Help Me With Save Electronic signature in Android

Contact Sales

Make the most out of your eSignature workflows with airSlate SignNow

Extensive suite of eSignature tools

Robust integration and API capabilities

Advanced security and compliance

Various collaboration tools

Enjoyable and stress-free signing experience

Extensive support

Keep your eSignature workflows on track

Our user reviews speak for themselves

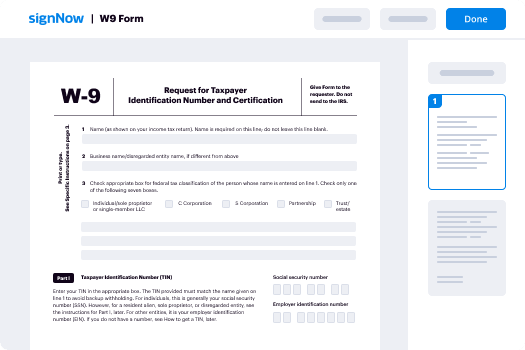

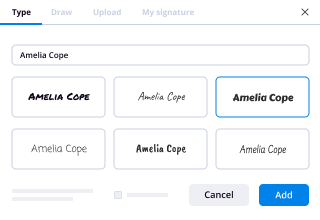

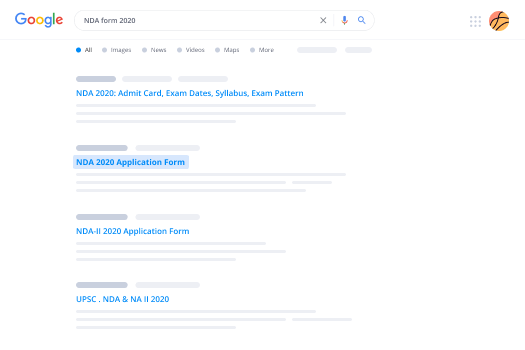

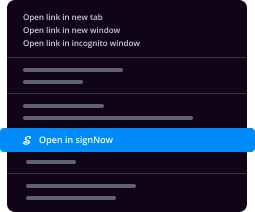

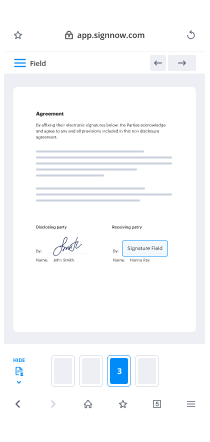

How to utilize a digital signature PDF on Android

If you're seeking to apply a digital signature PDF on Android, airSlate SignNow presents a user-friendly and effective solution. This application streamlines the signing procedure, enabling you to handle your documents effortlessly while benefiting from a broad array of features tailored for small and medium enterprises. With its clear pricing and exceptional support, airSlate SignNow is an outstanding option for anyone requiring dependable document management while on the move.

Instructions for using digital signature PDF on Android with airSlate SignNow

- Visit the airSlate SignNow site in your chosen web browser.

- Establish a free trial account or log into your current account.

- Choose the document you intend to sign or send for signature.

- If you aim to use this document frequently, convert it into a template for future utilization.

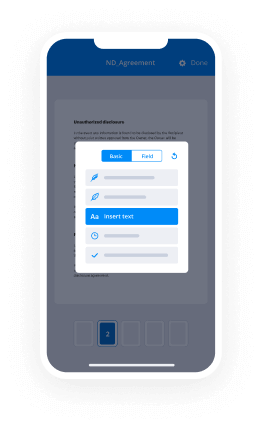

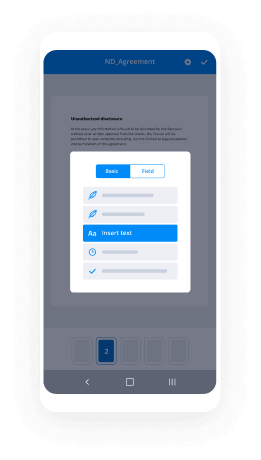

- Open your document to make any required changes, such as adding fillable fields or including further details.

- Sign the document and incorporate signature fields for recipients where necessary.

