Industry sign banking new hampshire lease template now

oh there we go alright cool so thanks for joining us today our webinar is all about cash flow and you know ways that you can finance and do rentals and leases and all sorts of stuff on your equipment to make the most of your investment and buying any kind of drone from us but a lot of our customers that have responded that this webinar series are looking at spring drones specifically so we'll have a lot of conversation about that and I want to introduce all y'all that are joining us either live and on the computer which it looks like a bunch of you are and then they're couple you have called in as well on the phone so welcome regardless of higher joining and so i'm brian sanders president of HSE UAV just glad to be here with you guys again beautiful sunny day here which is awesome oops when you're kind of stuck inside that it's nice out and also with me is brandon and brynn is with our premier lending partner eseni of capital so let Brandon introduce himself in a moment and also with us assignment and Simon is our chief technician and here to you know just answer a lot of questions that you might have again this webinar like our other ones is a focused session specifically about cash flow so that's how we're going to prioritize your questions today is around you know leasing financing those kinds of programs if we have some time at the end to answered nine questions about this we can jump into those too as a reminder however you've joined us whether on a computer or on a smart device at the very bottom of your screen you'll see an option for a Q & A so that's how you can submit questions to us and you'll be able to specifically you know type in any kind of thing that you want to know or things that you have on your mind and as we answer those questions will either answer live on the webinar or will type the response and once we answer them you'll get a notification and then also everyone else that's on the webinar with you will also be able to see your question and the answer as well so welcome all right Brandon I'll turn it over you certa introduce yourself and and we'll just get get started here cool all right well first off Brian thanks thanks for inviting me to do this this is a fun little opportunity here so thank you yeah like Brian said my name is Brandon 10 all I work I'm a finance manager over at a centium capital I'll even partner the HSC for I don't know about six months now we kind of started really good to go and I know we've been in talks a little longer than that but kind of started getting some business flowing here the last couple of months so I'm just gonna kind of start and kind of give everybody a brief history about ascending just who the hell we are and and and why choose us over you know a lot of different banks and lenders out there and what Wyatt centium and why I'm you know ye but you guys have partnered with us initially to I'll be super brief so I can talk all day and and you know for everyone with financing things right so I'll do that and then I think you know as we discussed before all its kind of start taking some questions I think it's just better that way that way I could address everything that everyone on the call or you know wants to address so so firstly I'll start with a little bit of a history about ascend iam so we were initially a bank back you know late 90s early 2000s and then a centium came around in 2010 we were actually one of our initial investors was Paul Allen a Microsoft so that's kind of our biggest thing right as we're a technology company this happens to offer financing oh and we're also the number one lender and in that regard right so we did last year we did a little over one and a half billion in financing so we have a huge portfolio as far as that concern um like I said before the largest privately held independent finance company out there so what's a little different with us well we were private equity until actually April 1st I don't know if I've even discussed this with with Brian or anyone else in the call and we're actually acquired by Regions Bank as of April kind of caught all of us off Garlin well I'd like Regions Bank so but really all it was was they just wanted to take us on their books they liked all the business we were doing we do a lot of you know I know there's a lot of other lenders out there that'll do a lot of these you know startups tour credits we're a little more strategic around taking those right and whether it's requiring down payments personal guarantor well a lot of these folks won't do that right so the positive with that right is we're still running pretty much business as usual as a senem and we're ness we're not running like you know most banks you go and try to get a commercial loan we're putting they're putting liens on your assets in your house and taking an arm and a leg just to get 30 grand and it takes you know 60 days to close and you got all that what's beautiful about us and again being acquired by Regions Bank is now we can offer those even you know more competitive Bank rates now for a credit customers awesome and and and our turnaround opposed to that month maybe two months for a bank I mean you Brian you you know you guys all know right I mean we can get a deal done all the same day we have credit decisions as fast as 20 minutes unsung that we could dock we could get you approved dock your deal and and fund you guys and you know on the same day now that's one of the things that's been so you know importance of customers friend and right is that the ability to say you know I want to take advantage of this technology right away right and sometimes other kind of lending and customers always have of course you know a variety of lending options