Redline Corporate Governance Charter with airSlate SignNow

Get the powerful eSignature capabilities you need from the company you trust

Select the pro service created for professionals

Set up eSignature API quickly

Work better together

Redline corporate governance charter, in minutes

Cut the closing time

Maintain important information safe

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Your step-by-step guide — redline corporate governance charter

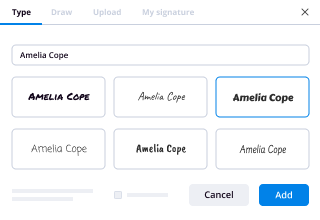

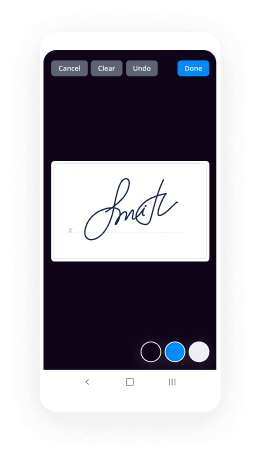

Employing airSlate SignNow’s electronic signature any organization can enhance signature workflows and sign online in real-time, giving a greater experience to clients and workers. redline Corporate Governance Charter in a couple of simple actions. Our mobile apps make operating on the move achievable, even while offline! eSign contracts from any place in the world and make trades faster.

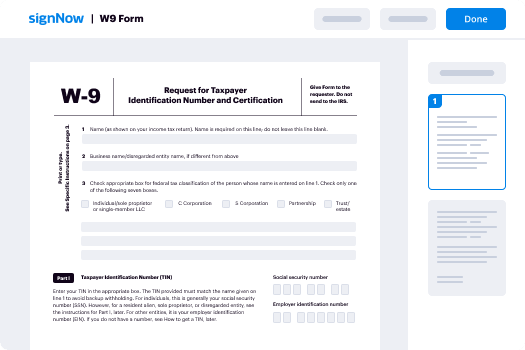

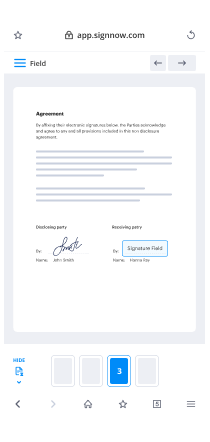

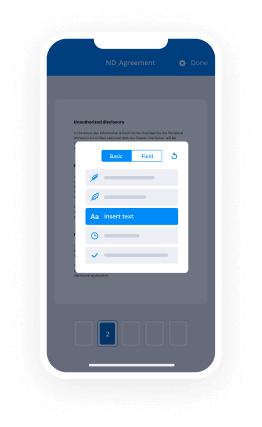

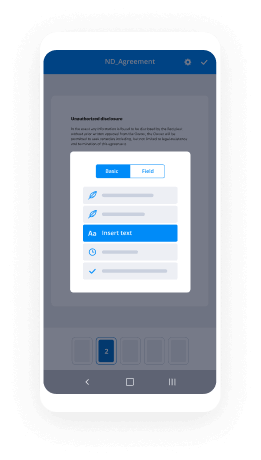

Follow the step-by-step instruction to redline Corporate Governance Charter:

- Log on to your airSlate SignNow account.

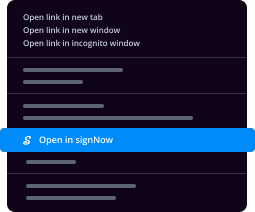

- Find your record within your folders or upload a new one.

- Open the record and make edits using the Tools menu.

- Place fillable boxes, add textual content and eSign it.

- Include several signees using their emails and set the signing sequence.

- Specify which individuals can get an signed version.

- Use Advanced Options to reduce access to the document add an expiry date.

- Press Save and Close when done.

Moreover, there are more extended tools open to redline Corporate Governance Charter. List users to your collaborative work enviroment, browse teams, and monitor cooperation. Numerous consumers all over the US and Europe concur that a system that brings people together in a single cohesive workspace, is exactly what organizations need to keep workflows functioning effortlessly. The airSlate SignNow REST API allows you to embed eSignatures into your application, website, CRM or cloud storage. Try out airSlate SignNow and get faster, easier and overall more efficient eSignature workflows!

