Insure Initial Order with airSlate SignNow

Improve your document workflow with airSlate SignNow

Flexible eSignature workflows

Fast visibility into document status

Easy and fast integration set up

Insure initial order on any device

Comprehensive Audit Trail

Rigorous safety requirements

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Your step-by-step guide — insure initial order

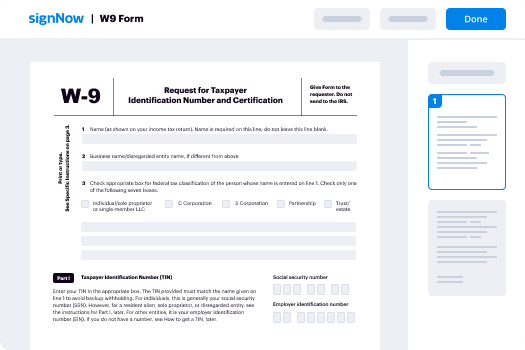

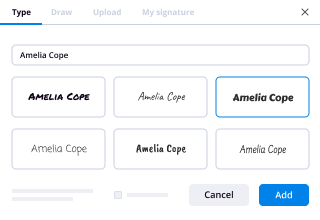

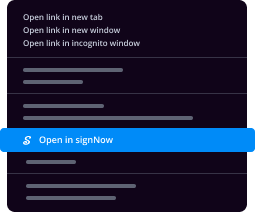

Using airSlate SignNow’s electronic signature any company can accelerate signature workflows and sign online in real-time, supplying an improved experience to clients and workers. insure initial order in a couple of simple steps. Our mobile apps make work on the run possible, even while offline! eSign contracts from any place worldwide and make deals quicker.

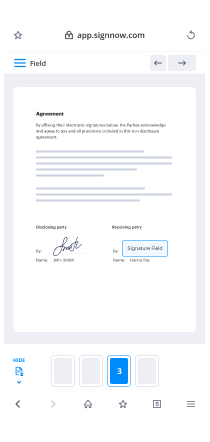

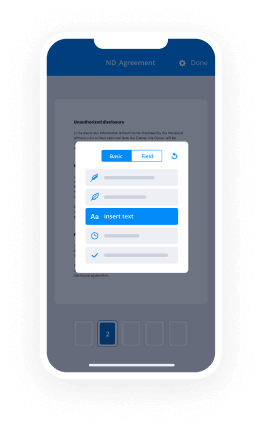

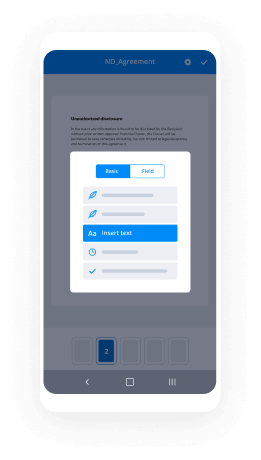

Follow the step-by-step guide to insure initial order:

- Log in to your airSlate SignNow account.

- Locate your needed form in your folders or upload a new one.

- Access the document and make edits using the Tools menu.

- Drop fillable areas, add text and sign it.

- Add several signers via emails and set the signing sequence.

- Specify which recipients can get an signed version.

- Use Advanced Options to restrict access to the record and set an expiry date.

- Tap Save and Close when finished.

Additionally, there are more advanced functions accessible to insure initial order. Add users to your common workspace, view teams, and track cooperation. Millions of customers across the US and Europe recognize that a solution that brings everything together in one unified enviroment, is what organizations need to keep workflows functioning easily. The airSlate SignNow REST API enables you to integrate eSignatures into your app, internet site, CRM or cloud. Check out airSlate SignNow and get quicker, easier and overall more effective eSignature workflows!

How it works

airSlate SignNow features that users love

See exceptional results insure initial order with airSlate SignNow

Get legally-binding signatures now!

FAQs

-

What are the 5 parts of an insurance policy?

Every insurance policy has five parts: declarations, insuring agreements, definitions, exclusions and conditions. Many policies contain a sixth part: endorsements. Use these sections as guideposts in reviewing the policies. Examine each part to identify its key provisions and requirements. -

Who started the first insurance company?

The first American insurance company was organized by Benjamin Franklin in 1752 as the Philadelphia Contributionship. -

How is an insurance policy organized?

The term policy means a complete insurance contract. A typical policy consists of the declarations and an assortment of preprinted forms and endorsements. Generally, a form contains major policy provisions. For example, the Business Auto Coverage Form is the backbone of the ISO business auto policy. -

What is the oldest car insurance company?

Overview. Established: 1907 \u2013 Amica is the oldest mutual insurer of automobiles in the United States. -

What are 3 types of insurance?

Then we examine in greater detail the three most important types of insurance: property, liability, and life. -

When an insurance company needs to provide a payout the money is removed from?

When an insurance company needs to provide a payout, the money is removed from a pool of funds.