- Press 'Continue' to set up and dispatch the eSignature invitation.

To sum up, airSlate SignNow is structured to ease the signing process for both individuals and enterprises. Its comprehensive feature set guarantees that you receive excellent value for your expenditure, making it a wise choice for document management.

Prepared to enhance your document signing workflow? Initiate your free trial with airSlate SignNow today and discover the advantages of effective document management!

How it works

Rate your experience

-

Best ROI. Our customers achieve an average 7x ROI within the first six months.

-

Scales with your use cases. From SMBs to mid-market, airSlate SignNow delivers results for businesses of all sizes.

-

Intuitive UI and API. Sign and send documents from your apps in minutes.

A smarter way to work: —how to industry sign banking integrate

FAQs

-

What is a digital signature for PDF on Android?

A digital signature for PDF on Android is a secure, electronic way to sign documents directly from your mobile device. With airSlate SignNow, you can easily create and apply a digital signature to any PDF document, ensuring authenticity and integrity without the need for printing or scanning.

-

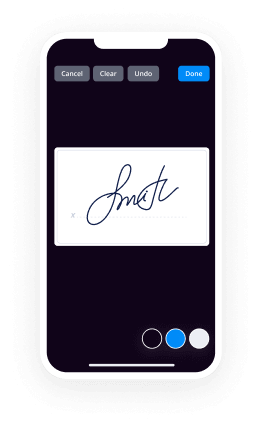

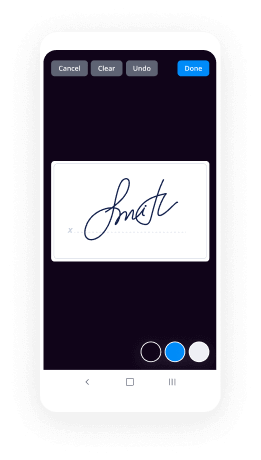

How do I create a digital signature PDF on Android using airSlate SignNow?

Creating a digital signature PDF on Android with airSlate SignNow is simple. Once you download the app, you can upload your PDF document, use your finger or stylus to sign it, and save it as a signed PDF. It's a quick process that enhances your workflow.

-

Is airSlate SignNow free to use for digital signature PDF on Android?

While airSlate SignNow offers a free trial, using the digital signature PDF feature on Android requires a subscription. The pricing is competitive, and it provides access to a comprehensive suite of features designed to streamline document signing and management.

-

What features does airSlate SignNow offer for digital signatures on Android?

airSlate SignNow provides a range of features for digital signatures on Android, including document templates, in-app signing, and real-time tracking of document status. These tools enhance efficiency and make it easier for businesses to manage their signing processes.

-

Can I integrate airSlate SignNow with other apps for digital signatures on Android?

Yes, airSlate SignNow offers seamless integrations with various applications, allowing you to streamline your workflow. You can connect it with popular tools like Google Drive, Dropbox, and Microsoft Office, making it easier to manage your digital signature PDF tasks on Android.

-

What are the benefits of using digital signatures on PDF documents via Android?

Using digital signatures on PDF documents via Android with airSlate SignNow provides numerous benefits, including enhanced security and reduced paper usage. It also speeds up the signing process, allowing you to finalize documents anytime, anywhere, conveniently from your mobile device.

-

Is it safe to use airSlate SignNow for digital signatures on Android?

Absolutely. airSlate SignNow employs advanced encryption and security protocols to protect your data and signatures, ensuring that your digital signature PDF on Android remains secure. You can sign documents with confidence, knowing that your information is safeguarded.

-

What are some must have Android apps?