How it works

airSlate SignNow features that users love

See exceptional results redline Corporate Governance Charter with airSlate SignNow

Get legally-binding signatures now!

What active users are saying — redline corporate governance charter

Related searches to redline Corporate Governance Charter with airSlate airSlate SignNow

Redline corporate governance charter

[Music] these days if we open up the the roster of the top shareholders in any publicity company especially large-cap you see the top 5 pretty much on 15 to 20 percent and from a economics Nobel laureate professor Oliver Hart who won a Nobel Prize a couple years ago so he recently wrote quite influential article bases say you know the purpose of the the company should not be maximize shareholder value per se as the the market value but maximize shareholder utility or shareholder welfare so the argument is that suppose I am the sole shareholder of a company obviously I would tell the CEO to do that maximize my welfare not necessarily maximize my world so his argument that this should not change if the if they're multiple shareholders now as both professors pointed out when a company is very diverse the old it's very difficult to reach a consensus or the shareholder welfare utility is and probably the common denominator is shareholder value I think that's that's a common standard but these days because these top five top institutional shareholders they are collectively pivotal in pretty much every proxy voting because they own fifteen to twenty percent so is it possible that the taste the preference the Blackrock fidelity vanguard of core the difference among them but it is possible that the preference of these organizations will dominate the purpose of the company because they cast the vote and they pretty much determine which direction the company is going so are we at risk or maybe you know every year Larry thinks and educating letter to all the CEO telling them how to do good and do well but how it is directing us these top five going to set up the right value system or should they also be focusing on the value because they're responsible they have fiduciary duty to their own investors who are the automatic beneficial owners of the company so very would like to have some clarification on issue so I've been an academic for the last thirty years and as you might imagine as you probably know right the the proof of the American profess aureate leans left and sometimes very far left and has all sorts of views about social justice and how society should be organized and what you may not know is of course we have pension money that has to be invested and at any university you have a choice of investment vehicles you can invest in an index fund or something equivalent to an index fund whether it be a Vanguard fund or some other fund and on every menu you'll find that there are the Calvert social investment funds as well and the Calvert social investment funds have a different different goal the index funds are trying to match market returns at the lowest possible cost but the social investment funds are willing to sacrifice some return in order to achieve social goals not surprisingly if you're cynical as I am overwhelmingly regardless of where people are in the political spectrum no matter how far on the Left they are they put their money not into the Calvert social investment funds but into the index funds because they're saving for their retirement too and they want to get the highest returns so that down the line they can afford to continue to hold their views and make their points and make the charitable contributions that they want to make so almost without regard to to one's political views when it comes to one's personal investments it is generally done in the way that the finance professors would predict it's different of course when you're talking about university money because there are a few pleasures purer than giving away somebody else's money and when it's about somebody else's money one can indulge one can pursue ones ones goals without having to to bear the costs what I worry about and what I think everybody should worry about is that as we're giving the asset managers all sorts of advice on how they should be actually furthering social goals and taking into account the interests of various stakeholders and departing from the fairly straightforward if difficult task of maximizing risk adjusted returns at the lowest possible cost that we better worry about the accountability at the asset managers that when we tell them we want them do all these different things many of which are in conflict with each other just as one worries about accountability at the board level in a multi stakeholder approach because any decision of a me sort can be justified if you owe duties to an inconsistent set of of interests so to at the asset management level and even more the asset management level does one is one concerned with that and it gets even worse because of the political salience of asset management I was on a panel at the SEC and ended up not being able to say anything because Phil Gramm the the former senator from from Texas was on the panel and and talked at great length what did you talk about it was a panel on proxy advisory firms but he didn't actually care about proxy advisory firms what he cared about was what the large asset managers were doing and he made the following argument he said you liberals to the people in the audience and listening online he said you liberals have these views on the environment and you tried to get your preferred environmental he said of course with his Texas accent what I'm not gonna try to mimic I you tried to get your environmental principles enacted into law and you lost in the legislature and then you try to get the courts to implement your preferred environmental policy and you're lost in the courts and now you're trying to implement your environmental poles using the assets of America's working peoples with the money that they're saving for retirement and that's outrageous you have no right to take your principles your your political views and use America's workers retirement assets to to do that and so what should happen he thought was that the asset manager should stick to their knitting and just try to increase returns for the workers that political argument I think is an incredibly powerful political argument that if on the Left we say we want workers to to consider we want firms to consider the interest of workers more we want asset managers to to tell firms that they should they should give more to the workers they should give greater share of the workers and so forth beyond what the labor markets demand you run the risk of the politicization of this because you know that phil gramm is going to come back with the alternative view so so i have on this set of points like like three things to make points points to