eSign Golden Ticket Made Easy

Get the powerful eSignature features you need from the company you trust

Select the pro platform made for pros

Configure eSignature API with ease

Collaborate better together

E sign golden ticket, within a few minutes

Decrease the closing time

Keep important data safe

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

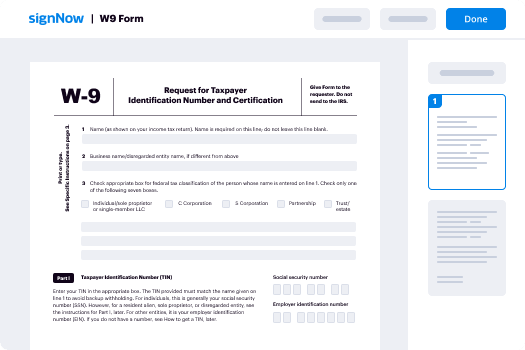

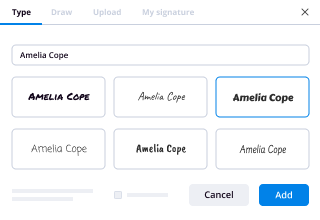

Your step-by-step guide — e sign golden ticket

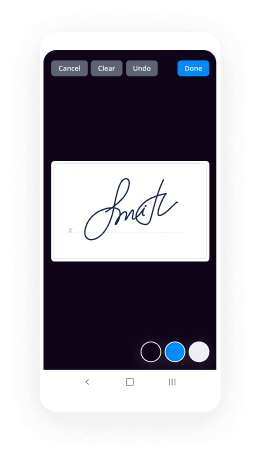

Leveraging airSlate SignNow’s electronic signature any company can increase signature workflows and sign online in real-time, giving a greater experience to clients and workers. Use eSign Golden Ticket in a few simple steps. Our mobile apps make working on the go feasible, even while offline! eSign documents from any place in the world and close tasks in less time.

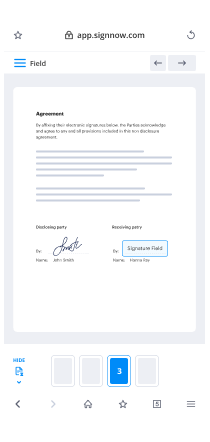

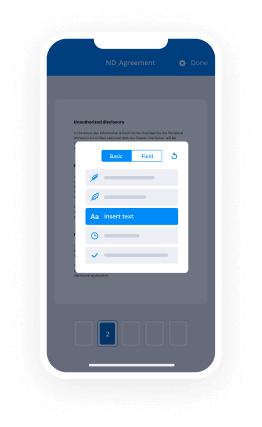

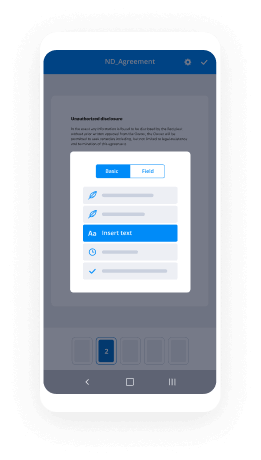

Take a stepwise instruction for using eSign Golden Ticket:

- Log on to your airSlate SignNow profile.

- Locate your record within your folders or import a new one.

- Open the template and edit content using the Tools menu.

- Drag & drop fillable boxes, add text and sign it.

- Include several signees using their emails and set the signing sequence.

- Indicate which individuals can get an signed version.

- Use Advanced Options to reduce access to the template and set an expiry date.

- Click Save and Close when done.

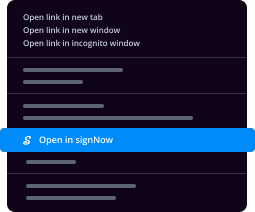

In addition, there are more innovative functions available for eSign Golden Ticket. Include users to your collaborative digital workplace, browse teams, and monitor teamwork. Numerous people across the US and Europe concur that a system that brings people together in a single unified enviroment, is the thing that organizations need to keep workflows performing effortlessly. The airSlate SignNow REST API enables you to integrate eSignatures into your application, website, CRM or cloud storage. Try out airSlate SignNow and get quicker, smoother and overall more effective eSignature workflows!

