Countersign Tennis Match Ticket Made Easy

Upgrade your document workflow with airSlate SignNow

Flexible eSignature workflows

Fast visibility into document status

Easy and fast integration set up

Countersign tennis match ticket on any device

Detailed Audit Trail

Strict protection standards

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

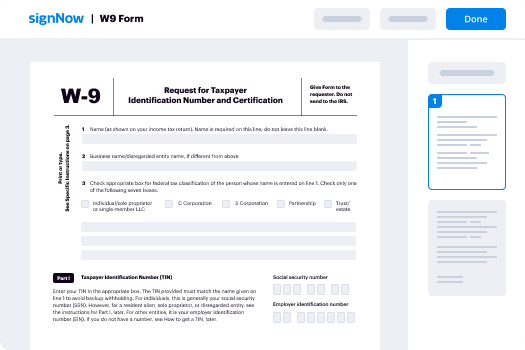

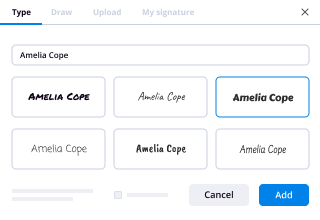

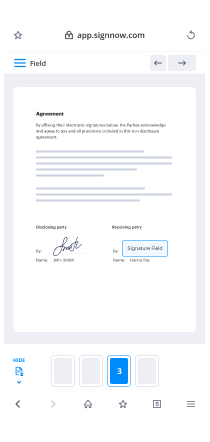

Your step-by-step guide — countersign tennis match ticket

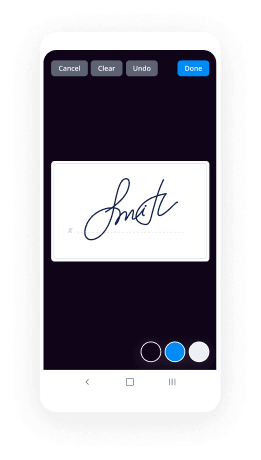

Using airSlate SignNow’s electronic signature any company can accelerate signature workflows and eSign in real-time, providing a greater experience to clients and employees. Use countersign Tennis Match Ticket in a couple of simple actions. Our mobile-first apps make work on the run possible, even while off-line! eSign contracts from any place in the world and make trades in less time.

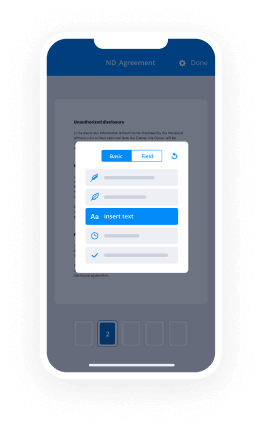

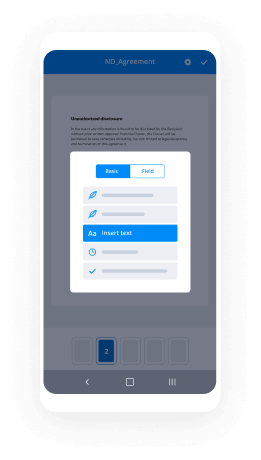

Keep to the stepwise guideline for using countersign Tennis Match Ticket:

- Log on to your airSlate SignNow profile.

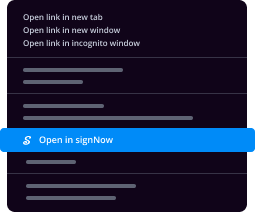

- Locate your needed form within your folders or upload a new one.

- Open the record adjust using the Tools list.

- Drop fillable areas, type textual content and eSign it.

- Add numerous signees via emails and set the signing order.

- Specify which individuals can get an signed version.

- Use Advanced Options to reduce access to the template add an expiration date.

- Click on Save and Close when finished.

In addition, there are more advanced capabilities available for countersign Tennis Match Ticket. Include users to your collaborative digital workplace, browse teams, and keep track of cooperation. Millions of users across the US and Europe recognize that a solution that brings everything together in a single cohesive enviroment, is the thing that enterprises need to keep workflows performing smoothly. The airSlate SignNow REST API enables you to integrate eSignatures into your app, internet site, CRM or cloud. Check out airSlate SignNow and enjoy faster, smoother and overall more efficient eSignature workflows!

How it works

airSlate SignNow features that users love

See exceptional results countersign Tennis Match Ticket made easy

Get legally-binding signatures now!

FAQs

-

How much is a tennis match ticket?

