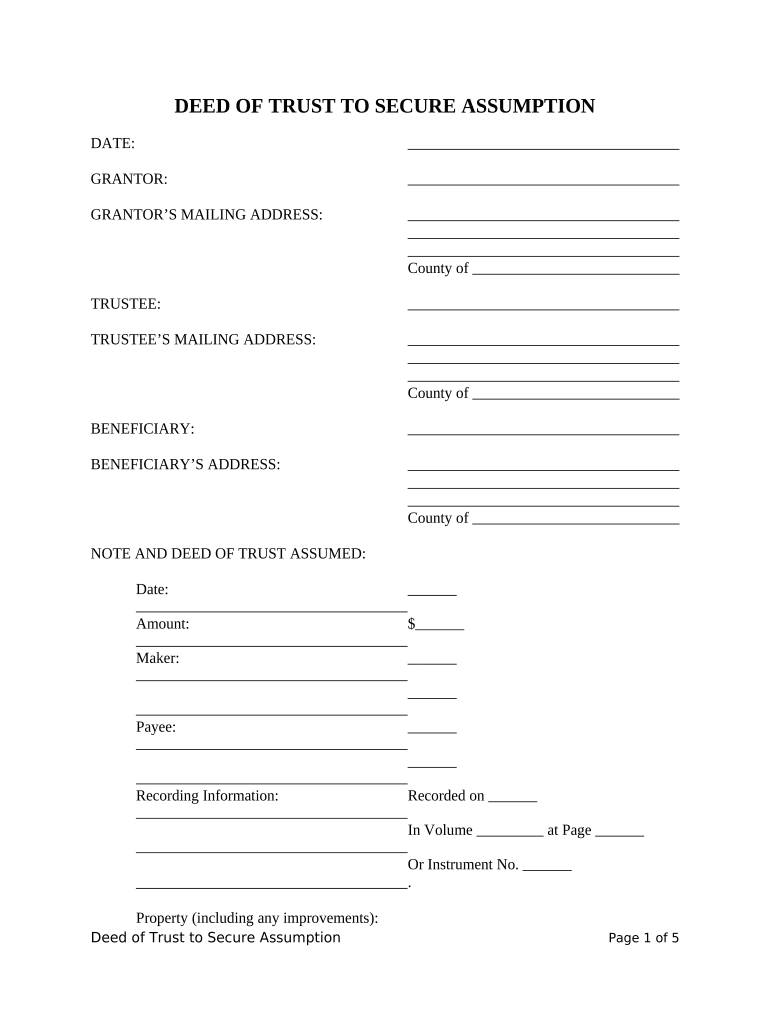

Fill and Sign the Deed of Trust to Secure Assumption Texas Form

Valuable instructions on finalizing your ‘Deed Of Trust To Secure Assumption Texas’ online

Are you weary of the complications involved with paperwork? Look no further than airSlate SignNow, the leading eSignature service for individuals and businesses. Bid farewell to the lengthy routine of printing and scanning documents. With airSlate SignNow, you can effortlessly fill out and sign documents online. Utilize the extensive features included in this intuitive and cost-effective platform and transform your document management practices. Whether you need to authorize forms or gather eSignatures, airSlate SignNow manages everything efficiently, needing just a few clicks.

Adhere to this comprehensive guide:

- Sign in to your account or initiate a free trial with our platform.

- Hit +Create to upload a document from your device, cloud storage, or our template repository.

- Access your ‘Deed Of Trust To Secure Assumption Texas’ in the editor.

- Select Me (Fill Out Now) to complete the form on your end.

- Add and designate fillable fields for others (if necessary).

- Continue with the Send Invite options to solicit eSignatures from others.

- Save, print your version, or transform it into a multi-usable template.

No need to worry if you have to collaborate with others on your Deed Of Trust To Secure Assumption Texas or send it for notarization—our service offers everything you require to achieve such objectives. Register with airSlate SignNow today and elevate your document management to new heights!

FAQs

-

What is a deed of trust to secure assumption?

A deed of trust to secure assumption is a legal document that allows a buyer to assume the mortgage on a property. This type of deed ensures that the lender is protected while the buyer takes on the existing mortgage terms. Using airSlate SignNow, you can easily create and sign a deed of trust to secure assumption electronically, streamlining the process.

-

How can airSlate SignNow help with a deed of trust to secure assumption?

airSlate SignNow simplifies the creation and signing of a deed of trust to secure assumption by providing an intuitive platform for document management. You can customize templates, gather signatures, and store your documents securely, all in one place. This efficiency not only saves time but also reduces the potential for errors in important legal documents.

-

Is there a cost associated with using airSlate SignNow for a deed of trust to secure assumption?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, making it a cost-effective solution for managing documents like a deed of trust to secure assumption. You can choose from monthly or annual subscriptions that grant access to features such as unlimited eSigning and document storage. Check our pricing page for detailed information.

-

What are the benefits of using airSlate SignNow for managing deeds of trust to secure assumption?

Utilizing airSlate SignNow for your deed of trust to secure assumption provides several benefits, including increased efficiency, enhanced security, and better document organization. Users can sign documents remotely, minimizing delays and making the process smoother. Additionally, our platform complies with legal standards, ensuring your documents are valid and secure.

-

Can I integrate airSlate SignNow with other software for my deed of trust to secure assumption?

Absolutely! airSlate SignNow integrates with various popular software tools, allowing you to streamline your workflow when creating a deed of trust to secure assumption. Whether you use CRM systems, cloud storage solutions, or project management tools, our integrations help you manage documents seamlessly across platforms.

-

How secure is my deed of trust to secure assumption when using airSlate SignNow?

Security is a top priority at airSlate SignNow. When creating a deed of trust to secure assumption, your documents are protected with advanced encryption and secure cloud storage. Additionally, our platform complies with industry standards to ensure that your sensitive information remains confidential and secure.

-

Can I track the status of my deed of trust to secure assumption with airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your deed of trust to secure assumption in real-time. You can see who has signed, who still needs to sign, and receive notifications when actions are completed. This transparency helps you stay organized and informed throughout the process.

The best way to complete and sign your deed of trust to secure assumption texas form

Find out other deed of trust to secure assumption texas form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles