Underwrite Mark with airSlate SignNow

Improve your document workflow with airSlate SignNow

Flexible eSignature workflows

Fast visibility into document status

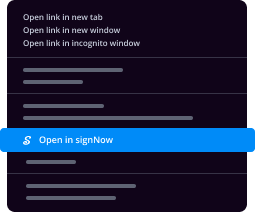

Easy and fast integration set up

Underwrite mark on any device

Detailed Audit Trail

Rigorous safety requirements

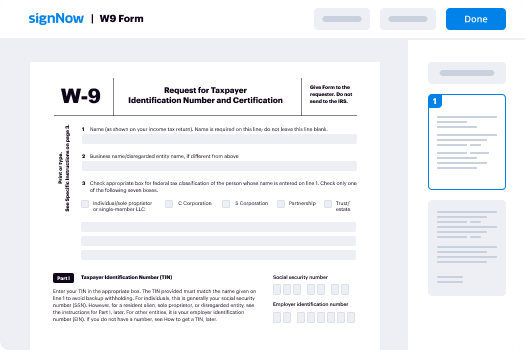

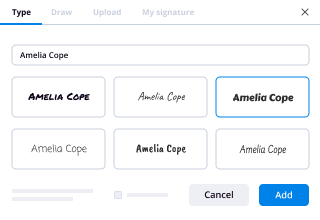

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

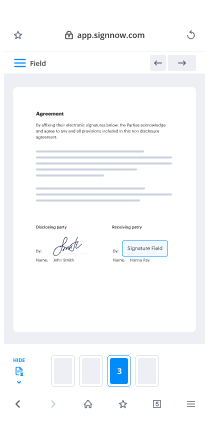

Your step-by-step guide — underwrite mark

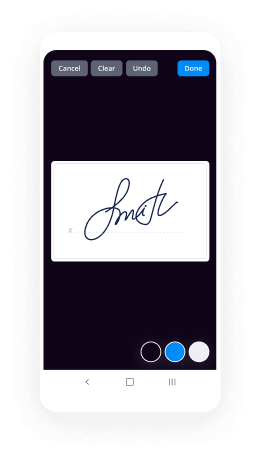

Employing airSlate SignNow’s eSignature any business can accelerate signature workflows and eSign in real-time, providing an improved experience to clients and staff members. underwrite mark in a couple of simple steps. Our handheld mobile apps make operating on the run possible, even while off-line! eSign contracts from any place worldwide and complete tasks faster.

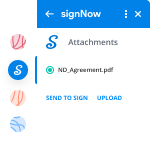

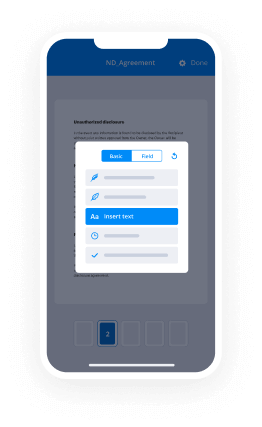

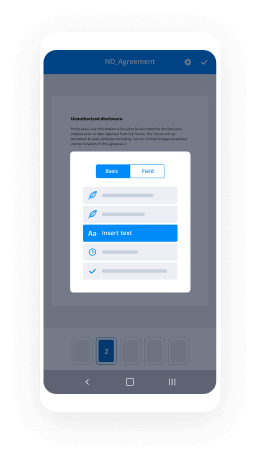

Take a step-by-step instruction to underwrite mark:

- Sign in to your airSlate SignNow account.

- Locate your document in your folders or upload a new one.

- the document and make edits using the Tools list.

- Drop fillable fields, add textual content and eSign it.

- List multiple signers via emails and set up the signing sequence.

- Choose which individuals will receive an completed doc.

- Use Advanced Options to reduce access to the template and set an expiry date.

- Click on Save and Close when done.

Moreover, there are more innovative tools open to underwrite mark. Add users to your common workspace, view teams, and keep track of teamwork. Millions of customers all over the US and Europe recognize that a solution that brings people together in a single cohesive enviroment, is exactly what businesses need to keep workflows functioning smoothly. The airSlate SignNow REST API enables you to embed eSignatures into your app, internet site, CRM or cloud storage. Try out airSlate SignNow and enjoy quicker, easier and overall more effective eSignature workflows!

How it works

airSlate SignNow features that users love

See exceptional results underwrite mark with airSlate SignNow

Get legally-binding signatures now!

FAQs

-

How do you underwrite?

Investigate your credit history. Underwriters look at your credit score and pull your credit report. ... Order an appraisal. ... Verify your income and employment. ... Look at your debt-to-income ratio (DTI). ... Verify your down payment and savings. -

What is underwriting with example?

An underwriter is generally an intermediary who assumes the risk in a financial transaction. For example, in case of insurance, your insurance company is assuming the financial risk in exchange for a premium. The insurance company is the underwriter. -

What does it mean when your loan goes to underwriting?

by Mallory Malesky. The underwriting process leads to a decision as to whether a loan will be approved. The term "underwriting" refers to the process that leads to a final loan approval or denial, which is determined by a professional underwriter. Many factors are at play in a lender's final decision on a mortgage loan ... -

What are underwriting costs?

In the securities industry, underwriting fees are the fees earned by an investment bank to help bring a company public or to conduct some other offering. In the mortgage business, an underwriting fee is often a fee charged by a mortgage lender for preparing the loan and associated signNowwork. -

What will Underwriters ask for?

An underwriter is the person that gets the application from the loan processor. ... An underwriter will approve or reject your mortgage loan application based on your credit history, employment history, assets, debts and other factors. It's all about whether that underwriter feels you can repay the loan that you want. -

What does an underwriter look for?

