ST: PAA1

9/11

ALABAMA DEPARTMENT OF REVENUE

Reset

SALES AND USE TAX DIVISION

Purchasing Agent Appointment

PURCHASING AGENT APPOINTMENT

Name and Address of Governmental Entity or Exempt Organization

Name and Address of Agent

NAME

NAME

MAILING ADDRESS

MAILING ADDRESS

CITY

STATE

ZIP CODE

PHYSICAL ADDRESS

CITY

STATE

ZIP CODE

STATE

ZIP CODE

PHYSICAL ADDRESS

CITY

STATE

ZIP CODE

CITY

ALABAMA EXEMPTION (NUMBER, ACT, LAW, ETC.)

Name and Location of Project

Appointment Information

NAME

EFFECTIVE DATE

PHYSICAL ADDRESS

Agency appointment will expire on the date of completion of the project.

STATE

CITY

ZIP CODE

SCHEDULED DATE OF COMPLETION:

IDENTIFY PROJECT

The undersigned governmental entity or exempt organization (“tax-exempt entity”) hereby appoints the above-named person or company as its agent to (check the

applicable box):

អ

អ

order materials that will be incorporated into the real estate constituting the construction project identified above; or

order and pay for materials that will be incorporated into the real estate constituting the construction project identified above with funds belonging to the tax-exempt

entity.

As agent of the tax-exempt entity, the person or company named above (check the applicable box):

អ

អ

is authorized to appoint subagents of the tax-exempt entity to order materials that will be incorporated into the real estate constituting the project; or

is not authorized to appoint subagents of the tax-exempt entity.

By signing this appointment we acknowledge that: the appointment applies only to the purchase of materials after the effective date hereof (which cannot be prior to the date

the appointment is signed); the agent has the authority to bind the tax-exempt entity contractually for the purchase of tangible personal property that will be incorporated into

the real estate constituting the construction project identified above; payment for the purchases made pursuant to such appointment must be made with funds belonging to

the tax-exempt entity; and the agent is required to notify all vendors and suppliers from which tax-exempt purchases are to be made of the agency relationship and that the

obligation for payment is that of the tax-exempt entity and not the agent. All purchase orders and remittance devices furnished to these vendors/suppliers shall clearly reflect

the agency relationship. The vendor or supplier may rely on the tax-exempt status of purchases made on behalf of the tax-exempt entity by the duly appointed purchasing

agent, provided that the criteria in Alabama Department of Revenue Rule 810-6-3-.69.02 and in the attached instructions are followed and the proper documentation exists

to confirm compliance with these instructions.

Sign Here

AUTHORIZED REPRESENTATIVE OF THE GOVERNMENTAL ENTITY OR EXEMPT ORGANIZATION

TITLE

DATE

Print Name

Name and Address of Subagent (Subcontractor)

APPOINTMENT OF SUBAGENT

Appointment Information

NAME

EFFECTIVE DATE

STREET OR OTHER MAILING ADDRESS

Subagency appointment will expire on the date the subagent completes work on the project by fulfilling the

contractual obligation to perform.

CITY

STATE

ZIP CODE

SCHEDULED DATE OF COMPLETION:

SCOPE OF WORK TO BE PERFORMED BY SUBAGENT

The undersigned agent (contractor) hereby appoints the subagent (subcontractor) to act as a purchasing agent of the tax-exempt entity to order, but not to pay for, materials

that will be incorporated into the real estate constituting the construction project identified above. In making purchases for the project, the subagent must comply with Alabama

Department of Revenue Rule 810-6-3-.69.02 and the attached instructions.

Sign Here

AUTHORIZED REPRESENTATIVE OF AGENT (CONTRACTOR)

Print Name

TITLE

DATE

�Instructions For Preparation of Form ST: PAA1

Purchasing Agent Appointment

The United States Government, the State of Alabama, counties and

incorporated municipalities of the state, and various other entities within

the state are specifically exempt from paying state and local sales and

use tax on their purchases of tangible personal property. These taxexempt entities cannot transfer their exempt status to a contractor or

developer who is required to purchase and pay for the materials that are

to be used pursuant to a construction contract with the tax-exempt entity. However, a tax-exempt entity may appoint as its agent a contractor to

act on its behalf to order materials or to order and pay for materials that

will be incorporated into real estate pursuant to a construction contract

with the tax-exempt entity. Purchases made by the agent on behalf of

the tax-exempt entity will be exempt from the payment of state and local

sales or use tax provided that the procedures outlined in Alabama

Department of Revenue Rule 810-6-3-.69.02 are followed. These procedures include the provisions below. (Note: This form should not be

used to purchase materials for a project that has been granted abatement pursuant to the Tax Incentive Reform Act of 1992, Chapter 9B of

Title 40, Code of Alabama 1975, as amended, or for the exemption available to contractors for the purchase of building materials for construction

projects with health care authorities organized under Article 11 of

Chapter 21 of Title 22 or Chapter 62 of Title 11. Tax-exempt purchases

of materials for these types of projects must be made in accordance with

the provisions of the applicable sections of the Code of Alabama 1975,

as amended, and ADOR Rules.)