Edit: I wrote this answer for “must have Android apps” but these are same apps which have changed the way I used to live my life. Each and every App has helped me in one or the other way. I hope you will also find them helpful and a bit life changing. So here is the list: 10. Psiphon For those who use WiFi with proxy settings. So Psiphon bypasses and tunnel the websites or app through a different IP Address. 9. Mirror It's a simple app to record your mobile screen. Based on the concept of CamStudio in PC where you can record your screen, Mirror offers recording of your Mobile screen. 8. NTES- National Train Enquiry System If you are from India and you want to know the running status, cancelled train (partial or fully), Live Station and other features, this App is a must have. 7. VOLT Simple but effective for those who want to learn new vocabulary. That's too obvious, then why not others? Coz here you get the “memory key” which helps you relate the words and easier to remember them. 6. Parchi It a note making app. But here’s a catch. You can view, review, edit and add right from your lockscreen without need to open the app. Isn't that amazing! I personally find this app very useful. 5. edX If you are student or a learner who wants learn something new everyday, and cannot afford to go in the prestigious institutions like MIT, Harvard University, Cambridge, IITM, etc ten it is a must have app. Enroll yourself in any course and Bazinga!! You are ready to learn from the most amazing professors. Similar to edX, we have Coursera. 4. Walnut Manage your expenses on your finger tips. Its easier then that. It shows you your monthly expenditure, ATM locations, bill remainders and many more features. Its a must have app. 3. CamScanner Everyone doesn’t own a scanner but most of us have camera. So click the pic, upload to CamScanner and voila you are done. You have the scanned copy of your documents, notes, Marksheet and upload them on your DigiLocker. 2. inshorts Till now you all must be knowing this app. The tagline is also simple “News in 60 words” and trust me it is worth having. In this “I don't have time” world, you need news to be fast and accurate so here it is. 1. DigiLocker If you have this app then you don’t need to carry your personal documents like driving license, Adhar card, voter ID card, or even your Marksheets. Keep them safe in actual locker and leave the rest to your DigiLocker. And the best part is that it is acceptable as the original ones at every governmental or non governmental institution because it is developed under Digital India initiative. That's it for the day. Thank you and Enjoy !!! Update 1: Today I came across two new apps which I found useful. Hope it would help you all. 1.Forest : Stay focused Features • A self-motivated and interesting way to help you beat phone addiction • Stay focused and get more things done • Share your forest and compete with friends • Track your history in a simple and pleasant way • Earn reward and unlock more tree species • Customize your whitelist : Leaving Forest and using apps in whitelist won’t kill your tree. 2. Swachh Bharat Toilet Locator Swachh Bharat Toilet Locator is specifically useful for Indians who're committed for Swachh Bharat. Update 2: So I am back with yet another interesting app for you all. And trust me it is worth hanving. You are bored just go through it and kaboooom !!! You are into a black hole. Enjoy the ride. 3. Curiosity It is the latest app I installed but got addicted to it. It’s exactly works like its name, generates a curiosity which inturn increases your knowledge. It covers a large field of scope from Humanity to science to faith and many more. This app deserves more snapshots but why to increase the length of my answer. Comment below if you think the list should be updated? Thank you.

-

What is the term cashless society, What are the benefits and can it be a reality in India?

