflows

Fast visibility into document status

Easy and fast integration set up

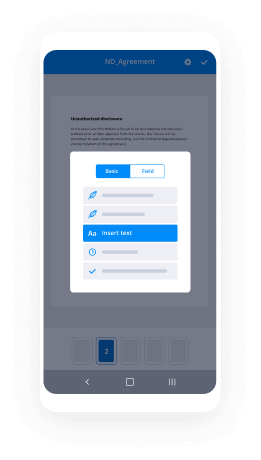

Size byline request on any device

Advanced Audit Trail

Strict protection standards

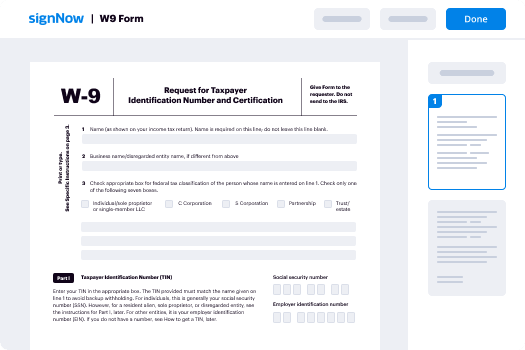

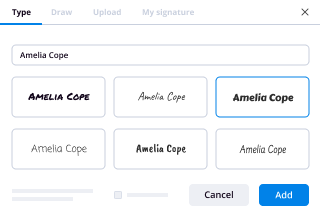

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Your step-by-step guide — size byline request

Employing airSlate SignNow’s electronic signature any company can accelerate signature workflows and sign online in real-time, giving an improved experience to consumers and employees. size byline Request in a few easy steps. Our mobile-first apps make working on the run possible, even while off-line! Sign documents from any place in the world and make tasks faster.

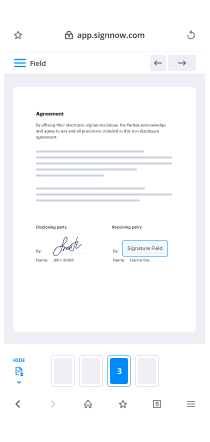

Take a walk-through guide to size byline Request:

- Sign in to your airSlate SignNow account.

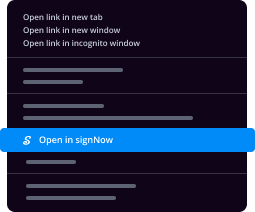

- Locate your needed form within your folders or import a new one.

- the document and make edits using the Tools menu.

- Drag & drop fillable fields, add text and eSign it.

- Add several signers using their emails configure the signing sequence.

- Specify which recipients will receive an signed copy.

- Use Advanced Options to reduce access to the document and set an expiration date.

- Tap Save and Close when completed.

Additionally, there are more advanced functions open to size byline Request. Add users to your collaborative work enviroment, view teams, and monitor collaboration. Numerous customers across the US and Europe concur that a solution that brings people together in one unified digital location, is the thing that enterprises need to keep workflows performing effortlessly. The airSlate SignNow REST API allows you to embed eSignatures into your app, website, CRM or cloud storage. Try out airSlate SignNow and get faster, easier and overall more efficient eSignature workflows!

How it works

airSlate SignNow features that users love

See exceptional results size byline Request with airSlate SignNow

Get legally-binding signatures now!

