IRS library

Other tax forms

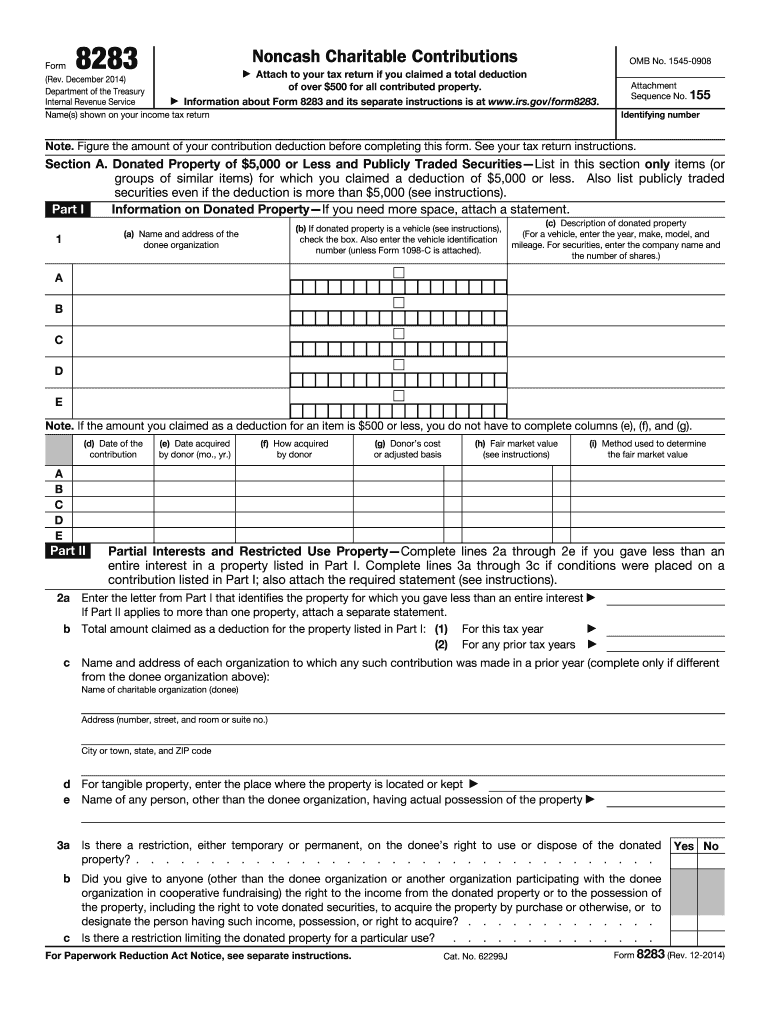

8283 form

Noncash Charitable Contributions filed by individuals, partnerships, and corporations.