whether it's their own local bank that they do business with with like they're checking and savings you know or other other custom maybe they check there and that particular lender doesn't offer you know equipment financing right or you know maybe it would take 60 days or 90 days and they just don't want to mess with that so that's one of the things that that we really appreciate about you know our working relationship with you guys so that's awesome Brandon cool so let's just jump right in and we don't have any questions right now from any of our attendees but I know that some of you guys had submitted those questions before the webinars so we'll just start crawling through those and then as a reminder anyone that's joined us just welcome welcome glad to have you I'm Brian Sanders and with me here my partner in crime is Brandon Jenelle with us in iam capital and as a reminder if you have questions that you want us to address today on the webinar use the Q and a button at the bottom of your zoom whether that's on a smartphone or a computer you'll see Q&A type your question in there and Brandon and I on the team will tackle it so cool um joy welcome by the way yeah totally will you start bringing up some of those questions that people submitted ahead of time and Brandon and I could get those sorry definitely so we have two that kind of go hand in hand so I'll read both of those together right whether this program be available to partners in Southeast Asia and then another customer askin financing be considered for companies outside USA and if at all possible what terms could be expected yeah so good good questions no I'm just absolutely non Southeast Asia unfortunately right now we could really only do us you know us they could you know states in the US Puerto Rico and then as far as other countries we do have partners I believe now in Mexico off the double check but I'm almost positive we have partner banks that were you know partnered with and in Mexico and I know for a fact Canada so we could we could definitely do Canada it's not gonna be the same pricing and you know we can't guarantee as far as our three to six-month deferral program zero down so I don't I don't know I don't know super specifics on raids terms I do know again they're Bank rates but the good thing is we'll be running it with our with our software and our you know everything that we do right so instead of waiting that twenty to thirty days whatever it is that most banks take we can get it done same day or a few days we just indicate those and they take over that loan just because we don't like to at least right now get into international fare so you don't understand yes so thanks joy that's that's great and I want to just let you kind of let the cat out of the bag Brendan which is awesome right because we were going to get to this anyway so one of the things that that has been really important to our customers is part of acquiring a sprang drone requires certain kinds of approvals right from the F and also in certain states while all states there's an approval process and some of those are really fast and some of those are a little slower so what HS he was really able to accomplish and one of the reasons that we have branded specifically on this call and his team is that it gives us the ability to offer a actual way to buy the equipment you know get your training done get all of your you know on-site calibration and testing any of your spray or application testing that you want to do at your location actually have the equipment get your FAA approvals get your state applicators licenses and actually not have to pay a full payment or the full cash upfront and as all of us know you know cash is really king right now and I think a lot of business owners are still really committed to taking advantage of or farm owners I mean any kind of application that you're looking at you want to take advantage of all of the efficiencies and the safety benefits of spraying with drones at the same time preserving capital so Brandon can you talk a little bit about how we've structured this deferred payment program and how that all works for customers so that they can kind of get an idea yeah so that so originally we so we've always you know had different promotional items whatever maybe whether is zero down to four payments whatever it is and and I suppose you had a third payment to be typically trying to save for our strategic partnership senators such as yourself right to offer to their customers and typically we would only really get it done on a sometimes be credits now with everything going on especially right now you know with Koba 19 and a lot of economic uncertainty you know there's still people out there that are still trying to acquire equipment and you know whether it's drones or really any other capital equipment right and so trying to make a living and make money so and all approvals that we're doing in-house so really all that means is minimum 650 650 FICO two years in business we can get you up to six months to fir payments I say up to because it's not always that there's a couple you know quirks and the credit sometimes that we might get three months for payments right now if you said Ryan that's the biggest thing right so you you know you want to acquire this equipment but you saw that your training you gotta get all your licensing done well you can acquire your equipment today get your proof for zero down so you'll pay our one-time documentation fee which is a flat twenty $95 which actually could be financed in here your loan amount right so adds an extra four dollars a month to your payment and then for the next three to six months we can defer your payments for only $29 a months we have to legally charge some sort of