What active users are saying — size byline request

Related searches to size byline Request with airSlate airSlate SignNow

Condition byline request

good morning everyone welcome to getting started with options question for you this morning have you ever wondered how you can profitably trade a stock that is currently falling in value if you've ever had that question stick around today we're talking about long puts or buying puts see you on the other side [Music] alright my name is Barbara Armstrong I am a coach with TD Ameritrade delighted to be joining you this morning as you can see from the lovely blue bird on the PowerPoint we are all now part of the Twitter community would love to invite you to join me as part of that group at the Armstrong underscore TD a so let's get through right through our important information so that we can get down to business talk about our objective for today in discussing the buying of puts or in discussing long putts options are not suitable for all investors as there are special risks inherent to options trading that may expose investors to potentially wrap it in substantial losses know that a long put puts the entire cost of the option position at risk should an individual long put position expire worthless the entire cost of the position would be lost know that in order to demonstrate the functionality of the platform we need to use actual symbols and we will however that is not to be construed as a recommendation we cannot begin to determine the suitability of any security or strategy for an individual trader know that any investment decision you make in your self-directed account is your responsibility also know that while the paper money trap paper money trading platform is a brilliant way for you to hone your trading skills and understand the mechanics of how to place a trade know that successful virtual trading during one time period doesn't guarantee successful trading of your actual funds at a later time period why because market conditions change constantly and we all know that all investing involves risk including the risk of loss Delta Gamma Vega and theta known as the Greeks show us how price time and volatility can impact our options trades so as we get going I'd like to encourage you if you're with me live this morning we have a great community that gathers every Friday at 11 o'clock Eastern good morning to Barry and to one and two Charles so glad to have you all on board ending onboard and engaged in the chat I joined TD Ameritrade eight years ago initially as a client just like you who wanted to take of advant advantage of education just like this in 2016 I joined as a coach so I do remember what it's like to be new and all I can say is keep coming back and keep placing practice trades until you your understanding is solid today I've designed this to be talked about a 12-week rotation today we're talking about buying puts so what's the objective of today's class the objective isn't to make you an expert in trading the buying of puts or in trading what we call long puts within half an hour but it's rather to give you an understanding of what trading along put is all about to introduce you to the concept so that if you find that this is a strategy that you might think might be helpful in helping you reach your goals you can go forward and learn more and I'll point you in the direction to get some additional resources beyond this webcast as we go through so what are we gonna do today we're going to look at the basics of what it means to buy a put we're going to look at why some traders might find this an industry interesting strategy we're going to place an example trade on thinkorswim and then look at where you might want to go next so hello did Terrance and Alfred it looks like the gang is all here so I'm glad to have you guys all on board so what does it mean when I buy a put well when we buy a put it gives us the right but not the obligation to sell the underlying stock at the strike price at any time up until expiration so what that means is if we're wrong we can walk away how much can we lose we can lose what we paid to buy the put that's what we have at risk and what is typically the goal well the goal is to benefit from our profit from the downward movement of a stock's price so let's just try and wrap our head around that for just a second so we're looking at this and let me just bring my drawing tools back up because I don't know if like me you're a pretty visual learner let's come back to this drawing tool so we have a stock that is falling in price and then it tries to recover and it starts to fall again and now it looks like it's going to fall again so if we buy a put that say let's say a hundred just to make the math easy so if we buy this put at a hundred and the stock does in fact continue to fall and let's say we pay three dollars for this putt that's the price so let's say we pay three dollars let's say it falls to $90 a share what must the put be worth well it must be worth because I have the right to sell it at a hundred if it's trading at ninety that put value has to be worth at least ten dollars right and now I'm not taking volatility into account I'm not taking time decay into account but if I have the right to sell the stock at a hundred and it's trading at ninety I could go out and buy it in the open market and sell it at a hundred so that's how this concept works I just want everybody to understand the meaning of that so then my profit on this would be seven dollars a share now what if instead of going down to 90 it goes up to 110 well I paid three dollars have the right right to sell the stock at a hundred but if I could sell it for one time this this put that I own that gives me that right doesn't do me much good does it because in the open market I could go out and sell it and get $10 a share more so this would end up being worth nothing so this is on this so you know some might look at this and say okay this looks like what we call a Bear Flag and so you're looking for something that's been falling take in a couple of days to try and recover and then it looks like it's going to start to fall again so the day it starts to follow I fall again and we call that some call it a commode or a clothes or a trade below the low of the high day wrap your head around that a close below the low of the high day or if we have something that has been going sideways for a while and consolidating and so one is looking for it either to break to the upside or if it breaks to the downside that might be an opportunity that some investors might see as a good time to perhaps buy a put so these are the types of entries one might be looking for okay so what kind of stocks would be a good candidate well we've just talked about some of these one we're looking for something that is moving bearishly or at least bearish to neutral now why would I say bearish to neutral and let me just change my drawing tool because if we have something that's going sideways and it's trading up and down then some investors might say well when it comes in it bounces off and we call this resistance and this support and if resistance and support and some of these terms aren't familiar to you I'd encourage you to join Cameron May on Mondays at 11 o'clock getting started with technical analysis and charting essentials I say that every week and if I say that every week it's because it's important and if you already have skills and I know many of you here I'm sure do I'd recommend schools never out for the pro get to pout mullaly's class at 2 o'clock on Fridays 2 o'clock Eastern so some might say well when it comes and it hits its head or bounces