Deposit Checkbox Article. Use eSignature Tools that Work Where You Do.

Get the robust eSignature capabilities you need from the company you trust

Choose the pro service created for pros

Whether you’re introducing eSignature to one team or throughout your entire business, the process will be smooth sailing. Get up and running quickly with airSlate SignNow.

Set up eSignature API quickly

airSlate SignNow works with the applications, services, and gadgets you currently use. Easily embed it right into your existing systems and you’ll be effective instantly.

Work better together

Enhance the efficiency and output of your eSignature workflows by providing your teammates the ability to share documents and templates. Create and manage teams in airSlate SignNow.

Deposit checkbox article, in minutes

Go beyond eSignatures and deposit checkbox article. Use airSlate SignNow to negotiate agreements, collect signatures and payments, and speed up your document workflow.

Decrease the closing time

Remove paper with airSlate SignNow and minimize your document turnaround time to minutes. Reuse smart, fillable templates and send them for signing in just a couple of clicks.

Keep important information safe

Manage legally-valid eSignatures with airSlate SignNow. Run your company from any place in the world on nearly any device while maintaining top-level security and compliance.

See airSlate SignNow eSignatures in action

airSlate SignNow solutions for better efficiency

Keep contracts protected

Enhance your document security and keep contracts safe from unauthorized access with dual-factor authentication options. Ask your recipients to prove their identity before opening a contract to deposit checkbox article.

Stay mobile while eSigning

Install the airSlate SignNow app on your iOS or Android device and close deals from anywhere, 24/7. Work with forms and contracts even offline and deposit checkbox article later when your internet connection is restored.

Integrate eSignatures into your business apps

Incorporate airSlate SignNow into your business applications to quickly deposit checkbox article without switching between windows and tabs. Benefit from airSlate SignNow integrations to save time and effort while eSigning forms in just a few clicks.

Generate fillable forms with smart fields

Update any document with fillable fields, make them required or optional, or add conditions for them to appear. Make sure signers complete your form correctly by assigning roles to fields.

Close deals and get paid promptly

Collect documents from clients and partners in minutes instead of weeks. Ask your signers to deposit checkbox article and include a charge request field to your sample to automatically collect payments during the contract signing.

Collect signatures

24x

faster

Reduce costs by

$30

per document

Save up to

40h

per employee / month

Our user reviews speak for themselves

be ready to get more

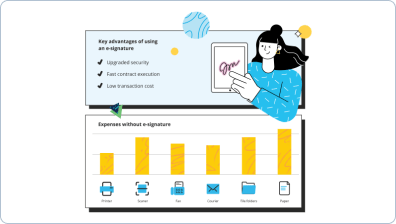

Why choose airSlate SignNow

-

Free 7-day trial. Choose the plan you need and try it risk-free.

-

Honest pricing for full-featured plans. airSlate SignNow offers subscription plans with no overages or hidden fees at renewal.

-

Enterprise-grade security. airSlate SignNow helps you comply with global security standards.

Your step-by-step guide — deposit checkbox article

Deposit checkbox article. Get highest benefit from the most respected and secure eSignature solution. Enhance your electronic deals employing airSlate SignNow. Automate workflows for everything from basic staff documents to challenging contracts and purchase templates.

Know how to Deposit checkbox article:

- Import a few pages from your device or cloud storage space.

- Drag & drop advanced fillable boxes (signature, text, date/time).

- Modify the fields size, by tapping it and choosing Adjust Size.

- Insert dropdowns and checkboxes, and radio button groups.

- Add signers and create the request for additional materials.

- Deposit checkbox article.

- Include the formula where you need the field to generate.

- Apply remarks and annotations for the users anywhere on the page.

- Approve all changes by simply clicking DONE.

Connect people from inside and outside your organization to electronically access important documents and Deposit checkbox article anytime and on any system using airSlate SignNow. You can keep track of every activity performed to your documents, receive notifications an audit report. Remain focused on your business and customer relationships while understanding that your data is accurate and secure.

