OMB Approval No: 3245-0074

Expiration Date:

1/31/2014

Certified Development Company (CDC) Annual Report Guide

INTRODUCTION

CDCs are required to submit an annual report on their operations to SBA. (13 CFR, §§ 120.826

and 120.830) All reports are to be prepared in accordance with the instructions and attachments

set forth in this guide.

Submission Requirements: In order to ensure uniform and comparable data by all CDCs, the

report has been designed to standardize reporting requirements. Each report must be submitted

on 8.5 by 11-inch paper with tabs that correspond with the tabs indicated in this guide.

.

(Exception: On a case-by-case basis, SBA will permit scanned versions of the annual

report if it includes all required documents and signatures and it conforms with the

instructions and attachments set forth in the guide. CDCs interested in applying for the

exception must contact their SBA field office.)

Timing: The annual report (original and one copy) must be filed with the SBA field office

serving the area where the CDC’s headquarters is located within 180 days after the end of the

CDC’s fiscal year. Incomplete or unacceptable reports will be returned to the CDC and will

not fulfill the requirement.

ORGANIZATION OF THE ANNUAL REPORT

TAB 1.

Economic Development Report

The Economic Development Report is designed to provide local economic

information as well as analytical data on the impact of the CDC’s non-504

assistance to small business. This report must include the following information

in the order described:

A. Comments on the general lending and business environment and a summary

of events affecting the CDC’s area of operations such as local economic

changes, plant closings, major community events, etc. (For Multi-State

CDCs, these comments must be provided for each state.)

B. A brief summary by non-SBA program (such as UDAGs, HUD 108 CDBG,

EDA, USDA and so on) of the CDC’s loan activity and the impact of this

activity on the CDC’s area of operations and its portfolio. The summary must

include the following by program:

1. For lending programs, the number of years the CDC has participated in the

program and the number of loans approved during the fiscal year.

2. For non-lending programs, the number of years the CDC has participated

in the program as well as a description of the relevance of the program for

local economic development.

SBA Form 1253 (11-10) Previous Editions are Obsolete

�C. A brief summary by SBA program not including the 504 loan program

(such as 7(a) packaging, pre-qualification or microloans) of the CDC’s

activity and the impact of this activity on the CDC’s area of operations and its

portfolio. The summary for each program must include the number of years

the CDC has participated in the program and the number of loans approved or

applications packaged during the fiscal year.

D. An economic development strategy that details the efforts the CDC will

undertake during the upcoming fiscal year to serve its area of operations. This

would include projections for 504 loan activity. (For Multi-State CDCs, these

comments must be provided for each state.)

TAB 2.

Operating Report

A. Officers/Directors/Membership/Staff Listing (as of the end of the CDC’s

fiscal year:

1. Board of Directors. Organize (by state if a Multi-State CDC) as follows:

a) director’s name;

b) which of the four required groups the director represents;

c) the director’s occupation, business address, and business telephone

number; and

d) if an officer of the board, what office.

(Note: Changes from the previous CDC fiscal year must be

noted with an asterisk.)

Loan Committees

If the CDC has a loan committee of non-board members, the same

information on each member of the loan committee must be supplied.

(For Multi-State CDCs, submission of loan committee

information by state is a requirement.)

2. Members. Organize (by state if a Multi-State CDC) as follows:

a) member’s name;

b) the county or counties the member represents;

c) which of the four required groups the member represents;

d) the member’s occupation, business address, and business telephone

number; and

e) if a shareholder, the number and percentage of outstanding shares.

(Note: CDC staff do not qualify to fulfill regulatory

membership requirements.)

SBA Form 1253 (11-10) Previous editions are obsolete

2

�3. Professional Staff. Organize by CDC office location as follows:

a) staff name;

b) staff function (marketing; screening, packaging and processing;

closing; servicing; liquidation; management);

i) if the individual fulfills more than one 504 loan program staff

function, identify each function and the approximate percentage of

time that the person spends on each activity [such as screening,

packaging and processing (75 percent), servicing (25 percent)];

ii) if the individual is contributed by a non-profit affiliate, identify the

affiliate and the approximate time the individual spends on CDCrelated activities versus affiliate-related activities [such as affilaterelated activities (50 percent) and CDC-related activities (50

percent)]; and

c) if applicable, any CDC office the staff person holds.

4. Contracts.

a) provide a copy of all contracts for staff that the CDC currently has in

place (Note: This is not required for the CDC’s attorney or

accountant.);

b) a copy of the board’s minutes approving the contract (the minutes

must include the names of the board members present); and

c) any justification by the board of the need for the contract, including

any analysis that the cost is reasonable and customary for similar

services in the area of operations.