TL;DR (Too Long; Didn’t Read):Cashless society can be a reality in India. Yes, it can happen right now! To make it happen, the government should take measures like this:Slowly reduce the withdrawal limit at the ATMs and banks in phases from the current ₹4,500/day to a reasonable amount, say, ₹1,000/dayClassifying transactions into PIN and No-PIN. The sum of all No-PIN transactions cannot exceed ₹1,000/dayPromoting a widespread use of innovative, cheap and secure Debit/Credit card readersGovernment incentives encouraging transition towards cashless societyAre you still wondering if these measures can help our country?If so, then you should definitely read the whole answer down below!Is there any country which has gone completely cashless?In a cashless society, when we go get coffee, buy some groceries or pay house rent, we use Debit / Credit card , online payment or any of the other cashless payment methods instead of Physical cash.Though, by definition, Cashless society replaces physical cash with modern cashless payment methods, there is no country which has gone 100% cashless. Sweden is leading the way towards a cashless society with cash transactions account for 2% of the value of all payments made in last year.How will a cashless society help our country?Tax Evasion: When all payments are made electronically, they can be easily audited. This would be a great problem to money launderers and tax evadersReduction in Crime: By going cashless, as there will be less cash in circulation, criminal activities like Real estate fraud, Smuggling, Fake currency, Terrorist activities etc will be greatly reduced.Security and Convenience: In Sweden, electronic payment advocates claim that there has been less crime reported as there is no cash to steal at banks and ATM’s. In addition to security, cashless transactions in future will be seamless and convenient for customers with no delays and queues.Why is it important for India at this moment?The demonetisation move by PM Modi is bold and important to curtail parallel economy. Though this move helps to bring out the black money and puts a break to the fake money racket, I feel that it’s a temporary measure to curb black money.If the maximum withdrawal limit increases from ₹4000/day to the previous ₹40,000/day , we will eventually be able to stash enough money. The people who resort to illegal black money transactions will be back to their routine and try to evade tax like they have been doing. Unless the government takes immediate measures to help people move towards a cashless society, the immense efforts by the people and their suffering will go in vain. Recently PM Modi urged the nation to become a cashless society which signifies its importance.Sounds great! But how to make India a cashless society?Demonetisation can bring signNow progress in the expansion of the financial system and cashless payment methods.How feasible are these cashless payment methods in India?Cashless payment methods like Digital wallets[1] (Paytm, Android Pay etc) require smartphones. But smartphone penetration is still less than 30% of the total population. So it will take years for our country to adopt to such payment methods. In India, apart from DD, Cheque etc.,the likely option is to go for Card-based payment. This is due to reasonably large penetration of Debit or Credit cards compared to smartphone penetration.As per RBI’s latest press release[2]Number of Debit cards is 700 millionNumber of Credit cards is 25 millionTotal bank accounts in 2015 was 1,170 millionThough the number of cards total to 725 million, ONLY 6% of the value of card transactions are used at PoS machines and 94% of the value is used for cash withdrawal at ATMs. The reason for these contrasting numbers might be because of the slow card transaction process, lack of awareness or security concerns ( theft / fraudulent transactions ) among consumers. Besides, many mom-and-pop shops and kirana shops, try to save the processing fee by refusing to accept card-based payments.How can we make use of the highly penetrated Debit/Credit card base as a primary instrument in making India a cashless society?Classifying transactions into PIN and No-PIN, based on type of authenticationThough the PIN-based (with/without Signature) authentication creates a sense of security among users, it is inconvenient and a prolonged process. To overcome this problem, transactions can be classified into PIN and No-PIN. PIN or Signature for authentication are required only when the transaction amount exceeds a certain limit, say, ₹1,000 per transaction. All the transactions below this limit would not require any authentication and are termed as No-PIN transactions[3]. By doing this, day-to-day payments of low value can be made seamless. In addition to this, the sum of all the No-PIN transactions on that particular day should not exceed the limit. Though the concept of No-PIN seems insecure, the cumulative limit on these transactions will ensure protection against fraudulent activities. Any such activity within the threshold amount needs to be insured by the financial institutions.For example, buying a smartphone worth ₹8,000 in a retail outlet using a Debit/Credit card requires PIN-based authentication and buying fruits and vegetables worth ₹300 will come under No-PIN transaction. Now if you lose your card and someone takes advantage of the No-PIN method, he will only be able to use up to ₹700. This amount can be insured by your bank upon reporting the lost card.Promoting a widespread use of innovative, cheap and secure Debit/Credit card readersAt the seller end, we need PoS terminals to accept card payments from consumers. But procuring a PoS machine from banks is a lengthy process. The banks also charge a commission based on the turnover. The government should make it easy for retailers to acquire these card readers. In addition to the traditional card readers, the government should encourage innovative alternatives which are cheap, secure and easy to procure such as Square Card reader, which is popular in the US.Square lets you accept all major Debit / Credit cards in a seamless way like this.Government incentives encouraging transition towards cashless societyIn order to encourage card-based payments, the Indian government has unveiled plans to cut transaction costs for electronic payments to pull more people into the formal economy and boost public revenue. One proposal is to offer sales tax rebates of 1 to 2 percentage points to merchants who report at least half of their transactions through online payments. Consumers could get an income tax rebate for electronic payment of a proportion of their expenses. Read more at: Modi government plans cashless coup with tax incentives on electronic paymentsReducing the withdrawal limit at ATMs and banks in phases from ₹40,000/day to a reasonable amount, say, ₹1,000/dayNormally, people tend to withdraw money from ATMs for most of the day-to-day payments. In order to urge society to move towards cashless, it is important to reduce the cash withdrawal limit to an acceptable amount.Illicit real estate trading, Hawala operators, Election campaigns, Fake NGOs etc., rely on cash transactions involving huge amounts. When there is a strict cash withdrawal regulation, it will take ages for people to accumulate cash and encourage such illegal activities. This will drastically reduce the black money circulation and put an end to the parallel economy.Limitations of our proposed solution:It will not be hassle free if people are not properly educated about this solutionDeploying huge number of card reader machines is a herculean taskProviding Internet access in every single part of country amidst shortage of electricityAre there any problems with cashless economy?[4]Citizens can’t do a bank run during an economic crisis. Cash is an important safeguard against economic volatility. At times of distress, when the confidence in the banking system erodes, citizens are likely to withdraw cash in large numbers and hold it in its physical form. On balance, there seems to be an optimal mix of digital payments and cash that should be in existence in an economy to stave off the consequences of a cashless society.Future scope:In future, the smartphones base is expected to grow and signNow 100% penetration. As the government works on pushing card-based payments, it should encourage private companies to develop secure and easy mobile based cashless payments. There might be a wider signNow for NFC-based smartphones with fingerprint authentication in future. This will make the transactions even more secure and convenient.Footnotes[1] Digital Wallets: Intro to Apple Pay, Chase Pay, Walmart Pay, and More[2] https://rbi.org.in/scripts/BS_Pr...[3] RBI Willing to Relax PIN, OTP Requirements for Sub-Rs. 2,000 Transactions[4] We are trying to become a cashless society — but is that a great idea?

