IRS library

Other tax forms

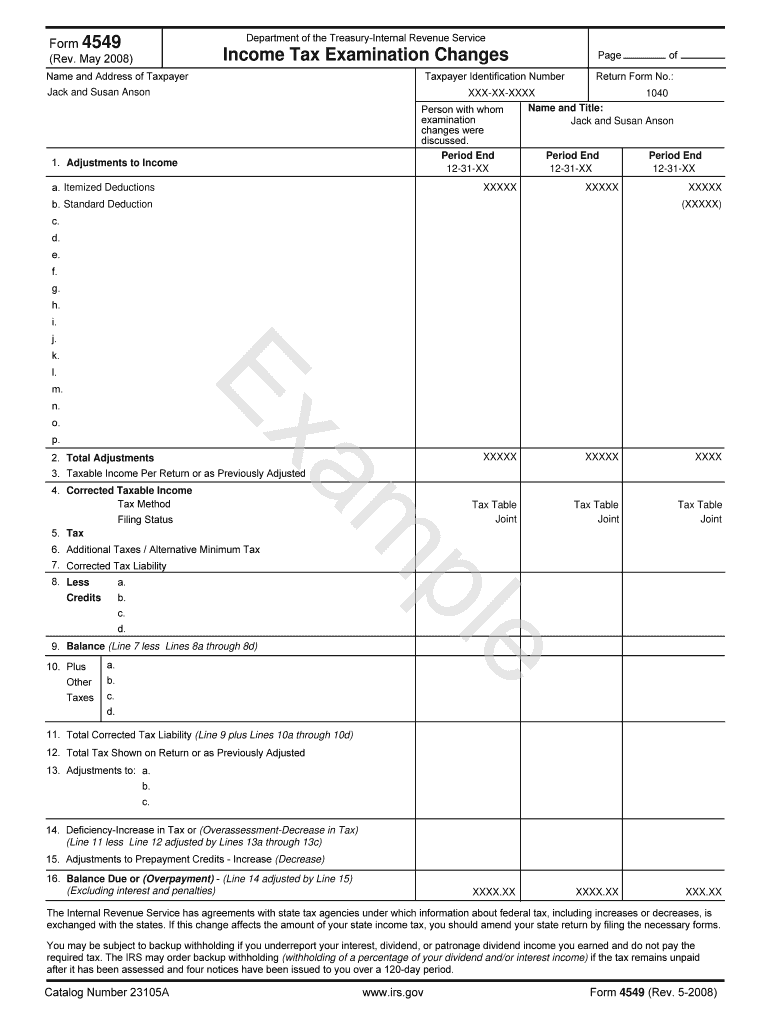

4549 form

Notice of Deficiency is used by the IRS to inform a taxpayer of unfiled returns and debt.

