How Can I eSignature Form for IT

Make the most out of your eSignature workflows with airSlate SignNow

Extensive suite of eSignature tools

Robust integration and API capabilities

Advanced security and compliance

Various collaboration tools

Enjoyable and stress-free signing experience

Extensive support

Keep your eSignature workflows on track

Our user reviews speak for themselves

Grasping signature templates with airSlate SignNow

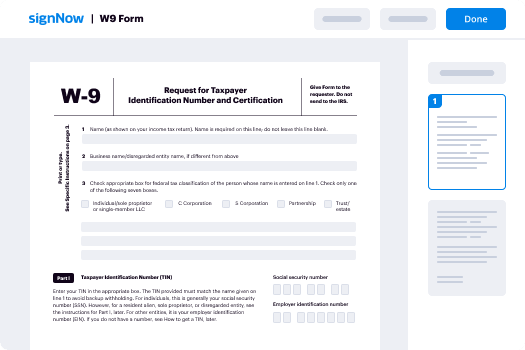

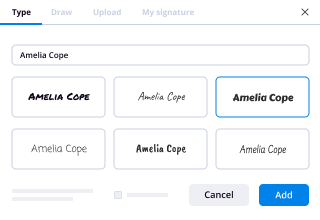

The signature template is an essential component in the realm of digital documentation, and airSlate SignNow provides a flawless method to produce, distribute, and oversee these templates. With an intuitive interface and powerful features, organizations can effectively manage their signing requirements without the complications of conventional paperwork. This guide will lead you through the process of utilizing airSlate SignNow for your signature template needs.

Instructions to generate a signature template using airSlate SignNow

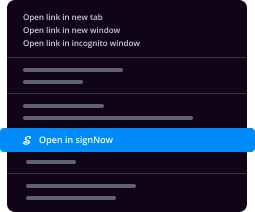

- Launch your web browser and go to the airSlate SignNow homepage.

- Establish a complimentary trial account or log into your current account.

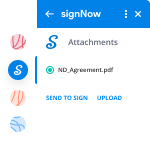

- Choose the document you want to upload for signing or distribution.

- If you intend to use the document again, transform it into a reusable template.

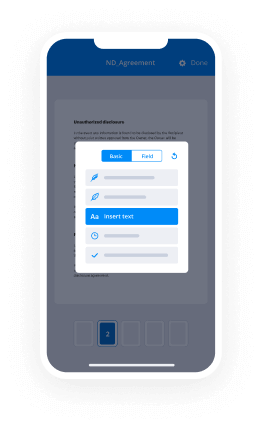

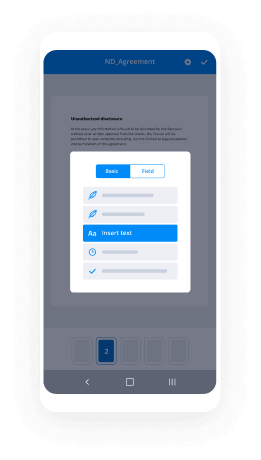

- Access the uploaded document and personalize it by incorporating fillable fields or required details.

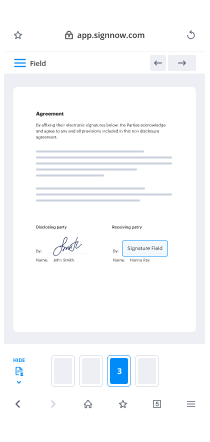

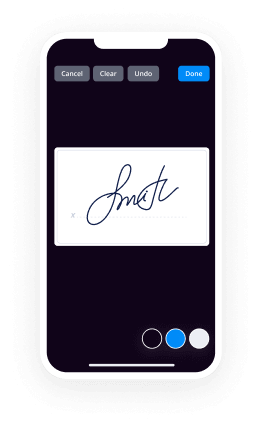

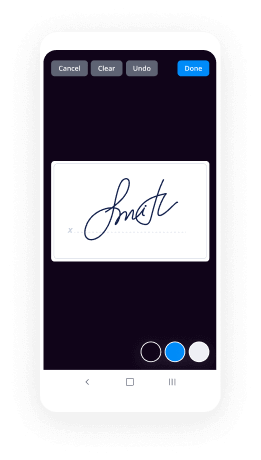

- Sign the document and add signature fields for your recipients.