touch payment and you can choose either $29 a month or $99 a month you choose the $99 a month it'll make your you know the rest year term payments slightly lower illegally right we have to we have to make that those touch payments just to make the contract legally binding so that's awesome so you know that was our original goal right Brendan is that customers could have the ability to really leverage you know the financial aspect like really having their money go further and not be so you know tied up or limited or restrained by some of those FAA processes or certain site they're taking longer well right I mean say right you get you get you know takes a month to get you know your licensing and what everything is start using your drone but you know what payments so Thanksgiving anything about the you know the cash you can generate until Thanksgiving and you know and you hope you know you owe two accounts on Netflix payment right right - LuAnn Netflix get out there and start making some honey right you're good it's perfect oh good that's awesome all right here's a question from one of our live attendees Brandon that says if we finance can we rent this system out I know a lot of or some finance companies do not allow renting systems if you financed it to purchase it yeah no um well it depends what the what the use would be for right so as far as if you were renting it like they had you know freely an extended period of time really if you owned trying to think of an example cuz drones are a little tricky so I like for example right I mean out of this would be the same thing and you you let me know I don't know the industry obviously what you guys but so I work with when that me directly but our company works a lot with like inflatable vendors right like people that produce inflatables like bouncy houses and those kind of things all right so we so we so we could finance inventory for rental companies right that go ahead and that rent those out to like birthday parties or whatever so with that is that kind of what they're asking that or I would assume so and you might this particular attendee might be able to fill us in if you'd like to go ahead and just kind of say a little more about what you're looking for Arthur you can type another question but typically what it might look like Brandon is that you know a company buys drones and then rinse them out right so that the there's another applicator down the road or another farmer that wants to use the equipment and they can rinse it out that way what he responds with but typically not yeah I would stand to say probably not on that there's very very few cases we can I can double check with senior management I can let you know let you guys know for sure but I'm gonna stand I'm leaning very far towards towards probably not okay all right got it yeah he's saying he's thinking about renting it out to others so that you know people that are using other kinds of applications other than what he's buying the drum Fork and having the vehicle rain so yeah can you chase that up the line and let us know yeah for sure so you get off this call I can I'll ask and even well I shouldn't even say that publicly but sometimes and some of those things right yes we know nothing I didn't know oh cool okay great that's a great question Arthur thanks for asking that and then let me see if we've got any other questions from our live audience here we should have some like game show music right like some ridiculous Simon can you can you find some kind of ridiculous webinar game show music that's like an s from North Carolina I need one of those long microphones so as a reminder to our attendees just click on that Q&A at the bottom to submit your questions so that we can tackle those for you today Brandon I'm sure it'll come up at some point and I know that you know every person's credit situation is different but can you give us some kind of ballparks of terms and rates and maybe what we'll see in the world like a monthly payment so people can kind of start you know getting their heads around what that would look like yeah so the way the way our contracts are structured you you guys have seen or Brian oh you've seen copies of our contracts they're structured as used contracts right so it's not your typical bank loan like a mortgage or a car loan where it's amortized over a certain amount of time right so say for example you have you have a 36 month term you have 36 payments at this we don't list the APR we structure it kind of as if you look even and it's the same thing as our same thing is our rental program which we can get to later on - right where it's kind of structured it's really used contract the way I look at it is kind of like a phone bill right so say you have a rise in you pay the rental on your the equipme

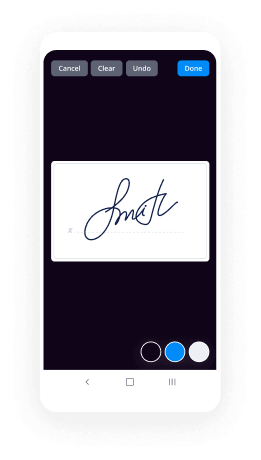

t itself on your phone and then the server is provided Brian so say you pay one hundred $29 a month the rise if you don't really call them hey what's the APR on this what's its built-in right so do you know that the financing is kind of built into that somewhere exactly so the reason for that long ramble here is is this so when you break it down so that although is that listed on our on our contract when you break it down the way I try to tell people is sort of I mean obviously we're credit based lender so a lot goes into it personal credit business credit although you're not taking that personal exposure we still look at that as a personal guarantor unless we could run it just under your business which would require minimum ten employees and I believe now five years in business to run it corporal a credit people those people that have been in business five plus years 700 psycho scores those people can see as far as APR between