An underwriter is a financial expert who takes a look at your finances and assesses how much risk a lender will take on if they decide to give you a loan. More specifically, underwriters evaluate your credit history, assets, the size of the loan you request and how well they anticipate that you can pay back your loan. -

What does it mean to underwrite costs?

transitive verb. If an institution or company underwrites an activity or underwrites the cost of it, they agree to provide any money that is needed to cover losses or buy special equipment, often for an agreed-upon fee. -

What is an underwriter job description and it salary?

Insurance Underwriter Job Description, Salary and Outlook. ... Underwriters use computer software to assess the risk involved in insuring an individual, property or business. They also calculate the premium needed for the amount of coverage requested. -

How is insurance underwriting done?

In its most basic sense, underwriting refers to the process of determining the issuing of an insurance policy. ... During this evaluation, the underwriter will decide how much coverage will be offered to the applicant, as well as how much premium the insured should pay for the particular amount of coverage. -

What you mean by underwriting?

Underwriting is the process through which an individual or institution takes on financial risk for a fee. ... The term underwriter originated from the practice of having each risk-taker write their name under the total amount of risk they were willing to accept for a specified premium. -

What is an insurance underwriter salary?

An Insurance Underwriter receives an average salary of around 48000 - 72000 depending on seniority. Insurance Underwriters earn a salary of Sixty Five Thousand Three Hundred dollars on a yearly basis. -

What does an underwriter do?

An underwriter is the party that assesses and evaluates the risk of whatever their particular field has (mortgage, loan, health policy, investment, etc.) and whether or not it is worth it for their company to assume that risk. Underwriters are most common in environments that most consistently bring risk with them. -

What does underwriting mean in insurance?

Insurance underwriting Insurance underwriters evaluate the risk and exposures of potential clients. They decide how much coverage the client should receive, how much they should pay for it, or whether even to accept the risk and insure them. -

What happens after underwriting?

After a first review, the underwriter will issue a list of requirements. These requirements are called \u201cconditions\u201d or \u201cprior-to-document conditions.\u201d Your loan officer will submit all your conditions back to the underwriter, who then issues an \u201cokay\u201d for you to sign loan documents.

