IRS library

Other tax forms

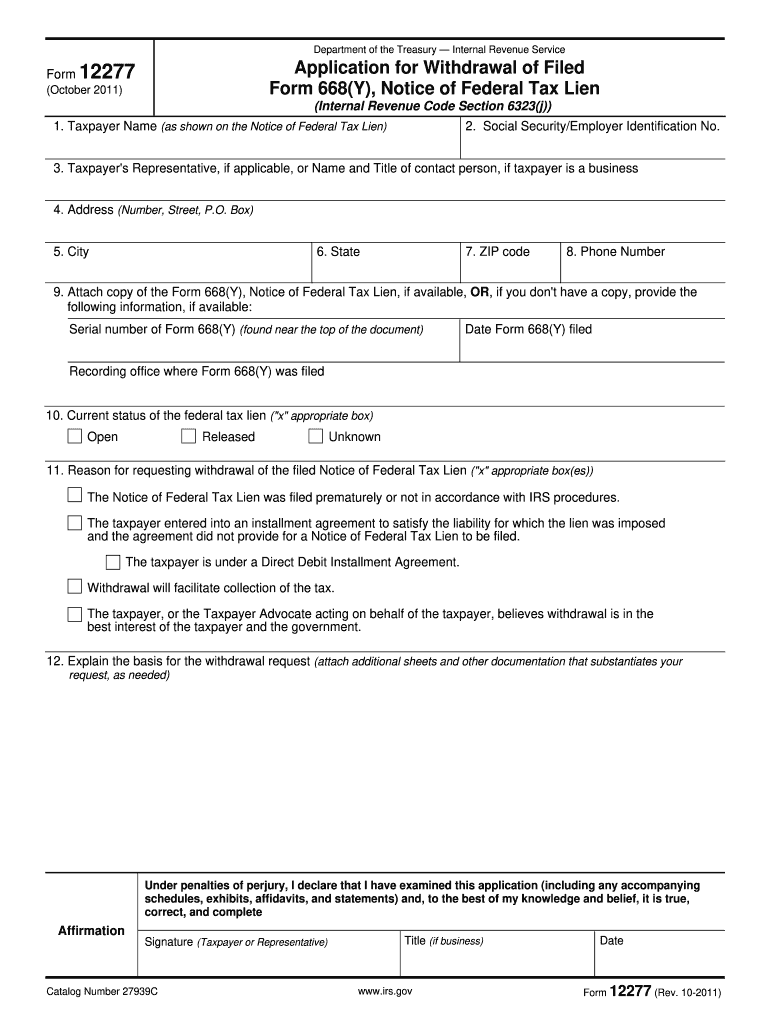

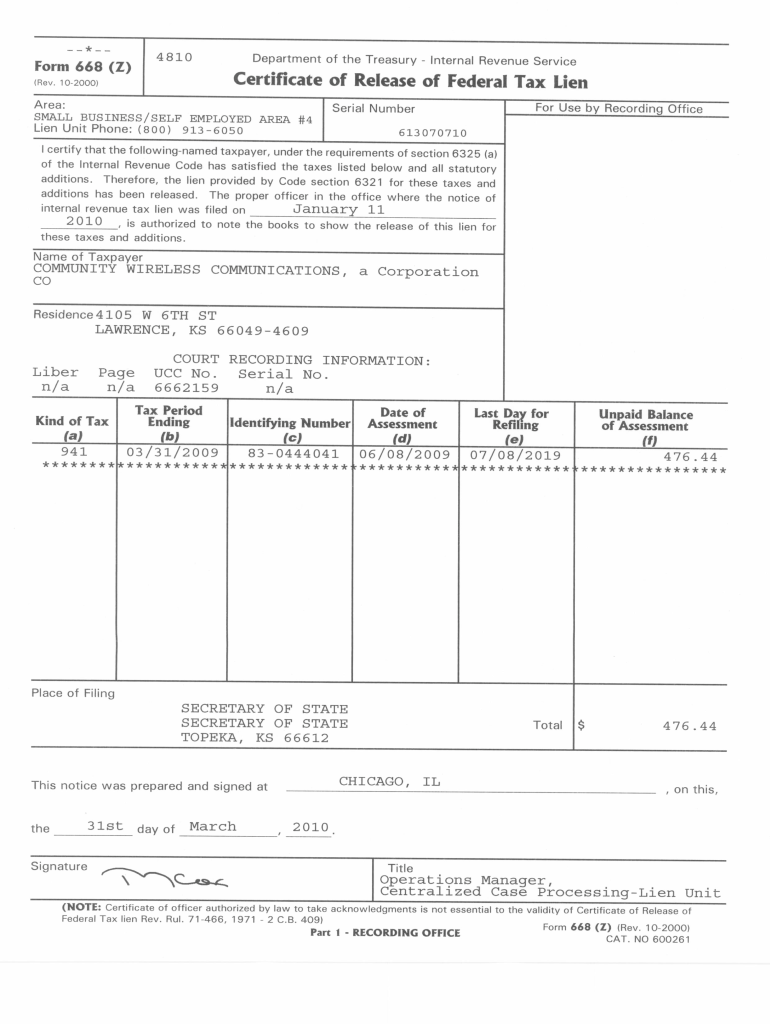

668-Z form

Erroneous Filed Lien. The IRS uses Form 668-Z to notify you of the release of a lien filed erroneously.

Learn more

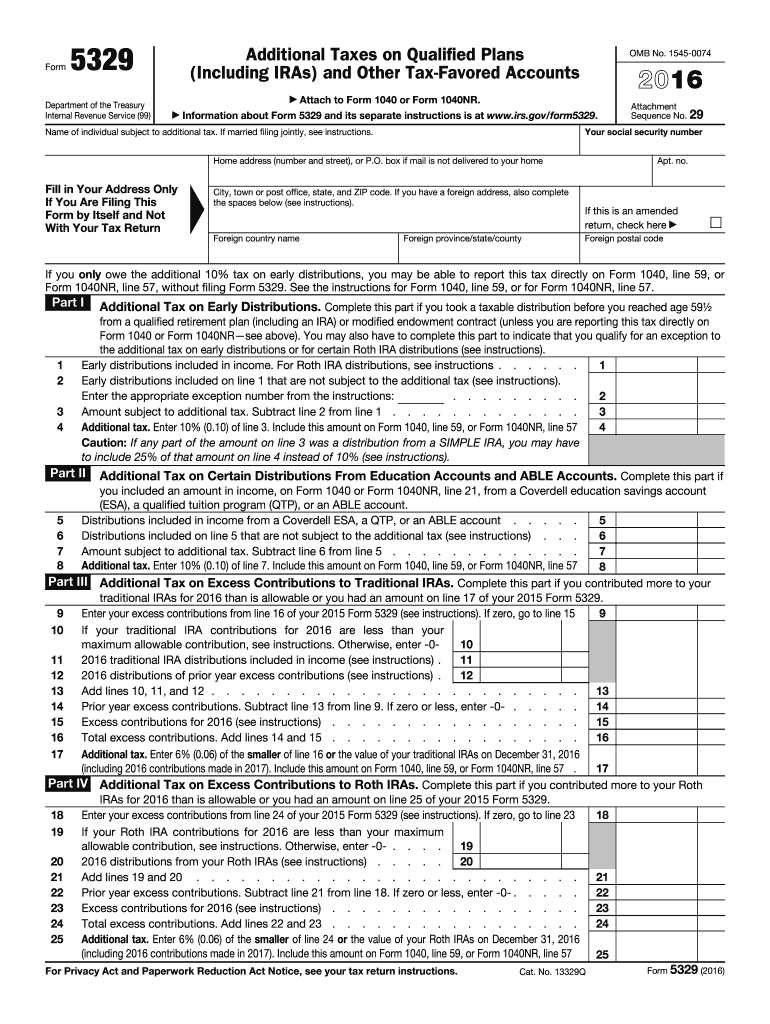

5329 form

Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts

Learn more

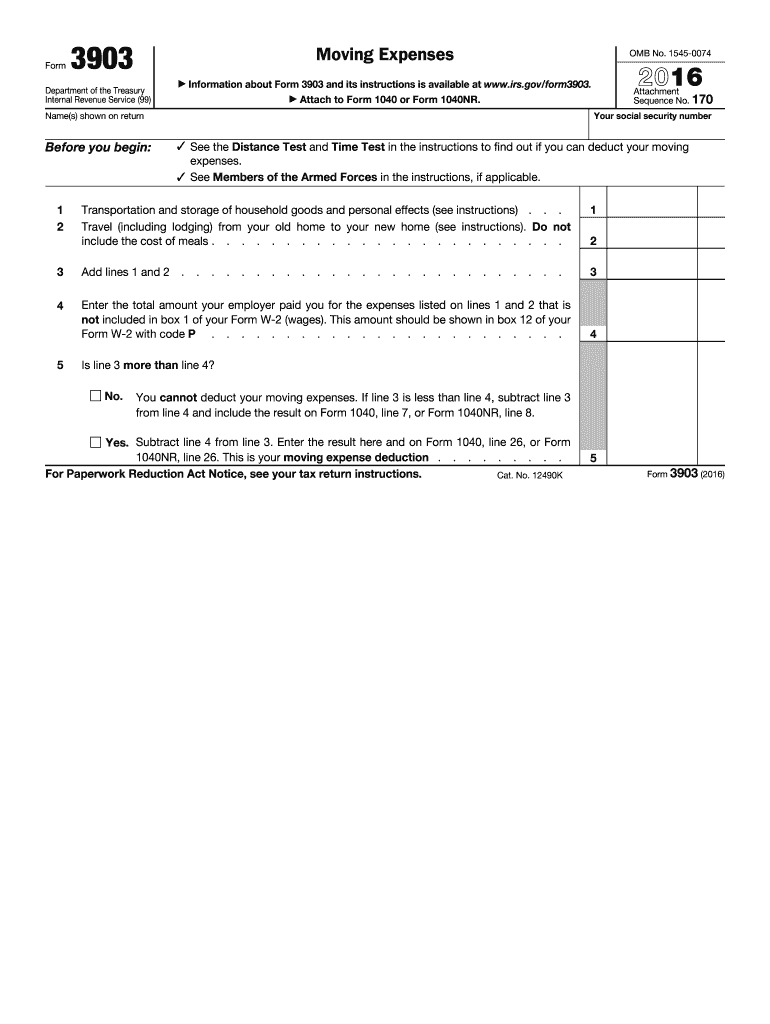

3903 form

Moving Expenses. Use this form to figure your moving expense deduction for a move related to the start of work at a new principal place of work.

Learn more

2433 form

Notice of Seizure is used to notify the owner of seizing the property for nonpayment of past due taxes.

Learn more