seven and nine percent which for commercial lending is phenomenal I mean you know that's awesome and again you're not getting any liens on your on your house and your car or anything like a sets you know you're able just to make those payments the only exposure taking is on the equipment that's only that's the only lien be place and anything is strictly in the equipment that way if anything were to happen you know and you had a default you wouldn't have to repossess the equipment you know nothing personal now and then you have your B credits right B credits which is probably most of our you know a lot of our applicants but even though I mean still good those people are two plus years in business 675 FICO even go down at 650 even if they have three or four years in business and those people could see anywhere between again depending but about nine to eleven nine to twelve percent APR which again you know over thirty six months is you know or we know whatever the term maybe is that bad and commercial lending that's super competitive even banks for a lot of those people you know will be eight and a half to nine percent and he'll you know if I if I catch Craig who my manager Brian you've spoken to on a good day maybe you can make an exception right so come it's a ridiculously affordable rate you know in my previous life in the finance world it was it was just really that's those aren't the rates at all and we were looking at with with without having a million personal guarantor x' and top rate credit or even you know capital secured or you know like a certificate of deposit back to loan or something like that it's exactly well and on top of that too and had nothing I guess a I haven't mentioned which this is all application only right so we're not asking and we might have to have some cases right but 90% of the time no banks no tax returns no financials nothing this is a strictly a one-page application saves you two minutes to fill out we get an approval with it it used to be in since we've actually been Believe It or Not very busy recently so some people within the hour though right will decision within an hour um you know I'll say I send out terms you tell me what you want to do we could sign docs you DocuSign it's done all in the same day that's awesome right and then you know if you know if there's some it sends sometimes so I'll address you to the secrets now right those are people six fifty or less FICO scores two or less years in business a lot of those and you're looking at 15 plus percent which are typically start off even that right do get a start up in my opinion one hundred thirty percent i mean that's that's fantastic yeah right and i don't know a lot of startup business that if I'm wanting to go to an SBA loan let's go back the same thing you know they're taking an arm and a leg they're putting liens in your house your equipment and or on your you know all personal assets if I think that exposure for an additional yeah okay so your interest rate say with us right maybe twenty four percent and you go your twenty eight percent you have your local bank it's twenty three percent right well divide that up over three three to five years what is that it's a couple it's a cup of coffee right I mean I I don't know right and you don't know how those are all structured right you might have a balloon payment on a bank you might have whatever now our products very simple you have X amount of payments at this payment and that's it and it's it's pretty simple so yeah and I think that's a good point too because you know as a business owner you know cash flow is everything right and that's just it just really makes a big difference for business to be able to have terms that work with equipment that the equipment produces X amount of dollars of income for our company and that I can pay for and this as long as one is here and the other is here where it's good shape but it really does yeah you know you know if structured properly it should be something you don't even notice right I mean I'll even give an example yeah and you said it right cash especially right now cash has never been more king than it is right now you know which I think personally I guess selfishly but I think but one advantage of this whole this whole economic crisis rise once we get out of here I mean financing is gonna be really kicking off again people want to preserve that capital and you know even give you an example I'm working on a deal right now for a gentleman that once once a new truck and trailer right and he's on you know I want to pay cash or you know it cost 30 grand I want to put 20 grand down well why is if you if your liquid already would have the cash behind hold on to that cash you know stay liquid it's you know for pay pay if you're what I hear you're droning your truck whatever you're buying is yielding X amount of dollars a month that's five times the amount of your payment it's an operating expense right and it's a good questions who are generally the expenses that they pay on your contract or those generally tax-deductible I know we can't get tax advice but so yeah they are yeah so so that was kind of the benefit of like the old school leases right was that was they were always as they were they're off balance sheet but they're not anymore the new tax laws there are certain applications or implications that are on our equipment finance agreements that are tax-deductible but that's kind of the beauty - of the rental that the rental rental program that we have with you guys and that we offer a lot of our clients now is is the lease of the 90s - the sixty five percent interest rates that those guys the jack in right and all that their own you know whatever it was so those guys are all dirty brokers that were