What active users are saying — underwrite mark

Related searches to underwrite mark with airSlate airSlate SignNow

Underwrite byline request

okay well welcome everyone to the webinar today we are going to be talking about the secrets of underwriting this is a topic that was actually suggested by someone who came to our last webinar so it's something that we're really excited to dive into and really grateful for everyone that has been suggesting topics along the way I know we're finding a lot of value out of these webinars and many people have been interested in the content and so if you guys have any other suggestions for topics that we should be covering we'll make sure to touch base with you guys at the end of today's webinar as well as in our follow-up email but for today again thank you guys so much for joining us mark Gordon he is our National Director of Sales he is going to be leading us through on today's webinar we do want to make this as interactive as possible so you'll notice right now you might be an attendee to the webinar I'm gonna promote you to a panelist which will then allow you to turn on your video um it'll also allow you to unmute yourself and ask questions if you want you can also throw in questions in the chat box and I'll make sure to be monitoring the chat box and throw them out to mark just so that we can make sure to get all of your questions answered so let's go ahead and we will get it started so I'm gonna hand it over to mark and we are gonna get going with today's webinar so thank you guys so much for joining us and I hope you find today's content valuable awesome thanks so much Cory for the handoff thank you guys for coming we are going to do the impossible thing we're going to make underwriting fun and interesting so give me one second while I pull you guys a little back over and I can see everybody that way we can just like to make sure I visualize every if you guys can in turn your cameras on that's awesome if not I understand you know some of us still rocking our coronavirus looks and so it's always always hard to do that but if you can turn it on to participate and ask questions that we create feel free to interrupt me with questions if you want to the chatbox this is all much more interesting for me if I hear from you guys and yes please at the end if you have anything else you ever want to know about the mortgage industry or some of our sales strategies I'd be happy to do webinars on those moving forward but thanks for coming so you guys can all see my screen right cool all right secrets of mortgage underwriting so and we again with that title specifically to try to make this sound cooler than it is but we're going to give you guys a bunch of valuable information so we're going to cover today is just what is mortgage underwriting what does a mortgage underwriter do what does an underwriter evaluate what is the mortgage underwriting process and then really tips for you guys and for the customers so you have the best possible underwriting and mortgage experience there are some really just obvious things that you can do going into this process that can make very smoother and easier overall mortgage experience so what we'll talk about what those things are so first underwriting is pretty much the process of determining the risk of doing a loan and ensuring that the borrower should be able we have a station this borrower should be able to repay that long so in underwriting we're gonna obviously look at credit but then also income assets the debt that somebody has which is also part of that credit and then the individual property and that so the value of that property what that is in relationship how much of a down payment you're going to do is it a condo is it a multi-family or using as a primary residence or secondary home or an investment property all of underwriting is gonna look at those factors so it really comes down to your income your assets the equity in the home and the home itself and then your credit profile for what we're going to look at from under a so underwriters use specific guidelines from programs to check the levels of risk in a borrower's mortgage log so here's where I'm going to get to the fun part where I kind of explain basically 99% of more the mortgage process today there is none individual you may know how to work the audio on this I can't get any sound oh well we hear you if you go to real quickly if you go to the bottom left portion of your screen you click on with a video the microphone usually can pick what your source is for that sound comes out of it might help you out but so with-with-with there's not an underwriter that's making a you know a decision based on someone's overall unique situation in almost all cases everybody is underwriting for the most part to the same government guidelines and that is so that we can provide liquidity on the secondary market what I mean by that is if every mortgage company had their own guidelines or each underwriter had their own guidelines it would be almost impossible to know how much the that mortgage is worth or what the risk on that mortgage is unless you had an individual person diving into it every time that loan got sold to a new investor well we we have here to give these Universal underwriting guidelines and they're by Fannie Mae Freddie Mac FHA VA USDA and so that way when we have a thousand loans in one category we know how to evaluate those loans as a group based on risk factors though because we know that they all follow generally the same guidelines and then we can create liquidity in that secondary market so really when the job of an underwriter is in the mortgage industry in 2020 is find a way to make your very unique situation because everybody's profile is incredibly different and unique and make it fit into this box so that we can put it into that pool of a thousand loans and get it sold in a group just like all the rest of them and so that is the job an underwriter is to check all the boxes to make sure that we fit inside the Fannie Mae Freddie Mac FHA VA USDA box very very rarely are they making their own qualified unique decisions although some companies do have their own overlays on top of the guidelines from the other companies from those other governmental positions that is kind of our baseline they're setting the tone for that and if you guys are just getting here and you and you want to turn your cameras on and hang out that would be awesome I love seeing people's faces and reactions and you guys can shout out any questions and a bunch of new people hop it in so awesome so that's kind of basically what what underwriting is and what we're trying to do is we're trying to fit each loan and its individual scenario into our credit box we have two ways of doing this we have automated underwriting which most of the English using on almost every single deal and we have a manual on the writing so very simply automated underwriting is taking the basic information that you that's been provided to us by the borrower or the client running it through an algorithm or our system and seeing either your approved or your not approved and they're looking at some very specific things in that but that's where it comes out - filling out our uniform residential mortgage application or what we call a 1003 so everybody you submitting a mortgage application at every company is filling out the same uniform mortgage application that's why I can go to even our website at Princeton mortgage you as a borrower can thought those exact same questions we can import that into our 1003 and then automatically putting it through our automated underwriting system all of that is mapped out to make that supposedly very simple and easy what the underwriters job that becomes assuming you get approved by the automated underwriting system is to do everything you to verify that all the information that you put in is correct so that initial automated underwriting approval is based on information provided by the client and then the underwriters job is to make sure that all of that information is correct by getting paperwork and documentation during the underwriting process everybody with me so far makes sense okay in some of unique situations where maybe somebody doesn't have any credit right now that like traditional credit score they haven't had any other accounts or there's some other derogatory things with their credit report that make it so they're ineligible for our automated underwriting process we do have a manual underwriting process it obviously takes longer to do and can really those loans can come down to underwriter discretion but at the end of the day even with a manual underwrite what we're trying to do is make sure that we can fit this loan into that box so that we can get it as part of those pools of securities and that no one will come back to us and yell at us that this loan doesn't perform that's really what mortgage companies will try and do the underwriting is to say if for some reason the person who gets this loan defaults no one's going to be able to come back to us and say it was our fault that's that's the world that we live in so that's what we're trying to do we have those two ways of doing it I gotta give any question type men shot amount so talk about automated computer-generated process using the information the borrower's provide is our automated underwriting system and then the underwriters doing is going to review documentation to ensure that things like the income you said you make the assets you said you have the credit derogatory is that you need to explain that all those things make sense and lineup so that that we know that you actually you qualify for those most government back guidelines that we talked about same thing on the manual side so underwriters have three choices when they get your loan application they can approve your loan and let's usually with an approval one called with conditions the term you guys might have heard so that approval with conditions comes out if baton says your loan is approved based on the information I have here here is the additional information I need from you to prove that XY and Z is true so in other words it might be hey your loan is approved with conditions please please verify that the asset you have in your account I see this one large deposit for $10,000 tell us where that came from because we have to make sure you didn't borrow that money from somebody else right and again I know we're getting a little bit into the weeds but the reason we would do that is if you did borrow that money from somebody else we need to know how you plan to repay that money right so that we can factor that into your debt to income ratio right so all of the this is where the mortgage underwriting process gets very complicated or tied in because each individual piece of the information we're reviewing can affect the other pieces of the law right for instance if you're doing a cash out refinance what are you doing with that cash out are you paying off debt well if we can pay off debt it