-

Which invoicing software can help me create a custom invoice?

Creating a professional invoice might seem like an easy thing to do but its often the toughest task, specially if you are doing it for the first time. Its often the last communication with the client and hence, must leave a good impression about your company.Lets find out how you can create a good looking professional invoice, best practices and some follow up techniques.6 Things To Do Before You Create An Invoice:1) Create organisation policiesBefore you do anything else, first create a policy for your organisation. Even if you are a sole owner, it would make sense to lay out some rules. To get you started, find answers to following questions:– Can I provide an option to return goods or services? If yes, what will be my return policy?– What are my payment terms? How much credit I can offer?– Should I charge a late payment fee? If yes, how much?– Should I ask for an advance payment? If yes, how much?You don’t have to spend a lot of time on it or get any legal help. Its more like the terms that you want your client to agree so that you can avoid any disputes later.2) Setup your payment collection methodAsk yourself how are you going to collect the payment once an invoice is sent to the client. If its by cash or cheque, how its going to be sent to you? If you want your client to pay you using credit card, signup for an online payment gateway. For international clients, Paypal is good place to start with. Indian companies can signup with Citrus or CCAvenue to setup a gateway. Most of the good payment gateways companies in India have now stopped charging for the setup and annual fees.Also check if there are any expenses that might be incurred at your end during payment collection process. It will be a good idea to include this cost in the invoice.Check how you can integrate a payment link on your invoices so that your customers can pay you easily .3) Design & brandingA good looking invoice can reinforce trust in your client’s mind. So, make sure that you use a simple and elegant invoice design. If you are using any accounting software, chances are, professional invoice templates might be inbuilt.Just upload your company logo and you are all set.4) Send Estimates/ QuotationsYou should always give estimates or quotations to your clients before the project begins. You should include things like deadlines, delivery items, revisions and other considerations as defined in the policy making step above.Proposals also give your clients an idea about how much he will be paying to you in future.5) No surprisesWhen it comes to invoices, clients do not like surprises. If there is an deviation in the order as mentioned in the proposal, you should inform your client about the change in fees. Lot of vendors tend to postpone this discussion till end of the project. When clients come across these new charges, they will either negotiate with you to waive off those fees or just delay the payment.So, whenever there is any change in the originally accepted terms, specially regarding pricing, inform your clients immediately and make them aware about the change in fees.6) Tell them that its comingHarish from Finkoi Financial Consultancy suggested this effective technique. Just before sending the actual invoice, he sends a short note to the client. It goes like this:credit:-Care Study Online-exclusive Study Matterial and Education tips

-

Which is the best wallet in India to keep my Bitcoin?