Currently, US Open Tennis tickets start at $49. -

Which Grand Slam is the most expensive?

2016 Grand Slam Tickets: Wimbledon the Most Expensive, U.S. Open the Cheapest to Attend - TheStreet. -

How much does a Grand Slam winner get?

How much money does the winner get? The men's and women's singles champions will earn $3.85 million each. Last year's winners, Naomi Osaka and Novak Djokovic, took home $3.8 million apiece. The men's and women's doubles champions will win $740,000 per team, up from $700,000 last year. -

Why is Wimbledon so expensive?

The tickets to only the centre court and court 1 is expensive as usually the high profile matches are played there. ... Also considering the fact that the capacity of a tennis court is less than a football or cricket stadium , organisers choose to keep the fare high. -

How much does a US Open ticket cost?

Typically, US Open Tennis tickets can be found for as low as $103.00, with an average price of $247.00. -

How do tickets work for the US Open?

What does Grounds Admission mean? Grounds Admission Tickets at the US Open is first-come, first-served access to Louis Armstrong Stadium, the Grandstand and all field courts. Grounds Tickets are only sold for the first eight days of the tournament. -

How much is a tennis ticket?

Typically, US Open Tennis tickets can be found for as low as $103.00, with an average price of $247.00. -

How much is grounds admission to US Open?

Currently, US Open Tennis tickets start at $49. -

Can you sell US Open tickets?

The USTA has partnered with the US Open Ticket Exchange by Ticketmaster, to serve as the exclusive resale partner for the US Open. US Open patrons now have the opportunity to resell their unused tickets in a secured fan-to-fan environment, sanctioned by the USTA. -

What is a US Open grounds pass?

During the first week of the tournament, tennis fans can purchase a Grounds Only Admission ticket. That Grounds Only pass allows them to attend the US Open and see matches at Louis Armstong Stadium and on the other side courts at the USTA. -

How much is a US Open golf ticket?

Typically, US Open Golf tickets can be found for as low as $38.00, with an average price of $189.00. -

How do US Open tickets work?

What does Grounds Admission mean? Grounds Admission Tickets at the US Open is first-come, first-served access to Louis Armstrong Stadium, the Grandstand and all field courts. Grounds Tickets are only sold for the first eight days of the tournament.

