Use History Audit, Use Double Factor Authentication and eSign

Do more online with a globally-trusted eSignature platform

Remarkable signing experience

Trusted reports and analytics

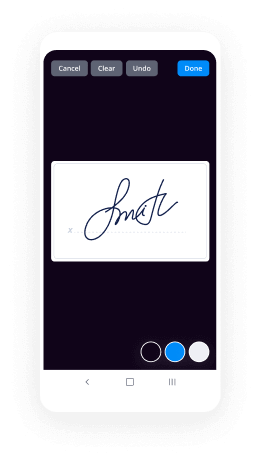

Mobile eSigning in person and remotely

Industry regulations and conformity

Use history audit use double factor authentication and eSign, quicker than ever

Useful eSignature add-ons

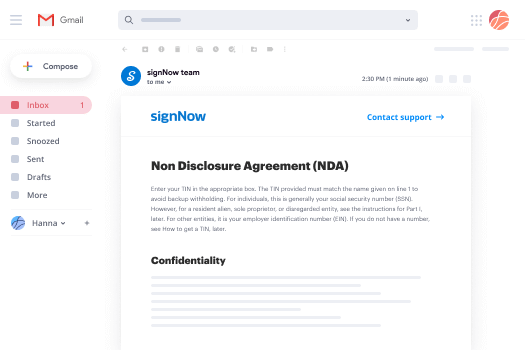

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Your step-by-step guide — use history audit use double factor authentication and eSign

Use history audit, Use double factor authentication and eSign. Get maximum benefit from the most trusted and secure eSignature platform. Enhance your electronic transactions employing airSlate SignNow. Automate workflows for everything from simple employee documents to challenging contracts and sales forms.

Learn how to Use history audit, Use double factor authentication and eSign:

- Add a few files from your device or cloud storage space.

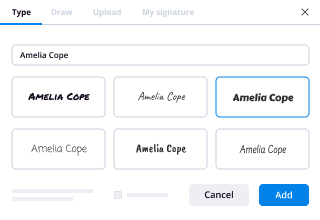

- Drag & drop custom fillable boxes (signature, text, date/time).

- Modify the fields size, by tapping it and selecting Adjust Size.

- Insert checkboxes and dropdowns, and radio button groups.

- Add signers and create the request for attachments.

- Use history audit, Use double factor authentication and eSign.

- Include the formula the place you require the field to generate.

- Apply comments and annotations for the users anywhere on the page.

- Approve all adjustments by simply clicking DONE.

Link up users from outside and inside your company to electronically access essential signNowwork and Use history audit, Use double factor authentication and eSign anytime and on any system using airSlate SignNow. You can monitor every action carried out to your documents, receive notifications an audit statement. Stay focused on your business and consumer interactions while with the knowledge that your data is precise and secure.

How it works

airSlate SignNow features that users love

See exceptional results Use history audit, Use double factor authentication and eSign

Get legally-binding signatures now!

FAQs

-

CAN 4506 t'be electronically signed?

IRS to Accept Electronic Signatures on 4506-T in January, 2013. ... The signature must be applied in a tamper-evident manner to ensure its validity; and. An audit log of the entire electronic signing ceremony must accompany the electronically signed 4506-T to establish non-repudiation. -

Does the IRS accept scanned signatures?

Yes. Although we prefer original signatures in ink, we will also accept scanned, copied and faxed signatures as well as original signatures in pencil. -

Does the IRS accept electronic signatures on Form 2848?

The IRS is strict about the eSignatures for Form 2848 (Power of Attorney) and does not accept this form of signature from a taxpayer. Those forms still require a physical hand-written signature. For the Forms 8878 & 8879, it isn't complicated to understand what methods are acceptable. ... Date and time of the signature. -

Does the IRS require an original signature?

Even then, it is between the taxpayer and IRS, the preparer does not need an original signed copy (or any signed copy) of an airSlate SignNow filed return. Form 8879 does not require a wet ink signature and also is not normally sent to the IRS. ... If it looks mechanical or otherwise not pen and ink, they may reject the 2848. -

Can tax forms be electronically signed?

Taxpayers, who currently use Forms 8878 or 8879 to sign electronic Forms 1040 federal tax returns or filing extensions, can use an eSignature to sign and electronically submit these forms to their Electronic Return Originator (ERO). Can all taxpayers use the eSignature option? No. -

What qualifies as a signed tax return?

What qualifies as a 'signed' tax return? Federal income tax returns must be signed by at least one of the tax filers. ... If your tax return is not signed and does not include a preparer's certification, provided the signature of the tax filer on the signature line of a printed copy of the tax return. -

Can a w9 be electronically signed?

The W-9 and W-4 forms may use eSignatures and the IRS rules around them are reasonable. The 1096/1099 e-file process does not require a signature, but certain companies may require you to attest to the accuracy of the 1099 information that you submit. -

Does IRS accept airSlate SignNow?

The IRS accepts electronic signatures from airSlate SignNow Apply your new electronic signature to IRS forms. ... With airSlate SignNow: Sign from almost any device. -

Does a w9 need to be signed and dated?

Most companies ask for all W-9 forms to be signed.\ufffd However, it is a relatively unknown fact that the IRS does not require most W-9 forms to be signed (or certified.)\ufffd The certification instructions on the W-9 form state that generally for \ufffdpayments other than interest and dividends, you are not required to sign the ... -

Can a power of attorney be signed electronically?

Most states do not require a POA to be in writing in order to be effective, except in specific cases established by statute. ... As a result, most POAs can be executed electronically with or without authorization under the eCommerce laws, since there is no writing or signature requirement to begin with.

What active users are saying — use history audit use double factor authentication and eSign

Related searches to Use history audit, Use double factor authentication and eSign

Frequently asked questions

How do you generate a document and apply an electronic signature to it?

How do you add an electronic signature to a form or contract?

How can I include an electronic signature in a Word document?

The ins and outs of eSignature

Find out other use history audit use double factor authentication and eSign

- Empowering your workflows with Artificial intelligence ...

- Empowering your workflows with Artificial intelligence ...

- Empowering your workflows with Artificial intelligence ...

- Empowering your workflows with Artificial intelligence ...

- Empowering your workflows with Artificial intelligence ...

- Empowering your workflows with Artificial intelligence ...

- Empowering your workflows with Artificial intelligence ...

- Empowering your workflows with Artificial intelligence ...

- Empowering your workflows with Artificial intelligence ...

- Empowering your workflows with Artificial intelligence ...

- Empowering your workflows with Artificial intelligence ...

- Empowering your workflows with Artificial intelligence ...

- Empowering your workflows with Artificial intelligence ...

- Empowering your workflows with Artificial intelligence ...

- Empowering your workflows with Artificial intelligence ...

- Empowering your workflows with Artificial intelligence ...

- Empowering your workflows with Artificial intelligence ...

- Empowering your workflows with Artificial intelligence ...

- Empowering your workflows with Artificial intelligence ...

- Empowering your workflows with Artificial intelligence ...