me first really following up on what what ed just said the trade association of the public pension funds which you know represents a trillion or so dollars in assets the vehemently opposed the Business Roundtable letter on the grounds that wait a minute these are retirement savings for public employees and you know trying to increase the ability of cities miss pallies etc to maximize those retirement payments is the only thing we should be concerned with and this goes to the point really the difficult factual question is to who benefits from appreciation from maximization of share value what is the incidence of the benefit of right I think that's a very important and questions certainly secondly many of the asset managers act on behalf of like ERISA special retirement savings plan for employees which require strict sole benefit rules for beneficiaries so the only action that that an asset manager who has responsibility for that pool the money can take is strictly speaking with with respect to the sole benefit a financial benefit of the beneficiaries the third point and this is a point on thinking through right now is what I call systemic stewardship so if you are a universal investor if you're a black rock with a portfolio across the entire economy well you know from finance theory that you improve welfare of your beneficiaries by increasing expected returns and by reducing systemic risk well expected returns means not just at a firm specific level because that's just what they call idiosyncratic if you make one one competitor good then maybe the other competitors are less make make make less money have you improved the portfolio results as a whole part of the argument on behalf of the activism is that if if there's what I call kind of governance externalities if all these managers are under pressure then they will all be then collectively the economy is more productive and so it would increase expected return for diversified investor but the second point and this is where you know I'm kind of working on this is is the notion of systemic risk so if if think about say climate change as a systemic or think about you know gross income inequality as a systemic risk which is to say the kind of or excessive risk-taking by financial firms as a systemic risk which is to say if the risk materializes in adverse ways it's going to impose losses across the entire portfolio and that systemic risk is going to be priced in an expectation and reduce the value of the portfolio so so so you know I I think a possible way for these asset managers that is described to think about what role they might play on some of these contested issues that Senator Graham raises is this pure finance story that we can make it better for our beneficiaries if we lower these systemic risks and if a big systemic risk is the incidence of o'clock hole I'm at change for the adverse results then maybe we as financial fiduciaries really ought to be thinking about that now the implementation of that you know is kind of early innings at least for me and I don't disagree with Ed that if Blackrock you know took a bold stand on the grounds that you know we're gonna reduce systemic risk that's what we're doing in whit's it's not a question of trading off it's just what we are obliged to do as a financial fiduciary that would lead to pushback but notice again that takes us very far away that kind of thinking takes us very far away from in effect the subject of the Business Roundtable letter the warren letter which imagines from my perspective that you can solve these big issues on a firm by firm basis and the actions by specific management teams and boards is going to really be the way to make head headway here and one further point about that and this is this is in a sense the Milton Friedman point right which he's kind of a Bugaboo in this debate so Friedman's concern was that if firms didn't think solely how to increase gains for the shareholders to make more money for the shareholders but were engaged in redistribution in in some way then pretty soon the next move is we'll wait a minute why should this why is why why should this Board of Directors gonna be you know probably men and women increasingly women of significant wealth social class position etc why should they be making the distributional choices and and it it then opens up the question once you've given up on the narrow mission statement and you see a broad mission statement then the governance arrangements as to who gets to make those decisions themselves become kind of open up and and pretty soon firms are sort of engaged in a very broad social function so so this is the part of the Friedman defense of what I think only for their shareholders is not just because the normative considerations for the shareholders Trump everybody it's you know he had a view about the correct relationship between government and firms and and in a way he was insane in giving managers a narrow focus only he was trying to avoid getting them in the big questions of governance I'm not defending that view particularly or saying the the therefore boards don't have responsibility to make these trade-offs and in particular that asset managers shouldn't be thinking about systemic stewardship I think that but I'm just sort of trying to suggest the broad range of considerations which you know the the Business Roundtable letter begins to him their their theory of politics here's a pretty narrow theory of politics as all I'm suggesting anyway so let me just follow up on that a little bit in terms of what is the politics what I take to be the politics behind this statement so if you take seriously the populist upsurge here and elsewhere in the world and you you think that it is related to sort of a hangover from the 2008 financial crisis and people sensing that the gains are not being fairly fairly shared and you worry about intrusive mandatory federal regulation what do you Elizabeth Warren statute what do you do Lizabeth Warren statute what do you do what is the private sector what is the private sector response that can preempt or avoid something like lilith Warren's accountable capitalism act so what's the answer that the the what's what I see happening is the sense that there needs to be a new arrangement among the private actors the firms and the asset managers in which there will be some way undefined exactly how that will there there will be a more equitable allocation of gains such that it will relieve the political pressure for more intrusive mandatory regulation what a my co-teacher at my seminar Marty Lipton refers to as a new paradigm and he's been pushing a new paradigm that essentially is meant to be a new settlement between the largest shareholders and the firm's to encourage and facilitate long term in investment and to facilitate greater game sharing with employees with the trade-off being greater breathing room provided by the