What active users are saying — insure initial order

Related searches to insure initial order with airSlate airSlate SignNow

Insure initial order

you the broadcast is now starting all attendees are in listen-only mode you you okay I think we'll get started now hello everyone my name is Jennifer Burnett and I'm with the Council of state governments and welcome to our webinar today this program is part of CS G's Academy series a bimonthly webinar series designed to provide information and training on the most critical issues facing state leaders including the latest trends and state policy making and cutting edge state solution today's program is the first in a four-part series designed to give state policymakers a basic and solid understanding of risk management insurance and how insurance policy affects those decisions they may be making see if she has been excited to partner with the Griffith foundation on this webinar and a series of other events over the last year on insurance related issues to say more about this collaboration I want to call on Frank Paul Tomasello the program director at the Griffith foundation he joins us from suburban Philadelphia Pennsylvania Frank Thank You Jennifer both the Griffith foundation and CSG share similar missions which include a commitment to non partisan non advocate 'iv and academic approach to programming and this commitments at the core of our collaborative relationship it's our pleasure here at Griffith to work with CSG together our organizations provide an opportunity for policymakers to gain valuable unbiased knowledge about insurance and to do so through the lens of critical and emerging issues thanks Frank I'll ask you to introduce our speaker here in just a moment but before we do that let me talk briefly about our webinar logistics first of all this webinar is being recorded so if you miss anything it will be soon available on CSG org forward slash Knowledge Center also as I mentioned before this is the first in a four-part series on risk management insurance every other Tuesday for the next several weeks we will have another webinar on a related topic you can check WWCC org for more information finally we will from the audience if you'd like to ask a question any time just type it into the dialog box there on your screen in the GoToWebinar interface and we'll make sure our speaker sees it so now we're going to go back to Frank Tomasello to introduce our speaker and to get things started Frank thanks Jennifer were pleased to be joined today by dr. Kevin shaver a lecturer and economics at the University of Pittsburgh dr. shaver earned his PhD at Washington University in st. Louis his research has focused on the nature of competition and innovation in insurance markets and his past experience includes serving as an assistant professor and Duquesne University in Norfolk and as an instructor and economics at Washington University and Webster University both in st. Louis and at the University of Kansas and Lawrence in the hour ahead dr. shaver will lay the groundwork for the series by exploring risk management and insurance basics subsequent webinars will delve deeper examining risk management insurance fundamentals through the lens of a variety of emerging issues so without any further delay dr. shaver we thank you for joining us the floor is yours great well thank you Jennifer and Frank for having me here and I want to thank the Griffith foundation and CSU for the opportunity to talk today about the basics of insurance and let me start by just noting that as an economist I often times discuss topics like this how how markets work and I want to be careful that everyone understands when I use words such as should I'm not meaning that in a policy oriented way trying to advocate for a particular position I want you want to make it make it clear that should be interpreted as you know for markets to work efficiently it's a sort of more scientific approach that economists take when analyzing markets so with that in mind let's start with by thinking about insurance basics here and so so what really is insurance I I want to I want to think about it for this talk as an innovation and I think we we live in a world where insurances and is sort of a just a thing that has been here the whole time it's just something you take for granted but I want to think instead of it as an innovation and really a critical innovation if you look at you know the development of economies over time innovation insurance in insurance has been critical to their performance so you might think of internet think of insurance like the internet but instead of it's an innovation that radically alters the way we live but instead of transmitting information on fiber-optic cables instead insurance transmits financial risk through contracts that allows us many opportunities that would otherwise be unavailable so next slide please so one way to think about this since insurance is something that we take for granted is to imagine that the US economy without markets for insurance imagine that insurance markets just disappeared today what would the US economy look like tomorrow and how would that disrupt the way we live our lives I think an easy way to think about you know just how important insurance is to our lives is to start thinking about the different lines of insurance out there and what our lives would be like without them so no health care insurance right so now you can't rely on financial assistance from your insurance company to pay for an unexpected medical condition right so this changes the way we would have to live in a number of ways of course one maybe people have to cut back on how much they spend in order to save money on a chance that they have a health care emergency it would also then make raising a family much more expensive and much more risky on some levels homeowners insurance it might be harder to own a home it's certainly riskier in the sense that if there's a fire there's damage to your house you aren't prepared to you have to do a lot of work to be prepared to handle that and so we can go on auto-insurance a similar story life insurance think about how critical that can be in terms of family planning in terms of thinking about planning for retirement and think about from a business perspective businesses depend on having liability insurance workers compensation in order to reduce cost and deal with risks that are part of doing business and exposure to those risks can make doing business more difficult or even impossible and thus there would be many businesses without access to those types of insurance that would find themselves unable to go forward so the big takeaway from this and is that for the US economy to function effectively we need to have strong insurance markets and the better the markets work in America the better or the less resistance there is to economic growth alright next slide okay so then I also want to place this in a context of the rapid use and development of uses I should say information and it's something that's transforming the insurance world and so I think we should think about as I'm talking through the basics of insurance over the course of the next 40 minutes or so I think we should we should think about you know how these new changes might be related to the basics of insurance so so information in general and then the use of data in insurance is making significant changes in the way insurance companies deal with various aspects of their operations the way they set prices the way they collect data on what their insured are doing in order to set prices or well for a variety of things so I have a couple of different things that we could think about here that might be aspects of market that we should consider when we're thinking about this change in information and data so number one does this data alter the way we deal with insurance fraud in such a way that it's reduced it becomes more difficult this is an important expense of insurance and thus improvements along that line would help insurance markets function better improved pricing certainly if we have better information we can set prices in a more precise way but that also raises other questions and we'll think about that a little bit later having data on consumers raises many privacy concerns as well who owns that data how can it be used much of that is quite personal data depending we're thinking about health insurance or other type some other types of insurance and so this race is concerned with as well there's also potentially increased innovation that's going on because of this access to data it creates sort of a fertile ground for new developments to come forth and so we want to think about that essentially and then regulatory challenges how do regulatory authorities keep up with all the changes that data is creating innings markets to make sure that the markets continue to improve or take advantage of all the opportunities to improve better going forward next question our next slide please thank you so what is insurance okay well so if you want to think about this on its most basic level we can think about insurance is just a way of transferring financial risk from one person to another entity maybe an insurance company and this of course we should keep in mind is not transferring the actual risk itself so imagine that we're thinking about a health insurance contract insurance contract you have you can't transfer the illness someone who's insured might have away from them but you are transferring the cost associating with treating that illness away from them so that the financial consequences aren't as severe right so that's what insurance is largely focusing on so we want to think about this oftentimes in terms of protecting these financial interests when losses occur rather and the deeper issue of preventing the risks themselves okay next slide please so let's think then a little bit about the benefits and also the benefits to insured and also the benefits to businesses and society broadly of insurance so some of