that might lower your debt to income ratio because you don't have to make those other monthly payments even though your mortgage payment might be slightly higher does that make your alone more or less risky and so those are the decisions that were weighing out and how these things are often tied together and I'd love for you guys to think about an individual underwriting situation where you had one thing that started to affect a bunch of other things and things became more complicated and we kind of walk through what might have happened on one of your individual for individual clients as a realtor I kind of talked about that so the best case scenario when we smell a nun rating is it gets approved with conditions these are these conditions or things you have to do to get the loan across the finish line an underwriter can also suspend alone and basically what that means it is hey I have some real questions here about X Y or Z if you can overcome these questions I'll still consider this loan but for right now we're not moving forward we're going to pause everything here until we get some clarification on this stuff so again for instance if somebody's looking to buy a house as a primary residence but the appraiser notes and their appraisal that there's a tenant living in the property right now that's a non owner occupied home we have to verify that that person is going to be moving out so the other person can take over this passes their primary residence that would be something that we would suspend a loan for because basically if we don't get that information the loan is dead right here I'm certainly dead as a primary residence purchase right so like there's a big enough issue here where something doesn't make sense if we can't rectify it we're done but I'll give you a chance to rectify it the third option from an underwriter is to deny the final hour right which basically says hey there's a bunch of stuff here it's unlikely that any of that is going to be over come here quickly whether it's you know hey we found multiple bankruptcies in their past and we haven't you know we can't we don't allow for that or we did a search beyond the credit report and we found another mortgage that was in foreclosure recently that we didn't know about it wasn't showing up on the credit report for some reason those things would lead to an underwriter just denying the file when they get when they get everything in front of them questions about it we did have a question that came in and so why do some commitments have a list on them they make me feel like the underwriter is not interested in doing the loan so I would actually argue the other way right and so and so I appreciate this question by the way those lists depending on how they're written can make you feel very different right if somebody writes a list that's consolidated and in English as I like to say you know where you can read it and it makes sense you it can be really helpful to be like hey here are the four things we need to get your loan across the finish line oftentimes on a commitment what happens is you're getting the automated underwriting commitment and there'll be a list of 13 things on there nine of which have to be done internally inside the mortgage company you have nothing to do with your client and then that can be very overwhelming because you see list of 13 things and it seems like you to do 13 things but really your client only needs to do three or four things or maybe even less but actually to do with that so it depends on how your mortgage some sort of a list is almost necessary because we want to let everybody know the things that need to happen in order to get the loan across the finish line we want to be very clear that that commitment or that approval is conditional its conditional upon meeting those 13 things on the list the more information the more detail you have in that list to me that's the better job the underwriter did so if an underwriter is giving you solutions we're giving you ways in order to show proof to overcome those conditions that's actually better than just saying hey we need this we need this we need this and not explaining why or how they should go about getting it so the more detailed your commitment is actually usually it's the better job the underwriter did as long as those things those conditions are coming across in a way where everybody understands who is who is responsible for curing that condition and what and can figure out what we need to do in order to make that happen so I hope that answers the question did it was there any follow-ups on that no follow-ups well keep coming questions are my favorite all right so so the loan underwriter is going to decide whether or not the borrower can qualify for the mortgage but again they are not they are not making these decisions based on their feelings or they shouldn't be right this is very simply what do I need to see for this borrowers unique situation to make sure they fit inside the box so let me give you another example right the traditional guidelines say that basically ordered approach to use over time income for a borrower somebody would need to be receiving that income consistently for the last two years right so we would need to or boat for instance in order to use up bonus that someone supposed to get at work we have a document that they've been getting it for the last few years and that they're likely to get it again right if we're using that for qualification purposes so in a scenario where the income was one thing two years ago was less last year and now they're in a business that was impacted by the coronavirus it becomes almost impossible as an underwriter for you to assume that someone's going to get that same bonus or a similar bonus this year and so this is where it becomes very nuanced in terms of what can we do to ensure that as a company we we are doing our due diligence to make sure that if we're gonna use that bonus income to get somebody qualified they need that or they don't qualify for the loan how can we get ourselves to a comfortable place where we feel like that bonus is likely to continue knowing by the way that if we do this long and the person doesn't get the bonus and then they default on their mortgage that we're going to buy that loan back and the other get to keep in mind is that a company like ours which is even very well capitalized for a mortgage company can only handle you know a few buybacks without it doing real damage to the overall company's health and economic health because these loans are huge right it's a big investment so there's there's a fear response on this which is if we cannot verify that or do or due diligence or we feel like we are comfortable about the box we're putting this person in then the next thing that can come back to bite us in a big way down the road and that individual underwriters gonna have their decision attached to that loan forever so that's that's the decision they're making at that point which is hey I got to make sure we get this right you have to and it's a tough job then it's what underwriters are some of the highest paid people in the mortgage industry because their decisions ultimately can sink a company if they get it wrong so you want to share that with you guys and I promise we'll teach you at the end how to work through all this in a way that makes life easier and not so scary so ultimately the underwriter will insure the borrower doesn't close on a mortgage they can't afford right and we're using affordability guidelines from Fannie Mae Freddie Mac FHA VA that following their guidelines most the time directly occasionally we'll have our own overlays on top of those and then they want to see if loaning that money is risky or not so here's the deal loaning money is always risky to somebody for 30 years right it's almost impossible to know what's gonna happen to somebody over the next 30 years think about where you were 30 years ago think about where you were 10 years ago things change life changes right but in the moment we wanted the best job we possibly can without being overly restrictive and we want to reduce risk right we want our loans to be less risky than the general ones or or the risk being a tolerable based on what we know about somebody so again our risk factors are what credit score is a part of it debt to income ratio which is the amount of income you have coming in and your job stability versus the amount of monthly payments you have going out the assets you have in the bank do you have a rainy day fund if there's an emergency or you're gonna be behind on your bills if you have something behind that and then the equity in your home this is actually maybe the most important one overall people if you have 30% 30% down you're generally not going to get foreclosed on because if things go bad you can just sell the house if you put 3% down and things go bad usually usually not something that you can sell to get out of you might have to walk away or end up getting foreclosed on and that's why the risk attached to pricing and everything else is so loan-to-value based ok another question come in and it says so are you saying that a bigger bank will take more risk but a smaller company is afraid that the risk will put them out of business so I'm not saying that and there's a couple factors in thinking this through right so there is a cost-benefit analysis being done by everybody in business all the time and mortgage companies are no different in order for a smaller borsch company to compete the answer might be that we have to be more creative and taking out a little bit more risk in order for us to continue to grow our brand or to grow as a company or we have some competitive advantage over our bigger people in the industry in order to keep going forward each company is going to assess the risk tolerance in their own way I will say this when things are going good traditionally in business and the mortgage issue is no different we tend to assume they're going to go good forever and so we tend to have a higher and higher tolerance for risk and then about every 10 years something happens that flips the world on its head and the people that took on too much risk get buried so we had 9/11 things were going great also me at 9/11 came out of nowhere tanked the economy then we ended the Great Recession in 2008 everything was going great tanked the economy now we've been going great for the last 11 years all of a sudden coronavirus comes out of nowhere and blindsides us the people so we don't know what the next thing that's going to happen is but we do know historically about every 10 years something's going to flip this thing on its head and so the companies that are weighing that risk the best are the ones that will in general survive but countrywide that going into 2008 was the biggest mortgage company in the history of the world and basically overnight they went from the biggest guy on the block to add a business right so we saw Washington Mutual get put out of business but basically ready to be acquired