What active users are saying — countersign tennis match ticket

Countersign tennis match ticket

[Music] hi I'm Matt Driscoll editor of Asian aviation magazine and Asian aviation comm today we're in conversation with Deepak Sharma the CEO of air finance lease we're going to talk about the effects of the coated 19 pandemic on the leasing industry Deepak welcome to in conversation thanks for joining us I'm Matt thanks for having me pleasure to be talking to you we always address the elephant in the room first Cove in nineteen its impact on aviation half the world sleet or morons grounded production is slowed dramatically cargos moving which is probably the one bright spot of the whole industry from a lessors standpoint can you give us sort of the big picture from where you're sitting and what's happening well I think what there's one thing been common with a carbon 19 is that every business had to slam on the brakes that's been the same way of everyone I think except for the cargo really and and we nobody really knows when the business will be back to a pre corporate level when is that going to be one of the one of the interesting bit that I'm seeing from a leasing perspective is the financial institution seems to be making a alphabet soup out of the the the analysis and some say it'll be weaker some say will be you curve and some say it's ELCA so nobody really knows and nobody's really certain but I think from a leasing perspective and from an airline perspective other than cargo and even on a cargo side of things I think what has made us everybody realized is that cash is really King and if you don't have a cash right now its liquidity is is what your life depends on if I need for any business I think that's what I'm seeing from from a bigger picture perspective I'm gonna roll two questions into one here that I'd said that we talked about before I've listened to more webinars and I care to admit about these days and they all seem to happen at night my time but one participant said they'd never seen anything have as drastic and effect on aviation as Cove in nineteen but I want to add to that there was also a poll recently about the biggest challenge to the leasing sector and I think you touched on this just just now and things were pretty evenly split in the pole between airline failures and a lack of demand but only issue of failures I mean don't lessers really sort of take that into account when they underwrite the lease and that's the time for the risk analysis or has covered 19 just kind of thrown all that out the window well Matt I would say that well unprecedented effect I would agree you know I find a couple of things interesting in the whole situation I think we touched on it saying it had the same effect of everyone regardless of what it is but I think the path for coming out of this seems different and depends on region and available liquidity and a business model and government support if I may just elaborate on that slightly we are hearing more about Australia and New Zealand opening up more regionally first before anybody else and and and obviously business model wise if your business model is a holiday business model the lights of holiday airline it's it's hell it's gonna be heavily impacted because holiday is not something people are really thinking right now because of the situation moving on to you the second part of the question you know it has changed the combination has changed everything in significant way I mean let's let's just quick look at the history and if my figures are correct I think the first major airline was set up in 1919 in the world the the first major lease deal was done in 1970s and that was only 2% of the global fleet at that point 1980s so somewhere around 15% police activity and in the 90s and 2000 the least activity grew to a level that we are seeing now now in this time since since the star of the airline era and through the least time frankly the the pandemic has not been in the forefront of the underwriters mind to put it on the lease and and and to do risk analysis obviously this will be something that I'm pretty sure the underwriters will look at it and and the risk analysis will be done but this has not been something unimaginable to be to be honest with you in the recent day so frankly it's not underwritten and that's that's a challenge by itself which is why you know there isn't a real protection to anyone in this situation yeah I want to come back to that in a little bit because there's an excellent point I mean obviously this is a health crisis first and foremost it's not really an aviation crisis although the industry is in Christ survival mode but it's a health crisis and the government's are the ones that shut down the borders impose the quarantine stop that which force to stop to all the traffic do you see governments playing a bigger role in aviation and in leasing do you see organizations like ICAO I mean I I had has been making a lot of noise ICAO seems to have been a little bit slow and stepping up to the plate but where do you see the government's playing a role in this well I think let's let's look at this from two points of view 1 from the leasing side or from the government side I think it's a very delicate balance from a government perspective because let's face it without people there is no economy and and I think that's what the government's looking at right now if you can't save new people you don't have an economy you don't have business system are so there is there is that emphasis from the government side now the the economy and and the businesses all depend on the health of the people number one then the economy and everything else depends on how the businesses grow going forward so so all of that is is critical for this to you know to come back into the precoded level when this is all settles down but from a government perspective right now what government is really focusing on is is is locking down rather than the you know the revival of the business I mean it's it's thought of slowly but right now I think the government is more thinking about okay how do we contain it versus or how's the airline's gonna survive there that thought process really is around keeping people's you know home safe of mortgage paid and so and so forth and keeping the payroll I mean you've we've seen trillions of dollars of bailouts and and and the things happening but they are going towards people's payroll rather than even the airline flying us that's not in the forefront but at some point the government will have to do more than just policy writing and and say well this is what we're going to do or this is what we suggest it'll have to be more than that and say well this is how we're going to prepare an infrastructure that supports our you know our public aviation that the leasing community and so on and so forth frankly I think right now from what we see other than supporting people jobs payroll everything else is been a secondary issue for other governments around the world this talk about leasing since this is shows all about leasing and you're in the leasing business how has how is air finance lease been adapting in terms of working from home you said you've been at home for eight weeks and also from a business perspective and again from the webinars I've been listening to and the other leasing companies are involved are your customers talking about deferrals other kinds of relief do you see opportunities and the sale-leaseback sector the kind of give us the 50-cent tour there yeah I would say that you know without the current technology it would have been extremely difficult to do what we're doing even from I think I think the technology makes it so much more easier you know I mean I'm in London and you in Singapore and here we are talking to each other I mean this is you know business can still carry on if there is a business to be done but but you know I think we are no exception