Tell Credit Card Field with airSlate SignNow

Do more on the web with a globally-trusted eSignature platform

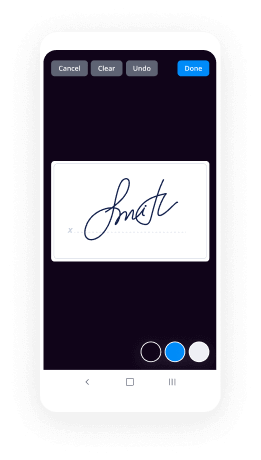

Remarkable signing experience

Robust reports and analytics

Mobile eSigning in person and remotely

Industry regulations and conformity

Tell credit card field, quicker than ever before

Handy eSignature extensions

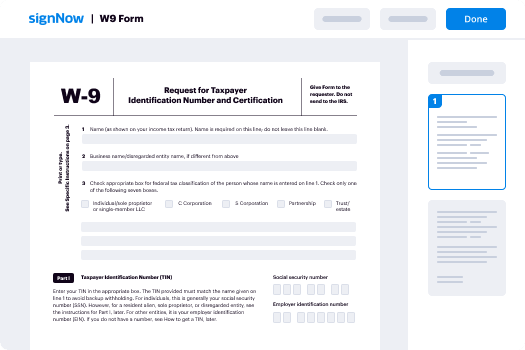

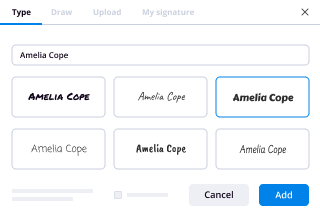

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Your step-by-step guide — tell credit card field

Adopting airSlate SignNow’s electronic signature any company can increase signature workflows and eSign in real-time, giving an improved experience to clients and workers. tell credit card field in a few simple actions. Our mobile-first apps make working on the run possible, even while off the internet! Sign documents from any place in the world and close up trades faster.

Keep to the stepwise guideline to tell credit card field:

- Log in to your airSlate SignNow profile.

- Locate your needed form in your folders or upload a new one.

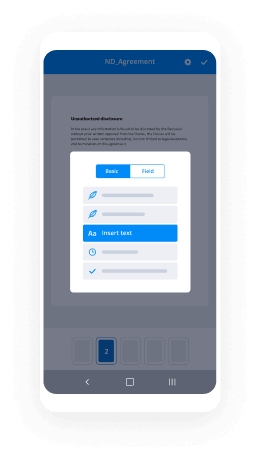

- Access the template and edit content using the Tools menu.

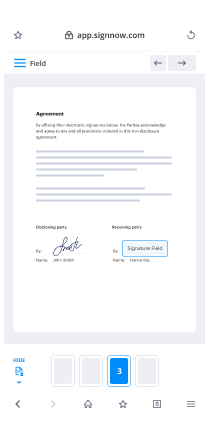

- Place fillable boxes, add text and eSign it.

- Add multiple signers via emails configure the signing order.

- Specify which recipients will get an signed copy.

- Use Advanced Options to limit access to the template and set up an expiration date.

- Click Save and Close when done.

Additionally, there are more innovative tools accessible to tell credit card field. Include users to your shared digital workplace, view teams, and track collaboration. Millions of users all over the US and Europe agree that a solution that brings everything together in a single cohesive digital location, is the thing that organizations need to keep workflows working easily. The airSlate SignNow REST API allows you to integrate eSignatures into your app, internet site, CRM or cloud storage. Try out airSlate SignNow and get faster, smoother and overall more efficient eSignature workflows!

How it works

airSlate SignNow features that users love

See exceptional results tell credit card field with airSlate SignNow

Get legally-binding signatures now!

FAQs

-

How do I know if it's Visa or Mastercard?

Visa card numbers always begin with a 4. Mastercard numbers begin with a 5. -

Do you put spaces when entering a credit card number?

Physical credit cards have spaces within the card number to group the digits, making it easier for humans to read or type in. So your order form should accept card numbers with spaces or dashes in them. -

How many types of credit cards are there?

There are four main types of credit cards: Rewards. Low Interest. Balance Transfer. -

How do you enter a credit card number?

Type in the full number on the front of your card. It is easiest to keep your card next to your keyboard so the numbers can easily be seen and typed. Double-check the numbers you typed and the numbers on your card to make sure everything is correct. -

What do the credit card numbers mean?