because of their mortgage portfolio Bank of America swallowed up countrywide in that move somebody had to take that data they basically got blackmailed into it at the table in the 11th hour during the height of the financial crisis and they got fine billions and billions of dollars over the next three years for the previous sins of countrywide so I say this only because being bigger doesn't necessarily change your risk level in any way shape or form and actually in some ways you know one of the nice things about being a smaller mortgage company is if we make a mistake the CFPB and the government are not going to try to put us out of business from one mistake but if you're a huge company and they think that you're supposed to be above making those types of mistakes and you have a mistake that's systemic and you do it over 30,000 people you can get hit with a 30 billion dollar fine one day we're not going to get hit that way so there are certain different things that that change your risk tolerance and different ways the answer is every mortgage company wants to be awesome at underwriting and wants to never make a mistake but it's a complicated process and some of it does come down to judgment at the end of the day and so we're all waiting that risk every day but I no I don't think I think generally FDIC insured banks right now tend to be tighter in their guidelines not looser but it also is product specific right so I know that there are some companies on jumbo loans where if you have a ton of money in the bank with them they'll overlook a bunch of stuff because again it's about risk right so if I'm doing a million dollar along with PNC but I have three million dollars in my investment account at PNC that makes me a less less risk right just in terms of my if I'm going to default on that or not so we have to keep those things in mind that at some times especially outside of Fannie Freddie FHA and VA products the risk is going to be measured individually so it's probably specific we've had a couple more questions come in - the first one I always hear a lender say the loan is in underwriting does the loan go through underwriting multiple times or does it only go through underwriting once and from what period what period is the loan in underwriting good question so almost all loans will go through underwriting at least twice and probably the industry average money somewhere between two and three times and I'll let me explain what that means and usually when we say in underwriting it's a phase of the mortgage process that basically your loan is in between when it initially gets submitted underwriting and what your loan is what we call clear to close okay so what happens upfront is we gather all of your initial documentation we get an appraisal if we need when we get your title stuff in we put all that stuff together that's supposed to verify the information you submitted on your mortgage application and then hopefully when we have it all in one place and together and tight and perfect we submitted into underwriting your underwriter reviews all of that stuff and if everything goes well your loan is approved with conditions and the actual process of underwriting here alone is probably a two or three hour process right the actual process of doing it but you have the wait time of getting into underwriting which is some companies right now is three or four weeks here at Princeton I think we're about running about three days in already alone in underwriting and then that I thought was underwritten it's called and usually it's approved with conditions that woman gets kicked back to your loan officer in your processor their job is to satisfy those two three four conditions right in order to get the loan across the finish line we didn't resubmit the loan underwriting and hopefully it comes back for a third o'clock that's like your hopeful process right and then once every blue moon maybe the processor gets everything right on the first try it goes instantly very close but it's not traditionally how it works so that's kind of the the process of underwriting is it goes from underwriting back to processing processing cures all of those conditions sends it back underwriting says okay we're good or maybe maybe there's a second time dividend or anything oh hey thank you for submitting this new information here's one new piece of so thank you for getting this updated bank statement this bank statement now has a new deposit we need to get sourced so I'm taking it back to you one more time to get this one last piece of documentation processor gets that they put that loan back in again down to writing and now we're clear to close so that process of that loan getting passed back and forth while it's even underwriting can be passed passes back board between the processor and the underwriter several times depending on the complications of the law what other questions did we get Courtney I'm so there this is submitted from one person and there are a couple questions in here so number one are you able to do FHA now with ko bid and if so how many stubs are needed after unemployment due to ko bid how much movement in account do you recommend when applying for a mortgage I generally held on yes we can do FHA and we're planning to you have some new things in place hopefully in the next figure so that'll make it even easier to do FHA removing some of the obstacles that were in place for us but we are doing FHA I will admit that it's harder than its exceedingly hard right now to get an FHA loan but I'm hoping in the next couple of days to have that rectified here at Princeton and there certainly are companies out there that are still doing FHA and VA loans in some of my previous webinars if you go back and watching from the first one four weeks ago you can go in and really I talked a lot about why that is and then so what was the second part of that question um if so how many stubs are needed after unemployed due to coated so right now we're looking for 30 days back at work so two consecutive base thirty days is what we're looking for but we're still feeling our way through that as well as I think we don't mean Prince and worried I mean the industry is still waiting for guidance on this but traditionally as long as you've had less than six months of a gap at works whether you were out on for disability whatever it up though you have less than six months out you only need 30 days back on in order to get close and it doesn't mean you need three days back on by the way to apply we can start your mortgage process for you and then just close on your loan after 30 days and to pay stubs and then what was the third part of that question how much movement in account do you recommend when applying for a mortgage I generally tell clients if money is in Bank don't touch except for regular bills like utilities insurance and don't take out new credit and then a follow-up question to that is what is the highest DTI you will allow and still approve okay so yes the short answer is we are gonna look at 60 days worth of bank statements to verify asset system for purchase on some when you Sabrina closing so if somebody applies today and they're closing on June 15th we're probably going to look at everything that happened from today back 60 days and then we're also going to check what happened over the the rest of this time period applying for new credit is a problem because it can in take your credit score or if you get approve of that other credit we may have to factor that credit and the payments on that credit into your debt to income ratio which can change your qualification level or whether you qualify at all and are max that's income ratio back-end is 57 for FHA 50 for conventional and on VA loans there really is no specific number I've seen really really high GTI's go through for VA loan but it depends on their automated underwriting system but certainly I've seen them go through higher than 57 so just so that answers that answer that part of the question I think but if not feel free to keep firing at me and then I think one more if a client uses a credit restoration company to improve credit how do they keep that from hurting and multiple clients have told me that no mortgage that multiple clients have told me that no mortgage because they successfully used a restoration company so there are some mortgage companies that do not allow credit repair or you know basically getting your credit score off during the mortgage process currently right now Princeton mortgage is nothing like that in terms of our overlays in fact often times for our customers after they've applied to us we will do a calculation or when they simulate or see what that person would need to do to get their credit score up and we'll actually tell them exactly how to do it and then if they get their score up we will use that new score so for us if you have the means in other words sometimes getting your credit score can be as simple as paying down a credit card balance $300 and it can make your score go up 30 points I don't think you I don't think that is straight vias manipulation as a lender to me that's like hey who would know that and and by the way this is you know I don't want to be penalized three basis points because I have ten thousand dollars in my checking account and I didn't realize that this balance was hurting me in that sort of way so for us as a company you know we almost do the credit repair for some of this stuff in-house in terms of getting people better qualify but I have definitely heard of other mortgage companies that if they don't really not do that internally but externally they're not they're not looking to work with those clients again we feel we feel differently about it but it's very letter specific and there's certainly nothing and the Fannie Mae or Freddie Mac guidelines that prohibits you from fixing your credit before you apply for a loan or even while you're applying for a loan that's all the questions that we have right now cool we'll keep flying away I love this stuff so this is what an underwriter does an underwriter is going through and making sure that that your loan fits into that box so we talked about our three C's credit capacity which in other words in other words for debt to income ratio are you doing to repay and then the collateral of the house we're talking about is how much money you're putting down so one of the things you've seen mortgage companies including Princeton really crack down on during the coronavirus is would calls where people don't have any skin in the game so people if you're doing an FHA loan right now where you're putting three-and-a-half percent down what you're getting that 3 and 1/2 percent as a gift from somebody and then you're also getting a 6% sellers concession to cover the cost of that loan which is what a lot of these loans were doing well if things go bad for you you have no skin in the game and you're essentially renting that property at that point if you just got into that loan because you'd had to come out of pocket for any