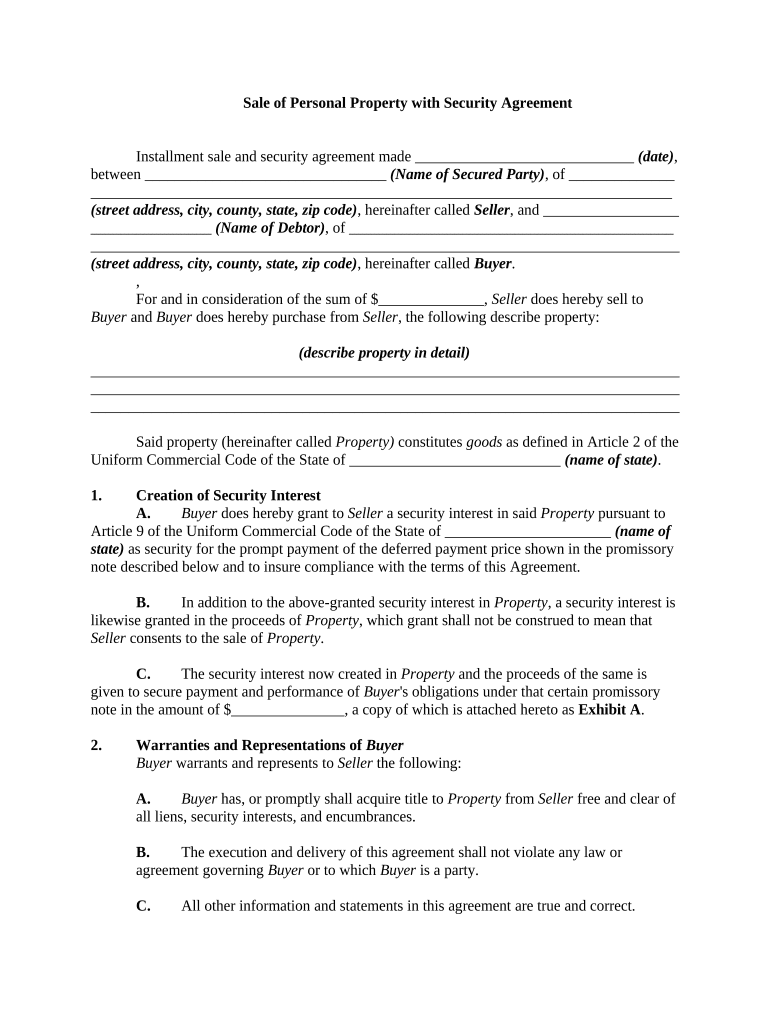

Sale of Personal Property with Security Agreement

Installment sale and security agreement made _____________________________ (date) ,

between ________________________________ (Name of Secured Party) , of ______________

_____________________________________________________________________________

(street address, city, county, state, zip code) , hereinafter called Seller , and __________________

________________ (Name of Debtor) , of ___________________________________________

______________________________________________________________________________

(street address, city, county, state, zip code) , hereinafter called Buyer .

,

For and in consideration of the sum of $______________, Seller does hereby sell to

Buyer and Buyer does hereby purchase from Seller , the following describe property:

(describe property in detail)

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

Said property (hereinafter called Property) constitutes goods as defined in Article 2 of the

Uniform Commercial Code of the State of ____________________________ (name of state) .

1. Creation of Security Interest

A. Buyer does hereby grant to Seller a security interest in said Property pursuant to

Article 9 of the Uniform Commercial Code of the State of ______________________ (name of

state) as security for the prompt payment of the deferred payment price shown in the promissory

note described below and to insure compliance with the terms of this Agreement.

B. In addition to the above-granted security interest in Property , a security interest is

likewise granted in the proceeds of Property , which grant shall not be construed to mean that

Seller consents to the sale of Property .

C. The security interest now created in Property and the proceeds of the same is

given to secure payment and performance of Buyer 's obligations under that certain promissory

note in the amount of $_______________, a copy of which is attached hereto as Exhibit A .

2. Warranties and Representations of Buyer

Buyer warrants and represents to Seller the following:

A. Buyer has, or promptly shall acquire title to Property from Seller free and clear of

all liens, security interests, and encumbrances.