Learn more

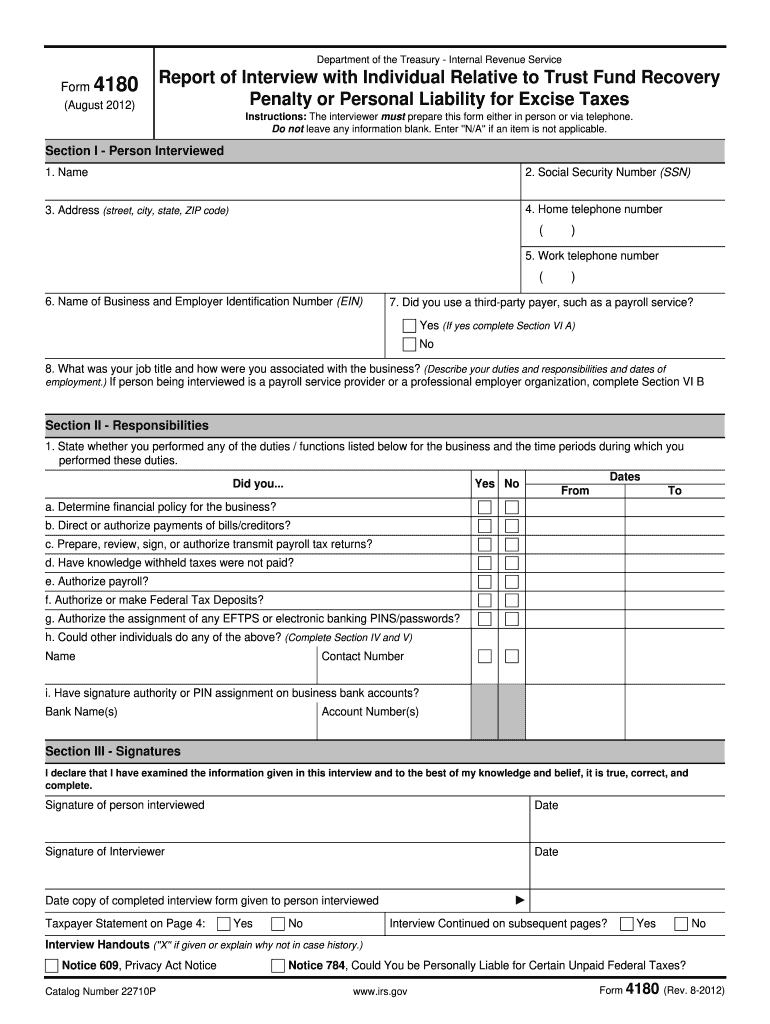

4180 form

Report of Interview with Individual Relative to trust fund recovery penalty or personal liability for excise taxes

Learn more

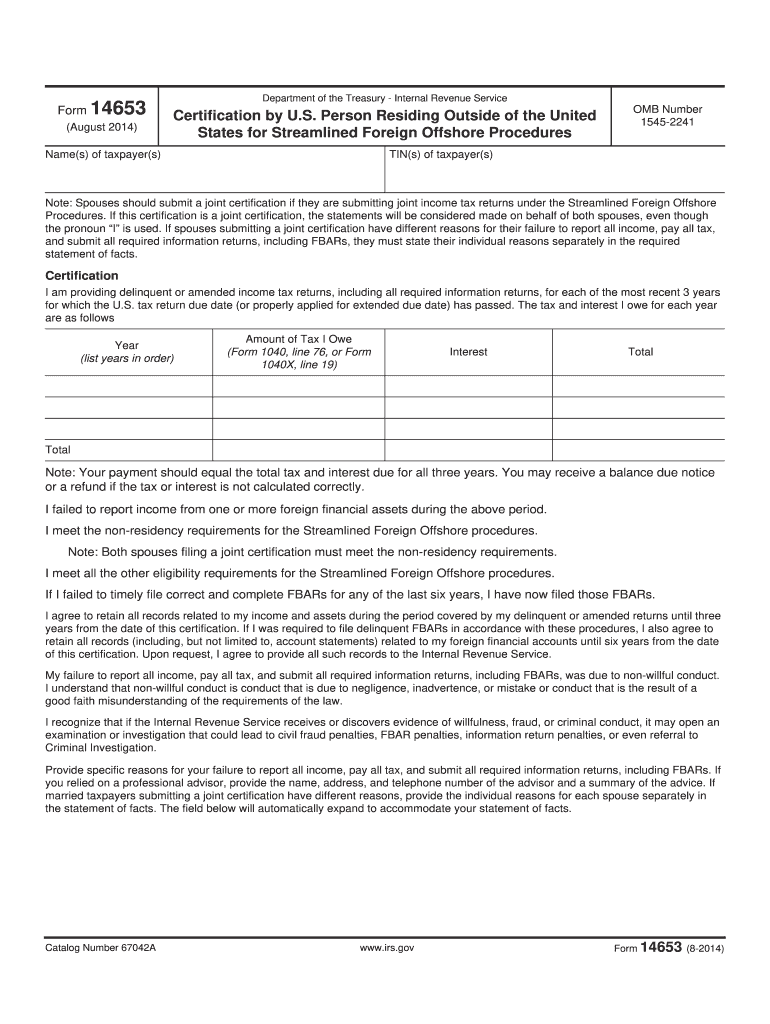

14653 form

Certification by U.S. Person Residing Outside of the United States for Streamlined Foreign Offshore Procedures