How it works

airSlate SignNow features that users love

See exceptional results eSign Golden Ticket made easy

Get legally-binding signatures now!

FAQs

-

What happens when you get a golden ticket?

A Golden Ticket is the pass that allows the owner to get into Willy Wonka's Chocolate Factory. Five Golden Tickets were hidden in Wonka Bars and shipped out into countries all over the world. The search for them turned into a worldwide mania and each ticket find was a press sensation. -

How do you make a golden ticket?

Get yellow or gold airSlate SignNow. Either color will do. Draw a out line like waves, zig-zag, etc. Write "Amanda" (if your name is Amanda...) on top of it. Write "Greetings to you, the lucky finder of this golden ticket, from Ms. Juno and the Grade 4 Class Alpaugh! ... Give yourself a pat on the back! You have a golden ticket. -

What is a golden ticket in Madden?

Real talk though, the golden ticket is a promo that releases a golden ticket item into packs. If you're one of the lucky few to pull the card, you'll be able to "create" your own card based off a player that's already in the system as a "mold" and then boost your choice of stats. -

What is the golden ticket?

A golden ticket is something that gives the holder a chance at an airSlate SignNow opportunity or prize. A golden ticket may be a qualification, a circumstance or a decision that gives the recipient a chance at an airSlate SignNow opportunity or prize. -

What is a golden ticket in Madden 20?

Madden 20 Golden Tickets will involve completing limited-time challenges in Ultimate Team to earn rewards. These Ultimate Challenges will be a sequence of three games each on two different days this week. Most likely they will be full games with three-minutes quarters. With each game, comes a reward. -

How did Charlie get a golden ticket?

One day, Charlie sees a 50 pence piece (dollar bill in the US version) buried in the snow. He buys a Wonka Bar and finds the fifth and final golden ticket. ... The ticket says he can bring one or two family members with him and Charlie's parents decide to allow Grandpa Joe to go with him. -

What does it say on a golden ticket?

A Golden Ticket is the pass that allows the owner to get into Willy Wonka's Chocolate Factory. ... The ticket says far more than could logically fit on it: "Greetings to you, the lucky finder of this Golden Ticket, from Mr Willy Wonka! I shake you warmly by the hand! Tremendous things are in store for you! -

What does it say on the golden ticket?

A Golden Ticket is the pass that allows the owner to get into Willy Wonka's Chocolate Factory. ... The ticket says far more than could logically fit on it: "Greetings to you, the lucky finder of this Golden Ticket, from Mr Willy Wonka! I shake you warmly by the hand! Tremendous things are in store for you! -

What is Silver Ticket attack?

Silver Tickets enable an attacker to create forged service tickets (TGS tickets) that are used to access compromised service accounts. The Kerberos Silver Ticket is a valid Ticket Granting Service (TGS) Kerberos ticket that has been encrypted/signed by the service account configured with a Service Principal Name (SPN). -

How do you get the golden ticket in Madden 20?

Golden Ticket players must be built off a base player item that has already been released in Madden Ultimate Team this year. Golden Ticket players cannot be players that have retired from the NFL during the 2019 season (In other words, Legends are good; however, players who retired this year are not). -

What are golden tickets in Madden?

The Golden Ticket Program is back in Madden Ultimate Team this year! For those who are new to MUT, finding a Golden Ticket allows you to create a player item that will be added to MUT (some restrictions apply). -

What time do golden tickets come out?

When is the Golden Ticket promo? Players will be able to participate in the Madden 20 Golden Ticket promo by playing Ultimate Challenges that will be available for just one hour. The dates and times the Ultimate Challenges are: Tuesday, March 10th @ 9PM ET.