down off resistance I could buy a put here as it's coming back down and then close it out here so I could get in here and out here this is why we're saying you know bearish to neutral could work we want stocks that have higher trading volumes and we want higher trading volumes not only on the stock but on the options too and on the options page as you'll see in just a moment we express that under two columns called open interest and volume and when we have high trading volumes here what it tends to lead to is tight bid-ask spreads and then these down trending stocks we just look at a visual that described when we might want to get in you know bouncing off resistance those bear flag patterns breaking below a support level particularly on high volume ok so let's go out and look at a chart ok I'm just going to look at the chat again because I have a question here ok so can't can't is asking a question about a collar so I expect that you've been watching a little James Boyd and he likes to talk about collars and he does a fantastic job on it a caller has a different purpose so we don't necessarily own this stock and it's beyond the context of this class to talk about a collar which is a more advanced strategy but I believe if you look at the classes James taught this week he did talk about collars in one of those so and with a collar you typically own the stock with buying a put one does not need to own the stock one you know you're just looking to buy a put as a standalone trade where you're looking to make a profit from a stock that is falling in value so come out to the chart with me and we are going to the big chart so walk with me and we'll have a look at at WDC here and I have a one year chart up well actually I honed in on it so if we come back out here a bit I'll come back to my one year we can see WDC has had quite a few ups and downs hasn't it you know we've you know came up here and then we can kind of rate back down to the same level that we've been at around the $34 mark we came back up you know to this similar high and hung out here for a bit broke out to a new high and then some might see this as a bit of a a sloppy double top where it broke below and is now moving to the downside when we come in and we look kind of up close and personal and I'll just do a little pirouette hair but when we come in and we look remember one of those signs we talked about was a bear flag and so some technical technicians might look at this and see this bear flag pattern setting up the one concern they might have is that today's candle oops today's candle is bullish and it's actually so what are we up here 58 cents or 1% so this is where some people might look and say maybe I'll put in a conditional order and what am I looking for remember that term where I said wrap your head around this we'd be looking for that close below the low of the high day so we're looking for that close below the low of the high day we don't have it right now but we could put in an order to say if today turns out to be the high day if this goes and we can pick a number 10 cents 20 cents whatever you want your number to be if it goes 20 cents below that then we will buy our put so how do we set that up well let's go back to the trade tab and we can have a look at that and I can bring that up here but it's I know it's easier for you to see if I come back to this other screen so we'll come back here so that it's a little easier for us to see so I've brought up two different time frames so one is just going to change my drawing tool here so one you always want to make sure you're looking at the right stock so we've got Western Digital up so check they're almost a million shares traded on this today and we're still very early in the trading day and when we look at time frame we can look at a couple of different time frames so we can look at December and if we go back to the chart you'll notice that most of those pull backs so the leg on the bear flag was you know maybe five six trading days so if you're saying well if I'm expecting this move if it happens to take five or six days why do I need 28 days well some investors will want to be out or their goal is to be able to be out at least three weeks ahead because time decay starts chipping away at the value of the option at an accelerated rate as we approach the expiration date now some might say well you know I'd like to give this a little more time because if for whatever reason you've been reading the news and I'm just you know making something up here but you would like to have more time you could come out to 56 days now what difference does that make well if we're looking to get into something close to the money one we're going to notice that the time frame here we've got a two dollar and fifty cents spread here well we've got 50 cents between the strikes for December so we can we have a little more variation but if we wanted to look at something that was more apples to apples if we came here and we said well we have a forty seven fifty here and we have a 4750 here and the price in December with 28 days is a dollar 57 and do we have volume being traded here yes we do over 4,000 contracts now we've got almost 7,000 contracts here and what's the Delta or the probability of it expiring in-the-money it's similar not exactly the same now Delta isn't a number that set in stone so if Western Digital really fell like a rock over the weekend and opened up a lot lower that Delta would be a lot higher on Monday and if on the other hand it really moved to the upside about Delta would change you know so it changes every day it would change and it would go down and your probability of the trade being profitable would go down with it so the difference here we're paying is not insignificant you know 250 versus a dollar 50 so time has value so that extra 30 days or 28 days that we're in the trade we're in twice as long gives us some more time so what we're going to do is our example today is we're going to look at the January 20th and what's the idea if we pay more when we sell it hopefully it will return us more like we'll be paid a higher price you know when we get back out as well but we are tying up more money and you know one of the mistakes that some investors have made is they don't want to invest that extra money in giving themselves a little more time okay so I've got lots of comments coming in here do you need a good move for a put to work man we only have half an hour guys the net of it is let's tee up this trade and then we can talk for a minute okay so I'm going to come in here right click anywhere on this and I want to buy and we're just going to come up here and say we just want to buy a single and but remember we wanted to make it can do you know so we're going to come and look at the chart and say okay today's low is what so let's get up close and personal here today's low is forty seven ninety six so I'm going to write that down 47 96 so let's just say we take 20 cents off it so if it goes to 47 76 we want to buy this putt and we're willing to pay whatever the market price is and we can have more confidence in saying that when we see that the bid what we call the bid-ask spread is tight or pretty close together there's a 15 cent spread out well sorry a 3 cent spread out here so we're going to say we're willing to pay the market price on this we're going to place a conditional order we'd like to buy if it goes at or below 47 76 so that trade below the low of the height a high day 47 76 save confirm and send now there's a 65 cent charge for each contract that we buy how much could we lose well if we paid two dollars and 50 cents for this we could lose two