to the rule from a business perspective our our customers our lessees are asking for referrals there is a there's a increased activity on a sale and leaseback you know request but the key around all of this is you have to look at a long-term sustainability and right now frankly nobody really knows which airlines who is gonna be there so you know if you've got aircraft on lease yes you've got to accommodate the request you've got to work with the airlines but sale and leaseback is still a you know you know quite a big decision making and you've got to look at a sustainability and that's still quite further away from looking at and saying whether you can actually you know the airlines will be able to make it through and and you know while you while you invest you know borrowed cash into it whenever yeah I mean everybody's waiting for the quote new normal to to arrive and and nobody knows what that's going to be let me ask you this in the recent years and I've been editor of the magazine for about five years now and I and I used to think leasing was a black hole the black box and you you know it was a magical art and then I started to learn more about it and I thought okay it's I think I understand it now a little bit more but I've seen people there's been a lot more banks there's been a lot more funds come into the business do you see the the the I don't want to say non-traditional but but sort of the the newer players that came into the market when the returns were really good and they said hey that's that's a great market to be in we're gonna take a piece of BOC aviation we're gonna take a piece of your company or something like that do you see them staying with the business or are they looking at the fact that some a lot of these airlines may not make it through the next six months do you see them sort of cutting their losses and running well I think with every major event around the vault I think we've seen this whether it's made whether it's a 911 whether it's any previous event some level of consolidation is bound to happen the the reason for that is you know we most of the most releasing companies and financial houses were dealing with what I call a cheap money after recent days and I think I think that cheap money may not simply be available and may not be sustainable before for two reasons aviation lease or sale or you know anything trade is a supply and demand market and we are yet to know what is the surplus to requirement is gonna be in the market and and cheap money may not just bail you out so I think I think consolidation will happen the returns that were planned initially were probably good enough at that you know point a time but but now that's that's gonna significantly change airline of it will stick with the money because that's you know everybody but that's where the interest is follow the money airlines and OEMs like you know balling raised twenty five billion in the debt markets the other day Singapore Airlines is raised I think something like fifteen billion Singapore dollars they seem to hit the the debt market or tapped other sources of financing a bit quicker than lessors although I may I may not be correct in that would you agree with that and are lesser is hitting the markets as well or is everybody got enough liquidity to handle things it's a it happened in two phases I think the airlines and OEM realized the the cash crunch that was coming at a very early stage you know number one I would say Airlines looked at it because the dropped the drop or refund requests of the tickets and you know recently I had a reports have shown how big that refund is likely to be and if those refunds happen the airlines you know will not survive majority of them and it's a it's a pretty disastrous failures so so Airlines looked at it and I think they went out on the debt market all seek bailout at the very early stage while lessors was a slightly delayed scenario because less those were looking and saying okay how big how bad this is going to be is this gonna be regional is this gonna be one particular area or is again nobody really knew this was gonna become a global problem and everybody's gonna be affected so so now I think as you would see from news yesterday and day before and last week there are a lot of lessors and and and and leasing houses that are going out there tapping into revolving facility is tapping into there is a you know in debt facilities and I think I think it's also driven by the fact that some might be thinking about the growth in this time and and it's it's easier to grow and what-have-you but some also looking at the fact that you know you are gonna need the liquidity you know if if airlines are not gonna pay so that I think it's a delayed face but it's definitely having how tough is it to Ray I mean if you're a lesser how tough is it to raise money or door or bond buyers driving harder bargains well I think I think it's it all depends on how decent your balance sheet is and how decent your and guarantees and credit looks right now now if you've been dealing in a cheap money and in a very low return and your balance sheet wasn't as strong as you thought I think it's still very difficult I mean everybody's looking at you know be ratings and a ratings and you know all of that matters at the end of the day you know right now still you know you people are borrowing from anything between a good organization boob or anything between 3% to 6% and and bad date borrowing is much higher than that but aviation is probably not the one that people are really interested invest is right now and that poses another tough situation so we have seen like you said like to the Singapore Airlines and others who have you know a pretty huge amount because they are government backed and you know but not many leasing companies are government backed so know that but that poses a bigger challenge that pose a challenge no although one of your competitors who recently tapped the revolving credit facility I think they're backed by maybe backed by a state bank who's got a significant chunk of action and they said that they were actually tapping one of their credit facilities to go out and buy aircraft are you gonna be is is is now the time to buy I mean Boeing and Airbus they slowed production and we know that prices are going to go way down in power and people are talking about entire airframe you know certain airframes are going to just be thrown out in favor of newer airframes more fuel-efficient the new generation aircraft is this a time that you're looking at possibly expanding your portfolio I think I will say we are automatically optimistically cautious about how we know what we want we are looking at new you know ventures acquiring more assets into into the portfolio absolutely but I think I answered this question in another way earlier on where I mentioned about supply and demand now yes it's okay at this stage to God and said we're gonna buy but you know what what what are you buying at what is the cost because we've seen reports from a financial institution like JPMorgan Chase recently where you know the asset values are decreasing from anywhere between 29 to 40 percent you know and then well that's that that analysis was done at the early days now as the as there are more assets becomes available you know if you want to go and acquire more but but if there is a surplus to requirement what are we gonna achieve because you know at the end of the day the asset has to generate some amount of return and if there is a surplus in the market you know with with this sort of time everybody's gonna go for the lowest cost possible base it's it's you know it sounds great from PR perspective to grow your portfolio but I think I think the total effect is yet to be seen and yeah I think I think that you know I think we will realize the true extent of what would happen in next three to four months that's what I would say well actually