- Click on 'Continue' to set up and dispatch your electronic signature invitation.

In conclusion, airSlate SignNow streamlines the task of developing and overseeing signature templates, making it a superb option for organizations aiming to improve their document workflows. Its features deliver considerable value for the investment, guaranteeing you obtain a signNow return on your expenditure.

Prepared to revolutionize your signing process? Begin your complimentary trial with airSlate SignNow today and discover the advantages of efficient documentation!

How it works

Rate your experience

-

Best ROI. Our customers achieve an average 7x ROI within the first six months.

-

Scales with your use cases. From SMBs to mid-market, airSlate SignNow delivers results for businesses of all sizes.

-

Intuitive UI and API. Sign and send documents from your apps in minutes.

A smarter way to work: —how to industry sign banking integrate

FAQs

-

What is a signature form and how does it work?

A signature form is a digital document that allows users to collect electronic signatures easily. With airSlate SignNow, you can create customizable signature forms that streamline the signing process, ensuring your documents are signed quickly and securely. Simply upload your document, add signature fields, and send it to your recipients for signing.

-

Can I customize my signature form with airSlate SignNow?

Yes, airSlate SignNow allows you to fully customize your signature form to suit your needs. You can add text fields, checkboxes, and branding elements to ensure your signature forms reflect your brand identity. This level of customization enhances the user experience and improves document engagement.

-

What are the pricing options for using signature forms with airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. You can choose from a range of subscription options based on your needs, whether you require basic features or advanced capabilities for your signature forms. Check our website for the latest pricing details and to find a plan that fits your budget.

-

Are there any integrations available for signature forms?

Absolutely! airSlate SignNow integrates seamlessly with popular business applications like Google Drive, Salesforce, and Dropbox. These integrations allow you to create and send signature forms directly from your favorite tools, enhancing your workflow and saving you time.

-

What are the benefits of using a signature form for my business?

Using a signature form streamlines your document signing process, reducing turnaround time and improving efficiency. With airSlate SignNow, you can track the status of your signature forms in real-time, ensuring you never miss a signed document. Additionally, it enhances security and compliance, protecting your sensitive information.

-

Is it easy to track the status of my signature forms?

Yes, airSlate SignNow provides an intuitive dashboard that allows you to track the status of all your signature forms in real-time. You can see when a document is sent, viewed, and signed, making it easy to manage your workflow efficiently. This feature ensures you stay informed about your document's progress.

-

Can I use signature forms on mobile devices?

Yes, airSlate SignNow is fully optimized for mobile use, allowing you to create and sign signature forms on the go. Whether you're using a smartphone or tablet, our user-friendly interface makes it easy to manage your digital documents anytime, anywhere. This accessibility enhances flexibility and productivity.

-

How can one start a call center?

Its very common question in mind when someone willing to start call center business.Unfortunately there are many fake contracts in indian bpo market, especially when you are start up, only you get such offers.. dont know how, but start ups only get connected to such scammers in searching for project. experienced never fall for.Lets see how to avoid those and get genuine , long term projects.Did you think, why you getting scammers in all search results?? Because you are not searching for real bpo business. or real call center projects.For example..You arranged few computers , some furniture, few ac, cabin , chairs etc . Now you think your CALL CENTER office is ready to start. Search for projects.. What type projects exactly… most of time, you searching for data entry, copy paste, form filling, or something easy where you get assured billing for hitting keyboard keys. When your business plan is something like this , why not, you get only scammers in places.In reality, you see many big mnc’s doing something easy jobs and earning in crores. wake up dear.. NO one is fool to waste money on easy tasks.. Outsourcing industry always follow one simple logic.. Outsource Challenging tasks, keep simple ones. Unless your role is not productive , forget you get any genuine project.AT first place, you need to understand one thing very clear , whatever projects you gonna get, if its easy money for simple tasks, sure scam. More hard job, challenging tasks , sure sign of genuineness.Majority Genuine projects you may find in Outbound , Lead generation, telemarketing , sales and marketing only.MOst of time ive seen, budding entrepreneurs , tend to work on kiddish jobs and dream for big amounts n return.. Result.. fall for any scam offer, company close in next 2 or 3 months. and blame all bpo industry, all are scams in such. etc.. Dude, its you, who invited them.Instead, be realistic, work on lead generation, thats only entry for you as fresher , company start ups no matter what is your personal work experience in mncs.. when you start your own business, its fresh start only.Be prepare to do investments, not to purchase projects.. never do that.To purchase quality data sets, to hire quality staff.. Your own , your team performance is only main factor decides whether you make profit or losses. Data sets always differs with project to project. do not be overconfident you can arrange everything.. follow guidance, its for your own good. Never think, you have all connections, if you did, you wouldnt be searching for projects , you doing that means those expert resources of yours are not up to mark and lac of actual business skills. NO OFFENSE.with all these negative, just think and remove it from your thought, plans and start fresh.There are many genuine reference available .. few as client, few as genuine consultant.for good client reference trySaleem Shaik's answer to How can I start an outsourcing business?Good luck. regardsAgarwal Anjali