hundred and fifty dollars or a hundred times that number why how do we know that if we come up here we can see the multiplier is a hundred and we're going to put this in our that we have a long put bucket if we don't we're just going to put this you know I'm just going to let this go to unallocated and I'll create I'll create a spot for it okay I wonder if I eat that up correctly let's go in and do that again just in case I made an error so we want to buy a single we're gonna make that good till cancel because it may or may not fill today we're going to put this at the market and we're going to come in and make this conditional market okay confirm and send we oh sorry come back here we want to buy this only if it goes at or below 40 796 yeah so this should not fill immediately it could fill easily by the end of the day okay so now we have our conditional order and when confirmed send we want to buy one contract the January expiration the 4750 put only if it goes out or below 47.96 cents and so our max profit on this would be if the stock went to zero our max loss they're assuming we're paying two dollars and fifty cents a share so we're going to tee that up so we can see now that we have something teed up here so we had a couple of questions so one is do you need a good move for this put to work so let's come back to our 1-year chart and that's a really great question so let's say this last move here was how much was $7 so let's say this move $7 to the downside so if we come back to the trade tab how much would we make so we can come here to layout come to Theo price first thing you always do is reset it and say hey if in the next two weeks so we'll go out to the end of the first week of December this fell by $7 what would this be worth well it would be now trading up forty one dollars and forty one cents and you'll now see that we have a new tab here that says Theo price and and this is just an estimate or a guesstimate if you will but this thing that's currently trading at you know 247 to 250 would be worth and again we haven't considered volatility or some of the other factors it would be worth approximately six dollars and sixty cents so it has to move if it just starts going sideways and it doesn't fall in price well what do we have we would have something that is declining in value now what if it went the other way so what if it went up by seven dollars a share in that taint same time frame and remember what are we risking the entire enchilada we could lose this whole two hundred and fifty dollars this would be worth approximately forty cents because you know when I buy a put and it gives me the right to sell why would I want to sell something at forty seven fifty if I could sell it you know higher I you know so then this put doesn't it has lost its value so I hope that aunt asks your question when you say volume you're talking about the number of contracts purchased right correct so if I come back here to you know a basic study set we've got volume and open interest open interest and I talked quite a bit about this last week so you may want to go watch the buying a call a class in the archives so we can see this is how many contracts are on the books in total volume is how many contracts have exchanged hands today and that number is thirty-seven for Western Digital January 17th 2020 expiration at the 4750 strike when we look at the $40 strike you know we have 85 contracts today 6000 97 on the books so I hope that answers that question strength in numbers right you want to run run with that we say that you want to run with the crowd right can you put a limit order yes there are other ways we could do this conditional order Kent but time precludes me from going over that so I just teed up the one that I thought was the easiest for us to do today but there are other ways that we can put in a conditional order and say we only want to pay X amount within a range okay so guys I've got to come back and just kind of wrap up some of these concepts so you know we want to look at our strikes election we want to look at expiration dates yes we can a basic set Terrence I'm going to do a little on-demand video on that so Terrence is asking can you explain the basic set yeah so I customized something and you can easily do that but that's a topic for another day but I will create an on demand on that and hopefully that'll be up in the next week or so and then I'll post something on Twitter when it's live and I'll post a link to it on Twitter so follow me and as soon as it's ready I'll make sure you're aware of it we're looking for stocks back to our regular programming we're looking for a stock that is moving bearishly or it could be in a big sideways pattern and some traders at least are going to position size assuming a max loss so if you're willing to risk $500 on a trade with this last one if you were paying 250 with a multiplier of 100 that would be two contracts you could potentially lose 500 that on that trade so where do you want to go next there's actually a course so if you go to TD Ameritrade comm and sign into the course there's a great overview on trading and you can go through that there are also some quick videos and then with respect to webcasts I've already talked about the technical analysis webcasts there's also a swing trading webcast which does a lot of directional trades on Tuesday mornings at the market open at 9:30 led by the wonderful John McNichol so you may want to check that out as well so but what I encourage you to do you know now that you know we kind of look back and go okay our objective was just to introduce you to the concept of what a-put was all about and then go over you know the appeal that some traders have it's you know leverage but the leverage cut both cuts both ways we did our example trade what I encourage you to do now is go through the stocks listed on the Nasdaq 100 there's a public watch list look for stocks that are down trending or pull up stocks on the Dow or on whatever watchlist you have in place a couple of example trades and then follow them through you know in your paper money as if you had your real money on the line and if you have questions as you go through when you go to John's swing trading class you can type those questions into the chat or you can go we have two Q&A sessions a week so you might want to join one of the Q&A webcasts and bring your questions to that also so guys that's a wrap for today remember that the software application is for educational purposes only remember that although we looked at Western Digital today that is not to be construed as a recommendation on the part of TD Ameritrade or myself we cannot begin to know what is suitable for any individual trader so the decisions you make in your live account are on you and on that note I guess I can say thank you so much for joining me whether you are here live or you are joining in the archives I love love love all the questions in the chat there is a survey here so if you'd like to give us some feedback and please click the bitly link five quick questions it'll take you about 20 seconds also if you found this you bowl smash that like button below subscribe to our channel if you haven't already we're always adding new content and you'll be notified you'll be the first to know when we add new things when we have new content that I think is particularly helpful to you guys I will make sure that I post a link to that on Twitter so follow me in the Twitter community my handles there in the byline on the bottom and that is a wrap for today folks thank you so much for joining me I'll see you in a webcast coming up soon take care everyone bye for now [Music]