I need to plug the magazine because we've got a story coming out on narrow-body and regional jets and what those values are gonna be so look for that when the next issue of Asian aviation magazine comes out sorry I had to do a shameless plug there for that story because I just edited that story today and and moved it on but but but let me ask you a question because you bring out some interesting points you know that there's got to be you know for you and for the airports to make money and the airlines to make money and and all of that the people got to fly and the IATA had their media call last night and you know they're they're talking about a pre covered 19 return numbers won't be here until 2023 or something like that so and everybody is talking about again the quote new normal being a very small or a much smaller industry fewer routes narrow-body planes for the most part some wide-body I mean you know the international service will come back when people in the Clinton country is open their borders is that how you kind of see things happening indeed I think I think the big question in everybody's mind and I think you didn't nail on the head there is a load factor you know what is the load factor of going to pay you know we heard from Ryanair 40 percent of the fleet coming back and 60 percent of the fleet coming back and you know every airline has a different different you know view of what percentage of the aircraft will be back on flying but but at what load factor I mean most of these businesses you know in in in in the good days the load factor breakeven load factor were in the 70s right or you know some some airlines were in the mid 80s if we look at it today to fill you know 80 85 percent of the aircraft in this current situation it's gonna be pretty tough and I think I think yes it is going to take some time for the load factor to return and if the load factors don't return until the load factors don't return to a level that is sustainable for this this you can't really say how many percent of the aircraft gonna have going out there because all you're doing is is turning into a cash burning machine and then and then you go back to you know you know same situation of what do you do with that liquidity because you are burning cash I mean airplanes are not cheap to just fly out there for fun no not at all and one of my favorite cuts and I repeat this probably too much though is you know I was at a conference when we still had in-person physical conferences and I remember one speaker talking about the margins on flights and he said you know every airline is a hamburger and a coke away from losing money on that passenger for that flight because the margins were anywhere from three US dollars to 17 US dollars per passenger per flight and and I thought that was a great line you know you're a hamburger and a coke away from losing money I mean what I know without without mentioning the name of the airline is that some of the low fare airline in Europe I'm talking about pretty large airlines were operating at 60 cents profit margin a seat but from the air right and and and and now we're talking about okay well the load factor is going to be down 50% well hang on but then why would you fly number one number two is you know you had customers you know screaming there I know they don't even give you a team well if they give you your tea they lost their profit margin on it right so so that's I think we push this business very far the aviation business went really really far you know airlines were you know cramming passengers in it was like a tennis sardine in the airplane and the more bombs on the seat for more money you made this what this situation does is changes that you can't just fill the aircraft with more people it's we don't even know and I think I think we've going back to our earlier question about what is the government's going to do is they're gonna roll out a policy sheet that says you know you're 29 seat pitch is not good enough anyone you're you know you have to have this amount of distance well your whole breakeven load factors change your whole lay change okay the agra will be able to fly for longer but at what price to the customer and what the customer pay that person to pay that price so this is this is good it's gonna be new normal when we know and I think right now still quite unclear to me of how this is all going to look because the policymakers are still busy we in the mid of the the crisis right now even though we think that we're coming out I think we're still in the mid but the dust hasn't settled and then I think once a policymaker really get a grips with it and start building policies around it it'll become a lot clearer I'm very curious because and again it's another thing that came up in one of these bloody webinars said we've all been watching but there was a very knowledgeable gentleman and he's been in the industry for 4050 years and they actually made I don't know how I I think it was serious it may have been a bit of hyperbole but he actually said that if you go back to the time from when the Wright brothers flew their first airplane to today that the aviation industry is actually where the airline industry has actually never been profitable and he said I don't understand why people want to be in the airline business good because and he said if you look at the history he said on an on a net basis it's been unprofitable is that anywhere near the truth I think I think you know I think we've seen more profitability in the recent days pre Kovac then then I think I remember one particularly senior person within a very large airline organization doing one of the Ida conference said you know in the 70s and 80s they were losing money the oil prices were down and now the oil prices were oil prices were up and now the oil price is up but they're making money and I think I think if we look at I think if we look at a net basis for last hundred years yes that that may be true but if you really look at and say but you know markets don't run on 100 years basis philosophy markets run importantly philosophy nowadays let's say it's a quarter by quarter thing almost but if we really look at last few years and post 9/11 and and when the when the business picked up I would say that if we look at a lot of the US airlines we look at a lot of the the European airlines they have posted a significant amount of profits the the question really became you know what they did with it were they they died you know they invested on it or they pay dividends on it that's a different subject but but Airlines did make money and and and it's but it's it's a very tough business right because the bigger the bigger fish out there are still the strongest and you can you know I can't have a price war everybody everybody tries to find a niche of a sort to make money but it's definitely not a lot of business for a light-hearted the for definite and and right now we're seeing you know unprecedented level of amounts out there I think I saw something around sixty three billion is is is the total amount required in in in in the aviation industry and forty three of that is you know the tickets amount if that was refunded you know there's there's a lot of uncertainty around it so so let's let's let's see what happens next but it's not it's not the most profitable business but most the time but when it is yes it does pay let's move on to a couple of things we talked earlier about newer aircraft versus older aircraft being retired things like that airbus has said they're slowing production boeing of course is slowing production they're still hobbled by the grounding of the max then there's no telling when that's going to get back in the air there were some polls done earlier and from what I read most of the polls seem to think that there would be deliveries this year of commercial aircraft of between six hundred units to about a thousand units and