just building yield and profit to their deals right so those ones how are off-balance-sheet transactions okay cool man all right great so um why don't we step in we've got a couple other questions that we're gonna type responses to Brandon can you tell our customers a bit about the rental program and how that works and what that looks like yes or our rental program is is pretty simple and it's it's very comparable to even our finance agreements right but it's easier for not only it's really easy for all three parties involved for HSC for myself and for the end-user essentially you have your pieces of equipment right and we in our program with you guys is you pay a payment of and I believe we have two different structures right so I believe one is $9.99 a month for two years and again going back to that phone example I made right the subscription model right you pay Verizon X amount of month you get the service and you get the equipment same thing here right like you to provide any updates on the equipment any training all that involved right and then at the end of say those two years again going back to the phone contracts say you have an iPhone 8 and your two-year contract is up the Verizon or whoever you may use all with the iPhone 10 okay cool yeah here's iPhone 10 where it's gonna renew your contract same thing here so say you get this drone right and at the end of the two years you could say either hey now I want to buy one you know buy this equipment and keep it and and you guys work that out a little different than a lease right I used to have the dollar buy outs now he doesn't work something out in the price as far as what to buy it for right or you they can just own it outright or hey renew my subscription I want to keep paying this a month and then you guys will provide newer and better equipment if there's a new a new model or upgrade whatever maybe all right cool very cool so another question that we've got for you sir is you go back let's see what's the upper limit Brandon on the amount of money that eseni Amul will cap will finance so all great question I started with that actually so we can do anything application only so we like to see minimum $10,000 can we do under $10,000 yeah absolutely but we're trying to kind of stay above that ten thousand ten thousand or more just and especially cost that too we you know we charge a bit more money for those transactions ever over ten grand simply or I'm sorry under 10 grand simply just because it takes the same amount of time to do a deal for five grand as it does for half a million right oh we can go as high as up to one and a half million we could actually go on go higher I just seen deals go higher obviously you know we need banks and whatever we have we have we need a lot of additional stuff from you but as far as our application only so there's our one-page on that application would be no up to up to $250,000 awesome cool thank you sir that's a great question that's interrupt two butts so saying this is obviously for for the end users right so say you talked to Brian or someone at HSE and you need a drone and oh hey you know what I need some other equipment - yeah great we could work with as many vendors as you want typically when you're approved minimum we get you approved up to one hundred and fifty thousand dollars and so you can you can use that for whatever whether it's additional drone you need more drones you need more coming for you guys or any other you know you need a new truck or you need I don't know a new sign whatever it is you know we can take care of so awesome and then Brandon is there a certain percentage of the total you know financed amount that can be allocated towards services like FAA processing training or you know is it say that the drone cost I don't know ten thousand dollars right and that there's two thousand dollars for this and the thousand dollars for something else yeah kind of percentage you're looking at there yeah good question so yeah we can cover up to 40 percent of soft costs so forty percent of the total amount right so yeah if you know your your drones ten grand or whatever it is we can cover up to four thousand dollars of soft costs so as shipping taxes whatever it may be awesome cool I'm going to jump back to a question on line here I know Joyce responding to the ones that are submitting live with us as well this person say is outside of the United States and oh I guess to clarify that Brandon so if someone is coming to us from Canada or from Mexico when they still go onto our website and submit the application or would they just call you and you connect them with your partners in Canada you said earlier that we can still use the benefit you guys's approval processes right yeah yeah so you you could still fill out our application all that would really do I just get a pretty simple email saying you know so-and-so is in Canada or whatever do you want to refer over to our partners I forget which base we work with directly but yeah I would essentially just said so either whatever's easier for the customer honestly right if they're on site and they just want to fill out an application gets right on there right they can do that or if you're talking on the phone hey like I'm located in Canada you guys do Canadian financing yeah we you know our partner or stadium capital has other syndicate partners in Canada you know I can direct you over to brain and you'd love to help you out whatever so and I can send them I also have a separate application for that Canadian and Mexican bank as well okay that's great cool man um let me see here what else we've got it looks like a lot of these questions are kind of intermixed for things that have come up already so I think we're in good shape there I'm looking