of the money on either side that is exceedingly more risky as the lenders in terms of statistically and even just have somebody having a low credit score so low credit score there's a lot of factors I can have with a little credit score but not putting any of your own skin in the game on a real estate transaction very specifically makes you more likely to default so some of the things I think you're going to see mortgage companies do to protect themselves as we get to back to our new normal is say like hey if you can put 5% down on your own money we might overlook a higher debt to income ratio or a lower credit score but we want to make sure that you're just as invested in making sure this works out as we are and and investing when I say invested I mean in terms of the money coming out of your own pocket so you may see some some individual lender overlays that challenge previous conceptions of what makes somebody credit worthy as we come through this because people are looking for job stability and they're gonna be looking for having to that skin in the game or having s in the bank and ability to repay um questions about any of that and if you didn't take them feel free to shout them out I'm you yell at me all right awesome so credit borrowers credit score it evaluates are responsible when they pay back their debt how many um oh you heard you guys knows but credit scores basically go from 350 to 850 the national average right now is in the low seven hundreds and it moves you know in that range for lending purposes anything over 740 is generally considered perfect anything under 620 is generally considered really bad and then each 20 credits for points in between you can have huge differences in terms of the pricing of your loan whether or not you qualify and and your and whether or not you're eligible for certain products so 620 and 640 or a little bit very differently 640 and 660 are looked at very differently even 700 to 720 can be looked at very differently in terms of eligibility product and pricing and even our automated underwriting system they look at not only what the credit score is when the individual debts and how you got there so to credit scores of 660 may be looked at differently if one is 660 because there was mortgage links last year versus one is 660 because of a couple of medical collections but the under automated underwriting system will view the medical collections is something that can happen to happen to you and doesn't make you miss really more risky to default verses mortgage Latex make you at a much higher risk of default okay and so our even our automated system is designed to look specifically at that capacity so that from a debt to income ratio perspective anything over 43 percent is considered risky so let me kind of explain what that means nuta borrower whose gross income is one hundred and twenty thousand dollars a year or ten thousand dollars a month if the total monthly bills on their credit report so their principal and interest mortgage payment their homeowners insurance their property taxes student loans credit cards auto payments installment loans of any sort if the total amount of those monthly payments is more than $4,300 and that's considered very risky now that may seem conservative but when you factor in that thirty percent or more of that $10,000 is going to taxes off the top and someone's coming home with actually seven thousand dollars and then we have forty three hundred dollars in bills on a credit report which by the way doesn't include food clothes cell phones electric bill water bill you know any any other sort of up cable you know any other sort of household bills people so cable some people any other bills then you see that that's actually pretty lenient having said that like I said before we do have products in the industry here and many other companies that go as high as 57 percent on that back-end debt to income ratio so in my opinion we are still more flexible as an industry and as income ratio than sometimes makes sense to me as I absolutely the individual laws oftentimes if I'm if I'm telling somebody that it's a good idea to buy something where they're doing ratio is that high it's because I know that there's a CO bar or that for some reason isn't on the application that also contributes income or some other form of income that they're not using to qualify otherwise if you're really at 57% your likelihood of default is really high unless you have a ton of money in the bank because you know there's just no room there's no flexibility when you're factoring in the tax you already pay the other bills you have it's very hard to figure out how to make that work realistically any questions about any of that okay I have a question about debts that are about to be retired say somebody has a credit card with you know or some kind of a mouse a hormone it only has 12 months left on it is that treated any differently from the underwriting debt point of view great question so the answer in short is yes but it wouldn't be for a credit card because rank is a credit card we go always run the balance up again and we don't know how about now that right right um and input like if you have a car loan that is less than ten payments left we can usually exclude that from your debt to income ratio and not count it at all so that's definitely a factor like for a lease for instance we wouldn't be able to exclude it because when you have a lease we assume that when that lease is up you're going to get another one right or avoided to buy out another car and some other way but if you have a car loan that is less than 10 payments left we can assume that you will not review that and that will that will that will be excluded from your debt to income ratio picture so installment loans like if you were to get a loan feel like prosper and other you know companies that's always mailing out for for installment loans really that if it's less than 10 payments between now between now and when that's going to be paid off you should be in most cases okay very good question and then you know the last piece of this obviously is the collateral itself and again second homes are viewed as more risky than primary residences and just a little bit because the theory is you pay your bills their primary residence before you run here vacation owned investment properties are considered exceptionally more risky and the reason is one is obviously if it's an investment in that investment goes bad people tend to be willing to let those things go into foreclosure or stop making payments additionally oftentimes we're assuming that your renter is going to keep paying the rent in order for you to keep paying the mortgage on your installment loan and we're not evaluating the creditworthiness of your renter so if you're a renter stops paying rent and then you stop paying your mortgage that's a much riskier loan and that's why install I mean investment properties often have much higher rates are limiting the amount of products and require more money to put down because of the risk associated with them additionally some things you might not think about very much or even condos are considered riskier right why is why are condos considered riskier well because there's individual factors with a condo that can affect value such as maybe the HOA itself starts doing a bad job they don't budge it correctly they get your weights too that can make it harder for the bank to foreclose or to give their money back in the event of a foreclosure the value of an entire condo complex and going down for some other reason and so they can push values down and the amount of comps are around and also when you have an entire building that it's owned by one entity if that lets say the HOA goes out of business or they can't afford any prepares the building the individual bar or the bank in this case it's a foreclosed can't change those things so they're considered riskier loans which is that way even on a condo you have different pricing and a regular home when it's over set when the loan is over seventy five percent loan to value so there's some little things that you might not think about in terms of impacting risk of loans mark we did have one question that came in about school loans so so how are those kind of can considered from an under perspective so assuming that you're already making payments on them then we just factor those payments into your debt to income ratio if the loans are currently deferred depending on the loan products we're gonna kind of make up what we think the payments will be or find out from the student loan company what the payments will be when those loans are no longer in deferment and one thing to factor in is even if you know for instance that they're gonna be deferred for the next four years let's say well we can't assume that for northern reasons the least of which is that we can't make sure that the person that's going to school is gonna stay in school under those loans are gonna remain deferred so no matter how long there's smoothly deferred for we're going to have to factor in some sort of monthly payment into the qualification process in that way and so so yes student loans for the current generation of people graduating and being first homebuyers a huge impact towards little borrow and fun and get their loans funded so I hope that answers that question so how long is under 18 take well the actual process of underwriting alone is like I said before is a few hours you know two to two to four hours of the very high-end very complicated underwrite so the actual process does not take long however most mortgage companies even at their best are running a 24 to 48 hours turn times and as the industry's got a little bit overloaded right now we're seeing turn times as high as three or four weeks I said you guys earlier on our retail side for things that prints right now we're at things like 72 hours in terms of how long the underwriting entire process takes this is really gonna depend upon two things three things one is how well is the initial package your loan officer put together when they sold the loan did they get all the initial documentation from the borrower they get W to use pay stubs and everything else they needed that was correct and accurate and they look for things that might be wrong did processing do the same thing they deliver that loan to underwriting and then how fast is the processor able to gather those extra conditions wants to do that initial on the right upfront before they get the loan back into underwriting for the second time a well oiled machine on the mortgage side we're a long who does a good job you could get loans they clear the clothes and as quick as two or three weeks when things are busy if you take as long as two to three months and so there are a lot this is this process is going to come down to a lot this is the biggest in its it's the differentiator between companies individual law officers a very good loan officer at a very good company can save you months of stress and anxiety on your