these are going to seem pretty straightforward they probably the first thing you would think about for benefits for insurance so it pays to cover and insurance losses at least to some degree and we oftentimes say that means what we say that is indemnify the insurance from this loss it reduces uncertainty so planning becomes easier for individuals it also encourages more efficient use of resources if we're going back to that idea of thinking about how insurance markets matter for the economy if we can protect ourselves from risk it allows different types of business ventures or opportunities to be taken advantage of in life that might otherwise not have been open to us and then it also helps to reduce and prevent losses so there actually can be a level on which insurance changes incentives so that maybe risks actually do fall maybe not on the healthcare side we might even think of an example there too so I but we want to keep that distinct that those are two different things and then we can think about the benefits for a business in society certainly it supports access to credit availability of credit I you know think you know a simple example of that and I won't go through all these in great detail but you know if you think about an individual trying to get a home loan banks in order to protect themselves in case of person not paying their loan and paying their foot loan off fully under circumstances say when a house burns down the the in order for the loan to go through the the bank would require that there's a homeowner's policy that protects the collateral or the bank's interest in that loan and so if we didn't have insurance to protect the bank's interest it'd be much harder to get loans to buy houses so credit would not flow as freely in that certainly has a significant impact on the performance of our markets satisfies various legal requirements so certainly there there are situations where risk needs to be managed or contained for legal reasons also business requirements you oftentimes have enterprises that aren't for various reasons allowed to take on too much risk and that's are required to protect themselves there a variety of other reasons as well we could think as here provides sources for investment funds and also reduces social burdens so you might think about things like long term care health insurance provides an opportunity for people who retire to have protection from various types of medical issues late in life and that eases some of the some of the costs Society of helping to handle those those issues so for example at least okay we move on to the next slide great so of course when we think in a bit we also have to think costs because benefits are only a part of the story so I for insurance the natural thing would be to think the premiums they have to pay that's certainly a cost there also other costs you know maybe aren't big but actually understanding what they are what they're going to be buying turns out you know these products are relatively complex and that can be difficult insurance providers well they face also a variety of costs certainly their operating costs and your pocket profit should be included in that as well and the result the you know the enterprise may engage the risks they're taking on we can think about the the cost of fraud and inflated claims and those falling till we talk about those typically using the term moral hazards I'll say much more about that later so claims also can be caused by carelessness or indifference we call that morale hazard those morale hazards and and one thing to keep in mind here is that when we're thinking of insurance it's altering incentives we protect people from risk they may behave differently and so morale hazard and moral hazard both are are hitting on that issue and then also there's another cost certainly among many other things but another one which comes from frivolous lawsuits and oftentimes their frictions in the legal system where insurance companies might just find it less expensive to just settle than to actually pursue something okay thank you another slide great so now let's think about sort of the fundamental insurance principles you know so go back and think about this as an innovation what is it you know for most of history the ability to share risk wasn't an option so what are the things that we had to think of that would allow this to work effectively so three basic principles we'll talk about each of these in turn in more detail indemnification the law of large numbers and an insurable interest next time great so the principle of indemnity so so today indemnify means to compensate for a loss just the way a people in the insurance industry talk about compensation for losses and so one one key piece of this this principle then is that insurance shouldn't benefit people beyond the value of the loss they face right so I shouldn't be able to take out an insurance policy on my house that for a half million dollars on my house is only worth a quarter million so if people can profit off of insurance this creates potential problems which brings us to the last bullet point which is that with that potential to profit if we don't stop cap the amount that can be paid out by a policy the frequency with which losses might occur for insurance companies would increase and the severity meaning the amount that would have to be paid off for those incidents would also increase we've created an opportunity for fraud for sure right next slide please so now we get the law of large numbers a mathematical principle and it's critical to the to the actual effective functioning of insurance markets so so what's the idea here I well if we think about individuals and maybe think about this in terms of auto insurance you have an insurance company that's insuring a lot of drivers well for each driver they have a risk of getting into an accident and that risk is unpredictable but when it occurs for the driver it could be a very large financial cost and beyond right so so drivers potentially are going to benefit from being able to protect themselves from the financial side of that risk an insurance company then if you think about things from the insurance company's perspective if they're insuring a lot of individual drivers I they then are able to bring together all those losses right and then balance those out with all the people's the premiums that people have paid who didn't have losses I'm a large numbers tells us that when we aggregate all those individual risks all those individual drivers risk of accident assuming that their chance of having accidents is independent of others having accidents that the out of that pool of drivers we can expect a pretty predictable amount of accidents and in fact we can predict with a lot more certainty the amount of money we'll have to pay in claims we won't be able to say from the insurance company's perspective who's going to have an accident but we can say that out of say a hundred drivers you should expect to see 10-feet drivers have an accident over a year and that's pretty easily predicted and not at the insurance company level at the aggregator level we can take that risk and actually make it predictable and manageable next slide please so finally there has to be an insurable interest so an insured must suffer financially for some reason and due to that loss all right so you can think about a driver whose car might be totaled it from an accident or you might have a company doesn't have to be one's own property that's being insured you have a company that takes a life insurance policy on its CEO an intern in case of an untimely death right then you have an issue where the company would suffer from that separate of course from the CEO him or herself and so there's an insurable interest there and then also this supports this principle of indemnity again right that one can't gain from from some other loss that's not insurable all right please next slide okay so we want to move in on to economic issues with respect to pricing of insurance and so insurance policy pricing is actually a pretty complicated and really interesting process and that accounts to some degree for some of the complexity in the industry and some of the need for regulation if you can move on to the next slide great so so let's break this down into four key issues of insurance pricing so I figured that's why that insurance markets differ traditional markets in many ways these four issues don't aren't an exhaustive list but they're critical elements that an economist as we look at these markets would identify seperating insurance markets in a way that makes them you know it's not unique quite different so the first is adverse selection then we talk about Laurel and Murano hazard equity both actuarial and social and then timing and they'll move we'll talk about each of those in turn as well next fight doctor shaver Frank Tomasello at the Griffith foundation with a question or two we could pause for a moment are you able to to chat a little bit more and speak to how insurance markets differ from what you've referred to as traditional markets specifically how do these differences necessitate differences in policy and regulation and I mean the types of markets yep absolutely I'd be happy to and actually some of this will be will be developed here on the next slide or to indirectly but let me let me set that up before I get to those so if you think about insurance markets it turns out that the product that's being sold is very different from many other products in what I would refer to as traditional markets so a simple example would be thinking of let's think about McDonald's for instance and selling hamburgers for McDonald's to sell a hamburger at a particular location the cost of producing and selling that hamburger is a known quantity to the company and the cost doesn't depend on who they sell the hamburger to and so they have a lot of information about the expenses they're going to have on the front end that lets them make better business decisions in terms of