What active users are saying — e sign golden ticket

E sign golden ticket

one of the main principles about borrowing money is how you're going to pay back with your income duh what's going on guys my name is minwin with what's a mortgage welcome to our channel the goal of our channel is to educate empower and to connect you with the right mortgage and tonight we are going over everything you need to know about your income and how to qualify for home ownership this is part one of our series it's a two-part series tonight i'm going to break down the different types of income you're going to need and break down that income on what you need to do to qualify for home ownership if it's your first time tuning in do me a huge favor hit the subscribe or notification button so you can join the what's a mortgage family right the wham fam we and you'll get notified every time we post new video or go live we go live mondays and wednesdays on facebook and youtube and we post our videos sundays and wednesdays at 9 00 a.m so don't forget to check it out also guys on instagram every day we give you a little tip every day we give you the one brick to get closer as you're building your house to get into home ownership all right guys also ask a lot of questions this is an interactive channel so you have questions regarding homeownership if you're buying tomorrow next week a year later three years later five years later if you have questions holding you back from buying please ask all right guys also guys if you find this video uh helpful useful do me a favor hit the like button and please share it with somebody it helps the algorithm a lot so let's get into it right everything you need to know regarding income when you're trying to qualify for home ownership right how are you going to pay back the money i want you to ask yourself this if you are borrowing hundreds of thousands of dollars right you got to pay back somehow you got to give the institution you're borrowing money from some type of certainty you can pay it back and you're going to do that with your income so how do banks view your income right they're going to loan you many money based on four types of income so if you're borrowing money you're either on fixed income rental income self-employed income or wage earner income aka w2 right so if you're borrowing money and you're getting income you're falling under one of the four categories or the bank's not gonna loan you the money right well in your and you're probably thinking well my income doesn't fall into the four it will once we break down the four okay let's get into the first type of income fixed income right so when you're talking about fixed income there's two types of fixed income there's government ordered or court ordered when i say it's government orders typically it's gonna be your social security income right if the state of whatever state you're in provides you income or the government provides you income that is government income so if you're getting government income right that is a fixed income right the second type of income is court ordered court order can be a lot of things it can be um child support alimony if you were in a car accident and you're receiving income right that is court ordered if you have workers compensation right that is court ordered if the court orders anyone who pay you money that is court ordered income but if tomorrow cousin jimmy gives promises to give you a thousand bucks a month because they owe you money for two to three years you cannot use that as income because it's not court ordered right at any time jimmy can pull back so when you are using income and i see it happen all the time government is pretty pretty vanilla right pretty easy to understand court order that's where it gets very uh sticky right so remember if you're receiving income who commanded or ordered the other party to give you the income was it a promissory letter right oh they promised me that and it's been stamped and it's been it's been notarized it has to be court ordered they can also make up something to pay you right so remember that so court org is very touchy when you're doing court-ordered or government income right they're going to ask for a reward letter right so if it's social security you get a reward letter every year it will increase because of inflation right uh court ordered letters right whatever money you're supposed to get there has to be a letter that you're receiving the money right and last but not least if it's court order they want to see the last two months of your bank statements to prove you're receiving the money all right so once you have the letters and you have the statements to prove you're getting the money then they can count that as income when you're trying to qualify for home ownership right it's not that bad only two month bank statements to show that you're getting the money well what happens you're getting cash right if you're getting cash or you can't prove that you're receiving the money and you have a court ordered letter guess what you can't use that income to qualify okay it has to be court ordered and you have to show proof of consistency that you're receiving the money to qualify for home ownership right so definitely i think if you're buying a home and you're doing something with fixed income i think one of the biggest pro problems people run into is they don't go out and get the documents right they fall in love with the home and now they're rushing through escrow and now they have to go to social security get in line or go to the courthouse get some documents right a lot of people can't find old child support letters or alimony paperwork right that go back to the court you can eat up a lot of time especially when you found a house and you're in love with it and the lender needs to provide a pre-approval or an underwritten approval and people run into issues where they can't get the information so if you are using fixed income to qualify for home ownership right definitely make sure you have all your ducks in a row and have all your paperwork ready so when the lender approves you you can move forward quicker i see it happens all the time right that people go out there they fall in love with their house and they're on fixed income i think i have one right now right they're on social security income but they don't have their updated reward letter right they had one from two years ago right so definitely guys make sure you have those things if you're using fixed income the second type of income jonathan this is for you rental income okay also rental income there's two types of rental