B. CDC Board Meetings. Organize as follows:

1. Dates of the CDC Board meetings during the fiscal year;

2. Names of the board members present including identifying which of the

required groups the board member represents; and

3. A listing of the borrower names (to include the loan numbers if available)

of any 504 loans approved during the meeting.

(Note: Board minutes may be accepted instead IF the minutes

provide all of the required information.)

Loan Committee Meetings

If in addition to the board meetings, the CDC has loan committee meetings of

non-board members, the same information must be supplied as well as the

date the board ratified the actions of the loan committee. (For Multi-State

CDCs, submission of loan committee information by state is a requirement.)

C. Legal. Provide a statement signed by the CDC’s Secretary or Legal Counsel

that certifies to the following:

1. All changes to the Articles of Incorporation or By-Laws made during the

CDC’s fiscal year have been submitted to SBA,

or a signed certification that no changes have been made.

SBA Form 1253 11-10) Previous editions are obsolete

3

�2. The CDC’s Membership, Board of Directors and any Loan Committees

are in compliance with SBA regulations governing CDCs.

3. If the CDC is involved in any legal proceeding as a plaintiff or defendant,

SBA has been adequately notified (a summary description of any legal

proceedings must be included),

or a signed certification that the CDC is not involved in any legal

proceedings.

TAB 3.

Financial Report

Level of review

For CDCs with a 504 loan portfolio balance of $20 million dollars or more (as

calculated by SBA), the CDC’s Financial Report must include audited financial

statements prepared by an independent CPA or an independent public accountant

in accordance with Generally Accepted Accounting Principles.

For CDCs with a 504 loan portfolio balance of less than $20 million dollars (as

calculated by SBA), the CDC’s Financial Report must include financial

statements reviewed by either an independent CPA or an independent public

accountant in accordance with Generally Accepted Accounting Principles.

Exceptions to this requirement for an independent audit or review will be

considered on a one-time basis for new CDCs or for CDCs that have not had an

audit or review previously. The authority to approve an exception resides solely

with the AA/FA or designee.

If any of the CDC’s staff is provided by an affiliate of the CDC, and/or if an

affiliate subsidizes the CDC’s operations, the CDC must also provide a copy of

the financial statements of the affiliate.

Contents of Financial Report

The Financial Report must include the following statements:

A. Balance Sheet

(Note: Neither SBA nor the Central Servicing Agent provides 503/504

loan balances to the CDC’s accountant for purposes of preparing the

CDC’s financial statements because the CDC is only contingently liable.)

B. Changes in Financial Position;

C. Income Statement; and

D. Additional Information.

If the Income Statement does not include the following 504-specific

income and expense amounts, then a separate listing must be attached

that details the following amounts. (For Multi-State CDCs, this listing

must be provided for each state.)

SBA Form 1253 (11-10) Previous editions are obsolete

4

�503/504-Related Income

1. Applicants/Approved Borrowers 504 Loan Deposits

2. 504 Processing Fee Income (and the dollar amount of debentures funded)

3. 504 Closing Fee Income (excluding CDC attorney’s fees)

4. 503/504 Servicing Fee Income

5. 503/504 Late Fee Income

6. 503/504 Assumption Fee Income

7. 504 Escrow Float Interest Income

8. Other 503/504-Related Income *

503/504-Related Expense

1. 504 Marketing, Screening, Packaging and Processing Staff Expense

2. 503/504 Servicing Staff Expense

3. 504 Closing Staff Expense (excluding CDC attorney expense)

4. CDC Management Staff Expense

5. Other 503/504-Related Expense *

* Identify what these miscellaneous items are.

TAB 4.

Analysis of 503/504 Employment Impact

Attached is an example format for submission to SBA of the CDC Analysis of

Economic Impact.

The definition of “Jobs Created” or “Jobs Retained” is the following:

Jobs Created: Full-time equivalent (8 productive hours per day/40

productive hours per week) permanent or contracted employment

created within 2 years of financing…

Jobs Retained: Jobs that otherwise might be lost to the community if

the project was not done. Do not count all existing jobs as being

retained if they were not at risk of being lost.

The report requires a listing of all funded debentures (except debentures that have

been accelerated) by one of two categories:

A. Debentures Funded Two or More Years: The actual jobs (as reported by the

borrower on the 2 year anniversary of the funding of the debenture) created

and/or retained. The CDC must provide totals for this section (see Exhibit 1).

(Include prepaid debentures but NOT debentures that have been accelerated.)

B. Debentures Funded Less Than 2 Years: The estimated (as indicated on the

loan application) created and/or retained. The CDC must provide totals for

this section (see Exhibit 1). (Include prepaid debentures but NOT debentures

that have been accelerated.)