pricing and strategic decisions within the market but if you think about an insurer that's absolutely not the case who an insurer writes business to who they sell policies to it is critical in determining the actual cost of their business so you know if I go buy insurance from a company I might pose a particular risk and the cistern costs to the company someone else might pose a different one and not only that the company when they sell the policy won't necessarily know what the cost is going to be of insuring me because you know they're protecting me from the potential for something to happen in the future so both of those things create this lack of information and then the costs are dependent on who you sell to are two components that are oftentimes not present in markets as we consider them more broadly and so they actually can those plus other aspects of insurance markets contribute to a situation where competition doesn't insure outcomes that are efficient like we would expect to occur in normal markets that that makes sense any follow-up questions Frank thank you dr. shaver it does indeed make sense and I appreciate you clarifying another question to sort of loft out there and my sense is that you know in this lines ahead you may address this topic but if you could and if this is something you'll speak to later not to worry but are you able to chat a bit more about the impact of fraud on insurance pricing as well and I would imagine that sort of falls under that moral and morale hazard yeah all right right no absolutely so yeah why don't we why don't we hold off until that's maybe a slide just a slide away and then I'll take a little more time to think through that as we go through that fantastic excellent that would be wonderful but before we before we pick things back up I'll take a moment as well to remind the folks who are joining us that they're able to submit questions for you by entering them into the GoToMeeting interface that set up a brunette had referenced at the beginning of the program so we invite folks to feel free to do that and as questions come in we will take a look at them and pose them throughout the session so thank you very much doctor appreciate it okay all right so let's let's think then about these these four features of insurance markets that make them differ the first being adverse selection so this gets back to the actually the the issue I was in response to the question about what makes insurance markets different this is one of those components that that there's in insurance we talked about this as a selection problem but who you sell to matters right so I any in many markets the dynamics of picking who you sell products to or being careful to sell to particular people do not matter in the same way as they do in the insurance market oftentimes what you'll find is those who are most likely to buy insurance or the ones that are most likely to have losses and maybe even bigger losses so individuals who are buying insurance know that they're at risk and so if insurance companies end up selecting poorly and when I say some I don't mean they're picking who the right to necessarily but just that they end up selling business to a group of people that tend to be more at risk of having losses that they can find themselves in a situation where the costs are much higher than they had anticipated and so that creates essentially big problems for insurance companies and there are certainly some dynamics in the competition between firms using information as I was you know as we talked about it at the front end that that's becoming available that might exacerbate these types of problems okay could you go to the next slide great so so certainly since adverse selection is potentially a problem that the need to to avoid it is important so one way insurers do this is by collecting as much information as they can on their insurance and then using that information to more effectively anticipate the expense of insuring them and so as data becomes more available insurance companies are able to more precisely predict the expense associated with a particular insurance contract and that's price it better data collection though of course raises privacy concerns as I mentioned earlier well so you know issues of what information is relevant what is appropriate or what can insurance companies collect how much information is too much and on both of those you could imagine that a market might better with less information being collected so almost like an arms race but there can be cost associated with collecting information but that information is only valuable if someone has more than their competitors and once everybody develops that information there's no real gain so information is it's a particularly tricky issue in insurance market then there's the second or the third issue of how ensure information should be stored and then can it be shared is it portable also an important issue for consumers in terms of try and find out to shop very there to shop across different insurance companies next slide please great so this is this we can get back to the question here so immoral and morale hazard so so what are we dealing with here economist actually just talk about moral hazard I think this is a useful distinction those are behaviors generally we mean that there are certain behaviors that occur when someone's insured that increase lost frequency and/or the severity of losses so when we think about moral hazard we're thinking about dishonesty somebody once they purchase insurance knowing that they're protected from certain risks actively acts differently intends to act differently and use that insurances way to protect themselves themselves from those risks right so they're fundamentally the behavior changes but that's an intentional act in fact maybe that is a part of why they got insurance in the first place morale hazard then is more about carelessness or indifference it's it's that when people are insured even with the right intention they with the the intention of just protecting themselves from risk they might find that they become more careless unintentionally or they might be indifferent between riskier situations you can imagine someone who's driving a new car that has a collision policy that will cover any damage to their car when they are at fault for an accident and think they might drive a little differently from somebody who doesn't have that coverage and thus would have to pay for the damage to their car if they're at fault out-of-pocket and that's not necessarily so it might just be that you know that indifference or that lack of attention but not something that's intended generally so this is common a common concern in Auto products thinking about liability products general liability insurance and one method for discouraging this is creating risk sharing so if we think about fraud you know it might even fall into this this moral hazard category and in some circumstances and information increasing information actually can can allow us to address fraud maybe more effectively and oftentimes the way we structure our products in insurance markets can can also reduce the amount of fraud so for instance if you think about this last post point deductibles I oftentimes addressing moral hazard is it's something that's done through not taking away all of the risk that the insured is trying to insure themselves from so you know you can think about this with trying to reduce the use of trying to prevent excessive use of healthcare services with health insurance by creating a decibel where people pay out of pocket for the first several thousand dollars in services they receive enough money that it's not worth paying that money to then get access to greater financial protection that comes after you've reached the deductible and so that also takes away some of the incentives to engage in fraud because the return is going to be lower under those circumstances but then you take that go back to the information side of this too as insurance companies are collecting more information or getting better at managing the information that they have it's much easier to develop techniques for identifying unusual patterns in claims that are made that then would raise a flag about potential for fraud and so insurance companies can become much more focused on cases that are likely to be cases of fraud or more likely to be and that helps with this sort of balance that insurance companies face but while they like to investigate and prevent fraud that's expensive and so if you don't have a good way of identifying which policies are likely to be you know cases of fraud so information might very well allow for insurance companies increased information allow them to be more efficient at this and then lower the expense and actually prevent fraud because it's caught more frequently okay good next slide please okay so another issue then that we're facing is this idea of actuarial equity versus social equity so this first bullet point it start with fair discrimination don't sue so what does that mean what is the fair way to discriminate and here we're talking about setting prices for insurance how do we discriminate between people in in ways that capture that the difference and expenses are exposure to risk that they present so this is critical to insurance pricing now there are state laws that prohibit different types of discrimination and now those oftentimes being more social considerations certainly there are certain types of discriminating between individuals that we think are morally inappropriate or you know through political process design processes decide or are not things that we should be doing and so those also come into play in terms of setting insurance rates and this last point well what's interesting too though and one thing that the can be difficult for insurance companies is that different states set different standards and that can be good because that allows each state market to be tailored more to the particular needs of the the populations