Send Document for Signing, Add Radio Buttons and eSign

Get the robust eSignature capabilities you need from the company you trust

Choose the pro platform designed for professionals

Set up eSignature API with ease

Collaborate better together

Send document for signing add radio buttons and eSign, within a few minutes

Reduce your closing time

Maintain sensitive information safe

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Our user reviews speak for themselves

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Your step-by-step guide — send document for signing add radio buttons and eSign

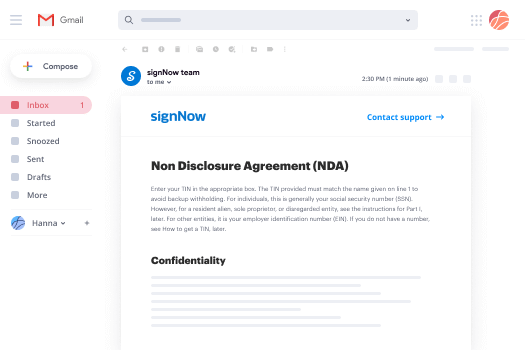

Send document for signing, Add radio buttons and eSign. Get greatest value from the most reliable and secure eSignature system. Streamline your digital transactions employing airSlate SignNow. Optimize workflows for everything from basic employee records to complex contracts and sales forms.

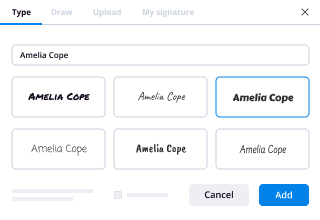

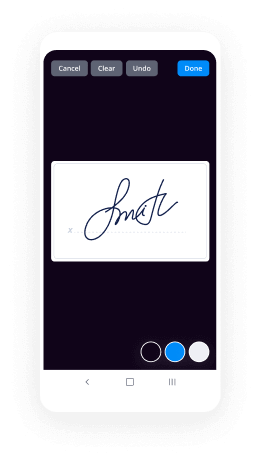

Learn how to Send document for signing, Add radio buttons and eSign:

- Import a series of files from your device or cloud storing.

- Drag & drop advanced fillable boxes (signature, text, date/time).

- Change the fields size, by tapping it and selecting Adjust Size.

- Insert dropdowns and checkboxes, and radio button groups.

- Add signers and create the request for additional materials.

- Send document for signing, Add radio buttons and eSign.

- Include the formula the place you require the field to appear.

- Apply remarks and annotations for the signers anywhere on the page.

- Approve all changes by simply clicking DONE.

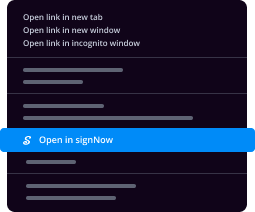

Link users from inside and outside your enterprise to electronically access essential signNowwork and Send document for signing, Add radio buttons and eSign anytime and on any system using airSlate SignNow. You can monitor every activity done to your templates, get alerts an audit report. Remain focused on your business and consumer partnerships while knowing that your data is precise and protected.

How it works

airSlate SignNow features that users love

See exceptional results Send document for signing, Add radio buttons and eSign

Get legally-binding signatures now!

FAQs

-

Will having 'email provider’ radio buttons on contact form improve user experience ?

No. You're trying to solve a non-problem, and your proposed solution adds friction.First, typing your e-mail address is not an issue anybody notices. Even less of a problem is typing the domain part of said e-mail address. And that only applies if your browser doesn't have auto-fill, which most people's do.Your solution means people are going to have to stop and think — “Oh, they want me to only type to the @ sign and then read this list and pick from it or check this radio button and then type the last part …” Just having to think that through takes more attention than simply typing “gmail... -

What could I do to improve my website? It’s not online yet, so a video of all the features is linked.

Hi Danny!All previous answers are full of useful advices and I want to add some too :)Add Contact page.Don’t forget about the footer. It must contain some contact information and list of your main pages.It would be better to make a blog instead of single page about sugar. You can write unique and uselful articles about metabolism, healthy food and share recipes without sugar etc. It will let you attract new visitors from organic search and social media, for example.Try to see how your website looks with a bit ligher and softer colors. For example, change ED7064 for FFB6AE and add 20–30% tr... -

Which is the best free WordPress search plugin?