■ Hardware WalletsA hardware wallet is a physical electronic device, built for the sole purpose of securing bitcoins.The three most popular and best Bitcoin hardware wallets are:1.ledger nano2.Keepkey3.TrazorHardware wallets are a good choice if you’re serious about security and convenient, reliable Bitcoin storage.Bitcoin hardware wallets keep private keys separate from vulnerable, internet-connected devices.Your all-important private keys are maintained in a secure offline environment on the hardware wallet, fully protected even should the device be plugged into a malware-infected computer.As bitcoins are digital, cyber-criminals could, potentially, target your computer’s “software wallet” and steal them by accessing your private key.Generating and storing private keys offline using a hardware wallet ensures that hackers have no way to signNow your bitcoins.Hackers would have to steal the hardware wallet itself, but even then, it can be protected with a PIN code.Don’t worry about your hardware wallet getting stolen, lost or damaged either; so long as you create a secret backup code, you can always retrieve your bitcoins.Why are hardware wallets bad?• They're not free!■ Hot WalletsHot wallets are Bitcoin wallets that run on internet connected devices like a computer, mobile phone, or tablet.Private keys are secret codes. Because hot wallets generate your private keys on an internet connected device, these private keys can’t be considered 100% secure.Think of a hot wallet like your wallet today: you use it to store some cash, but not your life savings. Hot wallets are great if you make frequent payments, but not a good choice for the secure storage of bitcoins.Why are hot wallets bad?• Not safe for the secure storage of large amounts of bitcoins.some hot wallets…!1.GREEN ADDRESS.GreenAddress is a multi-signature Bitcoin wallet available on the web, desktop, Android, and iOS. GreenAddress is compatible with hardware wallets like TREZOR, Ledger Nano, and the HW.1.“Multi-signature” in this context means that the site requires a manual confirmation from you for your coins to be moved; this greatly improves security.2.MICELIUM.Mycelium is the most popular Bitcoin wallet on Android. It's very easy to use for sending and receiving payments. Backing up your wallet is also simple, since Mycelium makes it very clear with setup and backup instructions.3.BITCOIN WALLET.Bitcoin Wallet, or “Schildbach Wallet”, was the first mobile Bitcoin wallet. Bitcoin Wallet is more secure than most mobile Bitcoin wallets, because it connects directly to the Bitcoin network. Bitcoin Wallet has a simple interface and just the right amount of features, making it a great wallet and a great educational tool for Bitcoin beginners.4.COPAY.The Copay Bitcoin wallet is also available for Android. It's easy to use and offers many advanced features that offer great flexibility.5.GREENBITS.GreenBits is the native Android version of GreenAddress. It’s a multi-signature wallet that also supports hardware wallets like TREZOR and Ledger.Your specific needs should determine the wallet you use, as there is no “best bitcoin wallet”.I mentioned some of the best(secure & efficient) wallets; hope it's helps.⚫”Thanks for Reading”⚫

-

Considering minimum balance requirements, interest rates, additional facilities, etc., in which bank should I open an account, a