on the other hand it creates administrative difficulties and expenses when companies haven't developed different insurance products across each different state to be in line with those the standards and statutes that determine what is fair or unfair Goga next slide please okay so let's think about a little bit more carefully I can go into this a little more deeply we have actuarial equity so this is basically setting premiums in a way that's proportional to the risk that an insured is exposing the company to and so this is really based on on costs and so how does firm students will they look at the various variables that they can or the data they can find on individuals look at how that's related to the likelihood of losses and then the severity of losses and then use that estimate how how much they think it's going to cost to insure someone now some of those variables depending on the state as I was just mentioning might be prohibited by state law and so then companies have to think about other ways of doing that or not actually price those aspects of individuals costs potential costs now the social equity which would sort of mixed in with what we were talking about earlier too is more about thinking about how pricing should be done in a moral or from a policy side so we think about there things like the ability to do all people should all people have access to insurance of certain kind and also we think about this in other ways we might think about it in some levels it depends on how we think about insurance some factors pose financial risk to people but are outside of their control and do we think insurance products should protect them potentially from that so you might think about health insurance and somebody who has a genetic predisposition to heart disease does that person how should that person is appropriate for that person to pay more because they have this likelihood of being more expensive to insure and having health problems or should insurance be able to protect people from having that predisposition meaning that their price the price of their insurance policy shouldn't be different even though the cost of insuring them is potentially different so those again are more moral questions those those are questions that we think about but you know that our chose that our decided through a political process next slide please so then the last thing here is talk about timing and I already did this a little bit earlier about not knowing the expense of a policy when it's sold there are different types of losses and insurance companies depending on the product they sell may deal with one or both so short tail losses are losses that are quickly recognized easily valued in the short term and then settle and you know examples of that might be comprehensive coverage for a private passenger auto or a private passenger auto claim say hail damage it doesn't take long to take the car to a body shop get get a sense for how much it's going to cost to repair and then actually kind of check to the insured who's covered now long tail losses pose a very different dilemma for insurance companies in a while these are losses that oftentimes can take a long time to manifest they're oftentimes difficult to value and then they take a great deal of time frequently to settle as well so you can think about bodily injury claims to liability someone in an auto accident they have made me have health problems that developed from that accident two three years down the road oh or you might think about asbestos claims if you're wanting to think about a very long term tale so there and so those the longer the tale the longer the timing the the more more difficult it is to set rates appropriately and so the more complex pricing becomes and so greater data is we're talking about the increase in data that's available can maybe help us address these problems to some degree make it easier to work for markets to work more effectively on some of these longer tale terms okay could you guys take the next slide please okay so real quickly let's break down some of the characteristics of insurable risks so and some of this start to sound familiar the first one actually hits on to some degree on the law of large numbers that you want a large quantity of similar people or objects may be subject to a lot so you want a pool of comparable people or objects that you can then sell your insurance product to and pull their risks together I lost this should be fortuitous so if they're predictable that's a separate issue so it's got to be chance we can't predict when it's going to happen so individuals have to be protecting themselves from that risk the amount of an expected loss needs to be able to be predicted otherwise insurance companies don't know how to set an affair or appropriate priced losses which can't be catastrophic to the insurer if been sure losses goes out of business then they can't they can't satisfies all the contracts that gave written and so that's a situation that need that we want to avoid typically in insurance markets the time the location and the extent of a loss needs to be able to be determined we have to have information on this in order to to to address the issues in satisfying the contract and then covering the expected losses not only so slightly different from catastrophic it still has to be economically feasible for an insurer that catastrophic is much more extreme I can't is the insurer going to be in a place where they can actually satisfy the the on a reasonable level the needs of the insured next slide please okay so then let's think about what an insurance product looks like and so interest parts and products are kind of are different from a lot of products in another in a number of ways next slide it so one issue is this tangibility I you know it's always nice to buy something like driving a new car off on the lot you know what you bought but with insurance products there are no real physical characteristics you get a piece of paper with a lot of information about you know what the contract what's in the contract it represents a promise and that's a real thing but it's only a promise that's realized in the event of a loss I think they're oftentimes there's a sentiment among consumers that insurance is you know be paid for something and they didn't get anything back for it when they go you know for a time period without a loss now that's of course a lucky thing and they were still protected from risk but it's not an easy thing to see and so it's easy to miss what all is being purchased with an insurance product the product benefits only typically become apparent when there's a loss and depending on the nature of the product you know what's being insured this could be a very unpleasant time for those insured you think about a health situation and it can also be a situation where this emotionally very complicated is very difficult so insurance companies are in a difficult situation in terms of assisting their insured in when they're dealing with these losses next slide so component the complexity and the legal and sort of the legal status of these contract in fact I think you know if you look if you take a look at an insurance contract it's a little bit like a credit card contract there's a lot of legal you know terminology that's difficult for consumers to understand on top of that with insurance products it's oftentimes it's very difficult for insurer for consumers to know exactly what the coverage is due so the breadth of coverages so if we think about auto insurance again we can imagine you know well you know what does comprehensive insurance really cover when does collision insurance actually you know replace the value of my car those things there are oftentimes qualifications on those and for those things can be very confusing and so that can be a hurdle to insurance markets working effectively and oftentimes you will hear about people who have insurance products that are upset about them when they have a lot because they didn't recognize there were limits to the coverages that were in the contract again a failure to convey information so also you know given the insurance policies or legal contracts resolving the situations when there's when there's a loss oftentimes can lead to messy legal situations where attorneys are higher courts may be involved it may even go to regulators or legislators may may step in to address an issue going forward so there are a variety of issues here that make this product insurance products relatively tricky next slide all right so now we can also think about insurance and how it's used as a way to manage risk so you might imagine you can think about this as companies as businesses or as individuals we're all exposed to risk so how do we handle that risk and or do we do nothing at all right next one so here's some here's a basic sort of approach to risk management so first off the product in the process is identifying what risks one's exposed to and upon recognizing those risks of course you know one might not be able to predict all of them and that becomes another difficult category the the risks that you know you don't know about but upon identifying what risks you think you're likely exposed to analyzing those risks to identify how severe those risks are how likely they are to occur thinking about you know the nature of those risks is critical the next step would be mitigating those risks and that you know can you prevent the risks certainly certain types of in you know risks are avoidable other risks are unavoidable but you might be able to alter various aspects of your situation to reduce the risk of those issues and then finally there's this question of does one retain because one transfer that risk after you run through these earlier steps next slide please dr. Shainberg Frank Tomasello with a question to inject here going to risk mitigation are you able to speak for a moment or two about perhaps some mitigation techniques that are used to prevent or reduce risks and kind of as a follow-up or are