I personally recommend Relevanssi. It replaces the common WordPress search with better search engine. It presents the results faster and with a higher accuracy. This combines with the better presentation of the results wows the website users. Relevanssi is offered in two versions, the regular and premium versions. The regular is available for free to download and use. The premium version comes with an additional cost and more features such as spelling correction and many more.If you want the simpler option, the below choices are also good.WP Ultimate Search - Based on Ajax framework, this p... -

How do I unsubscribe from Quora emails?

From our Help Center article, How do I unsubscribe from Quora emails?:If you want to unsubscribe from various Quora e-mails, you can do so by clicking the ‘Unsubscribe’ link located at the bottom of the email.In general, to control what types of e-mails you receive from Quora, including our Digest emails, go to your Settings page, navigate to "Email & Notifications" in the left-side navigation menu (or http://www.quora.com/settings/notifications), and toggle your settings from there.For more information about Quora’s features and frequently asked questions, check out our Help Center. -

What is the average income per online radio stream delivered to a recording artist/publisher?

What the artist will make is dependent on their recording agreement. If they are an independent artist and own the recording they will get 100% of the Label portion.I will break down some average figures using cpm (per 1000 streams) for each type of royalty. These are not set in stone but should be very close for 2015–2017….Label (owner of the recording) $1.50 cpm (per 1000 streams)Performance Royalties (ascap, bmi, sesac) $.30 (per 1000 streams)breakdown….$.15 cpm (per 1000 streams) to publishers$.15 (per 1000 streams) to songwriters for a totalMechanical Royalties (Harry Fox) $.12 cpm (pe... -

What could get cheaper and costlier in the GST bill?