I am sharing my experience with SBI, Citibank, ICICI and Axis.Minimum Balance Requirements -SBI require minimum Rs 1,000 balance. I guess it is same with other PSUs as well.In private banks, if you have a salary account, you can maintain zero balance.If it’s a regular savings account in private banks:ICICI and most Indian private banks - Rs 10,000Citibank - Rs 1 LakhsInterest Paid - I feel it’s same as 4% in most of the banks.Other Facilties -Citibank for me is the best in terms of online banking.You can transfer the money as soon as you add a payee.Though they keep only one physical branch and few ATM’s over a city, I hardly had to go to the bank in many years and even their staff encourage you to do online banking as most of the facilities are available.Once I ordered for a DD online after bank hours and they delivered it at my home on next day.Their customer care is also well equipped with knowledge and proactively tells you different options to resolve your problem. There are many things you can do through IVR (creating or resetting password) if that does not require human intervention.Their app though I did not find very user friendly and uninstalled it after some time.I am using their Credit card from a long time and I am pretty satisfied with the reward points and credit limit.You might get extra cash back or discount on online deals through Citi credit or debit cards.ICICIThey have improved from waiting time of 24 hrs to 30 mins for doing transactions after adding a payee.Since it’s the most popular private bank in India, they have multiple branches and ATM’s all over the city and at the same time you will see the branches crowded most of the times and if you want a DD it might take some hours to process and make it available for you.Their online portal is also very good and most of the facilities are available.ICICI’s customer care is good but I had face problems sometimes dealing with them. Some of them had no idea about few things and I have to visit the branch to clarify the issues.Their app is pretty good and at times when I do not have access to my computer, I used it and had satisfactory experience.I have their credit card but I use it very seldom because of their messy concept of payback points. I could not see where my points are being added after the transactions, plus the pay back concept makes it more complicated for me. Also, once I tried to use my payback points in an online transaction but the system rejected the transaction saying “Not enough payback points” but the card had sufficient points to make transaction.Hardly got any online deals for ICICI credit or debit card.AxisThey allow transactions after 4 hrs of adding a new payee.I had very bad experience with Axis, if you do not access your internet banking for 3 months, they will disable your online portal and you need to go through the trouble of activating it again.Plus, I found many issues while resetting your password online in Axis, their system has lot of bugs. Closed the account afterwards.SBIThey are worst in terms of online banking. Though they have centralized everything now, still they lack in many areas when it comes to online portal.You may need to visit the branch for even small things, like resetting the password of online banking in case you forgot the password and secret questions.I tried calling their customer care once and I was on hold for around 15 mins and then I gave up.SBI credit card I prefer on petrol pumps, though they credit back most of the surcharge applied on the transactions. Apart from that, if there are any online deals on SBI cards, I use it for the transaction.This sums up my experience with the Indian banks.Hope it helps.

-

What is eSignly and is it a good digital signature tool?

Esignly is an e signature app which provides proficient and innovative e signature solutions to its customers. Esignly is a product of Cyber Infrastructure (P) Limited and offers a line of services right from creating, signing, and sending to tracking and managing documents online.This electronic signature app provides its user with a single account which can le logged in from any electronic device and access it anytime.Here is a list of features provided this app that proves Esignly’s reputation in the industry as an admirable Digital Signature Tool-API- Helps in doing eSignatures swiftly ...

Trusted esignature solution— what our customers are saying

Get legally-binding signatures now!

Frequently asked questions

How do i add an electronic signature to a word document?

How to provide authorize electronic signature?

What is web page error missing parameter install key mean when trying to esign?

Get more for Help Me With Save Electronic signature in Android

Find out other Help Me With Save Electronic signature in Android

- Cs 550 term project report form

- Credit view form

- Vitamin d inadequacy and implications for health form

- Interior finishes form

- The scrivener modern legal writing form

- 2050p dot prepared by the center for technology in government using information in government program for the office of the new

- Message from the chair by jon nelson p ok form

- Request i grade college of fine applied arts faa illinois form

- Application and installation guidelines for form

- School climate innovations national center on safe supportive form

- Protocol document steps for translating and entering data into the form

- Commercial and multi family form

- Pcard application wmemorandum of understanding form pdf ehe osu

- Form 2 schedules indd esmart tax

- Instructions form 990 schedule f foreign activities irs

- Short form university of pennsylvania upenn

- Uri ric ph d program in education dissertation proposal form

- 0708 oru request for proposal rfp lender survey doc form

- Certification of out of state police officer state of oregon oregon form

- Vital volunteer application new 2 vital life foundation form