-

How do I file income tax return in India?

Greeting Friends !!!If you are going to file it yourself, then following is the procedure:-Before you start the process, keep your bank statements, Form 16 issued by your employer and a copy of last year's return at hand. Next, log on to http://incometaxindiaefiling.gov...Follow these steps:Step 1: Register yourself on the website. Your Permanent Account Number (PAN) will be your user ID.Step 2: View your tax credit statement — Form 26AS — for the financial year 2015–16 . The statement will reflect the taxes deducted by your employer actually deposited with the I-T department. The TDS as per your Form 16 must tally with the figures in Form 26AS. If you file the return despite discrepancies, if any, you could get a notice from the I-T department later.Step 3: Under the 'Download' menu, click on Income Tax Return Forms and choose AY 2016–17 (for financial year 2015–16 ). Download the Income Tax Return (ITR) form applicable to you.Which Income Tax Return Form Require to file or applicable F.Y. 2015–16 by Hetal M Kukadiya on Tax Knowledge Bank - IndiaStep 4: Open the downloaded Return Preparation Software (excel or Java utility) and complete the form by entering all the details , using your all documentsStep 5: Ascertain the tax payable by clicking the 'Calculate Tax' tab. Pay tax (if applicable) and enter the challan details in the tax return.Step 6: Confirm all the information in the worksheet by clicking the 'Validate' tab.Step 7: Proceed to generate an XML file and save it on your computer.Step 8: Go to 'Upload Return' on the portal's left panel and upload the saved XML file after selecting 'AY 2016-2017 ' and the relevant form. You will be asked whether you wish to digitally sign the file. If you have obtained a DS (digital signature), select Yes. Or, choose 'No'.Step 9: Once the website flashes the message about successful e-filing on your screen, you can consider the process to be complete. The acknowledgment form — ITR—Verification (ITR-V ) will be generated and you can download it.Step 10: you can Verify online with EVC Pin or Take a printout of the form ITR-V , sign it preferably in blue ink, and send it only by ordinary or Speed post to the Income-Tax Department-CPC , Post Bag No-1 , Electronic City Post Office, Bangalore - 560 100, Karnataka, within 120 days of filing your return online.Its Advisable to go with CA help for filling Tax return. There are lots of amendment come in every year, to file accurate return and Tax planning benefit etc so Prefer to go with expert like CA, Tax Preparer etc…Be Peaceful !!!

-

E-signing: Is typing your name on a form and clicking submit hold up as a legal signature?

