Sign Assignment of Shares

- Quick to start

- Easy-to-use

- 24/7 support

Simplified document journeys for small teams and individuals

We spread the word about digital transformation

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Top-notch form management with airSlate SignNow

Get access to a robust form library

Make reusable templates

Collect signatures through secure links

Keep paperwork protected

Improve collaboration

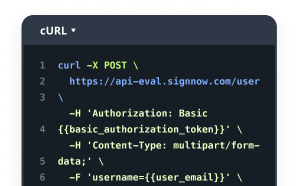

eSign through API integrations

Your complete how-to guide - assignment of shares

At present, it is likely you won't find a company that doesn't use modern technologies to atomize workflow. A digital signature is not the future, but the present. Modern day organizations using their turnover simply cannot afford to give up browser programs that offer superior data file management automation tools, like Sign Assignment of Shares option.

How to manage Sign Assignment of Shares airSlate SignNow function:

-

After you enter our internet site, Login or register your profile if you don't have one, it will require you a few seconds.

-

Upload the needed document or pick one from your library folders: Documents, Archive, Templates.

-

cloud-based storage compatibility, you can quickly load the appropriate doc from favored clouds with virtually any device.

-

You'll discover your data file opened within the advanced PDF Editor where you can add modifications before you decide to continue.

-

Type text, put in images, add annotations or fillable areas to be accomplished further.

-

Use My Signature button for self-signing or add Signature Fields to email the eSign require to one or several users.

-

Use the DONE button when completed to carry on with Sign Assignment of Shares function.

airSlate SignNow browser solution is important to increase the efficiency and output of all operational procedures. Sign Assignment of Shares is among the capabilities that will help. Utilizing the web-based software today is a basic need, not much of a competing edge. Try it now!

How it works

Rate your experience

What is the assignment of shares agreement

The assignment of shares agreement is a legal document that facilitates the transfer of ownership of shares from one party to another within a company. This agreement outlines the terms and conditions under which the shares are assigned, including the number of shares, the identity of the assignor (the person transferring the shares), and the assignee (the person receiving the shares). It serves to formalize the transfer and protect the interests of both parties involved in the transaction.

How to use the assignment of shares agreement

To use the assignment of shares agreement effectively, begin by filling out the required details in the document. This includes specifying the names of the assignor and assignee, the number of shares being transferred, and any relevant conditions or warranties. Once the document is completed, it can be sent electronically for signatures. With airSlate SignNow, users can easily upload the agreement, add signature fields, and send it to the involved parties for eSigning, ensuring a smooth and efficient process.

Steps to complete the assignment of shares agreement

Completing the assignment of shares agreement involves several key steps:

- Gather necessary information, including the names and addresses of the assignor and assignee.

- Specify the number of shares being assigned and any conditions related to the transfer.

- Upload the document to airSlate SignNow and use the platform to add signature fields.

- Send the document for signature to the assignee and any other required parties.

- Once all parties have signed, securely store the completed agreement for future reference.

Key elements of the assignment of shares agreement

Several key elements are essential in an assignment of shares agreement:

- Names of parties: Clearly identify the assignor and assignee.

- Number of shares: Specify the exact number of shares being transferred.

- Consideration: Detail any payment or consideration involved in the transfer.

- Effective date: Indicate when the transfer of shares becomes effective.

- Signatures: Ensure all parties sign the document to validate the agreement.

Security & Compliance Guidelines

When using the assignment of shares agreement, it is crucial to adhere to security and compliance guidelines. Ensure that all documents are stored securely and that access is limited to authorized individuals. airSlate SignNow provides robust security features, including encryption and secure storage, to protect sensitive information. Additionally, ensure compliance with relevant state laws regarding share transfers to avoid legal complications.

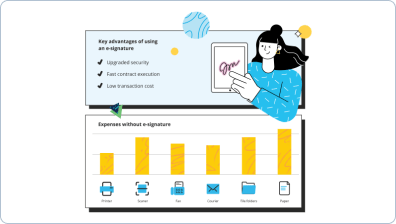

Digital vs. Paper-Based Signing

Digital signing of the assignment of shares agreement offers several advantages over traditional paper-based signing. With airSlate SignNow, users can complete and sign documents from anywhere, reducing the time and effort involved in printing, signing, and scanning. Digital signatures are legally recognized in the United States, providing the same legal standing as handwritten signatures while enhancing convenience and efficiency in the signing process.

-

Best ROI. Our customers achieve an average 7x ROI within the first six months.

-

Scales with your use cases. From SMBs to mid-market, airSlate SignNow delivers results for businesses of all sizes.

-

Intuitive UI and API. Sign and send documents from your apps in minutes.

FAQs

-

What is an assignment of shares agreement?

An assignment of shares agreement is a legal document that facilitates the transfer of ownership of shares from one party to another. This agreement outlines the terms of the transfer, including the number of shares, the parties involved, and any conditions that must be met. Using airSlate SignNow, you can easily create and eSign this document to ensure a smooth transaction.

-

How does airSlate SignNow simplify the assignment of shares agreement process?

airSlate SignNow streamlines the assignment of shares agreement process by providing an intuitive platform for document creation and electronic signatures. Users can quickly draft agreements using customizable templates, ensuring compliance with legal standards. This efficiency saves time and reduces the risk of errors in the documentation.

-

What are the pricing options for using airSlate SignNow for an assignment of shares agreement?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Whether you need a basic plan for occasional use or a comprehensive solution for frequent transactions, there is an option that fits your needs. Each plan includes features that enhance the creation and management of documents like the assignment of shares agreement.

-

Can I integrate airSlate SignNow with other software for managing assignment of shares agreements?

Yes, airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow for managing assignment of shares agreements. You can connect it with CRM systems, cloud storage services, and other tools to streamline your document management process. This integration ensures that all your business operations are synchronized and efficient.

-

What are the benefits of using airSlate SignNow for an assignment of shares agreement?

Using airSlate SignNow for your assignment of shares agreement offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick eSigning, which accelerates the transfer process. Additionally, all documents are securely stored and easily accessible, providing peace of mind for both parties involved.

-

Is it legally binding to eSign an assignment of shares agreement with airSlate SignNow?

Yes, eSigning an assignment of shares agreement with airSlate SignNow is legally binding in accordance with electronic signature laws. The platform complies with regulations such as the ESIGN Act and UETA, ensuring that your electronically signed documents hold the same legal weight as traditional signatures. This makes it a reliable choice for your business transactions.

-

How can I ensure the security of my assignment of shares agreement when using airSlate SignNow?

airSlate SignNow prioritizes the security of your documents, including assignment of shares agreements, through advanced encryption and secure storage solutions. The platform employs industry-standard security measures to protect sensitive information from unauthorized access. You can confidently manage your agreements knowing that your data is safe and secure.

Assignment of shares

Trusted eSignature solution - assignment of shares

Join over 28 million airSlate SignNow users

Get more for assignment of shares

- Start Your eSignature Journey: make an e signature

- Try Seamless eSignatures: make an electronic signature ...

- Explore Your Digital Signature – Questions Answered: ...

- Explore popular eSignature features: make my sign

- Explore popular eSignature features: make a sign

- Try Seamless eSignatures: making a signature in Word

- Explore popular eSignature features: making an ...

- Enjoy Flexible eSignature Workflows: Microsoft document ...

The ins and outs of eSignature