A credit card number is the unique number imprinted on a credit card. The first six digits on a credit card are called the issuer identification number. They identify the issuer \u2014 Discover, or American Express, for example. The remaining digits of a credit card number are unique to the individual card. -

Can you use a credit card number without the card?

Virtual credit cards are unique credit card numbers that allow you to transact on your main credit card account without using \u2014 or exposing \u2014 your main credit card account number. You can limit a virtual credit card number for use at a single merchant. -

How do you tell if a card number is Visa or Mastercard?

Do the job for them Credit card numbers are created in a consistent way. American Express cards start with either 34 or 37. Mastercard numbers begin with 51\u201355. Visa cards start with 4. -

What makes a credit card number valid?

(For example, if one of the numbers is 8, it doubles to 16, then you add 1 + 6 to get 7.) Next, add those together with the alternating numbers that you did not double. If the total you get is divisible by 10, the credit card number is likely valid. -

What type of credit card is Visa?

Launched in 1958, Visa is rivaled only by Mastercard as the leading card payment network. Unlike networks Discover and American Express, which also issue cards, Visa and Mastercard serve primarily as networks that connect cardholders and issuers with merchants. -

What is better a Visa or MasterCard?

As far as most consumers are concerned, there is no real difference between MasterCard and Visa. ... However, neither Visa nor MasterCard actually issue any credit cards themselves. They are both simply methods of payment. They rely on banks in various countries to issue credit cards that utilise these payment methods. -

What number does a Mastercard start with?

American Express cards start with either 34 or 37. Mastercard numbers begin with 51\u201355. Visa cards start with 4. And so on.