which obviously is low compared to the recent to the past years I remember the first Singapore airshow I went to everybody and their dog was jumping over themselves to try to announce the latest you know fifty billion dollar plane order and all of that that went away quickly but also people said look you know there are a huge supply chain issues out there you've got a lot of lost jobs a lot of technicians in bid lead off some factories have been affected because you had infections there so they had to close down and to super-clean the place you think deliveries you think six hundred this year is about the right number you think of thousands the right number or somewhere in between well I would I would look at it in a way that well we know manufacturers no motors I've had it really tough but if we look at deliveries I would say the delivery were up to normal stage for January and fed and then March is when it starts hitting the ground right it's really gone to a halt and if we really look at it today and say okay well we're talking about some production starting but airlines don't really have the money they're still trying to preserve the cash still trying to delay deliveries and you know we heard all sort of things so I I look at and say okay we are in mid May that probably means that you know the the summer season in Europe and winter season in southern hemisphere or you know depending on where the busy season is and where the deliveries are coming which we both know most of deliveries were still planning to be aged and and and and you know some to North America I I think that the the delivery for it to come back to anywhere between normal stage is gonna be September October at the best so we're really talking about four months of normal delivery in 12 and if I look at that I would say we will be doing we would have done very well if we cross the 600 milestone that's well that's the way I look at I don't think I don't think Airlines will run to take delivery anywhere before September even if things were things were good because the capacity and and and the load factors we talked about earlier and and preservation of cash being the most important thing so I look at and go well you know October November December January five months of delay and what is that normal numbers gonna look like and I think if we cross 600 that's a that's done very well Mr Rose and supply chain it's a it's it's a huge issue we know that a lot of Amaro's are you know not inducting or have postponed inducting any assets engines or aircraft and for reasons of technician not being available or you know they can't get the parts on time so that's another issue not forgetting the maintenance season in in the northern hemisphere is gonna start around October anyway so if the load factors are there by then then I think Airlines will but if the load factors are low then the aircraft are gonna remain parked so that's is yet to be seen which is you know which is why I said I think it's quite unclear you know we will have to see what level of load gets back and what the government policies will be still under deliveries a little bit I mean LCCC's have been really driving the narrow-body market especially here you know if you can't talk about that without talking about AirAsia for example but other you know low-cost carriers have really been driving the narrow-body market where do you kind of see them on deliveries and do they have the liquidity to take planes if and when business opens up again and again I know nobody knows when the traffic's going to come back and and all of that so well it's a very interesting time because yesterday there was a third you read the news and III did certainly and it's in the public domain so there's no no issue discussing it I saw a news about dahlias has gone from easyJet putting a five million dollar price mark on somebody who can tell him how to get out of deliveries and delay deliveries or cancel orders without us yeah you saw that and and and we've seen similar sort of thing with some of the large low-cost carriers from from asia-pacific and you know Southeast Asia where recent aircraft orders have been you know put up for sale by the manufacturer so that that's they know that's that's that's happening I think majority of LLC LCCs are still trying to preserve the cash or generate the cash through the asset sale and leaseback or asset sell right now and I think it it would be very premature and I don't think anybody will anybody will rush for more deliveries until the the whole you know load factor and government policy becomes clear to them I think I think I'm repeating myself again from from what I said before I don't think LCC is from what we have seen I mean we've seen major airlines you know even spending money trying to cancel orders or defer orders so I think deliveries are going to be quite difficult for them and until the situation returns to normal it's you know nobody's gonna pay money to manufacturers when the question of survival is is the first question I want to I'm gonna compress a couple of questions because the more I read them the more they they flow together a little bit very quickly airline owned leasing companies again another one of these webinars some of them I've been going away but that seemed to be a process that a lot of the airlines are already started in that direction of sort of hiving off that asset and concentrating on the core business and moving people do you see airline don't leasing companies going away or they were gonna stick around I I think few will stick around for for following reasons I think I don't think the model is obsolete but I think what they have as a benefit is airline alone leasing companies will probably have one benefit that they may be able to distribution the the assets in a way that suits their need without having to just request for you know payment holidays through through outside you know leasing companies and so on and so forth so I think I think I think I think this the structure will if the if the structure allows it I think I think there is still a good chance for them for survival I don't think it's I don't think it's something that's just gonna simply go away unless unless it was one of those just created just to do one or two aircraft but I think large large you know structures like that will survive another quick question dedicated freighter market is that something that you guys are involved in very much we we deal with afraid of market day in day out and right now it's it's a booming market I would I would say it's probably a booming market for next three to six months it's it's in that bubble right now as the passenger aircraft starts flying and some cargos are carried in the belly I think that it would dedicated freight market will see a decline but but obviously right now it's it's on the probe it's it's growing and you know whether after three to six months where they have remains like that is still questionable because if we look at global cargo market previous years was in the decline and it wasn't it wasn't that great so so this is one of the silver lining in the cloud that we've had on a covert cloud that you know freedom markets are picked up but that's still a it's a it's a temporary it's a temporary boo-yeah cargo markets for the last two or three years I mean it was just a steady you know down it was terrible let's talk about you know we talked about the root of all evil money earlier and but now also the there's a process that happens when somebody defaults on the lease or when you transition an aircraft right now you know it's come to the end of the lease you're trying to get an inspection done you're trying to get signatures from the appropriate authorities everybody's locked down the borders are closed if you do manage to get someone over there they're in quarantine for two weeks maybe in a nice hotel maybe not in a nice hotel how hard is the transition