In states which have passed it, the Uniform Electronic Transactions Act (UETA) would govern this. Section 7 of UETA, in particular, specifies: SECTION 7. LEGAL RECOGNITION OF ELECTRONIC RECORDS, ELECTRONIC SIGNATURES, AND ELECTRONIC CONTRACTS. (a) A record or signature may not be denied legal effect or enforceability solely because it is in electronic form. (b) A contract may not be denied legal effect or enforceability solely because an electronic record was used in its formation. (c) If a law requires a record to be in writing, an electronic record satisfies the law. (d) If a law requires a signature, an electronic signature satisfies the law.So, assuming that a signature is required for a contract to be valid, an "electronic signature" suffices. UETA defines "electronic signature" as follows:(8) "Electronic signature" means an electronic sound, symbol, or process attached to or logically associated with a record and executed or adopted by a person with the intent to sign the record.In basic language, this means that when you type out your name and click on the "submit" button, you've electronically signed the record, and the official comments to UETA (not technically law, but extremely persuasive) back this up:This definition includes as an electronic signature the standard webpage click through process. For example, when a person orders goods or services through a vendor's website, the person will be required to provide information as part of a process which will result in receipt of the goods or services. When the customer ultimately gets to the last step and clicks "I agree," the person has adopted the process and has done so with the intent to associate the person with the record of that process. The actual effect of the electronic signature will be determined from all the surrounding circumstances, however, the person adopted a process which the circumstances indicate s/he intended to have the effect of getting the goods/services and being bound to pay for them. The adoption of the process carried the intent to do a legally signNow act, the hallmark of a signature.Although not every state has adopted UETA either in part or in whole without modifications, I believe every state now has similar or identical provisions in its body of law. Assuming that this type of waiver would otherwise be legally enforceable (and many jurisdictions don't allow a waiver of liability for injuries under certain circumstances) then it would not be rendered unenforceable simply because it was signed electronically.Of course, in order to ensure the enforceability of any contract, one should generally consult with an attorney who is familiar with contract law in your jurisdiction and who could recommend a set of best practices for the storage and preservation of any contract stored as an electronic record.

-

What is the best electronic signature (eSignature / eSign) software for small businesses?

I use signNow. Its has great features and potential to use API when i need to.You have few others that are good and established. signNow Echosign is great.signNow - is another option. They also have stripe integration for payment.All of them will track responses ..like you can see who viewed and who signed.Gather your requirements :a) How many documents do you want to get signed every month?b) Does the content vary? if not you can create one template.c) Do you need API or can you fill the variables like name and address for a template and send it ?d) Do you want someone to pay when they sign? or is there a separate payment process - Right now out of box its only signNow ( AFAIK) or You can do Zapier integration if you have resources to help you with.Most of them start at low price and cost adds up when you want more than one template or you exceed maximum documents signed.Until you do a complete API integration, you can easily replace one with another. So you can start off with FREE plan and try it out and upgrade to basic plan and see if it meets your need and try the other vendor.If you know your numbers upfront, you can talk to the sales team.

-

How do you collect data?

Data collection is a method of gathering information in a way that allows businesses to address questions and predict future trends to make more effective decisions. Data collection is essential for credible research and business decisions.Data collection is a method of gathering information in a way that allows businesses to address questions and predict future trends to make more effective decisions. Data collection is essential for credible research and business decisions.Methods:Primary data collection:Quantitative: mathematical calculations, etc.Ex: black-and-white answer questionnaires; mean, median, mode, etc.Qualitative: use of non-quantifiable information (i.e. emotions, etc.)Ex: open-ended questionnaires, case studies, interviews, etc.Secondary data collection:Ex: publication date, depth of analyses, reliability of sources, etc.One type of data collection is market research. There are several data collection and market research analysis tools that you can use for online markets in particular. One great tool for online markets is Algopix. Algopix is a software that does product market research for Amazon, Walmart, & eBay Sellers. Using an algorithm, it analyzes market demand, possible margins, and shipping costs for current and future inventory. For consumers with large volume selling, Algopix has a bulk product analysis feature that allows the user to upload a spreadsheet with all the proper information of up to 3,000 products, which they then prepare a complete analysis for each product including shipping costs, possible revenues, demand, and much more. It saves time and makes it easy to manage your inventory as well as enter new markets.Algopix also has several tools that help sellers determine which market platform would be most beneficial to them. Such tools include an FBA fee calculator for Amazon, eBay category tree, online ASIN to ISBN converter, and a lot more. It is definitely one of the best market research analysis tools for online marketplaces.

-

What is the procedure for online registration of a company in India?

