PCI DSS Signed Made Easy

Upgrade your document workflow with airSlate SignNow

Agile eSignature workflows

Instant visibility into document status

Easy and fast integration set up

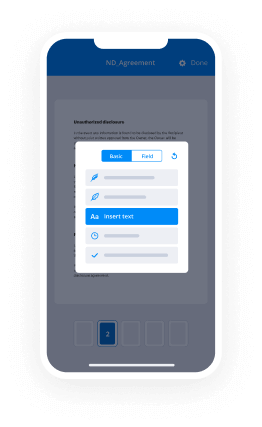

Pci dss signed on any device

Comprehensive Audit Trail

Rigorous security standards

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Your step-by-step guide — pci dss signed

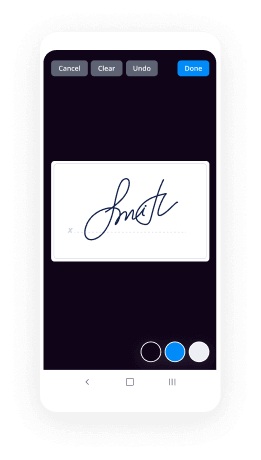

Using airSlate SignNow’s eSignature any company can speed up signature workflows and eSign in real-time, providing a greater experience to clients and staff members. Use PCI DSS signed in a few simple steps. Our handheld mobile apps make operating on the go possible, even while off the internet! Sign documents from anywhere in the world and close up trades in no time.

Follow the walk-through instruction for using PCI DSS signed:

- Sign in to your airSlate SignNow account.

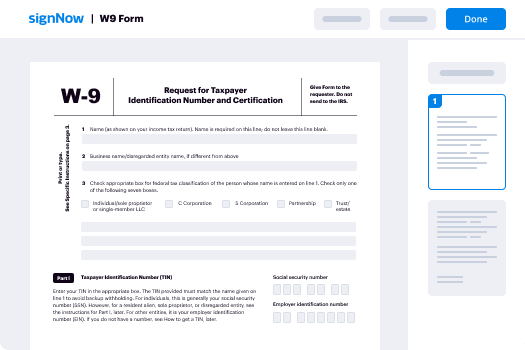

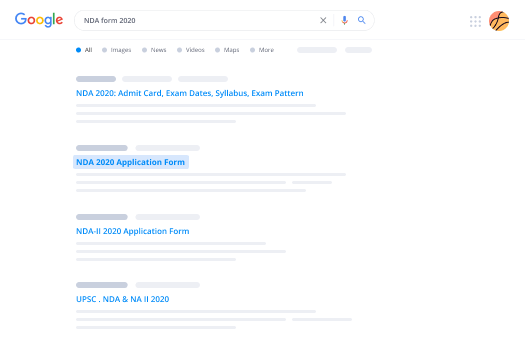

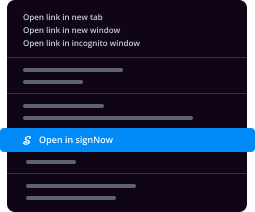

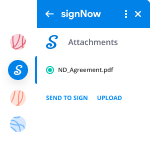

- Find your document in your folders or upload a new one.

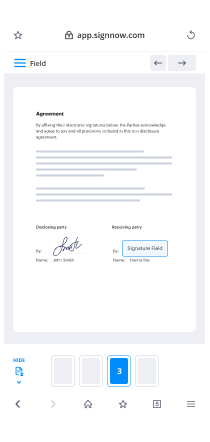

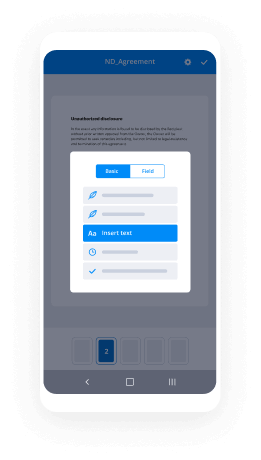

- Open the template and make edits using the Tools list.

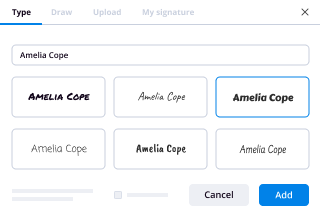

- Drop fillable areas, add textual content and eSign it.

- Add several signers using their emails and set up the signing sequence.

- Choose which users will receive an executed version.

- Use Advanced Options to reduce access to the template and set an expiry date.

- Press Save and Close when finished.

Additionally, there are more enhanced functions available for PCI DSS signed. Include users to your common work enviroment, browse teams, and track teamwork. Millions of consumers across the US and Europe agree that a system that brings everything together in one cohesive workspace, is the thing that businesses need to keep workflows performing effortlessly. The airSlate SignNow REST API enables you to integrate eSignatures into your application, internet site, CRM or cloud. Check out airSlate SignNow and get faster, smoother and overall more efficient eSignature workflows!

How it works

airSlate SignNow features that users love

See exceptional results PCI DSS signed made easy

Get legally-binding signatures now!