income there's existing rental income and there's future rental income okay with existing rental income they're going to go off your tax returns right you have something called a schedule e they're going to look on your tax return to see what you gross what you wrote off what the mortgage interest is what your property taxes are okay so when it's existing uh rental income is pretty easy okay it's um it's gonna be on your tax returns the second type of income future rental income so there's a couple different types of future rental income so if you own a house and you're vacating the house to buy another house that you're gonna move in right that vacating home is called future rental income if you're buying a property to rent it out you have future rental income because you have no proof right that you have consistency in receiving that rent yet okay so with that the lender is going to want a rental contract and they're going to want uh the deposit right so i see people do all the time they don't have a renter yet and they go out and they try to squiggle in that rental contract right which i think you should not do right make sure if you say you're gonna charge the the tenant uh the positive two three grand make sure you receive that in as a check i see people where uh they say that the deposit was three grand but then the uh the tenant only gives a thousand bucks now they can't qualify to uh buy that you know buy the house as a rental property okay so make sure you have all your information right uh information right also guys remember with rental income it's up to 75 of the gross income right of course if it's existing you're gonna go off the tax returns if it's future it's 75 of the gross income up to 75 which means also if you've been a landlord already right and you've been a landlord for a season of time right you can use the full 75 if you haven't right uh you can go up to 75 we're gonna go about we're gonna go into details on that on everything you need to know regarding income to qualify for home ownership part two that was a mouthful but there's gonna be a part two that's gonna break down fix income more it's gonna break down rental more right but today i just wanna give you a little lay down the foundations for you understand when you're trying to qualify what type of income um you uh you might have and also what documents you might need okay so with existing you're gonna go for schedule e if it's future they're gonna want that they're gonna want that rental lease right rental contract and they're gonna want the proof of your deposit check okay if you wanna use rental property right if you don't have it you cannot use future rental income because if you don't have a tenant who's going to occupy the property and take it over right you can't use future rental income to qualify which means you have to qualify with your new home your new home and your old home both mortgage payments if you're upgrading if you are buying your rental property and you don't have that deposit now you have to qualify with that payment but without help with rental income which can increase your dti which a lot of times can knock you out of qualifying for home ownership so make sure when you're doing rental right i don't see too many problems with existing because they see it on the tax returns the only problem i see with existing sometimes people write off too much right because they wrote off a lot even though technically they are positive but they're negative because they wrote off too much and now they have negative income for example if you look on your schedule after your your accounts receivable minus all your costs if you're negative 12 000 right that means you're negative a thousand bucks a month if you're negative 6 000 you're negative 500 bucks a month it's almost having a 500 a month credit card okay so be very careful with existing rental not to write off so much if you have rental but you're trying to buy another property okay with future the biggest issue i see people run into is they need to have a tenant so if you're buying a property make sure you have a tenant why how can i get a tenant if i don't own the property yet they want to assume that you are going to do it but let's say you buy a rental property right and the property already has a tenant in there you're going to need the existing rental contract right and as long as you have an existing rental contract and they can show proof that the tenant is currently making payments then you'll be fine but if you buy property and you have to put a tenant in it make sure you have the right information then you can qualify okay uh the third type of income self-employed income okay so when you're self-employed typically you're sole proprietary i think people get confused sometimes about self-employed if you are an independent contractor you're a self-employed okay if you have employees of course you're self-employed well now a lot of times people they talk to me hey man i have a job i work for a company but that company 1099's them if you get a 1099 you are self-employed okay so you're gonna find either a sole proprietary a c corp an s corp or an llc okay typically you'll get a two years of your schedule c 1120s or 1120s and your k1s right it all depends on what you file so remember you're in a two year history with self-employed right you can go um if you go from w-2 to self-employed which a lot of people are because of this pandemic they're going to want a two-year history that you've been self-employed right but if you go from self-employed wage earner you don't have to wait two years so remember when you're going self-employed make sure you have you let the lender know hey i'm self-employed right and if you just converted let them know how long but if you've been self-employed for over two years make sure you have all your documents all right we're gonna go over in part two on what the lenders are looking for today i just want to go over if you're self-employed you can still buy a home they're gonna go off on your tax returns that means you got to be a good boy or good girl for two years and you might not be able to write off everything what i would do before you submit your tax returns in in 2021 for 2020 let a lender review it if you're trying to buy a home or refinance in 2021 the last thing you want to do is you wrote off everything and you're not showing any income you might have all the money in the bank you might have a good credit but if you wrote off everything unless you plan on paying cash for the home you're not gonna get it right so make sure you have your documents ready