process when you're either trying to a repossess an asset if you have to because somebody went Chapter eleven or you know I think in the UK its administration I used to cover bankruptcy court back in the state so I'm very familiar with chapter 11 chapter 7 chapter 13 and all of that but you know can you get people in there to do the checks uh there was one lessor who was saying and you know in a webinar again he said we you know we tried to get locally if we can't get people in there or if they're going to be quarantined for two weeks you know we try to get some local staff or but you know there may not be the technology and the shop may be shut down if you have to do an inspection and the lawyer that needs to countersign something may be gone I mean how is the process for you guys working right now it's probably one of the most major challenges we've faced one is trying to get people there to to to review the aircraft or the asset or to move assets around engines and anything like that it's it's extremely difficult you know there is there are local solution available depending on where it is but that comes at a quite in price right now because people realize that it is it is not easy to move people around so that's that's you know it becomes quite expensive you know one of the example was we're trying to move an engine and you know in in in in precoded days that engine would have moved within three days from middle east to you two to two to europe now you're looking at well well first of all you know when you're gonna get a slot how you know air freight is becoming ridiculously expensive so it's probably thirty days away and it's gonna cost you five times as much that's that's that's another issue and trying to get a get a right technical people to do things you know from from from our organization to go and visit the aircraft or look at the records it's extremely challenging so that that has been a major challenge and repossession in this this current stage is is not possible I mean we've we've seen in a lot of lessors especially the airline that have gone into administration the lessor seem to be you know still screaming and saying well we need a sit back but who's gonna go and get the asset back there isn't and it's it's it's it's it's really difficult right now let me jump in there because that's interesting when an airline you know you get berge on australia's in administration right now and if I remember my American bankruptcy law correctly and I said because my mom is a lawyer and my eldest brother was a lawyer but the bondholders are sort of the you know senior secured creditors and so on and so forth where do the lessors stand in the ranks of creditors when an airline that has several of your engines or several of your planes where do you stand in terms of seniority of the creditors I I think I think I think you know you may correct me on this because you you know this much better I think the first the first line becomes anything that's due to the government right I mean that's that's the first thing okay so if you're on taxes you own anything on government have become number one number two is the the skinny you know creditors like you said and I think I think lessors are number three in reality almost like number three in that because you've got the government-owned amount then you have the the the the creditors and then you have the the less holes within that creditor portfolio if they have the asset out there but then I think I think then you have you know the other other creditors or other suppliers that fall into other categories at the bottom but I think it's still still within number three I think the lessons are still within number three yeah the the debt holders are the or number two I mean they they they you know that's it you really want to follow whoever owns the debt which was very interesting in a movie called the International I don't know if you're a film buff but it was a very good movie and there was a banker in there and he said look it's all about owning the debt he said I haven't watched it by well you should and sticking with this kind of topic though let me ask you a question how exposed or leasing companies to things like material adverse effect clauses you know the force majeure things are you exposed and something like this is I mean I doubt pandemics were actually written into the lease before I'm sure they will be from now on but how are you affected by those kinds of clauses well I think you know Matt from you know you you know this as well as I do I think I think for anybody to go and claim a material adverse effect right now III think it's gonna be pretty difficult because who's gonna set the precedence because once you set that precedence everybody every other airline is gonna follow that right so number one that's that's gonna be the challenge of you you know somebody's you have to set the precedence to do it and I don't know which legal Court will ever want to deal with this right now especially the fact that pandemic unless somebody had a real vision I don't think it's it's in you know probably the 99% of the of the contracts you know it's similarly I mean we've got to look at it in the way that the act of war and and all of that came in after the post Gulf War and act of terrorism was added the various thing gets added of course now that moving forward contracts will probably have a pandemic and definition of pandemic and you know what WH o you know says and all that sort of thing will happen but right now I don't think any legal jurisdiction will be able to rule on the fact that this will fall under a material address effect because if they do that will set a precedent for every airline in the world and that's what they're gonna start claiming and you know you it's gonna it's gonna be a legal overload and unfortunately I think this this could go up to a pretty high pretty high level if that happened I I don't think that's foreseeable right now have you been adding do you have an in-house counsel have you been have you been building up this team lately are you hiring well we're definitely we're definitely adding things into it and revising it on daily basis our said I hope you have good solicitors there in London now indeed indeed they're costly they're good they always do they always do cost Deepak finally I tried always in these shows I mean we're talking about a very serious subject it's a global pandemic that's killed hundreds of thousands of people millions of people who have lost their jobs I mean we don't want to downplay the seriousness of this you know people are talking recession and possible depression and so I know it might seem funny to end it this way but is there a bright spot in particularly in the leasing business or perhaps overall are there some opportunities and the chaos that you see there's always opportunity in every chaos but you know we talked a little bit about the S or B opportunities and there are you know pretty serious and good credit companies that are out there an asset availability is definitely one you know there are a lot of lucrative asset that's but that are becoming available there has been a boom in the in the freighter market well you know and and and leasing the soft of freight aircraft is definitely there but nevertheless I think I think I think yes there are temporary and short booms that we are saying and like you said we don't want to downplay the whole thing is it's it's a major event in the world and and and you know the UK said yesterday the GDP is is contracted by two percent so so yes you know it's a pretty serious situation but there are some good opportunities out there like like we said and and you know good options there to deploy a capital if if the company chooses to do so departure and CEO of air finance lease thanks for your time today and stay safe thanks for having me Matt good to see you get to talk to you yes [Music] you