shareholders that's what the new paradigm is trying to accomplish and it's trying to accomplish it in order to preempt or avoid something like the accountable capitalism act now I think I think that's an accurate description of what they're about it raises the question of whether it's good politics or bad politics whether it stands a chance of if there is a sufficient populist wave to ultimately elect Elizabeth Warren and we get to 2021 and she looks at the Business Roundtable letter and says you guys promulgated this two years ago but nothing's changed now we need to we were agree where an agreement on what the corporation should do it should deliver value to the customers invest employees deal fairly and ethically with supplier support communities and generate long term value I've got a plan for how to do that with mandatory employee representation and a variety of other things what I worry about in terms of the political the political sustainability and wisdom of something like the new paradigm or the Business Roundtable letter is is the Milton Friedman worry which is that you've as soon as you give up the the Polestar a furthering shareholder value and concede as one can read the Business Roundtable statement as doing that corporations owe obligations to all the stakeholders that in the political debate in the political debate you've given up the best argument for the private solution so I precisely want to follow up on that because when we'd read senator Warren's letter the the phrase repeat a 5-time is concrete steps so basically she challenged the business leaders you promised us this but exactly what are the concrete steps that you'll be taking so you know professor rocky talked about the settlement between the shareholders and corporations to do certain to do certain goods so to preempt or to avoid a more intrusive our level of regulation government intervention so my question would be this settlement really feasible because under the current governance system you know the the shareholders do get elected the board meetings voted on proxy they could launch a proxy context there could be a hostile takeover and a takeover you know the the directors have to follow strictly the fiduciary duty for the shareholder benefit so under the current governance rule can this settlement how this settlement could be feasible and if not is it a feasible for a presidential candidate or even a president to change the rule to elect board directors to make it have to be representatives of now shareholders such as employees it does happen elsewhere in the world so just wonder whether this you were feasible in the US well the law could change and then there would obviously be a period of adjustment as firms learned how to function with that German firms have cope mandatory co-determination for the largest public firms and they do very well but there are a lot of things that are different in Germany labor unions play a different role in Germany they have institutions like the works councils that bring in an employee voice in a variety of ways and so forth so you can run a very successful economy with co-determination it would take a period of time for us to do it right so so I guess I I start on this with with a different point of view which is income inequality and wealth inequality has not so much to do with large firms in the United States so their their first inequality in the United States has two different dimensions one of which is the hockey stick the point o 1% and everybody else that has nothing to do with the public firm and it has everything to do with the fact that a lot of economic activity occurs in a private business where their owners who are who have a lot of money and that's where the wealth is the latest tax data suggests really it's the flow-through enterprise of the firm's that are not even listed where the substantial wealth disparities really exist so nothing that's going to affect the public firm is going to touch on that secondly the income inequality debate in the United States again has two different dimensions one of which is between again the hockey stick at the far right hand side the 0.01% where the and the number of of the really wealthy is relatively small and the actual total dollars substantial but still across the broad economy not so huge the big the big inequality concern income and wealth is between the was without with just a high school or less or less education and those with college and more education and and if you look at the sort of the lines the non the high school in below wages and have been flat or declining over a long period of time College and above have with different degrees the the slope of increase is positive with different levels of positivity that inequality gap has again it's it's not really touched on by the Business Roundtable letter or any reform geared to that and and so my my concern is that what's sort of I mean a few things if you're concerned about the output of how this economic system has is producing is is is the governance of these firms really the right way is is that the lever is that the Archimedean point is that the catalytic point where the transformation or a big change can occur and and you know I'm drawn as I think about this too there was a very famous exchange in in the Davos meetings this past year where they had a Dutch economist who was on this panel discussing wet wealth in a call well wealth inequality and income inequality and they were discussing some of these governance issues and he said you know what it's taxes it's it's the estate tax it's the income tax it's other taxes and if you're not prepared to address those then the rest is BS and you're kidding yourself and so you know I mean Ben and I both got 30 years investment in this field and we want it to be sort of the most important field possible to the and social outcomes but I also think you got to be realistic about the tools that you're using which isn't to say that the governance questions and how firms behave and in particular firms in the multinational space behave so I was talking just earlier with Todd Baker who's sitting over there and we agreed that actually you know figuring out how to avoid the multinational shifting income to low-tax jurisdictions would be enormous ly beneficial at addressing many social questions because that's how you're gonna gin up resources to address them that's not a governance question right or it's not a corporate governance question and and climate change also maybe my systemic stewardship provides some lever for large owners to play a positive role but you know but again that that's not involved if you look at Elizabeth's letter it doesn't touch on that question at all you know it's just sort of worrying about communities and suppliers and employees with all respect that's kind of second order to you know the existential threat the climate change presents