Show moreFrequently asked questions

What is needed for an electronic signature?

How can I sign a PDF?

How can I virtually sign a PDF file?

Get more for size byline Request with airSlate SignNow

- Print electronically sign Tourist Transport Ticket

- Prove electronically signed SaaS Sales Proposal Template

- Endorse digisign Roommate Agreement Template

- Authorize electronically sign Transfer Agreement

- Anneal mark Freelance Invoice

- Justify esign Affiliate Agreement

- Try countersign Social Media Policy Template

- Add Insuring Agreement esign

- Send Rental Receipt Template signature block

- Fax Promotion Announcement Letter signature service

- Seal New Hire Press Release email signature

- Password Marketing Proposal Template signatory

- Pass Photo Release Form initials

- Renew Influencer Photography Contract byline

- Test Marketing Brief esigning

- Require Roommate Agreement Template digisign

- Comment watcher electronically signed

- Champion awardee digital signature

- Call for company countersignature

- Void Partnership Agreement Amendment template initial

- Adopt Funding Agreement template signature

- Vouch Tourist Transport Ticket template email signature

- Establish Simple Medical History template digital signature

- Clear Roofing Proposal Template template electronically signed

- Complete Pet Grooming Registration template byline

- Force Declaration of Trust Template template digi-sign

- Permit Gala Reservation Confirmation Letter template esign

- Customize Toll Manufacturing Agreement template signature block