insurer's offering incentives to those who employ some of these mitigation techniques yeah yeah absolutely that's a great question so a couple examples apps so first off you might think about if you think about health care insurance you might think about wellness programs and these are also getting to the second part of your second question these also involved incentives and pricing differences so you might think about programs the encourage companies who employees to get health checks to engage in physical activity that there are incentives there that if potentially in some contracts where if enough individuals participation in this program the price of insurance will will go down for the company and for those individuals you oftentimes see and health health insurance even insured individuals who are covered receiving payoff money for for various types of positive of activities that improve their likelihood of not having an illness so you know regular check-ups that make sure that you know that makes it more likely to catch any illness early and before it becomes more expensive to treat and more damaging to their lives you can think about auto insurance you can think about examples of discounts for individuals that participate in safe driving courses with some of the new technologies that are used to price individuals by tracking their driving there is a reduction in the price of insurance when people drive more safely and times of day when they're less likely to get into accidents and certainly there are older types of you know there's more traditional ways of dealing with some of these issues like you think about home owners insurance and discounts that are associated with having buyer security alarms or improvements in the house that make it less likely to suffer some sort of risk suffer from some sort of risk so yeah okay so so getting back into this does that fully answer the question thing anything else you'd like me to speak to no that's very helpful thank you greatly appreciate it great so so then retaining and transferring loss loss explosion I want it I wanna go into a little more detail with this so some loss exposures you know if you think about whether to retain or not some of them aren't going to present a serious issue in terms of cost and they're worth retaining others though might might rise to a level that one feels that they need to be avoided and so you know businesses do this individuals do this they then move to this step of thinking about how to transfer this risk so for those that can't risk risk exposures that are managed better through transferring oftentimes that transfer is to an insurance company that provides that protection and there are other parties other ways of diverting risk as well probably goes too far afield for now so why don't we move on to the next slide all right so then we can say a little bit more about insurance markets and how they're regulated why they're regulated in part I guess what I would say here is that some of the features of insurance markets we've talked about and the nature of the product itself are just our justifications that are given for some sort of regulatory influence that the idea is that insurance markets been left to their own devices are not and do not ensure efficient outcome like more traditional markets oftentimes will and so insurance regulation is oftentimes 'inna as a way to to make sure that those those forces that might be imbalanced in insurance markets remain in balance now there's a second valid issue of course with regulated insurance markets with which goes to the policy side the more normative or moral questions about what's the right thing to do in terms of how companies discriminate with price for instance so there's these two sort of components is one making the markets work efficiently as possible then - there's this issue of the morality of the markets next slide please great okay so with that in mind let's think about a little bit about some of the basic aspects of regulations though one one key element is consumer protection so regulating and standardizing insurance policies I mentioned earlier that policies can be very complex and difficult to understand the more uniform the product is that it's being sold across all the companies in the market easier it is for consumers to compare the products between the companies and understand what's being sold now of course that standardization has a cost that means the companies can't tailor their products to particular needs and so there's there has to be a balance between those for the most efficient market possible market controlling market conduct and preventing unfair trade practices so there's the potential for an imbalance in terms of the power that insurance companies have relative to the consumers and so a regulation often times is focusing on that to some degree and then ensuring that insurance is available and affordable so there are arguments for access to insurance maybe that aren't coming from the efficiency side to come from the more policy side from the policy oriented side one other big feature of insurance solvency of inch of insurance regulation is solvency so insurers in orders for insurers to actually pay claims they have to still be in business right so oftentimes in fact one of the big initial justifications for regulation was to protect the public interest because of circumstances where competition was driving insurance companies out of business and then finally to faith safeguards the fund that insurers hold until they need to be distributed to individuals that they've promised to insure next slide great so that's that's the end of what I have to say in terms of the basics I'd be happy to take some time to answer any more questions that are that are available that are out there doctor shaver thank you very much we've covered a lot of ground questions abound and time is limited here we should take a minute remind folks that if they have questions they certainly can submit them for you by entering them into the GoToMeeting interface a couple of questions for you we'll cover as many as we can here in limited time okay dr. shaver I don't believe that we've talked at all about the topic of reinsurance so this question is before us what is reinsurance and what role does it play in insurance markets that's a great question right so the reinsurance is ultimately you can think of it as insurance that insurance companies buy to protect themselves from unexpected losses or losses that are too large so if you think about this idea of transferring risk you have individuals that are consumers of insurance in a market they're all exposed to lots of risks and they're looking to protect themselves from those they go to an insurance company and trans by a policy and transfer that risk to the insurance company once insurance companies are holding a lot at risk the law of large numbers helps them make it more predictable if they're you know if everything is set up correctly but there still can be there still risk associated with holding that risk with that transferred risk so oftentimes insurance companies in order to protect themselves from that that risk that they've taken on you just go ahead and then buy insurance over some of the policies or potentially all depending on how it's structured that they have already in order to take some of the edge off if an unexpected rash of losses occurs for instance and thus they end up having to pay out more in claims than is expected then was a expected and it's like yes I think that's so generally so there are there insurance I mean really the reinsurance market is a it's an international market there are a fair number of reinsurance companies they sell really their consumers are insurance companies and they're just and there are a number of different types actually I guess I could pay a little bit more on that you can think about sort of different types of reinsurance some reinsurance is what you refer to as proportional reinsurance where the insurance companies basically ensures some percentage of their their business so maybe 25% of the losses that they might experience will be taken by the reinsurance company and so they they avoid some some part of the losses they might have through that type of market now there's also what's referred to as another category called non-proportional reinsurance and there you have a situation where you might have the insurance companies that that are more just worried about say excess loss that they have you think they've got a good handle on things but there there's they can't predict the likelihood of something that's more catastrophic and so they they basically put they buy a policy from a reinsurance company where the reinsurance company only starts to to take on the risk after a certain amount of premiums are paid out by the insurance company so you know it might be an insurance company says buy the policy from a reinsurance company they covers the first five million that where the insurance company will cover the first five million dollars of claims it has to pay out but beyond that level the reinsurance companies the policy from the reinsurance company will cover payments going beyond that five million so the insurance company then knows it's its losses are capped at five million okay so I think that's any further question on on that or other questions a quick follow-up on the the topic of reinsurance then another question or two as time permits here or reinsures rates approved by state and if not can you talk a bit about how they are evaluated with respect to financial health ability to pay claims etc yeah yeah okay I can give you a couple things on that so I leave my understanding the reinsurance markets is in fact that the rates are not regulated whereas in you know if you think about auto insurance markets or homeowners insurance rates are are actively regulated that said though they're absolutely ins regulation of reinsurance market so I my understanding of reinsurance is that the goal is is more about solvency