here we've got some other kind of more technical questions that the team's typing responses to as well let me see anything else that's coming up here um and I guess one specific question Brandon do you guys have any one in India by any chance that you work with we do not okay okay you might if you guys have a chance to it's a really big market for UAVs so that might be something to put on you know you guys as raid artists to look for a financing partner out there what one of our attendees is saying is that there's not currently a lender that they've been able to find that finances UAVs in India so yeah and I'm sure tunas being especially after the the acquisition from Regions Bank I'm sure there'll be a lot more and it probably won't be anytime soon we're still kind of going a bit of a transition phase but I think once we start to kind of go more towards you know they're like what would they want to do right I think we'll have a little more access and international market awesome yeah that's that was actually a quiet you asked that question you first got quiet like hey like I know we don't want to dip our toes international markets I'm not really into a point yet either but like I do the questions about it like you know is that something that is the bank I guess something you know everyday we're working on finding partners it's just it's a little harder in the commercial space right and and simply unfortunately it's simply like okay well for financing piece of equipment in India and customer defaults I mean that's kind of a pain to go you know repossess that equipment that's right and where we resell it and just relate you know we're a little lazy and I'm not gonna say about the guy in India it's probably laughing no all right so let's see here another question came in and it says can the drone be used for more than one type of customer so if I bought the aircraft right and I were to work with you Brandon on financing and I said hey I want to start out using this drone for real estate but then later I'm going to do search and rescue or law enforcement work you know could I use that drone for a lot of different types of applications yeah as long as as long as as long as you apply and are approved under your business entity yeah I mean honestly I what you do after I mean I'm kind of going back to the rental thing like you know that listing right but yeah I mean that I mean that though yeah you could use it for whatever is yeah whatever you want to use it for you use it for awesome cool and then another question from that same attendee says about the soft costs you know if this particular applicant needed to buy things like uniforms you know advertising dollars etc how how deep of a dive are you guys going to be looking forward to explain all of those soft costs or like I guess in other words would it be kind of like a cash out purchase where some of that can go specifically to a cash or would they need to have some kind of purchase order for all those vendors yeah so we so as long as we have yeah we need a purchase order invoice from from the vendor and yeah we just added onto into our system and then we can generate payments and everything from there so but yeah that's actually another good question too so I know as far as a lot of you know a lot of customers right now or need cash right and done don't really need any equipment but it's another that we could offer to we do have a great working capital program that I personally do not work with you to still ask me about them and you could still apply with that or apply for them through me we have a team out in New Hampshire actually runs that too so yeah any customers out there that need working capital is a little additional cash like I said before we can't finance inventory but if you need just if you need a

ditional cash you need a mentor whatever it may be or it's a private party sale right it's an improvement from you see the cash in hand we can do that as well and those are more short-term loans right so those are anywhere when you they could be daily payments monthly payments and I believe now they go up to two years okay that's great man that's really cool and then I've got another couple things here and Brandon we touched on this earlier but I just want to make sure that we cover it fully so this participants saying you know for let me see how is the loan process like the application maybe pricing or availability different for a company based loan right like actual companies applying for a loan versus an individual borrower so we can't do any consumer lending it's got to be under your business entity right so are they asking I'm assuming they're asking more what's the difference as far as running it strictly under your corporation or your business and not having a personal guarantor maybe is that is that maybe more the question they didn't say that they're just saying what's the difference between you know a company applicant it looks like a company borrower versus just an individual so yeah but we can't do any district individuals it has to be under entity you need to have we need to have majority ownership so right so for example if you're an employee of a of a certain entity that that's looking to buy equipment I mean we need you can apply still that's fine but we still need as far as personal guarantor as we need you know majority ownership sheet on it and the process of starting an actual business with you know the state that that person loosened is pretty straightforward you can usually you know so sole proprietors is a common and I can't give legal or tax advice to your folks but I've got some experience with this you know you can set up a sole you know that's established with the state that you live in usually the Secretary of