B. The execution and delivery of this agreement shall not violate any law or

agreement governing Buyer or to which Buyer is a party.

C. All other information and statements in this agreement are true and correct.

3. Covenants of Buyer

Unless and until Seller agrees to another course of action, Buyer covenants as follows:

A. Buyer shall notify Seller of any change in the location of Property from Buyer 's

above address and shall not remove Property from ___________________ ( state) for any

one period exceeding ________ (number) days in length without Seller 's written consent.

B. Buyer shall not sell, transfer, lease, abandon or otherwise dispose of any of

Property or any interest in the Property .

C. Buyer shall keep Property in good condition and free of liens, security interests

and encumbrances, other than the security interest created by this agreement. Buyer shall

not use Property for hire or in violation of any applicable statute, ordinance or insurance

policy, shall defend Property against the claims and demands of all persons, shall

promptly pay all taxes and assessments with respect to Property , and shall not permit

Property to become a part of or to be affixed to any real or personal property without first

making arrangements satisfactory to Seller to protect Seller 's security interest.

D. Buyer shall promptly notify Seller of any default as defined in this agreement.

E. Seller may inspect Property at any time, wherever located.

F. Buyer shall keep Property insured with companies acceptable to Seller against

such casualties and in such amounts as Seller may require. If requested by Seller , all

insurance policies shall be written for the benefit of Buyer and Seller as their interests

may appear, shall provide for ______ (number) days' written notice to Seller prior to

cancellation, and shall be deposited with Seller . Seller may act as attorney-in-fact for

Buyer in making, adjusting and settling claims under or canceling such insurance and

indorsing Buyer 's name on any drafts relating to the same. Seller may apply any proceeds

of insurance toward payment of the obligations under this agreement, whether due or not

due, in any order of priority.

G. At its option, Seller may discharge taxes, liens, security interests and other

encumbrances against Property and may pay for the repair of any damage to Property ,

the maintenance and preservation of the Property , and insurance on the same. Buyer shall

reimburse Seller on demand for any payment so made, plus interest, at the rate of

_______% per year from the date of such payment. Any such payment by Seller shall be

secured by Property .

H. Buyer shall from time to time execute financing statements and other documents

in forms satisfactory to Seller as Seller may require and shall pay the cost of filing or

recording them in whatever public offices Seller deems necessary. Buyer shall perform

such other acts as Seller may request to perfect and maintain a valid security interest in

Property under (cite appropriate statute of Article 9 of state’s UCC) _______________

_________________.

4. Protection of Property

Buyer shall not illegally use or secrete Property . Buyer shall keep Property free of all

taxes, liens and other charges. Buyer shall maintain Property in good repair and shall be

responsible to Seller for any loss or damage to Property .

5. Assignment by Seller

The interests of Seller in this contract may be assigned at any time without notice to

Buyer . When so assigned, the assignee shall be entitled to hold such interests free from any

defense, set-off, or counterclaim of Buyer

6. Transfer of Property

Buyer shall not sell, lease, assign, encumber or dispose of Property without the prior

written consent of Seller .

7. Default

Default under this agreement shall consist of any one or more of the following events:

A. Any omission or delay in the making of any installment payment.

B. Nonperformance or delay in performing any of the other provisions of this

contract.

C. Any attachment or execution is made or levied on Property , any petition in

bankruptcy or insolvency or for the appointment of a receiver in liquidation or

trustee is filed by or against Buyer or for any of Buyer 's property, any assignment

for the benefit of creditors is made by Buyer , or any petition or other proceeding

is filed by or against Buyer for reorganization, compromise, adjustment or other

relief under the laws of the United States or of any state relating to the relief of

debtors.

D. Seller deems itself insecure for any reason.

8. Remedies

A. In the event of any default by Buyer in the terms of this agreement or said

promissory note, Seller may pursue any legal remedy available to collect all sums owing

under this agreement, to enforce its title in and right to possession of Property , and to

enforce any and all other rights or remedies available to it, under (cite appropriate

statute of Article 9 of state’s UCC) ______________________________________ or

otherwise. No such action shall operate as a waiver of any other right or remedy of Seller

under the terms of this contract or under the law, generally. All rights and remedies of

Seller are cumulative and not alternative, and no waiver of any default shall operate as a

waiver of any other default.