Luxury cars, FMCG products, consumer durables, electronics items and readymade garments will become cheaper once GST is rolled out next year, but mobile phones, banking and insurance services, telephone bills as well as air travel will be dearer due to higher tax. Under the new indirect taxes regime, likely to take effect from April 1, 2017, levy on manufactured goods will come down, while consumers may end up spending more as service tax burden would go up, as GST is a consumption based tax.While the government is sure of the benefits the Goods and Services Tax will bring to the common man, it says it is still early days to predict which items will become more expensive or cheap. “On the whole, GST will bring down the burden of taxes on common man. However, unless the rate structure is finalised, it is not possible to predict which items will get relief,” Revenue Secretary Hasmukh Adhia told PTI.Tax experts claim that the current practice of tax on tax — for example, VAT being charged on not just the cost of production but also on the excise duty that is added at the factory gate leading to cost build-up — will go once GST is rolled out. This will help bring down prices of a range of products — from FMCG to consumer durables and electronics to readymade garments.On the other hand, for goods which currently attract low rate of duty like small cars (excise duty of 8 per cent), the impact of GST will bring about a price hike. However, for SUVs and big cars that attract excise duty of 27-30 per cent, will see a marked drop in prices. Tax experts feel that all services, barring essential ones like ambulance, cultural activities, pilgrimages and sporting events that are exempt from levy, will become costlier as the present 14.5 per cent rate is likely to increase to 18-22 per cent.Therefore, eating out, travel, telephone bills, banking and insurance services, hiring cabs, broadband, movies, branded jewellery and popular sporting events such as IPL will become expensive. “We cannot predict specifically any such thing. Once the rate structure of various items is decided then only we can predict the items on which the tax will go up or come down,” Adhia said, when asked if tax on services like mobile bill payment will go up with GST.GST, hailed as the most powerful tax reform that India has seen, aims to do away with multiple-tax regime on goods and services and bring them under one rate. GST will alter the present system of production-based taxation to a consumption-based one. While manufactured consumer goods will become cheaper as the incidence of excise duty and VAT will come down from 25-26 per cent at present, the cost of services would by and large, go up from the present 15 per cent levels.Currently, a consumer pays 25-26 per cent tax over and above the cost of production due to excise duty (peak of about 12.5 per cent) and value added tax (VAT). While there is no indication of what the GST rate will be, experts put it between 18 and 22 per cent which will, in all likelihood, make basic goods cheaper. Certain essential items such as raw food articles are not taxed at present and are expected to remain out of GST.The key products that would witness price reduction under GST are luxury automobiles, processed food, FMCG and pharma products. Processed food will continue to be taxed, but the applicable GST is likely to be lower than the current combined tax on such products. Hence, expect these to become slightly cheaper. The services that may witness increase in cost are telecom, rent-a-cab, movies, music concerts and tickets for sports events like IPL, according to Mahesh Jaising, Partner, BMR & Associates LLP.Tax advisory firm Nangia & Co said essential services for mass consumption may see a lower rate as they may be kept in lower tax bracket. Investment management and insurance premiums, which attract a service tax now, may also become costlier with the higher rate of GST. “GST is a mixed bag for the telecom sector. Customers are presently paying 15 per cent on cell phones and data card, which may see an upward movement. However, DTH players and cable companies may see a reduction in cost of services,” said Nitish Sharma, Partner (Indirect Taxation) Nangia & Co.Economic Laws Practice Partner Rohit Jain said common man could see some price escalation in services, while the taxation of real estate sector needs some clarity. “For a common man, the cost of services may go up, but there will be a reduction of price of goods,” Jain said, adding that land should be kept out while calculating the tax for purchase of real estate property. The total levy paid in buying a real estate property from a builder currently is 7 per cent (5 per cent Service Tax plus about 1-2 per cent VAT).For FMCG and pharma products, the manufacturing hubs for such products are influenced by the excise/state incentive schemes. Under GST, the manufacturing locations may be readjusted from a commercial perspective and have an impact of prices of such goods. Goods attract an excise duty of 12.5 per cent and a VAT of 12.5-15 per cent depending on the state. Further, there are numerous cascading of taxes on account of levy of CST, input tax credit retention under the VAT laws, levy of entry tax/Octroi/ local body tax, etc till the time the product signNowes the end customer.A combined effect of these taxes lead to an effective incidence of indirect taxes in the range of 23-25 per cent for the consumer. “Under the GST regime, there would be an airSlate SignNow reduction in the overall indirect tax cost and increased credit flow for the manufacturers. This reduction in indirect tax cost can lead to reduction in production cost and increase in base line profits, which would in turn give headroom for reducing prices for end-users,” Jaising said.Nangia & Co’s Sharma said GST would signNowly reduce logistics costs across the value chain and lead to improved margins as a result of lower transportation costs. ICRA, in a report said, that the tax base would widen under the GST regime to cover the unorganised sector, thereby protecting the Governments’ revenues. This could also lead to the organised sector gaining an edge in sectors which have a strong presence of unorganised players. “The GST rate applicable to services is expected to be higher than the current service tax rate, thereby offsetting the revenue loss from organised sector manufactured goods. However, this may have an adverse impact on demand for services,” ICRA said.

What active users are saying — send document for signing add radio buttons and eSign

Related searches to Send document for signing, Add radio buttons and eSign

Frequently asked questions

How do you generate a document and apply an electronic signature to it?

How do I insert an electronic signature into a Word document?

How do I eSign a PDF on a PC?

The ins and outs of eSignature

Find out other send document for signing add radio buttons and eSign

- Increase Compliance with eSignatures: how to sign power ...

- Increase Compliance with eSignatures: how to sign power ...

- Increase Compliance with eSignatures: how to sign power ...

- Increase Compliance with eSignatures: how to sign real ...

- Increase Compliance with eSignatures: how to sign ...

- Increase Compliance with eSignatures: how to sign ...

- Increase Compliance with eSignatures: how to sign under ...

- Increase Compliance with eSignatures: how to sign using ...

- Increase Compliance with eSignatures: how to sign when ...

- Increase Compliance with eSignatures: how to sign when ...

- Increase Compliance with eSignatures: how to sign your ...

- Get Started with eSignature: iphone how to sign pdf

- Increase Compliance with eSignatures: legal document ...

- Increase Compliance with eSignatures: legal document ...

- Increase Compliance with eSignatures: legal document ...

- Increase Compliance with eSignatures: legal document ...

- Increase Compliance with eSignatures: legal letter ...

- Increase Compliance with eSignatures: legal notice ...

- Unlock the Power of eSignature: libre office sign ...

- Increase Compliance with eSignatures: limited power of ...