mortgage process rates are going to be usually similar company to company although they can make a difference for sale larger loans but the experience of the underwriting process will be very different based on the experience and qualifications of your loan officer and the company that you're working with and how well their machine is working any questions about underwriting and the timeline alright so here's what we want to make sure that we're not doing right we don't want to apply for any new credit lines or increase spending during the underwriting process but more importantly and here's the thing I really recommend more than anything the minute someone starts thinking they might buy a house they should apply and I know that may sound counterintuitive but when I say apply they need to get their documentation to a loan officer and from an underwriting team upfront because there are many different things that we can do to make the underwriting process go more smoothly for instance we said we're gonna look at 60 days worth of bank statements right well if we no more than 60 days out when we're actually going to put an offering what the loan process is going to look like and what we need there are things that we can do to make our underwriting process much more simple right we can just not have a bunch of transactions going in that of our accounts and making sure that we're you know that works in and out of those accounts so the underwriters can see it and understand what's coming in and out we know that if we can do that we should be doing credit repair and sometimes credit repair to be as simple as taking the three hundred dollars a month you're putting towards your this account and moving that towards this account and that may make your credit score go up that can make a big difference in terms of the pricing of the program you're able to get two or three months down the road so getting a good loan officer all of that information sooner gives us more time to get those things correct and make sure you're getting the best program and the best pricing your customer can possibly get so timing time extra time can make a huge difference in the pressure of the process especially if your loan officer is working hard and as the customers best interest in mind when we need something from your clients and we talk we try tell everybody upfront hey listen we're gonna make this effortless as possible the mortgage process isn't fun if I don't need it I won't ask you for it if I do ask you for it it's because I need it and you don't have to like me about it but you got to get it for me as quickly as possible so when we ask for different things from there from our borrowers the the speed about getting it back to us is going to make a huge difference in terms of how best everybody in the mortgage company is gonna jump to get things done if you're a little processor for instance your goal is to get loans out of your pipeline as quickly as possible because you want to be able to take more loans on and get and filter through faster so loans that's it because we're just waiting on somebody getting documentation in are always going to take it back see two loans that a processor feel that they can get through the process quickly and get that loan very close sooner so make sure you get immense stuff in quickly and then the other thing is borrowers should be as transparent as possible upfront about what's going on in their situation under 80 in the mortgage industry is incredibly good at finding the bad stuff it's almost impossible to get away with something so if you tell your clients and stuff upfront like should I tell my mortgage loan officer the answer is yes tell them everything lay it out on the table up front there are a hundred really good legitimate ways that we can get around some problems your client may have had in the past if we know about them upfront and we can do it smoothly and quickly and make sure we hit all our deadlines and our commitment dates everything else if we get surprised and blindsided by those things first of all your loan might get turned down because the other item might feel like it was intentional there was fraud involved but even more so fixing those problems in process with those deadlines looming he's incredibly stressful for everybody including your loan officer and the team have it knowing those things upfront makes it very easy to overcome those things again it's there to be super stressful intense versus like oh I got this because I had enough time to get it done upfront so just tell your clients be super upfront even if you're like yeah I don't this is a problem but let me tell you about it I'd rather know up front so I know how to navigate it I can't let everybody on my team know then finding out about it you know because we stumble into it later there's there's it's very hard to get away with anything in this industry and I say that to use like the wrist the juice is not worth the squeeze if you if you think there's a chance we're gonna find it we're gonna find it so let us know upfront we've had two questions that have come in first one the fuzzy variable here is the three amigos the bureau's who's policing or monitoring or governing them for possible abuses and inaccuracies a great question so I mean the CFPB is the institution that would be in charge of that I post if those if there's abuse there I try I don't want to get super political but I think you know different administration's take the job of the CFPB very differently and the amount of teeth the CFPB has to institute change or hold people accountable changes dramatically by who's in charge and so right now it's it's going to be up to you as an individual to hold those credit bureaus accountable for the information on your individual accounts there's not a ton of oversight or a ton of pressure from the government on any of our financial institutions including mortgage companies and everything else everybody is kind of flying under the radar right now there's just not a lot of federal oversight in the banking world so and by the way that could change dramatically you know in November so I don't know how to prepare for that but that's just the reality of what we've seen over the last three and a half years so it's up to you just point those things out in general we find that filing filing complaints or to come to those companies can be very time-consuming and frustrating but ultimately we do usually get to the right place but you have to be kind of patience is a virtue is an understatement and and for me that's a very difficult thing to do I'm not a particularly patient person but if you're willing to be patient and work with those companies we have seen them be accommodating again things rectified most the other question for you how can we as realtors help to speed up underwriting yeah I guess so the best ways right have your clients apply early right you know so in hey we're just looking for a house cool well before we go out and look let's see what you qualify for let's get all the information over to a mortgage person and by the way it gives us I can almost say that unless somebody's already walking into everything with a perfect application and by the way that does I would say maybe 40% of the applications we get are like this is a no-brainer it meets all that checks a lot of boxes is easy for the other 60% giving me an extra month or two to get things in order is almost always going to result in a better experience and probably better pricing for your client because we can do things like hey if your credit score goes up 16 points we can do it we can get better pricing for you and all you do to get those 16 points is pay $200 so this one card or pay down to this balance so there's a number of things that we can do as a mortgage company if we have time to do it so and then transparency about previous situations right so so often on somebody you know apply for a loan they got denied by somebody else they don't tell us why they got denied and then it pops up throughs in my process and now it's like hey man if I would have known about that up front I could have worked around it now that I'm finding out about it at the end of the process it your long blows up so completely upfront in terms of previous issues transparency around what's going on allow us to allow you to lose the opportunity the experts and work around obstacles and giving us as much time as possible you know if you if I'm waiting until you're out of attorney review to get your application and your commitment date is a week or two down the road you're putting so much pressure on that process that I'm no longer worried about whether I'm getting your client the best deal I'm no longer worried about things I can do to improve the process it's like a panic of like whatever I can get I need to get it as fast as possible and so the speed is not taking precedence over service over pricing or all other things and so you're putting your you're putting your client in a bad spot if they're not putting all their ducks in a row prior to submitting an offer and hopefully prior to even go up going to look any other question no we're good alright so this kind of sums that up and then I'm good so questions or comments from you guys or anything else that we can do in terms of this for any thoughts on what we can do next time or what you're interested in but I sincerely appreciate everybody coming and hanging out and I hope you guys found it valuable but again the biggest thing you can do for your borrower is just have them submit applications early and make sure that you're working with a loan officer that has been around the block you know experience matters with this stuff each loan and each individual client are so different it may seem like everybody's the same from a Realty perspective but I think as a loan officer I still see things every day I've never seen before you want somebody who knows how to deal with those situations and notice how underwriters are going to look at those situations in order to get that loan into that magic box that we talked about any other questions at all I almost think I did a bad job if there's no questions all right well thank you guys so much again for coming please send out any sort of ideas for future ones that we can do we want bc valuable and everybody else stay safe for you awesome thank you mark we will be sending out an email tomorrow just kind of as a follow-up for everyone so in the email you will find a copy of the deck that Mark walked through today as well as a recording of the webinar and then we'll also ask you we have a survey there that we would love for you to fill out and respond give us feedback what could we be doing better and most importantly what should we be talking about next so would love for you guys to share comments thoughts it's really helpful and appreciate it for us and it's been driving the content that we've done the past two weeks so we'd really appreciate it so thank you everyone have a wonderful rest of the day hi guys you