To begin an entrepreneurial journey you must know about the basic legalities and process connected with a company.Company Registration or Incorporation is most important step for a business journey.There are few things you need to know before you move to registration process. There are different types of company registration in India.Private Limited Company – It is one of the most used domain of company registration due to following reasons.Partners have their own secure share holdings.Allow an ease in process in loan and funding.Allow customers to build a trust with company.2. One Person Company – In One Person Company, a single person gains full authority over the company thereby restricting his/her liability towards their contributions to the enterprise. Therefore, the said person will be the sole shareholder and director.So there will be no opportunity for contributing to employee stock options or equity funding. Additionally, if an OPC has an average turnover of Rs. 2 crores and over or acquires a paid-up fund of Rs. 50 lakh and over in 3 consecutive years , it has to be converted to a private limited company or public limited company within six months.3. Limited Liability Partnership – Limited Liability Partnership Registration, governed by LLP Act 2008 combines the benefits of a partnership with that of a limited liability company. LLP was introduced to provide a form of business that is easy to maintain and to help owners by providing them with limited liability.Limited Liability partnership is having following features.LLP gives the separate legal entity in which partners have limited liabilityIt gives an ease of process to transfer the ownership with other person.LLP is suitable for small business which is having capital of around 25 Lacs and turnover of 40 Lacs.Get straight away for registering your company with India’s 1st Legal Hub for Business / Startups / Individual only at www.getmeofficial.com

-

How do I apply for a PAN card?

HIGHLIGHTS * Permanent Account Number or PAN card is an identity proof in India * It is needed to open a bank account in the country * You can get one easily via a process that is completely online A Permanent Account Number or PAN Card is an important document in India. You’ll need it to file income tax returns, to make payments above Rs. 50,000, and even to open a bank account. A PAN card is a valid proof of identity in India and it can be issued to citizens of India (including minors), non-resident Indians (NRIs), and even foreign citizens. The procedure for application varies for these categories of people but if you are an Indian citizen and wondering how you can apply for PAN card online, we will give an answer in this guide. These steps are for individuals only, and not for other categories under which a PAN card can be issued, such as an association of persons, body of individuals, company, trust, limited liability partnership, firm, government, Hindu undivided family, artificial juridical person, or local authority. Documents required to apply for a PAN card online Indian citizens need three types of documents to apply for a PAN card. These are identity proof, an age proof, and a proof of date of birth. 1. Identity proof documents (one of):Elector's photo identity cardRation card having photograph of the applicantPassportDriving licenceArm's licenseAadhaar card issued by the Unique Identification Authority of IndiaPhoto identity card issued by the Central Government or State Government or a Public Sector UndertakingPensioner Card having photograph of the applicantCentral Government Health Scheme Card or Ex-servicemen Contributory Health Scheme photo card certificate of identity in original signed by a Member of Parliament or Member of Legislative Assembly or Municipal Councillor or a Gazetted Officer, as the case may beBank certificate in original on letterhead from the branch (along with name and stamp of the issuing officer) containing duly attested photograph and bank account number of the applicant 2. Address proof document (one of)copy of the following documents of not more than three months old electricity bill landline telephone or broadband connection bill water bill consumer gas connection card or book or piped gas bill bank account statement depository account statement credit card statement copy of post office passbook having address of the applicant passport,passport of the spouse voter ID card latest property tax assessment order driving licence domicile certificate issued by the GovernmentAadhaar card issued by the UIDAIallotment letter of accommodation issued by the Central Government or State Government of not more than three years old property registration document certificate of address signed by a Member of Parliament or Member of Legislative Assembly or Municipal Councillor or a Gazetted Officeremployer’s certificate in original 3. Proof of date of birth (one of):birth certificate issued by the Municipal Authority or any office authorised to issue Birth and Death Certificate by the Registrar of Birth and Deaths or the Indian Consulate as defined in clause (d) of subsection (1) of section 2 of the Citizenship Act, 1955 (57 of 1955)pension payment order marriage certificate issued by Registrar of Marriagesmatriculation certificate passport driving licence domicile certificate issued by the Government affidavit sworn before a magistrate stating the date of birth If you are looking to get a PAN card for any category other than the individual, the full list of valid documents for a PAN card is on the Income-tax department’s website [ https://www.incometaxindia.gov.in/Documents/documents-required-for-pan.pdf ]. How much does it cost to apply for a PAN card online For Indian citizens, applying for a new PAN card costs Rs. 116 (plus online payment charges or around Rs. 5). The fee is Rs. 1,020 for foreign citizens (with around Rs. 5 as online payment charges). How to apply for PAN Card online Follow these steps to apply for a PAN card online in India: 1. You can apply for a PAN card online either via NSDL [ https://www.onlineservices.nsdl.com/paam/endUserRegisterContact.html ] or UTITSL [ https://www.utiitsl.com/UTIITSL_SITE/pan/#six ] websites. Both have been authorised to issue PAN cards in India. For this tutorial, we will show you how to apply for a PAN card via the NSDL website [ https://www.onlineservices.nsdl.com/paam/endUserRegisterContact.html ]. 2. On the page linked in the previous step, you will see a form titled Online PAN application. Under Application Type select New PAN - Indian Citizen (Form 49A). If you’re a foreign national, select New PAN - Foreign Citizen (Form 49AA). 3. Select the category of PAN card you need. For most people, this will be Individual. 4. Now fill in your personal details such as name, date of birth, mobile number, etc., enter the captcha code and click Submit. 5. Now you have three choices — authenticate via Aadhaar to avoid sending any documents, scan documents and upload them via e-sign, or to physically submit documents. 6. We chose to authenticate via Aadhaar as all it needs is an OTP and payment. If you don’t want that option, the steps for the other two are similar except the part where you have to send documents. 7. Enter all details such as Aadhaar number (optional) as requested on screen, and click Next. 8. This step requires you to fill in your name, date of birth, address, etc. Do that, and click Next. 9. Now you will hit the banana skin that’s the AO code (Assessing Officer code). This looks complicated but is actually quite simple. Just select one of the four choices at the top — Indian Citizens, NRI and Foreign Citizens, Defence Employees, or Government Category. 10. Then under Choose AO Code, select your state and area of residence. Wait for a few seconds and you will see a full list of AO codes in the box below. Carefully scroll and look for the category that applies best to you. There are different categories for companies, non-salaried people, government servants, private sector employees, etc. If you don’t know which category you fall under, contact a chartered accountant to find out. Click on the correct AO code and it’ll be auto-filled in the form above. Click Next. 11. Select the documents you have submitted as proof of age and residence from the drop-down menu, fill in required details, and then click Submit. Now you will be redirected to the payment page and you can choose one of many common online payment methods. The fee for PAN card applications for Indian citizens is Rs. 115.90 inclusive of all taxes. A small fee is added to this as online payment charges so the total works out to around Rs. 120. Once you have paid, you will be asked to authenticate via Aadhar OTP, or submit documents via e-sign, or to physically send the documents to NSDL. You will also receive an email acknowledgement from NSDL about your application and your PAN card will be couriered to you once the application has been processed. Keep the acknowledgement number handy, we recommend that you either save it somewhere safe or print it.