State is the department that you go to register that business for an LLC due to a sole member LLC you know contact a legal adviser of course to help you with all the documentation to make sure you're protected but that process of quote/unquote starting a business is actually from a you know the things to do is actually kind of straightforward so and then a question kind of spinning off of that Brandon say that I have a brand new business right so that entity itself like the LLC or corporation is new but saying that as a guarantor you know my credit is 790 or something like that so would I still fall into the to the credit C category because the entity is new even though as an applicant I'm highly qualified how does that work yeah unfortunately that's just the way commercial lending is I wish I get to say you know we have other there's other lenders out there but that now that kind of applicant and I'm always transparent with our clients right I mean yeah do I want her in your business sure I mean do I necessarily want to slam a 25% interest rate down you know but those applicants are probably better off going to their bank now the bank loan is still gonna be upper teens lower 20s and you're still obviously gonna have all that personal exposure on your credit and kind of get nailed a bit there but that's probably the only case that I would if you have that you know 790 800 credit and our startup that's probably your best the only time I'd recommend you know doing an SBA loan or going you're awesome a good question yeah it really was and then this person is also following up with another question that says what is a simians definition of a company so is that all entity types like sole proprietor LLC corporations partnerships LLP is correct yeah we take we take them all as long as you were like I said a minimum two years in business and then you know at a personal side we do look at personal credit like I said 655 oh yeah you're good to go yet we have a home for you we have a solution somewhere for you so nice cool here's another really good one - Arthur your awesome great questions here it was asking what happens if a vendor goes out of business and also I think separately what happens at the end of the finance period period so oh man that's that's an interesting question have they go out of business well we have a whole team dedicated to that so I really personally do not really know that process typically from what I understand and from previous experience not at a centium but working at like dirty broker shops so even they would actually be somewhat alright about that right so typically what we would do is you work out some kind of deal with the customer like again I'm I handle this is to be our customer service we have a whole repossession team that does their whole thing that I don't really know about but essentially we work on some kind of buyout right hey you owe this left on your you know on your on your contract we'll give you a 10% discount or whatever it may be or we can work out other payment structures and even like right now I know a lot of people are going out of business with everything going on code 19 to kind of help some of those customers we're actually deferring their payments to if they are heavily affected by this crisis six months so say you're you're you know ten months into your contract you still have to 24 months whatever it is you know we're helping delay those payments and extending that term I we're not making those payments for you but you're extending yeah we're extending that term now as far as at the end of the finance contract yeah it's you know it's it's simple you make your final payment there's double balloon payment nothing and you use only equipment after that a typical finance agreement so you make your 36 to 48 60 payments whatever it is and but then the term your or the at the end of the term you're done you know you own the equipment great awesome so just as a reminder to our folks that are joining us live or they're on the phone with us or however you're connected we just have a couple it's left of our webinar today so if you have some questions we haven't covered yet make sure to submit those on the QA you know we'll wrap up in the next five minutes or so and let me just think of some other things Simon Joy any other questions that you know you've been asked recently of customers that you think would be helpful for us to cover today on on this webinar or anything else that you guys kind of have been wondering or or you don't want to run by Brandon here um no except for you know this besides like everything that can be financed including the soft cost and everything that can be put in there it's also like any of our aircraft um you know whether like with the different applications use 4k cameras of different payloads you know like all the I mean you know if you're spraying or seating or you know any our heavy lives we're also distributed for unique so we had customers asking recently if they can finance you know four to five thousand dollars like smaller amounts for you know smaller aircraft such as cameras and just kind of wanted to let everybody know again that it's for our entire product line any of our aircraft and equipment so it's it's pretty great option to have Brandon's been really helpful to just about everything I'm sure there's people out there that have questions that I don't know if this we might have a webinar specific for this but questions related to how price their services for example pricing their their work for aerial spring for example for a big group but I think maybe that's something they would do a separate webinar for it's gonna take a lot of time to answer yeah and actually considering that - we'd love to hear your feedback