IRS library

Other tax forms

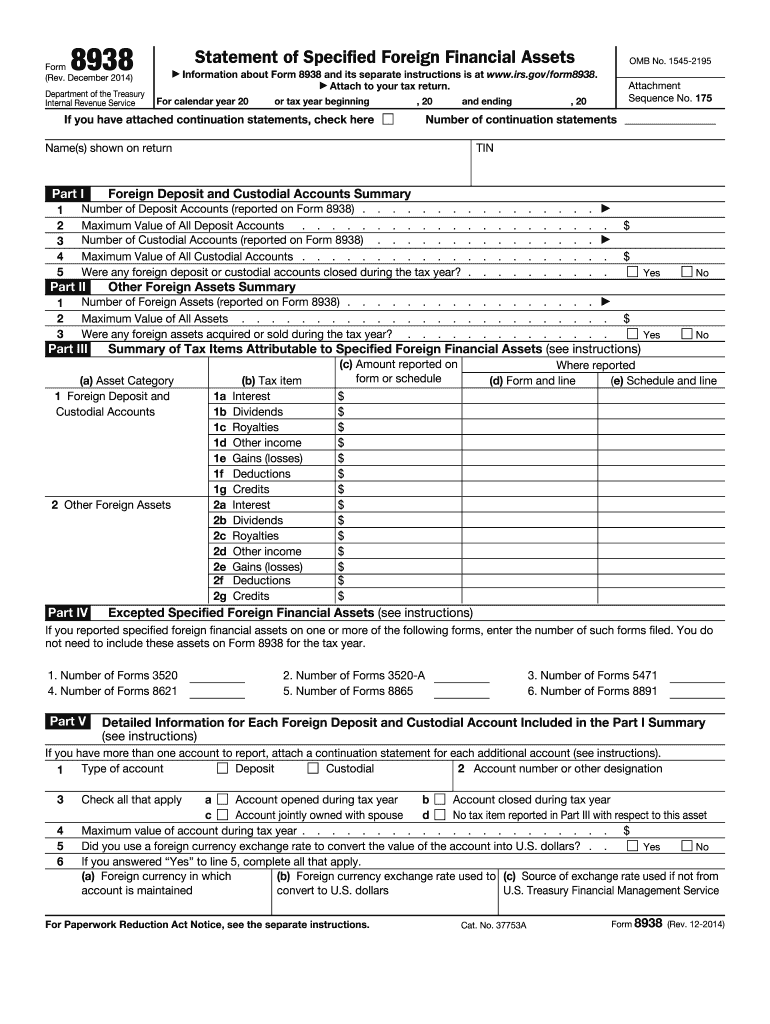

8938 form

Use this form to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you have an interest is more than the appropriate reporting threshold.

Learn more

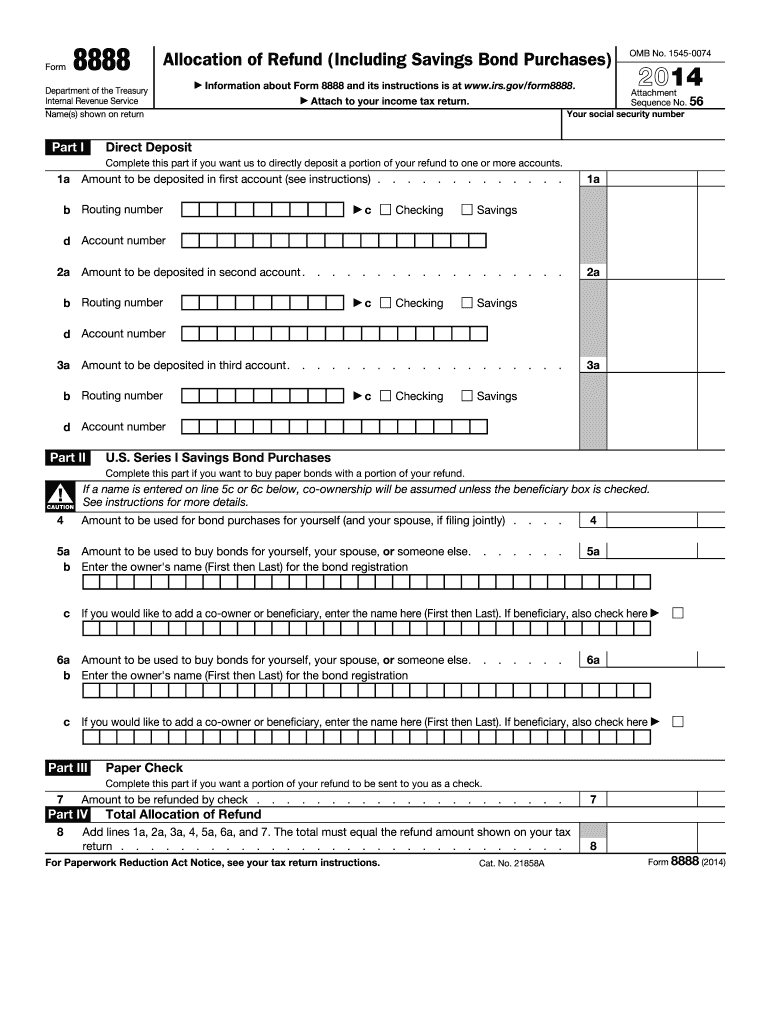

8888 form

Use this form to directly deposit your refund (or part of it) to one or more accounts at a bank or other financial institution (such as a mutual fund, brokerage firm, or credit union) in the United States.

Learn more

RP 99-38 form

This revenue procedure updates Rev. Proc. 98-63, 1998-52 I.R.B. 25, as modified by Announcement 99-7, 1999-2 I.R.B. 45, by providing optional standard mileage rates for employees, self-employed individuals, or other taxpayers to use in computing the deductible costs of operating an automobile for business, charitable, medical, or moving expense purposes.