Trusted esignature solution— what our customers are saying

Get legally-binding signatures now!

Frequently asked questions

How do i add an electronic signature to a word document?

How to scan and save an electronic signature?

Attach a digital arrow in a pdf to indicate where to sign?

Get more for How Can I eSignature Form for IT

- How Can I Save Electronic signature in Box

- How Do I Save Electronic signature in ServiceNow

- Help Me With Save Electronic signature in ServiceNow

- How Can I Save Electronic signature in ServiceNow

- How To Implement Electronic signature in ERP

- How To Set Up Electronic signature in SalesForce

- How Do I Set Up Electronic signature in SalesForce

- Help Me With Implement Electronic signature in ERP

Find out other How Can I eSignature Form for IT

- Virginia military survivors and dependents education program roanoke va form

- Wyoming new hire form

- Arizona form 285 2006

- Application northstar winery form

- Matching gift forms

- Form 4506t template printable

- Caregiver charting forms

- Guardian retirement solutions lehigh pennsylvania form

- Usa patriot act independent review form

- Pinnacol first report of injury form 2009

- Verification of colorado residency ucdenver form

- International fuel tax association registration form oklahoma

- Fax number to send employment application to maxor pharmacy form

- Knife river online application form

- Forever resorts application form

- Application for employemt esrh form

- Poultry litter transfer form deq

- Scif e3067 formpdffillercom 2007 2019

- Form 5020

- Jwu physical examination form