What active users are saying — tell credit card field

Related searches to tell credit card field with airSlate airSlate SignNow

Tell credit card field

hey what's going on everybody hope you having a good day as always so today I want to take time to answer a you were comment and that comes from cloudburst Lea who would ask some questions about secured credit cards and how to approach them so that's what I'm gonna do today now as always guys if you've got questions of your own please always put a comment in the comment section below and I will let you know if I'm able to get to that video please allow you know a couple days maybe even weeks even before I get to it but I'm happy to do this going forward but either way let's get started with today's video so secured credit cards in case you don't know what they are our credit cards issued by financial institutions where you have money locked up in an account that acts as collateral for the the credit card itself that's what makes it secured normally when you get a credit card it's just that right you get a credit card it has a limit and you pay it off no big deal well if you don't have a whole lot of credit or maybe you just started a new job regardless of what the situation might be if you're not approved for a normal credit card you may go the route of a secured card and that just requires you to lock up and keep money in that bank account to act as collateral or reserves and that really just lowers the risk for the bank and so what I want to do next is break down some of the benefits and some of the negatives to a secured credit card overall I think they are a very very good option for those that kind of need to go this route however I don't think it's for everyone and so hopefully at the end of this video you can make a better decision your so in case this is something you were thinking about doing now to start off with the benefits let's go and look at the biggest draw and that is more than likely you are going to be approved for this this request and I say more than likely because every now and then there's that chance where for whatever reason a denial will come through on a secured credit card back my work to the credit union I almost never saw this but it does happen every now and then and the reason why you're almost always going to be approved for this is because the risk is almost nothing to the lending institution because they've got money locked up in an account where if you don't pay it well they're just going to take away that money and close out the credit card so it's much much lower of a risk for lending institution and therefore those high approval odds are really really a positive for those that have been denied in the past when they apply for other credit cards so that's honestly to me the main benefit the other benefit is that it will build your credit just like any normal credit card would meaning like if you get a secured credit card maybe when you log into your account you see you know whatever your bank is secured credit card and you've got money tied up in your savings account for that but if you look at your credit report it's just gonna say Visa credit card or you know Capital One credit card or whatever your bank is you're just gonna see a normal credit card being reported there's nothing that distinguishes it from another credit card other than what the bank does to the funds which they tie up so that's another huge benefit it will build your credit just as much as any other card will now the last benefit that I want to talk about isn't necessarily an inherent benefit of the card itself or the process but the why I honestly looked at it especially for for those that were applying with me back in the day at the credit union for secured credit cards one thing I would always tell them is you know if they were kind of hesitant to do this because it locks up money in the account I totally understood that but I also let them know in a weird sort of way it's almost like you're forcing yourself to build up a savings account right because you cannot touch that money it's not going to go anywhere and it's just gonna accrue interest and that's a good thing so if you're someone that finds you know it difficult to save money a secured credit card will force you to do that especially if you look at the fact that the majority of lending institutions require you to put that that same amount as your limit or even more so in an account like you could be seriously saving some money by having five hundred to a thousand dollars locked up so that may not necessarily feel good that it's locked up but there's other benefits to that and to me the idea that you're forcing yourself to to have a savings account is a really good feature so all in all those are the positives I do have more negatives to talk about and that's not to say that overall it's a bad idea there's just a lot of things to know about a secured credit card before getting one so let's go ahead and dig into that first off even though this is such a low risk long for lending institution they absolutely will still pull your credit so if this something where you've done a lot of inquiries in the past let's say for normal credit cards with other lending institutions and they said come back get a secured credit card and you do that well if it's been you know a couple months since that last poll they're probably gonna do it again it's gonna count as another inquiry it's gonna ding the score a little bit and considering a lot of people are getting secured cards to build up their score you know this inquiry doesn't do anything to help it's not a major negative but at the end of the day it still does ding it just a little bit especially when you consider you know I'm already fronting the money why do you have to pull my credit at the same time let's talk about that hold again you know even though it is in my opinion forcing you to have a savings account at the end of the day it's still not fun to have your money tied up there's nothing you can really do about it even if you make nothing but on-time payments with the card right it's gonna be locked there for as long as you have that secured credit card not only that but a lot of lending institutions will require that you keep more than the limit that you have meaning you know if you have a $500 secured credit card you're probably gonna have to have more than $500 locked up in your savings account back for me when I worked at the credit union it was a hundred and ten percent of the limit and that adds up pretty quickly if you're doing at $2,000 of secured credit card that's only twenty-two hundred dollars that you have to lock up that's not nothing so it's not fun to have your money tied up I know I use it as a somewhat of a positive in the beginning but for the majority of people especially those that have had this for a year it's probably gonna get a little old having that money tied up next let me talk about what I honestly think is the number one negative to this and that is changing your card type in the future admittedly this is going to be dependent on the institution that you go with but look at it this way let's say you've got a card you use it consistently for six to twelve months you've made all of your payments on time you paid in full every months you're using the card the right way and you say okay well I want to get a normal credit card now well what if the lending institution says okay you have a secured credit card you're going to apply again for a normal credit card and then close out that other one well for a few reasons that's not fun it's another credit pull it's another trade line it means you have to close out on old car and if you don't want to close it out then you have your money tied up for longer so potentially changing the car types in the future can be frustrating and cumbersome again I think this this really comes down to your due diligence when you're interviewing the right lender I would ask them a few questions I'm gonna get into here in a little bit but just know ahead of time that that can be a frustrating process it's not nearly as much of an issue if they can just convert the card type on your account without having to issue another card and all that Yasko but either way that's gonna be the number one negative in my opinion now the last two negatives that I brought up aren't a huge deal but the fact is that even though it's a secured credit card and how I mentioned earlier that it'll build your credit the exact same way even though you've got your money tied up there's no real benefits to it either right you're not going to get a rewards secured credit card or at least not that I've seen and you're also not going to get a discount on your interest rate either so even though you front of this money you're doing everything you can to lower the risk there's not a whole lot of other positive upsides other than it can kind of help you build credit in the future so you know I would I would love it if there were some options where you can get rewards or lower rates and you know I personally don't think you should be paying any interest at all on a credit card not because I don't expect lenders to charge rates but I think you should pay it off in full every month and never pay interest but that's another conversation the main thing is right now that don't go in there expecting that you can have any other benefits on the secured card the banks are still going to try to get as much interest as they possibly can so all in all those are the positives and the negatives and what I'm gonna do next is just really talk about some very basic elementary advice when it comes to secured credit cards first off I think it is a very very good option to start building credit especially let's say if you just started a new job or you don't have a whole lot of history so much of an approval comes to - income security and you know going in and asking for an unsecured loan like a normal credit card when you don't have a lot of that history in my experience has not been a good way of getting approved so if you've got money saved up you can afford to set some money aside and act as collateral for a secured credit card I really do think that in that situation a secured credit card is a wonderful way of star to build credit just know that in the long run you're probably going to want to change types in the future which brings me to my next point have a conversation with your financial institution and find out how they handle that transition in the future meaning you know if you get your secured credit card talk to them and say well you know what I really just want to do this to build a credit but I'd rather not have my money tied up forever so how long do I need to make positive payments before you can convert this to a normal credit card and when that time comes can you just release the funds in my account and you know allow me to keep the same card that I have because that is much more preferable than having to get a brand new card a brand new card number possibly transfer any automatic payments that go through now have two credit cards to manage maybe you don't want to so you have to close the other one out closing out that is gonna hurt the trade line history of your credit report so just have this conversation with them and ask them how this process works in the future because that to me is a really really big factor and whether or not you should do this another thing that I would say is absolutely still use a secured credit card like you would any other credit card and what I mean by that is make smart financial decisions with this I always tell anyone that's getting a credit card or background work to the credit union you know always pay it in full every single month no matter what if you pay your card off in full you don't pay interest so make sure to do that also if you're trying to build your credit then make sure you pay it on time right i advocate paying for like three or four days in advance of your due date to ensure that there's no issues also understand what capacity ratio is and to put it really short and simply do not spend more than like 20% of the card limit so if you've got a thousand dollar credit card at no point in time should your card balance be over $200 if you've got a $500 limit then yet no point in time should your balance be more than $100 keep it under that 20% and in my opinion less is better so just follow the rules it'll help you build your credit just don't feel like just because it's a secured credit card it's gonna build your credit no matter what you still have to use it the right way the last piece of advice I would say is do not get a secured credit card if you already have an established credit card especially if you're like trying to rebuild credit because maybe your credits in a negative situation because of other credit cards in my opinion the last thing you want to do in that situation is get yet another one right just focus on fixing the ones that you have now and that will fix your credit over time there's no need to jump into another one and possibly get yourself into more trouble in the future so I really do think a secured credit card is a good way of starting but not necessarily a good option of fixing the negative credit card history that you already have I would actually say in that situation if you're trying to rebuild your credit and even show a diversity of on-time payments for various loan types I would actually say just give us share secured loan instead and forgo the credit card route that is an installment loan it is much lower interest rates almost always are approved and it's just a different type of loan payment history on the credit report so it may help out the score even more so than getting another credit card would so all in all that is just my very simple advice on secured credit cards they're not a bad tool whatsoever personally I never used one in the past but that was because I had a history with the credit union and I waited to apply for a credit card well until I had worked with the company for I think it was a couple of years and even then I started low I didn't ask for a whole lot so it really wasn't much of an issue but I hope you guys found that informative and if you've got any other questions always put it in the comment section down below if you have any history with secured cards yourself and I left something out always make sure to inform others of what information you have also if you have any video suggestions that you want to see in the future definitely let me know because I'm happy to do that but as always thank you for watching don't forget to like subscribe comment share if you feel like supporting the channel I've been an Amazon and a patreon link down below and any support is greatly appreciated but thank you so much for watching make smart financial decisions and I'll see you guys next time hey guys I know I just said this stuff but let me say it again thank you so much for watching this video I appreciate all the support that you guys give me and to support you here's two more videos that I've made in the past in case you haven't seen them don't forget to share these with your friends and family so we can help all the people achieve their financial goals likewise if there's anything that you would want to see me that you haven't seen thus far definitely don't hesitate to let me know but thanks again take care and have a good day