The appointment of the contractor as purchasing agent of the taxexempt entity must be made in writing and may, but is not required to,

take the form of a completed Purchasing Agent Appointment, Form ST:

PAA-1. The appointment must be made prior to the contractor’s purchase of materials that are claimed to be tax-exempt. In the absence of

a written appointment the contractor must pay the sales and use taxes

otherwise due. A contractor may not purchase materials, incorporate

them into realty prior to obtaining a properly completed and signed Form

ST: PAA-1, or other written appointment, and later claim an agency relationship and petition for a refund of sales and use tax paid on the materials. The Form ST: PAA-1 can only be used to appoint the contractor to

purchase on behalf of the tax-exempt entity materials that will be incorporated into the real estate constituting the project. However, execution

of the Form ST: PAA-1 does not preclude a separate written appointment

of the contractor as agent of the tax-exempt entity to purchase other tangible personal property.

Purchases made by the purchasing agent on behalf of the tax-exempt

entity are exempt from the payment of sales and use taxes, provided that

funds belonging to the tax-exempt entity are directly obligated and payment is made with funds belonging to the tax-exempt entity. When the

contractor is also appointed as agent to pay for the materials on behalf

of the tax-exempt entity, payment must be made from an account designated for this specific purpose and funded by the tax-exempt entity. It is

permissible to use a trust account for multiple projects, provided that the

account is funded by the tax-exempt entities and records are maintained

to document the source of funds for each project. The contractor may

not commingle its own funds with the funds in the account. The contractor may not deposit its own money into the account. The contractor may

not pay for materials with its own funds and receive reimbursement from

the account.

PENALTY. Any person who makes unauthorized use of this document

with the intent to evade payment of tax is liable for any sales and use

taxes that may be due, together with interest, and may be assessed

additional penalties as provided in Section 40-2A-11, Code of Alabama

1975, as amended.

APPOINTMENT INFORMATION. All information requested on the

attached Purchasing Agent Appointment, Form ST: PAA-1, must be provided, including by attachments to the form. The project name, location,

and description must be included. Tax-exempt organizations must provide their Alabama Sales and Use Tax Certificate of Exemption number,

Legislative Act number, or state law by which they are exempt from sales

and use tax. The form or other written appointment document must

reflect the date the appointment will become effective, which cannot be

prior to the date the document is signed. The agency appointment will

expire on the date of completion of the project. The scheduled date of

completion must be reflected on the appointment document. However,

the scheduled date of completion may be extended by approval of the

tax-exempt entity when it is determined that the project will not be completed by that date. The agent shall not make any purchases without

payment of sales or use taxes under the authority of this appointment

before the effective date or after the date of completion of the project.

This Purchasing Agent Appointment must be signed by an officer or

duly-authorized representative of the tax-exempt entity. The signed original document must be retained by the contractor, and a copy should be

retained by the tax-exempt entity. In a subsequent audit, to substantiate

the contractor’s appointment as agent to purchase on behalf of the taxexempt entity, the contractor will be required to provide to the auditor

upon request a copy of the executed appointment document.

AGENT’S APPOINTMENT OF ONE OR MORE SUBAGENTS. When

authorized by the tax-exempt entity, the agent (contractor) may appoint

one or more subagents (subcontractors) to act as the purchasing agent

of the tax-exempt entity to order, but not to pay for, materials that will be

incorporated into the project. For each subagent appointed, the agent

(contractor) must document the appointment by completing the section

provided on a copy of Form ST: PAA-1, or otherwise document the

appointment in writing. The document must include the date the appointment of the subagent will become effective, which cannot be prior to the

date the contractor signs the document appointing the subagent. The

subagency appointment will expire on the date the subagent’s work on

the project is completed. The scheduled date of completion of the subagent’s work on the project must be reflected on the appointment document. However, the scheduled date of completion may be extended by

the contractor (agent) when it is determined that the subcontractor’s

work on the project will not be completed by that date. The subagent

(subcontractor) shall not make any purchases without payment of sales

or use taxes under the authority of this appointment before the effective

date or after the date the subagent’s work on the project is completed.