B. Upon any default under this agreement, all remaining installments due pursuant to

said promissory note may be declared by Seller immediately due and payable. In the

event of nonpayment, Buyer shall on demand deliver Property to Seller , and Seller may,

without notice of demand and without legal process, enter on Buyer 's premises and retake

possession of Property on such premises or wherever found. Seller may require Buyer to

make Property available to Seller at a place to be designated by Seller that is reasonably

convenient to both parties.

C. Seller , on obtaining possession of Property on default, may sell Property or any

part of them at public or private sale either with or without having Property at the place

of sale. To the extent lawful, Seller may be a purchaser at such sale. The net proceeds of

such sale, after deducting all expenses of Seller in retaking, storing, repairing and selling

Property , including reasonable attorney's fees, shall be credited against the total amount

owing by Buyer to Seller in accordance with the terms of this contract. Any surplus shall

be paid to Buyer or to any other person legally entitled to the surplus. In the event of a

deficiency, Buyer shall pay the amount of same to Seller .

9. No Waiver

The failure of either party to this Agreement to insist upon the performance of any of the

terms and conditions of this Agreement, or the waiver of any breach of any of the terms and

conditions of this Agreement, shall not be construed as subsequently waiving any such terms and

conditions, but the same shall continue and remain in full force and effect as if no such

forbearance or waiver had occurred.

10. Governing Law

This Agreement shall be governed by, construed, and enforced in accordance with the

laws of the State of __________________.

11. Notices

Any notice provided for or concerning this Agreement shall be in writing and shall be

deemed sufficiently given when sent by certified or registered mail if sent to the respective

address of each party as set forth at the beginning of this Agreement.

12. Entire Agreement

This Agreement shall constitute the entire agreement between the parties and any prior

understanding or representation of any kind preceding the date of this Agreement shall not be

binding upon either party except to the extent incorporated in this Agreement.

13. Modification of Agreement

Any modification of this Agreement or additional obligation assumed by either party in

connection with this Agreement shall be binding only if placed in writing and signed by each

party or an authorized representative of each party.

WITNESS our signatures as of the day and date first above stated.

________________________________ _____________________________

Seller Buyer

Exhibit A

PROMISSORY NOTE

$ ___________________ __________________________

(City and State where executed)

________________________

(Date)

FOR VALUE RECEIVED, the undersigned ___________________________________

(Name of Buyer) does hereby promise to pay to ______________________________________

(Name of Seller) , or order, the principal sum of $_________________ together with interest

thereon from date at the rate of __________ Percent per annum on the unpaid balance until paid.

The said principal and interest shall be payable at _____________________________________

_________________________________________ (street address, city, county, state, zip code) ,

or at such other place as the holder hereof may designate in writing, in _______ consecutive

monthly installments of $_______________. The first of said installments shall be due and

payable on the first day of _________________________________ (Month and Year) , and each

subsequent monthly installment shall be due and payable on the first day of each succeeding

month thereafter until the entire indebtedness evidenced by this Note is fully paid.

The undersigned further promise to pay the holder of this Note a late charge of ________

Percent of any monthly installment not received by the Note holder within _______days after the

installment is due.

It is agreed that in the event default is made in the payment of this Note at maturity, or of

any installment thereof, whether maturing by expiration of time, by default as herein provided, or

as provided in the Security Agreement given in security hereof, and the same is placed in the

hands of an attorney for collection, then an additional amount of Ten Percent (10%) on the

principal and interest of this Note shall be added to the same as a collection fee, and the failure to

pay any installment when due shall mature the entire indebtedness at the option of the holder of

this Note.

The makers, signers, drawers, guarantors, sureties and endorsers hereof severally waive

presentation for payment, demand, protest, diligence in collecting, notice of dishonor, notice of

extension of time, and notice of protest or nonpayment.

WITNESS MY SIGNATURES, as of the day and date first above named.

_____________________________________

_____________________________________

Printed Name and Signature of Buyer)