Learn more

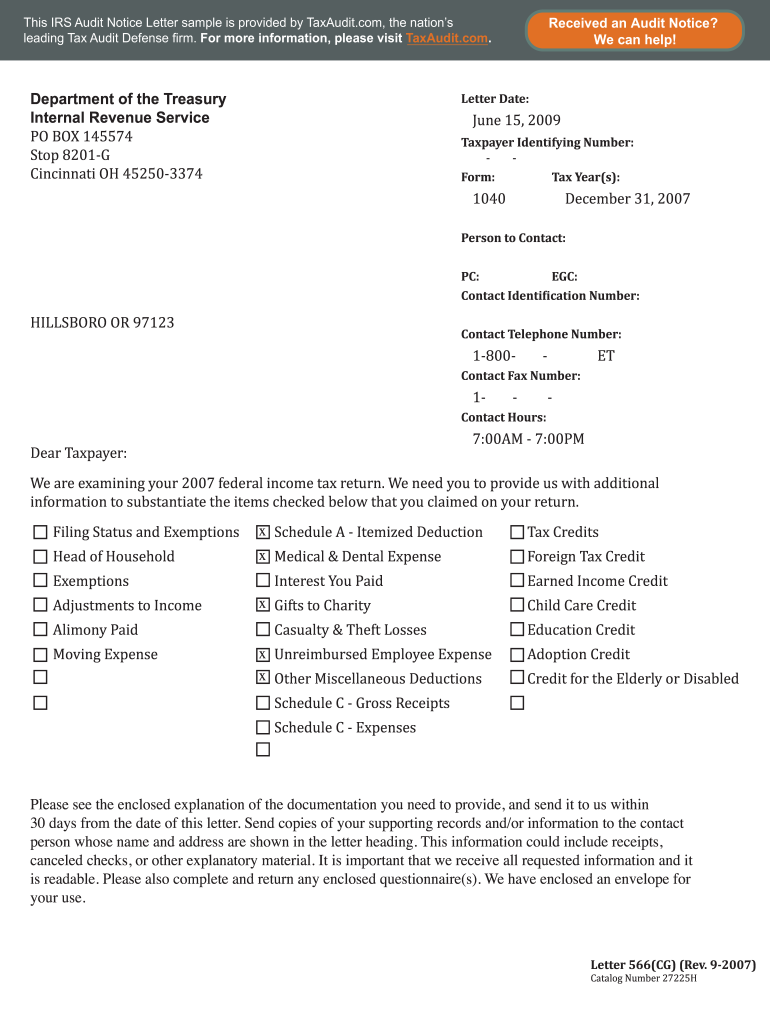

566 (CG) form

Letter 566(CG) is sent to the taxpayers to examine their federal income tax return.

Learn more

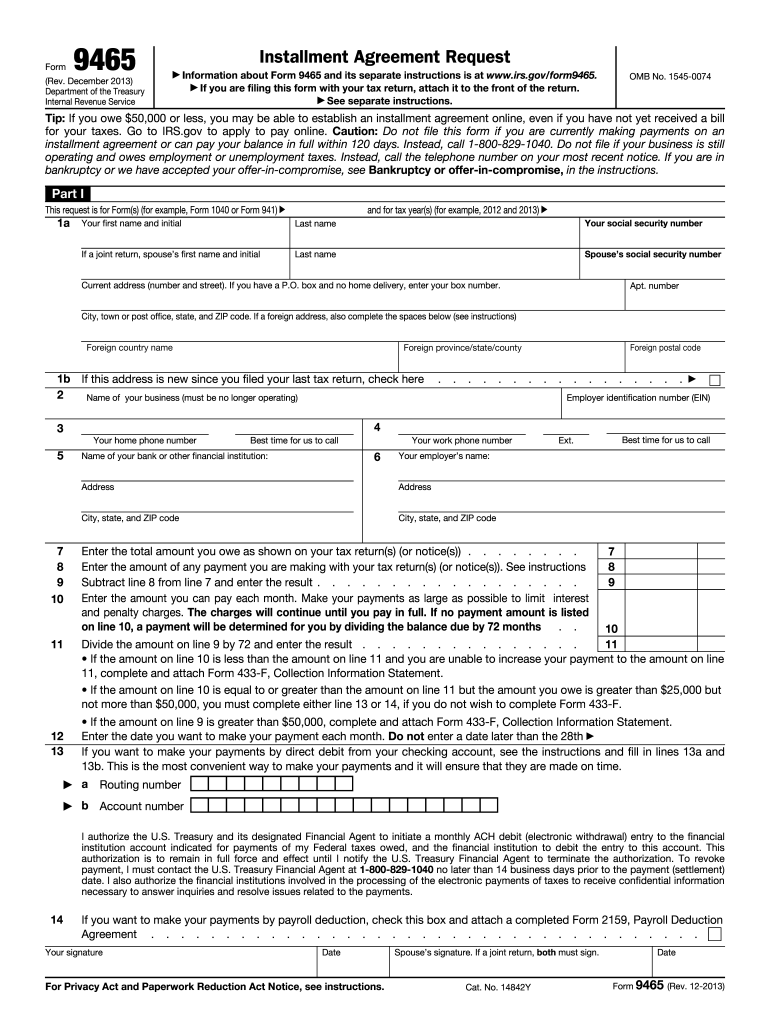

9465 form

Use Installment Agreement Request to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice sent to you).

Learn more

14039 forms

Identity Theft Affidavit. Complete this form if you need the IRS to mark an account to identify questionable activity.

Learn more