for the lender so they can take a look at it and so they can average out your income it's either inclining or declining if it's declining more than 20 percent they're not going to average it they're going to take uh your recent year which is probably gonna be your worst year and divide that by 12 okay it all depends if your decrease more than 20 percent all right so now we went over fixed income we went over rental income we went over self-employed income right last but not least our most popular one wage earner w-2 okay so if you're a wage earner or w-2 right it's the easiest way to qualify for home ownership they're going to ask for your last two years of your w-2s your 30 days of pay stubs remember that's at 30 days and they're gonna order a voe right right now as everyone is either changing jobs or changing careers if you want to qualify to buy in 2021 you just need to be at that job for 30 days they're gonna ask for one month worth of pay stubs right as long as your income is 40 hours a week they're not going to average but if you're part-time and you don't have that full 40 right and you quit a job or you got laid off you went to a new job they're gonna take the average okay so make sure when you're a wage earner right it's a lot more self-explanatory than the other the self-employed rental or fixed right they're gonna go off of your pay stubs and your w-2 if you've been at that job for only eight months right they're gonna do 40 hours for eight months if you've been that job for a year and a half you're gonna ask for a w-2 and the recent pay stub all right so remember as a wage earner just have all your w-2s if your w-2 is not out yet you're trying to get qualified use your last pay stub from december the prior year that should have a breakdown of your hourly your salary your overtime your bonus right that will help you right qualify quicker without a voe even without that w-2 because the last pay stub breaks everything down okay so make sure you have your w-2s your pay stubs if you are going with a cal hfa loan certain down payment assistant loans that's for three years of your tax returns and your w-2 when they're qualifying you so make sure you have all the information and last but not least in this wager one right your voe the golden ticket to home ownership i got asked a question today why what's the difference between a big lender and a smaller lender right a voe does cost a lender money right a lot of employers now unless they're a small employer you send it directly into them most of the bigger companies use um a verification company to validate your income right it costs them like 40 50 or 80 bucks or something like that right a lot of the bigger companies they validate all that income right up front so the income is concrete right these smaller companies not saying all but a lot of them they don't want to pull a voe until you're in escrow the problem you're going to run into if you pull a vue while you're in escrow and the underwriter declines your income or cuts your income your approval doesn't mean anything right this weekend i'm not going to say his name but who you know who you are calls me frantic oh man my realtor had me go to with another lender and they said there's no way you can approve me conventional this person had like a 740 fico they said i have to go fha i know why you're trying to make your borrower go fha if you have a 740 fico there are times you might have to go over fha but majority time you're not they want to go they want the borrower to go fha so they can make more money on the client right why would you go fha with a 740 fico score you have five percent to put down right but like oh no your dti is too high with some small company right the voe is verification of employment rather okay forgot to say that the voe is your verification of employment but because i work for a bigger company right when we took the client's application we validated the income like that right in seconds we spent our 80 bucks and we got the income it's been validated it's concrete the bar all they need to do is make sure when they get paid every time every week every two weeks that the income is not declining yes they can validate everything but if they see that your income is declining guess what they can't they're gonna cut your income okay so besides that they qualified but this voe that we have broke down everything the other lender didn't have the voe the other lender would have given them an fha loan right when they qualified for a conventional loan the payment is better on a conventional loan if the fico is above 7 20 740 okay and right now where rates are at and everything conventional is the way to go if your credit is there if your credit is not there you can't get in there within 90 days buy with what you have now right don't try to fight it because by the time your credit is fixed homes might not be there anymore or prices might go up or rates might go up right so you can't fix your credit in 90 days to get to where you want to be buy with what the credit you have today okay so yeah this voe is a game changer we had him approved conventional the other person wanted to go fha right and the the the maker breaker with his v was this voe this voi can either kill a deal or make a deal right so make sure when you're getting approved make sure that lender orders that voe asap if they don't you're out there i see people happen all the time you shop for a loan you find a house you call becky you call uncle uncle john and you're like oh my god we got the home right and then everyone gets excited and all of a sudden the lender you sign you sign your disclosures you you order your appraisal they already ran your your credit card for your appraisal you're like sending a chicken chicken chicken i can't wait to get my 30-day notice and then hit you with the hit you with the smack right the voe comes in income gets cut by felicia right when you should have done that view it's uh verification employment upfront all lenders miguel uh pull voice right it has to be third party back when i did the original view video right back in the days things have changed you can walk your viewing to your lender into your uh hr department if it's a small company and that's company can send it directly back to the lender okay the lender has to get it from the company for it to be validated right if you want to get one so you can review it then have the lender get that voe from your lender have the your hr fill it out give it to you but your hr company or your hr department asked them how do you validate my income to buy a house if they give