How it works

Open & edit your documents online

Create legally-binding eSignatures

Store and share documents securely

airSlate SignNow features that users love

See exceptional results Deposit checkbox article. Use eSignature Tools that Work Where You Do.

be ready to get more

Get legally-binding signatures now!

FAQs

-

How do you endorse a check to mobile deposit?

To endorse a check for mobile deposit using airSlate SignNow, simply open the app and select the document. Sign your name using their robust eSignature feature, and add any necessary information such as the date or account number. The streamlined process increases productivity and impresses customers while saving money and maximizing ROI for companies. airSlate SignNow’s customizable eSignature workflows empower small and medium businesses, managers, and employees accountable for documents to move fast and confidently towards their goals. -

How do I deposit a check with a picture?

To deposit a check with a picture, airSlate SignNow offers an electronic signature solution that streamlines your document workflows. By utilizing high-volume eSignature features, you can increase productivity and impress your customers with fast, efficient transactions. With airSlate SignNow, you'll also save money while maximizing ROI. Whether you're a small business owner or a manager overseeing important documents, airSlate SignNow is the solution you need to move forward confidently and securely. -

How does depositing a check by picture work?

Depositing a check by picture is an easy and convenient way to add funds to your account. Simply take a picture of your check with your bank's mobile app, verify the amount, and submit it. The app will then process the deposit and add the funds to your account - all without the need to visit a physical branch. -

Can you deposit a picture of a check?

Yes, you can deposit a picture of a check with airSlate SignNow's high-volume eSignature features. With airSlate SignNow, users can increase productivity with document workflows, impress customers, and save money, while maximizing ROI. With a customizable eSignature workflow, airSlate SignNow is the perfect solution for SMBs and mid-market businesses looking to streamline their document processes and gain a competitive edge. Try airSlate SignNow today and experience the ease and efficiency of electronic signatures. -

How long does mobile check deposit take?

Mobile check deposit typically takes 1-2 business days to process and post to your account. With airSlate SignNow, individuals and companies can increase productivity by streamlining their document workflows, impress customers with a professional and efficient signing process, and save money while maximizing their ROI. Whether you are a small business owner, manager, or employee responsible for important documents, airSlate SignNow offers customizable eSignature solutions to meet your specific needs and improve your document management process. -

Is it safe to deposit checks with phone?

Yes, it is safe to deposit checks with phone using airSlate SignNow's high-volume eSignature features. With airSlate SignNow, users can increase productivity with document workflows, impress customers, and save money while maximizing their ROI. As a reliable and customizable electronic signature solution, airSlate SignNow provides complete security and ensures the legality of documents. So, whether you are a small business owner, manager, or employee accountable for your documents, you can trust airSlate SignNow to streamline your document management process effortlessly. -

Is it better to deposit a check in person?

airSlate SignNow is the best electronic signature solution for busy individuals and companies. By using its high-volume eSignature features, users can easily manage and automate document workflows. This increases productivity, impresses customers, and ultimately saves money while maximizing ROI. With airSlate SignNow, SMBs and mid-market companies can confidently streamline their document processes and focus on growing their business. -

How do I deposit a check with my phone?

To deposit a check with your phone, simply download the mobile app of your bank, select the deposit option, and capture images of the front and back of your endorsed check. Then follow the app's instructions to complete the deposit. With airSlate SignNow's electronic signature solution, you can increase productivity with streamlined document workflows, impress customers with efficient signing processes, and save money while maximizing ROI with customized eSignature features. airSlate SignNow is the perfect solution for small and medium businesses, managers, and employees accountable for documents, providing simple and effective electronic signature workflows for every need. -

Is it safe to deposit a check with your phone?

Yes, it's safe to deposit a check with your phone. Just make sure you use a reputable banking app that uses advanced security features like encrypted data transmission and secure logins. It's a convenient way to save time and avoid lines at the bank. -

How do I deposit a check?