Learn more

Foreign Account or Asset Statement

Submit a separate Statement for each foreign account or asset included in your voluntary disclosure form.

Learn more

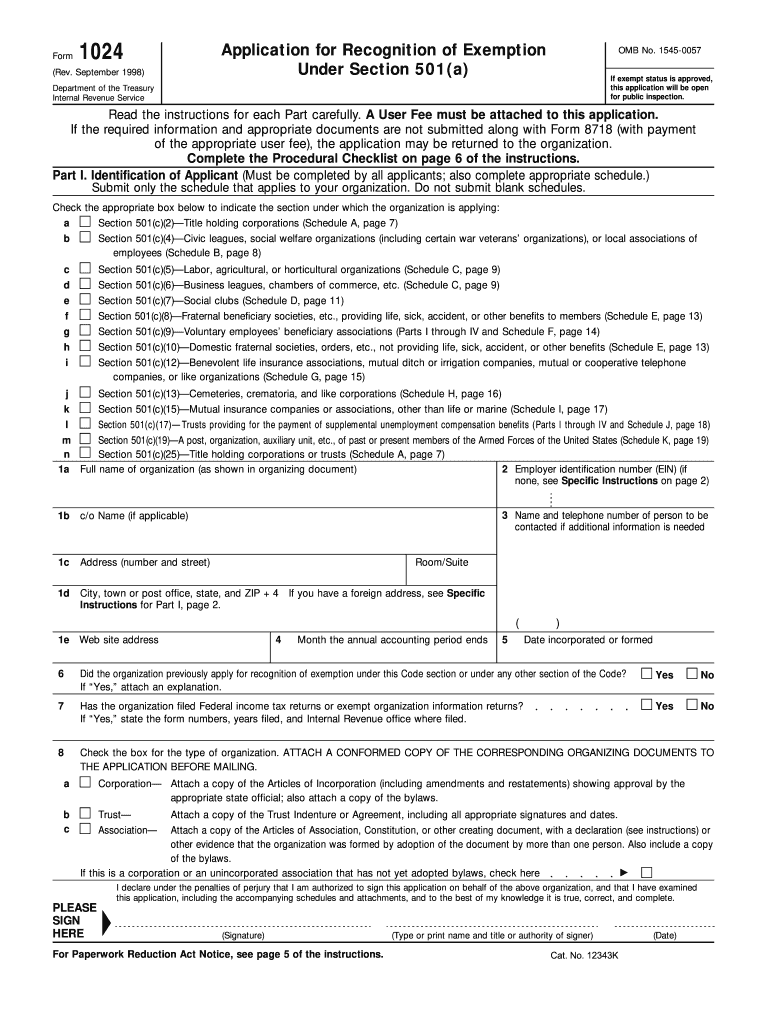

Example Attachments 1023

Samples of Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code.

Learn more

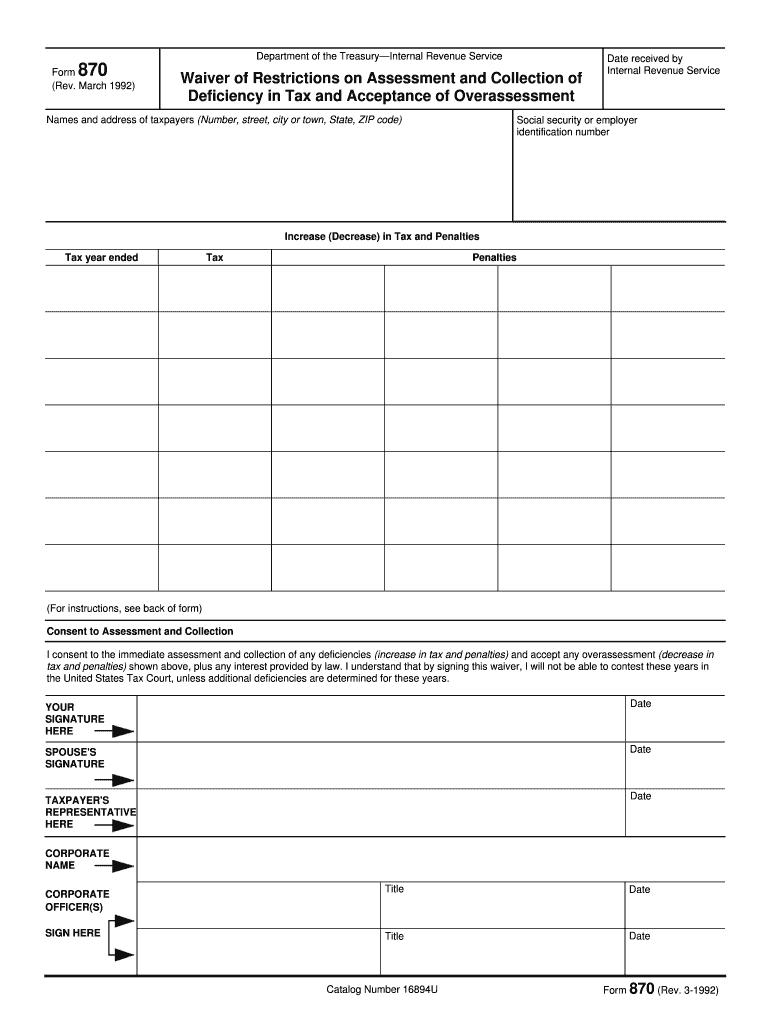

870 form

Waiver of Restrictions on Assessment and Collection of Deficiency in Tax and Acceptance of Overassessment

Learn more