you a salary key then that you have to give the lender the salary key but these bigger like bigger companies where i work at or these bigger these huge companies they can pull the vue themselves right they have the the the technology and they have um they have the resources to do it a lot of these smaller companies not talking smack on them right you cannot control it even same thing with mortgage brokers right you're out there dealing with the mortgage broker shopping for a home right and the voe gets cut or they don't pull that voe up front and you're having little hiccups to try to qualify after you're in escrow right so with the wage earner the 30-day pay stub especially in the job transitioning is a very big nail right also that voe is the maker breaker right if you use overtime or bonus to qualify you for home ownership you definitely right you definitely want to make sure that voe is in right it's the maker breaker it will literally it make or break deals i see right i see shattered dreams broken hearts devastating to right future for people who don't get their viewers pulled right also the vue is good for 30 days so after 30 days that thing has to be pulled again especially during pandemic right now they pull that thing like every week they want to make sure you are not declining in income all right so that right there guys is our part one of everything you need to know to qualify for home ownership right of course we're gonna do part two on wednesday so don't forget to check it out so today let's go over again we talked about the four types of income that the lenders are gonna use right they're gonna use fixed income remember there's two types there's government ordered and court ordered okay remember that right so that's fixed income rental income second type of income right on rental income there's existing rental and then there's future rental okay make sure you have the right documents if you're doing with future rental all right if existing pretty easy offer your tax returns but remember be careful don't write off too much if you're trying to qualify to buy or refinance the third type self-employed remember right if you're self-employed they're gonna want to see a full two years unless you're gonna go five percent down conventional they'll ask for one year tax returns but they want you to be self-employed for at least five years or more or the business has been around for at least five years or more okay so that's uh with self-employed income all right make sure you know it's a uh sole proprietory pretty much you're gonna file a schedule c if you're a c corp it's 1120 s corp or llc you're going to get a 1120s and your k1s make sure you have your documents ready for your lender all right so they can validate it all so you can go out there and shop with certainty and last but not least our most popular income w-2 wage earner income all right make sure you have your w-2s your recent 30-day pay stub is huge right now because of pandemic they checked the heck out of that thing okay and last but not least get that voe in if you're using overtime you're using bonus you just changed off 90 days ago they're going to want to see that voe especially a lot of you guys if you took time off right you need that void just so they could show the gap of all that time you took off so they don't average out your income to see why well if he makes x amount his looks like his income is declining why is it declining oh he took two weeks off without pay that completely makes sense right lenders need to see that and you want to show them that and remember that vue is good for 30 days all right guys that is part one of everything you need to know about income to qualify for home ownership right next on wednesday we're going to talk about we're going to break down fixed income rental income right self-employed and wage earner we're going to get the details of things you should know right about that income so you can go ahead and qualify for home ownership we're also going to go over the income calculator okay so let's go some q a if you have questions about income tonight right definitely bring it on teski kata right how about uh income from overseas if you file it on your tax returns then you can use the income right as long as they can validate the income or the the income with your employer and you file it and you have a two-year history you can use that income to qualify for home ownership all right that was a great question and hopefully that is a great answer michi robles i have a stable job for the past four years and money in the bank i also have a savings account i have bad credit and a repo on my credit how can i purchase a home so it depends how old the repo is and how bad the credit is right if typically if you haven't had anything bad with your credit in the past 12 months no delinquencies no charge-offs if it's just old stuff and it's and you've had your job for a while you have money in the bank you can probably qualify fha but the only way to tell is to run your credit and then run the numbers and then make sure it makes sense all right hopefully that helps you out gb had a question what's an average net for self-employed to buy a home i write off everything gb there's no answer yet because we need more information what you should do gb if you're self-employed and you want to buy a home run your credit on credit karma it's not going to affect your credit score get a list of all your monthly credit obligations your revolving debt your installment debt your mortgage debt any collections right student loans put add up all those monthly payments second figure out the mortgage payment you're looking for take your mortgage payment your monthly credit obligation payments and add them together take that number times it by two that is what you should net right to qualify to buy the home at that price hopefully that helps you out veronese vallejo what is the difference between fha and conventional the difference between fha and conventional is the pmi and the down payment okay so let's go with down payment first when you're going fha you're either gonna go three and a half percent down or five percent down right fha is more flexible on the credit right but the pmi is constant right which means there's upfront mi at 1.75 no matter where the credit at is at or no matter how much you put down okay the monthly pmi is .85 all right conventional loan they're gonna require better credit but the pmi right ranges depending on your credit and down payment typically someone would go conventional if they're going with a 720 credit score or higher with a 5 