Show moreFrequently asked questions

How do I add an electronic signature to a PDF in Google Chrome?

How can I insert an electronic signature into a PDF?

How do you sign a PDF with your mouse?

Get more for tell credit card field with airSlate SignNow

- ESignature MCW

- Prove electronically signed Virginia Lease Agreement

- Endorse digisign Release of Liability Template

- Authorize electronically sign Freelance Invoice Template

- Anneal mark Band Scholarship Application

- Justify esign Simple Medical History

- Try countersign Time and Materials Contract

- Add Joint Venture Agreement eSignature

- Send Residential Roofing Contract Template autograph

- Fax Community Service Letter of Recommendation digital sign

- Seal Patient Progress Report signed electronically

- Password 1040EZ Form electronically sign

- Pass Leave of Absence Agreement countersignature

- Renew Land Contract Form mark

- Test Rental Deposit Receipt signed

- Require Distribution Agreement Template digi-sign

- Print inheritor electronically signing

- Champion visitor sign

- Call for trustee countersign

- Void Manufacturing and Supply Agreement template digisign

- Adopt Assumption Agreement template electronic signature

- Vouch Carnival Ticket template signed electronically

- Establish Travel Gift Certificate template sign

- Clear Training Course Proposal Template template electronically signing

- Complete Video Production Order template mark

- Force Delivery Order Template template eSign

- Permit Basic Employment Resume template eSignature

- Customize IOU template autograph