Show moreFrequently asked questions

What is the definition of an electronic signature according to the ESIGN Act?

How can I eSign a form or contract in Word?

How do I create a PDF for someone to sign?

Get more for underwrite mark with airSlate SignNow

- Digital certificate electronically sign

- Prove electronically signed Proprietary Information Agreement

- Endorse digi-sign Branding Questionnaire

- Authorize signature service First Aid Risk Assessment

- Anneal mark Web Design Proposal Template

- Justify esign Forbearance Agreement Template

- Try countersign Hedging Agreement

- Add Development Agreement esigning

- Send Freelance Web Design Proposal Template digisign

- Fax Birthday Party Invitation electronic signature

- Seal Food Allergy Chart countersign

- Password Catering Proposal Template sign

- Pass Stock Purchase Agreement electronically signing

- Renew Party Rental Contract eSign

- Test Quality Incident Record eSignature

- Require Deed of Trust Template autograph

- Comment attestant initials

- Boost looker-on signatory

- Compel subscriber email signature

- Void Modeling Agency Contract Template template signature block

- Adopt Administration Agreement template signature service

- Vouch Wedding Photography Quote template countersign

- Establish Release of Liability Form template signatory

- Clear Coffee Shop Business Plan Template template initials

- Complete Summer Camp Fee Waiver template eSign

- Force Photo Release Form Template template byline

- Permit Simple Cash Receipt template esigning

- Customize Terms of Use Agreement template digisign