Learn more

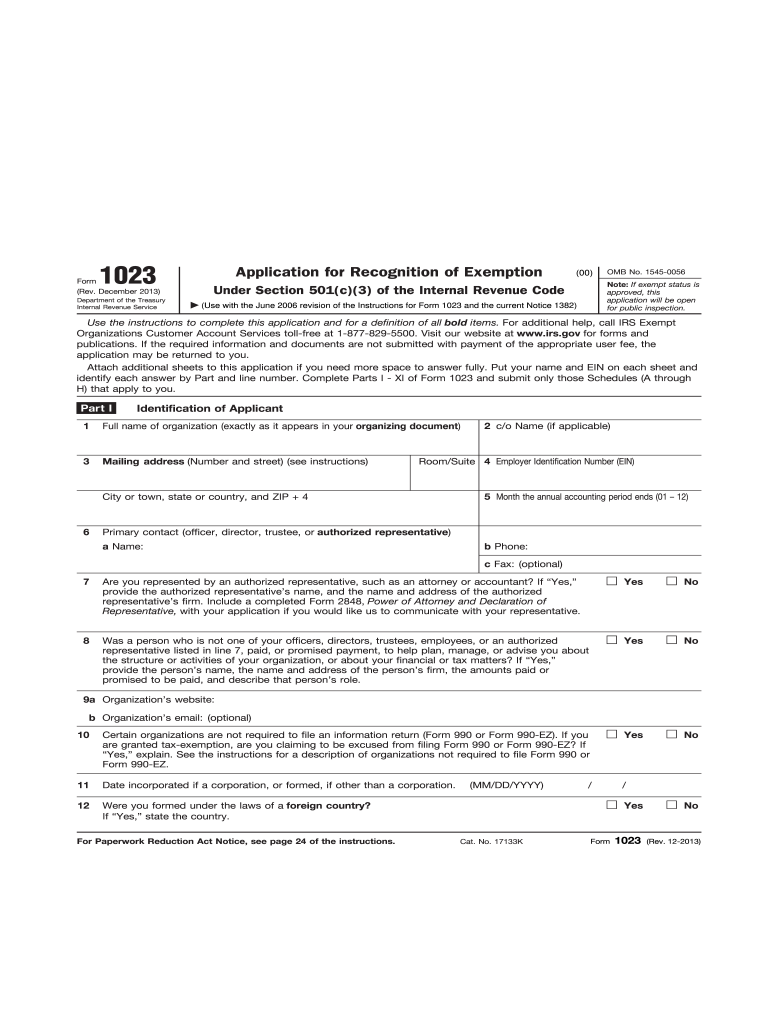

1023 form

Organizations file this form to apply for recognition of exemption from federal income tax under section 501(c)(3)

Learn more

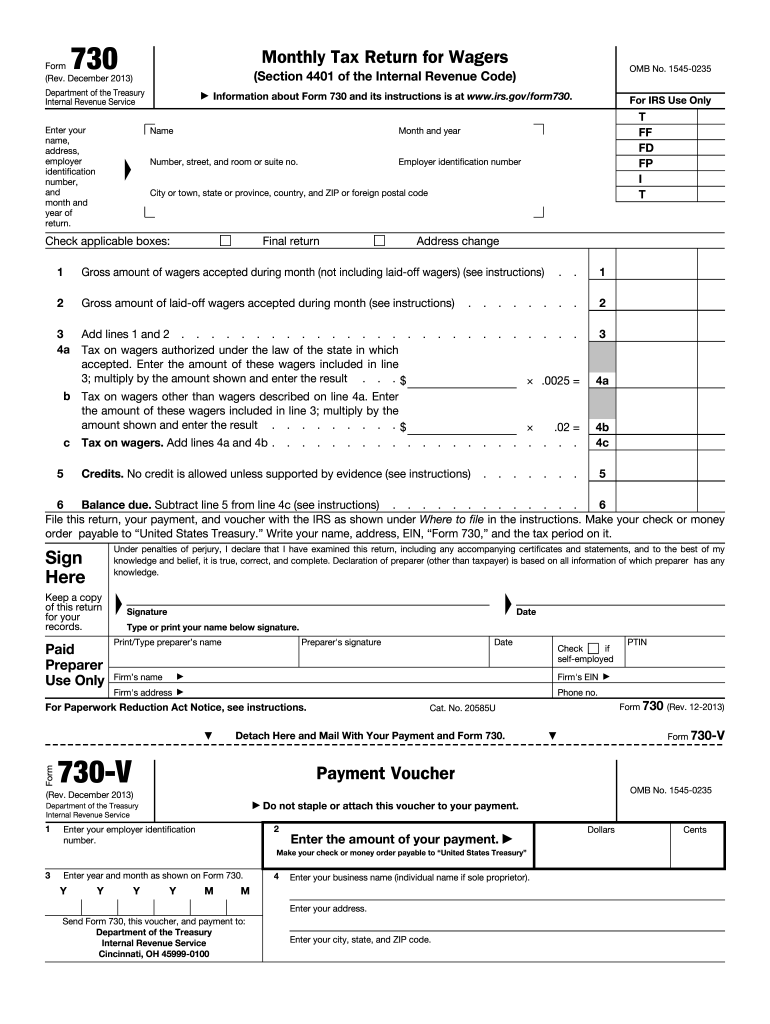

730 form

You must file this form and pay the tax on wagers under Internal Revenue Code section 4401(a) if you:

Are in the business of accepting wagers,

Conduct a wagering pool or lottery, or

Are required to be registered and you received wagers for or on behalf of another person but did not report that person’s name and address.

Learn more