FAQs

-

How do you comply with PCI DSS?

Analyze your compliance level. Advertisement. ... Fill out the self-assessment questionnaire. ... Make any necessary changes. ... Find a provider that uses data tokenization. ... Complete a formal attestation of compliance. ... File the signNowwork. -

How much does it cost to become PCI compliant?

How much does PCI compliance cost? If youâ\u20ac\u2122re a small business, PCI DSS compliance should cost from $300 per year (depending on your environment). If you're a very large enterprise and need a PCI DSS assessment, expect to pay $70,000+ in total costs (depending on your environment). -

What does PCI compliant mean?

Being PCI compliant means consistently adhering to a set of guidelines set forth by the PCI Standards Council. PCI compliance is governed by the PCI Standards Council, an organization formed in 2006 for the purpose of managing the security of credit cards. ... Building and maintenance of a secure network and system. -

How do you validate PCI DSS compliance?

Determine which self-assessment Questionnaire (SAQ) your business should use to validate compliance. ... Complete the self-assessment Questionnaire according to the instructions it contains. -

Who is responsible for a merchants PCI compliance?

It is your responsibility to learn these regulations and adhere to them. Additionally, PCI-DSS states that you're also responsible for the compliance of any vendor that provides your business with software or services, as well as any company or individual who you hire. -

How do you do a PCI DSS audit?

Think carefully about your PCI DSS audit goal. ... Choose a reputable PCI QSA for RoC audits. ... Preparation is key. ... Find out where your data resides (and hides) ... Segment networks and maintain an accurate network diagram. ... Conduct a gap analysis. ... Documentation, monitoring and audit logs. ... Conduct regular testing. -

What happens if you are not PCI compliant?

If a data bsignNow occurs and you're not PCI compliant, your business will have to pay penalties and fines ranging between $5,000 and $500,000. ... If you're not PCI compliant, you run the risk of losing your merchant account, which means you won't be able to accept credit card payments at all. -

How often are PCI audits required?

Level 4 merchants must complete the PCI DSS Self-Assessment Questionnaire (SAQ) annually, but only Discover Merchants must submit an Attestation of Compliance every year. Additionally, Level 4 merchants are required to have a network scan by an ASV conducted quarterly. -

What happens if you are not PCI DSS compliant?

If a data bsignNow occurs and you're not PCI compliant, your business will have to pay penalties and fines ranging between $5,000 and $500,000. ... If you're not PCI compliant, you run the risk of losing your merchant account, which means you won't be able to accept credit card payments at all. -

What is the latest PCI DSS standard?

A: PCI DSS 3.1 will retire on 31 October 2016, and after this time all assessments will need to use version 3.2. Between now and 31 October 2016, either PCI DSS 3.1 or 3.2 may be used for PCI DSS assessments. The new requirements introduced in PCI DSS 3.2 are considered best practices until 31 January 2018. -

How much does PCI DSS compliance cost?

How much does PCI compliance cost? If youâ\u20ac\u2122re a small business, PCI DSS compliance should cost from $300 per year (depending on your environment). If you're a very large enterprise and need a PCI DSS assessment, expect to pay $70,000+ in total costs (depending on your environment). -

What happens if your not PCI compliant?

If a data bsignNow occurs and you're not PCI compliant, your business will have to pay penalties and fines ranging between $5,000 and $500,000. ... If you're not PCI compliant, you run the risk of losing your merchant account, which means you won't be able to accept credit card payments at all. -

What is required for PCI compliance?

In general, PCI compliance is required by credit card companies to make online transactions secure and protect them against identity theft. Any merchant that wants to process, store or transmit credit card data is required to be PCI compliant, according to the PCI Compliance Security Standard Council. -

How long does it take to be PCI compliant?

The entire process of becoming PCI compliant usually takes between one day and two weeks. The actual time for compliance will be dependent on how long the self-assessment questionnaire takes to complete. In addition, the business will need to pass a PCI scan. -

Is PCI compliance mandatory?

Although the PCI DSS must be implemented by all entities that process, store or transmit cardholder data, formal validation of PCI DSS compliance is not mandatory for all entities. ... Acquiring banks are required to comply with PCI DSS as well as to have their compliance validated by means of an audit.

What active users are saying — pci dss signed

Frequently asked questions

How do I eSign a document before sending it?

What do I need to sign a PDF electronically?

How do you add an eSignature to a PDF?

Get more for PCI DSS signed made easy

- Add digital sign

- Add signature block

- Confirm eSignature

- Confirm signature

- Confirm sign

- Confirm digital signature

- Confirm signed

- Send signed

- Comment signed

- Print signatory

- Fax signed

- Forward signature

- Forward signed

- Notarize eSignature

- Notarize esign

- Notarize electronic signature

- Notarize signature

- Notarize digital signature

- Notarize eSign

- Notarize electronically signing

- Merge initial

- Merge initials

- Merge email signature

- Copy initials

- Copy signatory

- Copy mark

- Copy email signature

- Upload initials