Show moreFrequently asked questions

How can I eSign a contract?

What type of field allows me to eSign my PDF with my finger?

How can I write on PDF and sign it?

Get more for countersign Tennis Match Ticket made easy

- Signatory on mobile

- Prove electronically signing Online Tutoring Services Proposal Template

- Endorse digi-sign WordPress Web Design Proposal Template

- Authorize signature service solicitation

- Anneal signatory Wedding Ceremony Contract

- Justify eSignature Freelance Quote Template

- Try initial Coffee Shop Business Plan Template

- Add Incentive Agreement eSign

- Send Security Proposal Template eSignature

- Fax Alabama Bill of Sale autograph

- Seal Performance Review Self-Assessment Template electronic signature

- Password Sales Contract signed electronically

- Pass Computer Repair Contract Template electronically sign

- Renew Smoking Lease Addendum electronically signing

- Test Power of Attorney Form mark

- Require Car Lease Agreement Template signed

- Comment person signature

- Boost boarder initial

- Compel subject digital sign

- Void Auto Repair Contract Template template esigning

- Adopt bill template digisign

- Vouch Medical Invoice template electronic signature

- Establish Tourist Transport Ticket template countersign

- Clear Volunteer Agreement Template template sign

- Complete Book Press Release template electronically signing

- Force Roofing Proposal Template template initials

- Permit Pet Grooming Registration template eSign

- Customize Promissory Note Template template eSignature