C. C. A summary section that calculates the CDC Job Creation and Retention

Average (see Exhibit 1) as well as the $ of Debenture/job.

SBA Form 1253 (11-10) Previous editions are obsolete

5

�PLEASE NOTE: The estimated burden for completing this form is 28 hours. You are not

required to respond to any collection of information unless it displays a currently valid OMB

approval number. Comments on the burden should be sent to US Small Business Administration,

Chief, AIB, 409 3rd St., SW, Washington, DC 20416 and Desk Officer for the Small Business

Administration, Office of Management and Budget, New Executive Office Building, Room

10202, Washington, DC 20503. OMB Approval (3245-0074) PLEASE DO NOT SEND

FORMS TO OMB.

SBA Form 1253 (11-10) Previous editions are obsolete

6

�

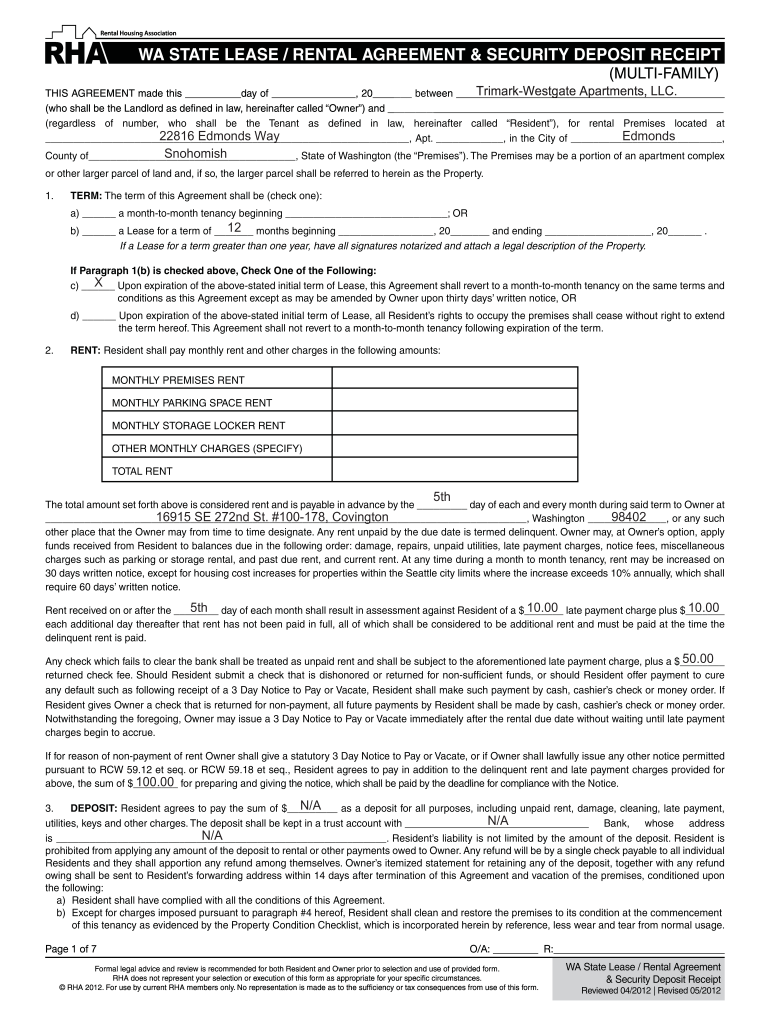

Useful Advice on Setting Up Your ‘Washington State Residential Leaserental Agreement And Security Deposit Form’ Online

Are you fed up with the inconvenience of managing paperwork? Look no further than airSlate SignNow, the ultimate eSignature solution for individuals and organizations. Wave goodbye to the lengthy process of printing and scanning documents. With airSlate SignNow, you can easily complete and sign documents online. Utilize the powerful tools integrated into this user-friendly and cost-effective platform and transform your method of document handling. Whether you need to authorize forms or gather electronic signatures, airSlate SignNow takes care of everything effortlessly, with just a few clicks.

Follow this comprehensive guide:

- Log into your account or begin a free trial with our service.

- Click +Create to upload a document from your device, cloud storage, or our template library.

- Open your ‘Washington State Residential Leaserental Agreement And Security Deposit Form’ in the editor.

- Click Me (Fill Out Now) to prepare the document on your end.

- Add and assign fillable fields for other users (if necessary).

- Continue with the Send Invite settings to request eSignatures from others.

- Save, print your copy, or convert it into a reusable template.

Don’t fret if you need to work with others on your Washington State Residential Leaserental Agreement And Security Deposit Form or send it for notarization—our solution provides everything you need to achieve such tasks. Create an account with airSlate SignNow today and elevate your document management to a new level!