down or better because the pmi unconventional will be cheaper than fha but if you're under 720 you want to go conventional typically the pmi will be higher than an fha loan okay but remember on a conventional the pmi will fall off once you have a certain amount of equity in a certain amount of years on an fha you would have to refinance out of it typically on fha two rates are lower than on a conventional but on a conventional remember there's more flexibility with pmi on fha right the pmi is higher and you have to refinance out of it that's why they kind of give you a bonus kicker with a lower interest rate hopefully that helps you out roxcb for a wage earner i need the last three years w-2 so or they're going to take the average income of all three years or do they take the last year's income which is much higher so if you're a wage earner and you're doing down payment assistance they want your last through your tax returns because they want to see right that you didn't write off any mortgage interest in the last three years if you're trying to qualify for a first-time homer home buyer program that's down payment assistance right when they look at your tax returns right uh they're gonna give you your base income of of what you have now right they're gonna average out your overtime or bonus in the last three years that's how they view your income hopefully that helps you out genevieve is a voe done for each employer over the past two years or only most recent employer so if you're trying to qualify to buy a home they're going to pull a vue for all your employers in the past two years so if you've worked at multiple jobs they're gonna pull it for each job you worked at to add up to a total of two years union workers if you change jobs a lot right and you're trying to qualify to buy a home have the lender start pulling all the voes right away the only voe they're going to have to keep updating right every 30 days is the recent one that you're at but have your lender go and call your uh employers and pull all your old viewers tally up to the two years and your recent employer right if that voe expires they're going to pull one every 30 days hopefully that helps you out nam gib hi min how soon can you refi aft from an fha to a conventional does the property need to have 20 equity and the answer is no nam you can go from fha to conventional whenever you have enough equity to go to conventional typically you're gonna need three percent equity after you cover all your closing costs right after everything is said and done you need three percent full equity right typically you want to have five percent full equity so you can get the better deal i wouldn't do it on three percent i would do it on five percent or better all right if you bought a home a year two years ago and you have an fha loan right do not do a streamline go from fha to conventional for sure all right if you have a home that's fha and you don't have enough equity after six payments right it's better to go with an fha loan to drop the payment so you can attack the payment and do one more refi right because you can probably refi again one more time right once you pay down more principal because your payment dropped then go from fha to conventional all day long all right hopefully it helps you out hi hi min can i put only 10 down payment for a second home or vacation home the answer is yes if you buy a second home right not an investment a second home you can do 10 down but remember kai right you cannot use rental income or airbnb income to help you qualify if it's a second home you've got to qualify to buy with your current mortgage payment and the second home mortgage payment alright hopefully that helps you out nessa ness do you recommend to pay off debt before thinking of buying a home and is there a first-time homebuyer program question number one right should you pay off debt right now where interest rates are at right depending on where you're looking but right now for every 300 a month three or three hundred and thirty dollars a month you eliminate that's 50 000 more home so you got to look at your debt right first number one get approved and then if you're not happy with that approval pay off the debt you need to pay off to increase your buying power okay so get qualified first and then if you're not happy with that purchase price pay down the debt you need to to qualify for more home and this is their first time home buyer program yes there's down payment assistance also um fannie mae and freddie mac has something called a home ready and uh home possible program and the one program what's a three percent down conventional hopefully that helps out now i'm give what's the difference between closing costs and cash to close closing costs is the cost to get the loan that does not include your down payment cash to close includes your down payment and your closing costs added together hopefully that helps out belgium villanueva can i purchase something over 3 000 while in escrow if you buy cash of course if you're gonna finance it right i would not do it because it can bring up your debt to income ratio let's say your credit is about to expire remember your credit is good for 90 to 120 days and you go out you finance something for three thousand bucks right it that monthly payment is added to your debt to income ratio and if you're barely qualifying you can run into some problems and you might knock you out from qualifying hopefully that helps you out all right guys that wraps it up for us tonight i really appreciate everyone who reads through right tonight was everything you need to know to qualif uh about your income to qualify to buy part one this wednesday will be part two all the little tricks and things you need to know about income to qualify to buy all right hopefully you enjoyed our content i appreciate everyone who liked who shared who commented also everyone who subscribed if you did not subscribe please hit the subscribe button and join the wham fam all right tuesdays i answer questions throughout the day so you have questions i answer if hopefully a friend or someone might see that question it might help them out so definitely ask questions on tuesday on instagram and thursday at 6 30 we do a market update on instagram so don't forget to check it out all right guys enjoy the rest of the night we want to end all our livestream with our attitude is gratitude without you there would be no us so thank you so much have a great night guys again thank you so much for watching our show if you have any challenges or concerns regarding what's a mortgage call me 714-332-2526