If you're looking for an easy and secure way to deposit a check, airSlate SignNow is the solution for you. With its high-volume eSignature features, you can streamline your document workflows, impress customers, and save money while maximizing your ROI. Whether you're a manager or an employee accountable for documents, airSlate SignNow can help you increase productivity and move fast with customizable eSignature workflows that meet your specific needs. So why wait? Sign up for airSlate SignNow today and experience the benefits of electronic signature solutions firsthand!

What active users are saying — deposit checkbox article

Frequently asked questions

How do I digitally sign documents with Microsoft tools?

There are several ways to digitally sign documents with Microsoft. However, the best way to eSign a Word document is with the help of airSlate SignNow. The platform helps generate and use legally-binding electronic signatures and validate any type of document format, including Word and PDF. To insert an eSignature, open your document in airSlate SignNow, add a signature field, click on the field, and select Edit -> Add new signature, then draw your signature and press Sign.

How do you sign PDF docs online?

The most convenient method for signing documents online is by using web-based eSignature solutions. They allow you to eSign documents from anywhere worldwide. All you need is an internet connection and a browser. airSlate SignNow is a full-fledged platform that has many additional features such as Google Chrome extensions. By utilizing them, you can import a doc directly to the service from your browser or through Gmail by right clicking and selecting the appropriate function. Take online document management to the next level with airSlate SignNow!

How do you add a signature to a PDF?

The process is pretty easy: log in to your airSlate SignNow account, upload a document, open it in the editor, and use the My Signature tool. In the pop-up window, choose your preferred method. If you are using the service for the first time, you can create your electronic signature by drawing it with your touchpad or using a mouse, typing and selecting a handwritten style, or uploading it. All of them are legally binding and will be recognized as valid. If you already have saved signatures in your account, just select the one you prefer and place it on the sample.

Get more for deposit checkbox article

- ISO 27001:2013-compliant Customer relationship management

- ISO 27001:2013-compliant Lead management

- ISO 27001:2013-compliant Contact and organization management

- PCI-compliant CRM

- PCI-compliant Customer relationship management

- PCI-compliant Lead management

- PCI-compliant Contact and organization management

- PCI DSS-compliant CRM

The ins and outs of eSignature

How to add signatures to PDF documents

Explore tips and hints for creating legally valid eSignature and adding it to PDF documents. Know how to solve your pain points with airSlate SignNow’s eSignature.

Your 2020 guide to electronic signatures

Find out everything you need to know about electronic signatures, such as their validity, practical usage, and much more.

A Comprehensive Guide To How To Sign and Date a PDF as an HR Manager or Director

Read our how-to guide and learn how to sign and date a PDF with an eSignature. Manage onboarding workflows at ease with tools for adding dates and eSigning PDFs.

Find out other deposit checkbox article

- Make the most out of our AI-driven tools to sign real ...

- Make the most out of our AI-driven tools to sign ...

- Make the most out of our AI-driven tools to sign ...

- Empowering your workflows with AI for bank loan ...

- Empowering your workflows with AI for car lease ...

- Empowering your workflows with AI for child custody ...

- Empowering your workflows with AI for engineering ...

- Empowering your workflows with AI for equipment sales ...

- Empowering your workflows with AI for grant proposal ...

- Empowering your workflows with AI for lease termination ...

- Empowering your workflows with AI for postnuptial ...

- Empowering your workflows with AI for retainer ...

- Empowering your workflows with AI for sales invoice ...

- Empowering your workflows with AI tools for signing a ...

- Start Your eSignature Journey: sign pdf documents

- Start Your eSignature Journey: online pdf signer

- Start Your eSignature Journey: sign doc online

- Start Your eSignature Journey: sign documents online

- Start Your eSignature Journey: sign the pdf online

- Start Your eSignature Journey: signing on pdf online