on what you guys want to hear as far as content and upcoming topics for our webinars original talk about so Simon and I were discussing kind of like how does your business and your business operations yeah what you know our clients are charged and we'll see if we can get a couple customers on the phone that are out there doing it already and yeah that'd be great and then I just saw we had a couple other questions Oh Brandon this one's for you besides the one-page application what other documentation is needed to secure the loan do you need copies of LLC paperwork business license etc yeah good question but yet typically not unless unless we can't find you registered on your States Secretary of State website which that's that's what I use as a prelim on that underwriter our underwriter you're on writers have different software and things they use but I mean if yeah as long as you're a registered entity and your tears and business very rarely unless there's something kind of quirky and we can't find proof of ownership maybe so we might ask for something with that but other than that I would say especially in in that in that rate that transaction range of like 10 to like 50 grand typically we don't need anything else unless again there's this something quirky that we can't find or there's something a little sketchy about the the company that's applying maybe but yeah other than that ya know typically I would say 70 percent of time in that wheelhouse you have just our one-page application and then our documents that you sign is a one-page Jack you signed document it takes literally 2 seconds to click in two spots read over the you know the fine print it's one page and boom the second we get that email back we pay you guys so awesome cool all right I'm going to go ahead and get all of our folks your contact information here and I thought that would be easier than what's happening here but a couple things so what if you're going to our website HSE des UAV comm and then over the the section that says learn there's an area where you can actually click on leasing and financing that's one way to get to the application also Brandon's phone number and contact information is on there I'm working on pulling that up for us now as well I don't know why it's not on here my little screen share thing let's see I think I have an idea hang on folks okay it's a little blurry but this will work all right so here is Brandon's contact information in the middle section here so his phone number seven one three six three four forty 802 I'll read that again in case you're on the phone you can't see what we're sharing so again seven one three six three four forty 802 and Brandon would you generally prefer that people you know call you or submit the applications firstly what's the way that allows you to most accurately answer questions for people so yeah so personally and this is just me being brewery eyes I would prefer you to applied first just because unfortunately they're like half the time I'll get calls and dissent from you it's you know it's from all of my vendor relationships and customers I'll have these long-winded conversations with them and then they applied right and that's a couple hours of my time and they apply and it's and they come back with a 500 credit score right so and oh no my credit is good right so I personally I mean if you have an urgent question and there's something right maybe shoot me an email first because I am even with everything going on I'm still I still remain relatively busy and a lot of other you know things going on to shoot me an email and then I love it you know give you a call and to have a few minutes but yeah I would say if you could apply first again it takes two seconds to apply once I see that your application was submitted and once I get a credit decision you'll receive a call for me anyways and then with any questions you have from there I'll be more than happy awesome cool all right great well I think that's a wrap you guys and Brandon just thanks again for your time thanks for sharing you know talk a part of your workday with us and our customers so that they could get these questions answered and you know to Simon and joy thanks for your partnership as well and you know helping us respond everything in real time so that Brandon and I can try to have a actual you know I don't know I'm trying to think of the word that I'm looking for a useful conversation or something where we don't sound crazy from trying to type and talk at the same time so it's just great so thank you again for joining us joy tell people if you will how they're gonna be able to see this and how they're gonna get the written questions will you let our attendees know about that yes thank you um and I actually just put Brandon's contact info up in the chat too for the people they're watching live they could just copy and paste that over somewhere it has the link oh no it didn't make the link oh no I was gonna say I copied the link to the application so they can go directly to it but if you go to our website there's a link on there um and then let's see so our goal is by the end of the day to have this webinar recording posted on our YouTube channel which I also put the link in the chat for previous web webinars and we'll post that on there and then for everybody that RSVP'd we'll also send out an email that includes the video link in that so you guys have quick and easy access to it and then of course stay tuned for the next invitation going out for our next webinar topic to be announced right all right cool Brandon Simon anything else for you guys no I'm all good is you know thanks thanks again for inviting me out here is fun awesome yeah that's all for me all right cool thanks for joining everyone [Music]