Show moreFrequently asked questions

How can I allow customers to eSign contracts?

How can I turn a PDF into an eSigned document?

How can I have my customers electronically sign a PDF quickly?

Get more for eSign Golden Ticket made easy

- Countersign on mobile

- Prove electronically signing Investment Plan

- Endorse digi-sign agreement

- Authorize digital sign Travel Planning Registration

- Anneal signatory Fashion Show Sponsorship Proposal Template

- Justify eSignature Membership Agreement Template

- Try initial Manufacturing Contract

- Add Bridge Loan Agreement eSign

- Send Product Sales Proposal Template eSignature

- Fax Work for Hire Agreement autograph

- Seal Leaving a Church Letter electronic signature

- Password Confidentiality Agreement signed electronically

- Pass Term Sheet Template electronically sign

- Renew Pet Addendum to a Lease Agreement electronically signing

- Test Delivery Driver Contract mark

- Require Profit Sharing Agreement Template signed

- Comment beneficiary signature

- Boost person initial

- Compel client digital sign

- Void Interior Design Contract Template template esigning

- Adopt petition template digisign

- Vouch Cruise Itinerary template electronic signature

- Establish Boarding Pass template countersign

- Clear Loan Agreement Template template sign

- Complete 911 Release Form PDF template electronically signing

- Force Business Letter Template template initials

- Permit Camp Trip Planning template eSign

- Customize Annual Report Template – Domestic for Profit template eSignature