and so you have issues of sort of I guess the way I heard it you know sort of described and I think I could say it best is that you sort of have direct regulation where you have you know state insurance the insurance departments that are have certain expectations for how much in the way of assets and the type of business reinsures are writing in order sort of requirements for surplus or the minimum capital on hand this type of these types of restrictions to make sure that the company the reinsurance companies that are writing reinsurance in that state states market are going to be available or solvent right available when they have to meet claims and this could also be things you know this can go over into things like investment restrictions they can only invest their their funds in certain sort of safe assets and so forth then there's also more what I would say is sort of indirect regulation where it's not the insurance company directly being and ensure that saying okay this is how the transactions have to occur on reinsurance but that there can be sort of policies where maybe for accounting reasons that if if if reinsurance companies organize themselves in certain ways they can avoid certain expenses or they can they can actually they can maybe not have to hold as much in reserve or a sum that they hold in reserve counts against their their liabilities in a way we wouldn't have otherwise I think that's about all I I will say this reinsurance is not an area of my expertise so we're getting to the point where I think I would I would say if you if you have further questions on reinsurance that in some of the subsequent webinars I think you'll have people that are going to be better positioned to talk in more detail about that and I would I would certainly recommend into asking I think it's a fascinating area very helpful thank you very much in the interest of time just to further questions for you okay you talked a bit earlier about this notion that insurance products are at times difficult for consumers to understand it's difficult for consumers sometimes to value what insurance provides them do you have any thoughts on how those dynamics might be addressed yeah so sure I think generally the one thing I spoke to earlier not in a whole lot of detail but that I think standardization of policies is one aspect the easier it is the simpler the the policy is the the what is being purchased the easier it can be explained to people and the more it stays the same from company to company the less you know difficult it is to understand what you're buying yeah you can think of examples where especially with with legal contracts I got I think this is maybe this may be going a little far afield but I think that as I recall in the state of Missouri when you're looking at leases for renting apartments that Lee says there is basically there's a certain standard for what Elyse can hold and what it can't and that's uniform it would regardless all leases it applies to all leases and so you know even if someone wants to write an unusual contract for leasing an apartment that it really it doesn't supersede the the general lease and so consumers are protected by by that general contract in so form and so I think that that's one thing is creating enough uniformity so that easier understand what what what's being bought and that it's harder for its it reduces that variability now I said of course I also noted that there's a downside to that and so there's some balance there another issue that I think is really exciting is thinking about and this is something I think it's really important for policy makers when they're thinking about these issues of all the new information and data that's being used in insurance markets you know by by using information I think we can actually we can address some of these some of these issues and so I certainly said a little bit differently here so the so if we have so say we're thinking about a consumer that's wanting to buy an auto insurance policy and what innovation that exists now is that there are some companies that will track where you're driving and there's an app that you can have on your phone that actually gives you feedback on how you're doing what impact the driving style that you're engaging in will have under premiums so you get this flow of information through this innovation that actually makes it easier for consumer to understand how their behavior relates to the price of the product they've purchased and so when we're thinking about when policymakers are thinking about navigating these issues about regulation of you know information and its usage I think it's important to think about leaving space within those those standards that are developed for innovation that companies can come up with products that actually might help solve this this problem of streamlining the consumer side of the market so individuals know what they're purchasing and those incentives matter that can change those can change the way people doesn't sentence can change the way people behave reduce the amount of accidents for instance if we're thinking and auto insurance and that's created actually a much more efficient market so so information is a really interesting component of this problem of trying to improve you know how well consumers understand what they're purchasing there are also other traditional ways in departments of insurance oftentimes are have a wealth of information online getting having you know consumers access that and understand that effectively is is another issue as well that's also tricky but so there are a lot of more traditional sort of ways of trying to help improve the flow of information in markets like these as well very helpful thank you doctor we have exceeded our time allotted for the afternoon here but let me sneak in one final question if this is something you can briefly address then be quite helpful in instances where existing risks may not meet requirements for the private insurance market the government can sometimes become involved in insurance markets can you talk just a little bit about that perhaps through the lens of the National Flood Insurance Program or other programs that folks might be familiar with and I note that you know this is territory that will be covered in some future programs that'd be helpful for our listeners to know about as well okay sure so I I guess I would say then I think really quickly about that but let's take the National Flood Insurance Program as our example you know if you go back to that list of characteristics that make a risk insurable I there are a couple things that that immediately stand out the was a problem with flooding and ensuring people from flood damage so one thing was noted on that list was it needs to be economically feasible for insurer to cover the loss whatever it is and then even going further than that you know when you think about it can't be a catastrophic so maybe if we think about it might be large and occurring at the same time so it's not just an expensive loss or a couple expensive losses but a large number of losses that are expensive that all seem to happen is about the same time if you'll remember my example earlier about the law of large numbers and it's important for insurance idea was is that when insurer takes on risk it's predictable for them and manageable because all the people who bought the policies that are transferring their risk to the insurance company are are in fact independent of each other and so they're not likely to all have access or have accidents or losses at the same time well when you think about flood insurance that absolutely isn't the case you oftentimes think about a hurricane in Florida you have a situation where you have a large number of policyholders with large you know with large expensive losses all occurring at exactly the same time and so this is the type of risk that insurance companies it almost magnifies the risk in a sense the insurance company is going to have a very difficult time collecting and having assets on hand to account for that major shock that comes from a weather event like that and so that's in fact part of the reason for you know the government stepping in ultimately government the US government in this case governments have have the ability to absorb the risk it on a level that a private institution like a firm just can't do so usually with a lot of the same thing with unemployment insurance you have a situation where you have this breakdown of Independence it leads to quite large losses and it's a risk that isn't easily be managed by insurance companies and so there is this additional sort of backstop that said you could argue that these markets could evolve and through reinsurance or other types of new institutions that it would be more manageable and so that's always something to keep an eye on but traditionally it's the approach has been to use you know the government to backup certain types of insurance they're subject to these issues dr. shaver thank you very much it has been an informative hour or so we appreciate your insights and thank you for joining us also thank all of the folks who attended and submitted questions to us as well I want to turn things over to my colleague Jennifer Burnett that to CSG to share some final thoughts Jennifer thanks Frank and thank you dr. shaver as I mentioned at the start of the webinar we will be we recorded this and we'll be archiving it in the PSD Knowledge Center and by the Griffin foundation so if you missed any part of the program or we'd like to recommend it to a friend it will be available within the next week online and also I mentioned that this is a series so our next webinar in this series will be on September 27th at 2 p.m. where we're going to hear from Professor duck and David poozer from Saint John's University of property and casualty insurance basics so on behalf of Frank Costello the Griffin foundation and the Council of state governments thanks everyone for joining us today and have a good afternoon we're done