Show moreFrequently asked questions

How can I make documents so that someone else can electronically sign them?

How do you sign your name on a PDF?

What is the difference between a digital signature and an electronic signature?

Get more for redline Corporate Governance Charter with airSlate SignNow

- Print electronically sign Rental Property Lease Agreement Template

- Prove electronically signing Pet Boarding Confirmation Letter

- Endorse digi-sign Holiday Party Invitation

- Authorize signature service Itinerary Planner

- Anneal mark Proxy Card

- Justify eSignature Creative Employment Application

- Try initial Wedding Contract

- Add Guaranty Agreement electronically signing

- Send Transportation Proposal Template mark

- Fax Home Inventory signed

- Seal Professional Employee Record autograph

- Password Bonus Plan digital sign

- Pass Remodeling Contract Template initial

- Renew Free California Room Rental Agreement Template electronically sign

- Test Freelance Web Development Request countersignature

- Require Chores Agreement Template digital signature

- Comment signatory signed electronically

- Boost donor electronic signature

- Compel gawker digisign

- Void Flooring Contract Template template eSign

- Adopt Interest Rate Lock Agreement template eSignature

- Vouch Music Business Proposal template autograph

- Establish Award Certificate template electronic signature

- Clear Barter Agreement Template template signed electronically

- Complete Appointment Confirmation Letter template electronically sign

- Force Living Will Template template sign

- Permit Single Page Business Plan template electronically signing

- Customize TV Show Pitch Template template mark