A description of the work to be performed by the subagent must be

included. For each subagent appointed, the Appointment of Subagent

form or other writing must be signed by the agent (owner, partner, member, corporate officer, or other individual authorized to sign the document). The signed document must be retained by the subagent (subcontractor). A copy of the document must be provided to the tax-exempt

entity for their records and a copy must be retained by the agent (contractor). A subagent’s purchase of materials on behalf of the tax-exempt

entity is exempt from the payment of state and local sales and use taxes

provided that the criteria set out above and in ADOR Rule 810-6-3.69.02 are followed. In a subsequent audit, to substantiate the subcontractor’s appointment as agent to purchase on behalf of the tax-exempt

entity, the subcontractor will be required to provide to the auditor upon

request a copy of the executed subagent appointment document.

�

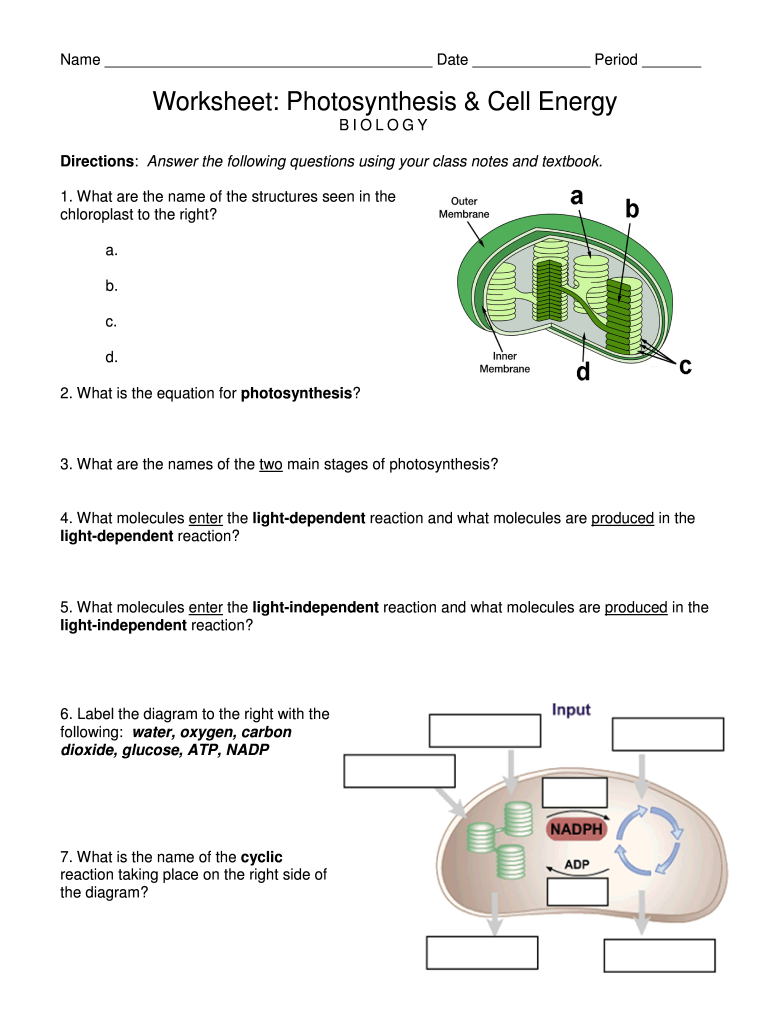

Useful advice for finishing your ‘Photosynthesis And Cell Energy Worksheet Answers’ online

Are you fed up with the inconvenience of handling paperwork? Look no further than airSlate SignNow, the premier electronic signature solution for individuals and businesses. Say farewell to the lengthy process of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and sign paperwork online. Take advantage of the powerful features integrated into this simple and cost-effective platform and transform your approach to document management. Whether you need to sign forms or gather signatures, airSlate SignNow manages it all seamlessly, needing just a few clicks.

Follow this detailed guide:

- Log into your account or sign up for a complimentary trial with our service.

- Click +Create to upload a document from your device, cloud storage, or our form repository.

- Open your ‘Photosynthesis And Cell Energy Worksheet Answers’ in the editor.

- Click Me (Fill Out Now) to complete the document on your behalf.

- Add and designate fillable fields for others (if needed).

- Proceed with the Send Invite options to solicit eSignatures from others.

- Download, print your version, or transform it into a reusable template.

Don’t fret if you need to collaborate with your teammates on your Photosynthesis And Cell Energy Worksheet Answers or send it for notarization—our platform provides you with everything required to complete such tasks. Sign up with airSlate SignNow today and take your document management to new levels!