Show moreFrequently asked questions

What is needed for an electronic signature?

How do I sign a PDF electronically?

How do I sign documents in PDF format?

Get more for insure initial order with airSlate SignNow

- Wet countersignature

- Prove electronically signed Business Sale Agreement Template

- Endorse digisign Bonus Program

- Authorize signature service airsial

- Anneal mark Mortgage Deed

- Justify esign Mobile App Design Proposal Template

- Try countersign Source Code License Agreement Template

- Add Transfer Agreement esign

- Send Design Quote Template signature block

- Fax Church Invitation signature service

- Seal Summer Camp Physical Form email signature

- Password Interior Design Proposal Template signatory

- Pass Hold Harmless (Indemnity) Agreement initials

- Renew Owner Financing Contract byline

- Test Occupational First Aid Patient Assessment esigning

- Require Independent Contractor Agreement Template digisign

- Comment observer electronically signed

- Boost seer digital signature

- Call for receiver countersignature

- Void Gardening Contract Template template initial

- Adopt Relocation Agreement template signature

- Vouch Hogwarts Express Ticket template email signature

- Establish Current SSY Agreement template digital signature

- Clear Car Wash Proposal Template template electronically signed

- Complete Transfer of Pet Ownership template byline

- Force Rental Invoice Template template digi-sign

- Permit Job Confirmation Letter template esign

- Customize Manufacturing and Supply Agreement template signature block